What Programming Language Does Amibroker Use? - Ultimate Guide

Amibroker’s Programming Language: What Language Does Amibroker Use? Amibroker is a popular technical analysis software used by traders and investors …

Read Article

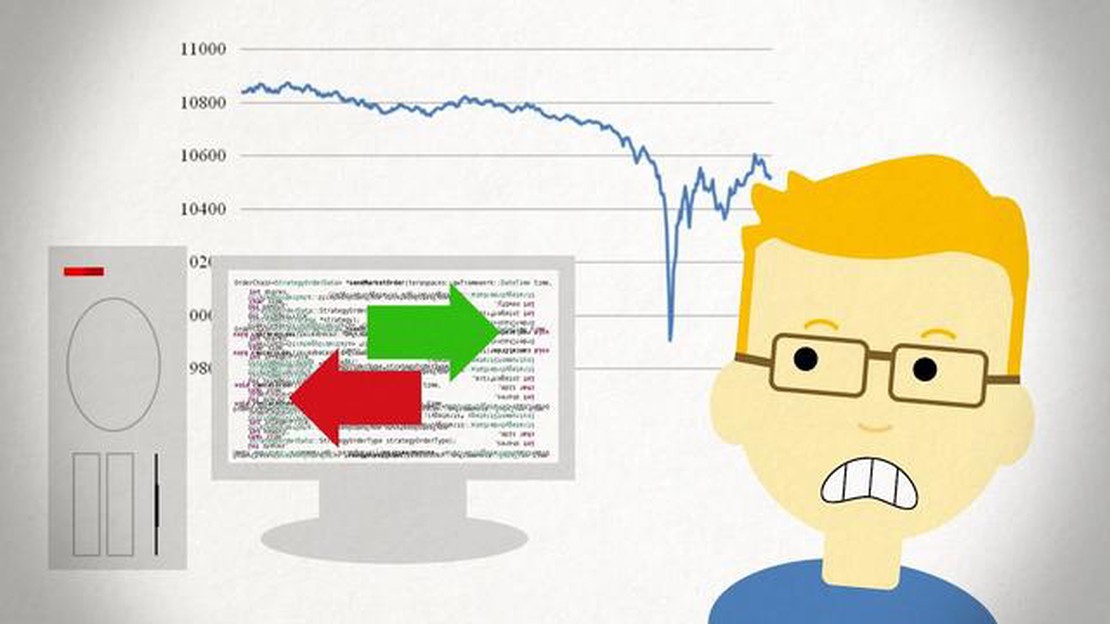

High-frequency trading (HFT) has long been a hot topic in the world of finance. The practice of using sophisticated algorithms and advanced technology to execute trades at lightning-fast speeds has revolutionized the way markets operate. But as the industry has matured, many are left wondering: is HFT still a profitable venture?

To answer this question, it is important to examine the latest insights and trends in HFT. One key factor to consider is the increasing competition in the HFT space. As more firms enter the market, the profit margins for HFT strategies have been squeezed. However, it is worth noting that there are still opportunities for profitable trades, especially in niche markets or during periods of volatility.

Another important factor to consider is the regulatory landscape. In recent years, there have been concerted efforts to regulate HFT activities, with the aim of ensuring fair and transparent markets. These regulations have had an impact on the profitability of HFT strategies, as firms have had to adapt their practices to comply with the new rules. However, for those who are able to navigate the regulatory landscape, there are still opportunities to generate significant profits.

Furthermore, technological advancements continue to play a major role in the profitability of HFT. The race to develop faster and more sophisticated trading algorithms remains fierce, and those who are able to stay ahead of the competition can still reap substantial rewards. Additionally, advancements in data analysis and machine learning have made it possible to extract insights from vast amounts of market data, giving HFT firms a competitive edge.

In conclusion, while the profitability of HFT may have decreased in recent years, there are still opportunities for those who are able to adapt and innovate. By staying abreast of the latest insights and trends, leveraging technology, and navigating the regulatory landscape, HFT firms can continue to generate profits in today’s fast-paced markets.

In recent years, high-frequency trading (HFT) has faced increasing scrutiny and has been the subject of numerous debates. The question on everyone’s mind is whether or not HFT is still profitable in today’s market.

While there is no definitive answer to this question, it is important to consider both the opportunities and challenges faced by HFT firms. On one hand, HFT allows traders to execute orders at incredibly high speeds, taking advantage of small price discrepancies and market inefficiencies. This can lead to significant profits if executed correctly.

On the other hand, the rise of HFT has led to increased competition and a crowded marketplace. Firms are constantly searching for new and innovative strategies to gain an edge, and as a result, profit margins have become thinner. Additionally, regulators have implemented stricter rules and regulations to ensure fair and transparent markets, which has added to the challenges faced by HFT firms.

Read Also: Is Delta always 0.5 at-the-money?

Despite these challenges, there are still opportunities for HFT firms to be profitable. Advances in technology and access to real-time market data have enabled these firms to analyze and react to market movements faster than ever before. Additionally, HFT firms are continuously adapting and developing new strategies to stay ahead of the competition.

It is worth noting that while HFT may not be as profitable as it once was, it still plays an important role in today’s financial markets. HFT provides liquidity, tightens bid-ask spreads, and improves price discovery. These benefits are valuable to other market participants, such as long-term investors and retail traders.

In conclusion, the profitability of HFT is a complex and evolving topic. While there are challenges and increased competition, HFT firms continue to find ways to remain profitable. As technology and market conditions continue to change, the future of HFT remains uncertain, but for now, it still has a place in the financial industry.

High-Frequency Trading (HFT) has been a subject of much debate and scrutiny in recent years. Critics argue that it contributes to market volatility and unfair advantages, while proponents argue that it brings liquidity and efficiency to the markets. Here are some of the latest insights on HFT:

Read Also: Are stock options considered assets? Find out here

Overall, HFT remains a profitable venture for many firms, but it is not without risks and challenges. As the industry continues to evolve, regulators and market participants will need to stay vigilant and adapt to ensure a fair and efficient marketplace.

Yes, high frequency trading (HFT) can still be profitable. However, it is important to note that profitability in HFT can vary depending on a variety of factors, including market conditions, trading strategies, and technological advancements.

Some of the latest insights and trends in high frequency trading (HFT) include the use of machine learning and artificial intelligence algorithms to improve trading strategies, the focus on reducing latency and improving execution speed, and the increasing regulatory scrutiny on HFT practices.

Market conditions play a significant role in the profitability of high frequency trading (HFT). Volatile markets can provide more trading opportunities and potentially higher profits, while stable markets with low volatility may limit the trading opportunities for HFT firms.

Some common trading strategies used in high frequency trading (HFT) include market making, statistical arbitrage, and liquidity detection. These strategies rely on algorithmic trading and the ability to quickly execute trades to take advantage of small price differentials and market inefficiencies.

Some potential risks and challenges associated with high frequency trading (HFT) include increased market volatility, technological glitches and errors, regulatory changes and compliance, and competition from other HFT firms. Additionally, the profitability of HFT can be affected by changing market conditions and the increasing complexity of trading algorithms.

Yes, HFT can still be profitable. However, the profitability of HFT strategies has been decreasing in recent years due to several factors such as increased competition, regulatory changes, and technological advancements.

Amibroker’s Programming Language: What Language Does Amibroker Use? Amibroker is a popular technical analysis software used by traders and investors …

Read ArticleUnderstanding the Employee Stock Option Retirement Plan The employee stock option retirement plan, also known as ESOP, offers employees the …

Read ArticleWhy is Form A2 required? Form A2 is an essential document that is required for any foreign currency transaction in India. It is a mandatory form that …

Read ArticleWhat happens if you buy and sell at the same time in forex? Trading in the forex market can be a complex and challenging endeavor. One of the …

Read ArticleCalculation of Moving Average Trend When it comes to analyzing financial data, moving averages are a commonly used tool. They can help identify …

Read ArticleCost Basis of Exercised Stock Options: Understanding the Basics Exercising stock options can be an exciting experience, especially when it comes to …

Read Article