Impact of Stock Options on Top Management Performance

Impact of Stock Options on Top Management Performance Stock options have become a popular form of compensation for top executives in many companies …

Read Article

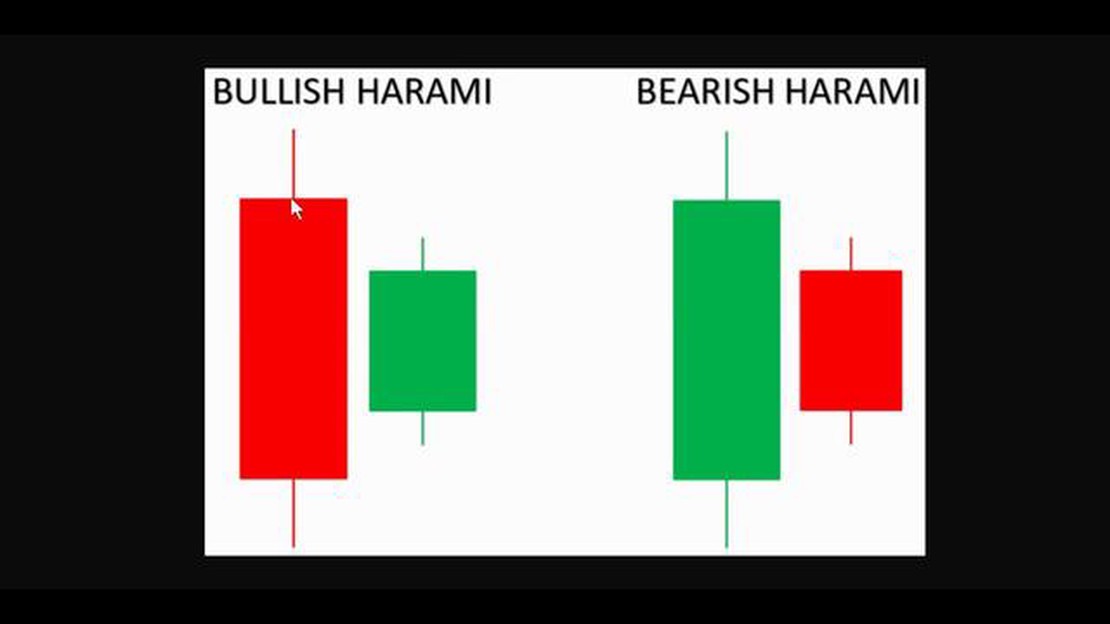

Bullish Harami is a popular candlestick pattern used by traders to identify possible trend reversals in the market. It consists of two candlesticks, where the first candlestick is bearish and the second candlestick is bullish. The bullish candlestick is completely engulfed by the larger bearish candlestick.

This pattern is considered to be a bullish reversal pattern, indicating that the previous downtrend may be coming to an end and a new uptrend could be forming. Traders often interpret a Bullish Harami as a signal to go long or buy a particular asset.

The reliability of the Bullish Harami pattern has been a topic of debate among traders and analysts. Some believe that the pattern is a strong indication of a trend reversal, while others argue that it should be used in combination with other technical indicators to confirm its reliability.

“The Bullish Harami pattern can be a powerful signal when used in the right context,” says John Smith, a technical analyst. “However, it is important to consider other factors such as volume, trendlines, and support and resistance levels to increase the probability of success.”

While the Bullish Harami pattern can provide valuable insights into market trends, it is important for traders to exercise caution and use it in conjunction with other forms of analysis. By understanding the strengths and limitations of this pattern, traders can make more informed decisions and maximize their chances of success in the market.

The bullish harami candlestick pattern is a popular pattern used in technical analysis to signal a potential trend reversal from bearish to bullish. It consists of two candlesticks, with the first one being a large bearish candlestick and the second one being a small bullish candlestick completely engulfed by the first candlestick.

When the bullish harami pattern occurs, it suggests that the selling pressure from the previous bearish trend is losing momentum and the bulls are starting to take control. It is seen as a sign of market indecision followed by a potential reversal in the direction of the trend.

The pattern is characterized by the second candlestick that opens and closes within the body of the previous bearish candlestick. This indicates that the bulls are stepping in and pushing the price higher, potentially signaling the start of a new uptrend.

However, it is important to note that the bullish harami pattern alone is not a guarantee of a trend reversal. Traders often use additional technical analysis tools and indicators to confirm the signal. For example, they may look for bullish confirmation through an increase in trading volume or the emergence of other bullish patterns.

It is also worth considering the context in which the bullish harami pattern occurs. If it appears after a prolonged downtrend or at a significant support level, it may increase the probability of a successful trend reversal.

Read Also: Calculating Moving Average Forecast in Excel: Step-by-Step Guide

In conclusion, the bullish harami candlestick pattern can be a useful tool for identifying potential trend reversals, but it should be used in conjunction with other technical analysis techniques for confirmation. Traders should always consider the overall market context and use proper risk management strategies when making trading decisions.

The Bullish Harami candlestick pattern is a two-candle pattern that indicates a potential reversal in the market. It consists of a large bearish candle followed by a small bullish candle that is completely engulfed by the body of the previous bearish candle. Traders often look for this pattern as a signal to enter a long position, as it suggests that the selling pressure may be exhausted and that buyers may soon gain control.

However, it is important to note that the reliability of any candlestick pattern is not guaranteed. While the Bullish Harami pattern can be a strong indication of a bullish reversal, it should be used in conjunction with other technical analysis tools and indicators to confirm the validity of the signal.

Traders often use volume analysis, trendlines, and other candlestick patterns to further support the Bullish Harami pattern. Additionally, it is crucial to consider the overall market context and the strength of the prevailing trend before making any trading decisions based on patterns alone.

Read Also: Find Out if Plus500 Works in New Zealand - Everything You Need to Know

It is also worth noting that the Bullish Harami pattern is more effective when it occurs at key support levels or in oversold conditions, as this increases the likelihood of a significant price reversal. Conversely, if the pattern occurs in overbought conditions or at resistance levels, it may not be as reliable and could signal a potential continuation of the existing trend.

In conclusion, while the Bullish Harami pattern can be a valuable tool in technical analysis, it is important for traders to consider additional factors and indicators before making trading decisions. Its reliability is enhanced when used in conjunction with other tools and within the appropriate market context. Risk management and proper trade execution strategies are essential when trading based on candlestick patterns.

When trading with the bullish harami pattern, there are several factors to consider in order to increase the reliability of your trades. These factors include:

By taking these factors into account, you can improve the success rate of your trades when using the bullish harami pattern. Remember to continuously analyze and adapt your strategy based on market conditions and other relevant factors.

A Bullish Harami is a candlestick pattern that indicates a potential trend reversal in a financial market. It consists of two candlesticks, where the first candlestick is large and bearish (red), and the second candlestick is small and bullish (green or white). The small bullish candlestick is completely engulfed by the body of the previous bearish candlestick.

To identify a Bullish Harami, you look for a bearish candlestick followed by a smaller bullish candlestick that is completely engulfed by the bearish candlestick’s body. The body of the bearish candlestick should be larger than the body of the bullish candlestick.

The reliability of the Bullish Harami pattern depends on various factors such as the market conditions, the timeframe being analyzed, and other technical indicators. While it is considered a potential trend reversal pattern, it should be confirmed by other technical analysis tools and indicators before making trading decisions.

A Bullish Harami suggests that there may be a potential trend reversal from bearish to bullish. It indicates that the selling pressure may be weakening and buyers might be stepping in, potentially leading to a price rise. However, confirmation from other technical analysis tools is recommended before making trading decisions.

Yes, there are limitations and risks associated with the Bullish Harami pattern. It is important to note that no candlestick pattern is 100% reliable, and false signals can occur. Additionally, it is essential to consider other technical analysis tools, market conditions, and risk management strategies before making trading decisions based solely on this pattern.

Impact of Stock Options on Top Management Performance Stock options have become a popular form of compensation for top executives in many companies …

Read ArticleThe Headline of the Equity Trader Resume: Examples and Tips When it comes to a career in equity trading, having the right skills and experience can …

Read ArticleThe Put Strategy in Options Trading: Explained Options trading offers a wide range of strategies for traders to capitalize on market movements. One of …

Read ArticleReasons to Sell a Call Instead of Buying a Put When it comes to trading options, many investors focus on buying puts as a way to profit from a decline …

Read ArticleWas Dwight Howard ever MVP? Dwight Howard is one of the most dominant players in the history of the NBA. Throughout his career, he has achieved …

Read ArticleIs ESPP eligible for long term capital gains? Employee Stock Purchase Plans (ESPPs) are a popular form of compensation offered by many companies. …

Read Article