Understanding Executive Stock Options: Everything You Need to Know

Understanding Executive Stock Options: A Comprehensive Guide Executive stock options are an important component of compensation packages offered to …

Read Article

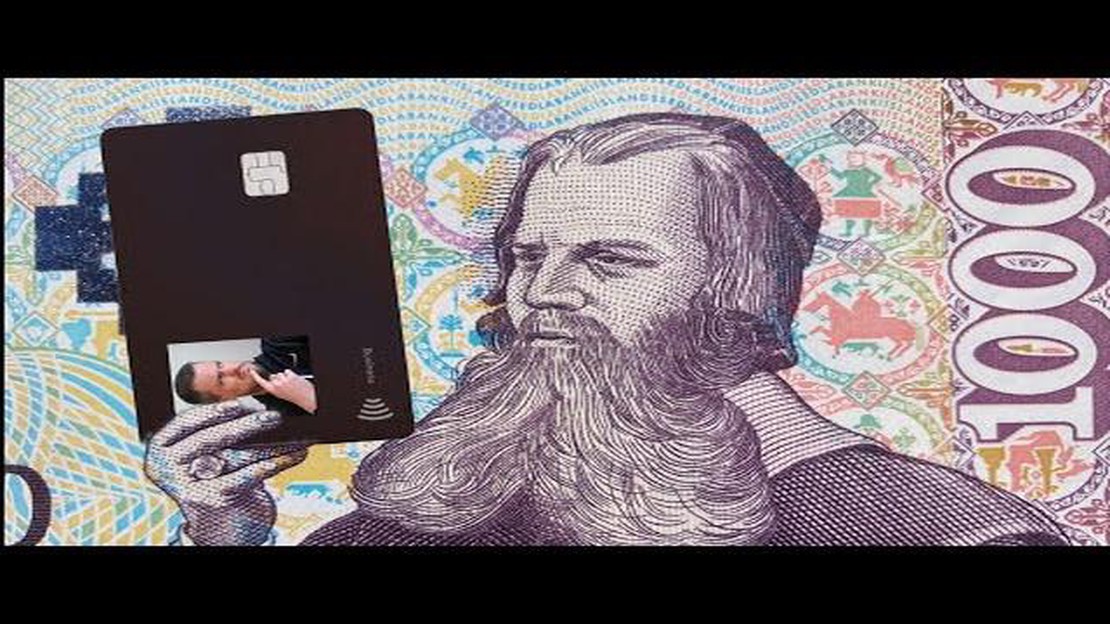

When traveling to Iceland, it is important to consider the best options for exchanging money. While some travelers prefer to exchange their money before arriving in the country, others may find it more convenient to exchange currency once they have arrived.

One option for exchanging money in Iceland is to use the local currency exchange services. These services are available at airports, banks, and exchange offices throughout the country. It is recommended to compare the exchange rates and fees offered by different providers, as these can vary.

Another option is to use a debit or credit card that offers favorable foreign exchange rates. Many banks and financial institutions offer cards that allow you to withdraw cash or make purchases in local currency without incurring high fees. However, it is important to check with your bank or credit card provider about any fees or limitations that may apply.

Additionally, some travelers find it convenient to use digital payment methods, such as mobile payment apps or prepaid travel cards. These options allow you to make payments or withdraw cash in local currency using your smartphone or prepaid card, making it easy to manage your expenses while traveling in Iceland.

In conclusion, there are several options for exchanging money in Iceland. It is recommended to compare exchange rates and fees, as well as consider the convenience of using debit or credit cards, digital payment methods, or local currency exchange services. By being informed about the best currency exchange options, you can make the most of your trip to Iceland.

When traveling to Iceland, it is important to know a few things before exchanging your money. Here are some key points to keep in mind:

1. Currency

The official currency of Iceland is the Icelandic Krona (ISK). It is recommended to have some Icelandic Krona with you for small expenses, as cash is still widely accepted in the country, especially in rural areas.

2. Exchange Rates

Before exchanging your money, it is crucial to check the current exchange rates. Different currency exchange providers may offer slightly different rates, so it is worth comparing options to get the best deal. Online platforms and currency converters can help you stay updated with the latest exchange rates.

Read Also: Understanding JATS Stock: Everything You Need to Know

3. Credit and Debit Cards

Using credit and debit cards is a convenient way to make payments in Iceland. Most businesses, including hotels, restaurants, and shops, accept major international cards such as Visa and Mastercard. However, it is wise to carry some cash for emergencies or small purchases in places that do not accept cards.

4. ATM Withdrawals

ATMs are widely available throughout Iceland, especially in major towns and cities. They are a convenient way to withdraw cash in the local currency. However, keep in mind that some ATMs may charge a fee for international cardholders, so it is advisable to check with your bank regarding any applicable fees or charges.

5. Exchanging Money

There are several options for exchanging money in Iceland. Banks, currency exchange offices, and some hotels offer currency exchange services. Banks generally have better exchange rates compared to other providers, but they may charge higher fees. It is recommended to compare rates and fees before making a decision.

Read Also: Is AIMS Forex Legit? Discover the Truth about AIMS Forex Trading

6. Keep Receipts

When exchanging money in Iceland, it is important to keep all receipts. These receipts may be useful for accounting purposes or in case you need to exchange any leftover currency back to your original currency upon departure.

By being aware of these factors, you can make informed decisions when it comes to exchanging money in Iceland. Whether you choose to carry cash or rely on cards, it is always beneficial to plan ahead and be prepared for your financial needs during your stay in Iceland.

When traveling to Iceland, it’s important to consider your currency exchange options to make sure you have the best experience during your trip. Here are a few options to explore:

Before your trip, it’s always a good idea to research and compare the exchange rates and fees offered by different currency exchange options. This will help you make an informed decision and ensure you have the necessary funds for a smooth and enjoyable trip in Iceland.

Yes, it is recommended to exchange some money before traveling to Iceland. While credit cards are widely accepted, there are still some places that prefer cash, especially in rural areas. It’s always a good idea to have some local currency on hand for smaller purchases or in case of emergencies.

The official currency of Iceland is the Icelandic Krona (ISK). It is best to bring your local currency and exchange it for ISK upon arrival in Iceland. Some international airports may have currency exchange offices where you can swap your money, or you can withdraw ISK from ATMs. Avoid exchanging your money at hotels or tourist areas, as they tend to have higher exchange rates and fees.

Yes, there may be additional fees when exchanging money in Iceland. Banks and currency exchange offices usually charge a commission or service fee for the transaction. It’s a good idea to compare the rates and fees of different exchange options to find the one with the lowest cost. Additionally, some ATMs may charge a withdrawal fee, so it’s worth checking with your bank before using foreign ATMs.

Yes, credit cards are widely accepted in Iceland, especially in larger cities and tourist areas. However, it’s always a good idea to have some cash on hand for smaller establishments or places that may not accept cards. Some businesses may also have a minimum spending requirement for credit card payments. If you plan on using your credit card, check with your bank for any foreign transaction fees that may apply.

Understanding Executive Stock Options: A Comprehensive Guide Executive stock options are an important component of compensation packages offered to …

Read ArticleUnderstanding the Mean Reversion Trading System Mean Reversion trading is a popular strategy used by many traders and investors to profit from the …

Read ArticleWhat is the NBR forecast? The NBR (National Business Registry) forecast is a crucial tool for businesses and economists alike. It provides insights …

Read ArticleWhat is Ticker Tape Used For? Ticker tape is a long, thin strip of paper that has holes punched in it. It was originally used in stock exchanges to …

Read ArticleIs Dukascopy a true ECN? Dukascopy is a well-known name in the forex industry, offering a variety of trading services to clients around the world. One …

Read Article4 Types of API: A Comprehensive Guide Application Programming Interfaces (APIs) play a crucial role in modern software development. They allow …

Read Article