US Banks with branches in Malaysia: Complete List

US Banks with Branches in Malaysia If you are an American expat living in Malaysia or a Malaysian resident looking for a bank with ties to the United …

Read Article

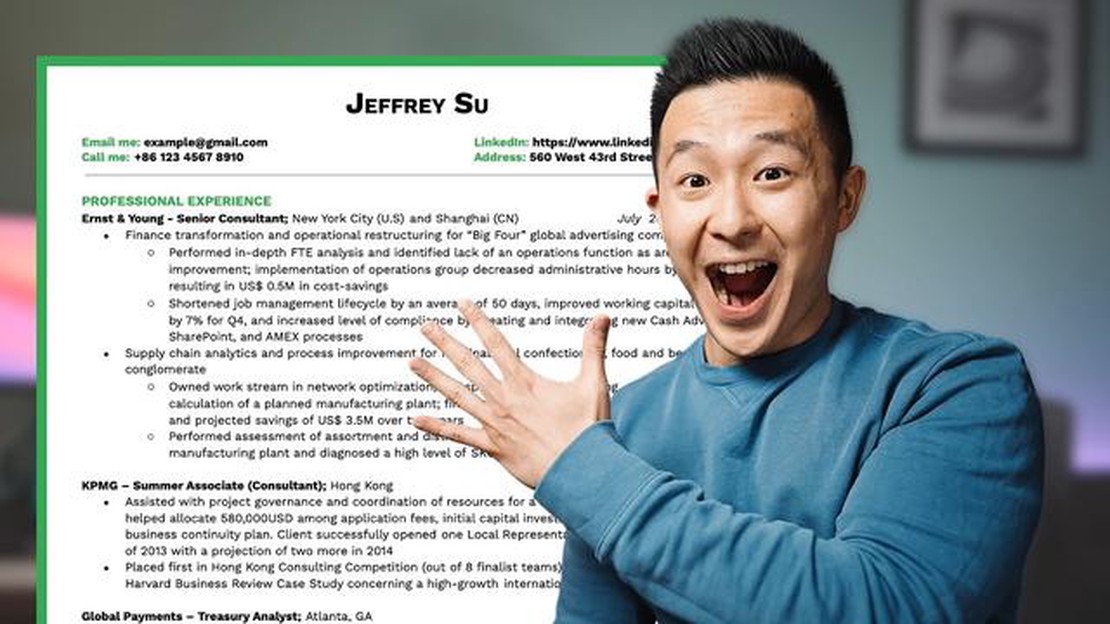

When it comes to a career in equity trading, having the right skills and experience can make all the difference. As an equity trader, your resume headline should effectively convey your expertise and qualifications in order to stand out to potential employers.

First and foremost, a successful equity trader must possess a strong understanding of the financial markets and a keen analytical mind. This includes a deep knowledge of equity trading strategies, risk management, and financial modeling. Additionally, a successful equity trader should be able to quickly adapt to changing market conditions and make informed decisions based on real-time data.

Furthermore, excellent communication and interpersonal skills are crucial for an equity trader, as they often work closely with clients and colleagues. Effective communication skills allow equity traders to build strong relationships with clients, understand their needs, and provide them with exceptional service. Additionally, strong interpersonal skills enable equity traders to collaborate effectively with colleagues and share insights and strategies.

Lastly, a successful equity trader should possess strong decision-making skills and the ability to handle high-pressure situations. The financial markets can be highly volatile and fast-paced, and an equity trader must be able to make quick and confident decisions in order to capitalize on opportunities and mitigate risks.

In conclusion, a well-crafted resume headline for an equity trader should highlight the key skills and experience that are essential for success in this demanding field. A combination of financial knowledge, analytical ability, communication skills, and decision-making prowess will set a candidate apart and attract the attention of potential employers.

As an equity trader, it is crucial to possess a diverse set of skills and qualifications. Here are some key attributes that are essential for success in this role:

These skills and qualifications are highly sought after in the field of equity trading and will help you to excel in your career as an equity trader.

Equity Trader at XYZ Trading Company (2018-Present)

| Responsibilities: | Execute equity trades on behalf of clients and the firm using various trading platforms. |

| Achievements: | * Consistently achieved trading volume targets, contributing to a 20% increase in company revenue. |

Equity Trader at ABC Securities (2015-2018)

Read Also: Top Strategies for Successful Options Trading in 2021 | Expert Tips

| Responsibilities: | Managed a portfolio of high-net-worth clients, executing equity trades based on their investment goals and risk tolerance. |

| Achievements: | * Achieved a client retention rate of 90% through personalized service and effective investment strategies. |

University Name, City, State

Certification Name, Institute Name, City, State

As an equity trader, having the right certifications and memberships can greatly enhance your credibility and open doors to new opportunities. Here are some certifications and memberships that can make your resume stand out:

Chartered Financial Analyst (CFA): The CFA certification is globally recognized and demonstrates your expertise in investment management and analysis. Obtaining this certification showcases your commitment to professionalism and industry knowledge.

Financial Industry Regulatory Authority (FINRA) Licenses: Holding FINRA licenses, such as Series 7 and Series 63, is often required for equity traders to legally buy and sell securities on behalf of clients. These licenses show that you are qualified to handle different aspects of the financial industry and adhere to regulatory standards.

Member of a Professional Traders’ Network: Joining a professional traders’ network, such as the Trader’s Association or the Financial Traders Guild, can provide valuable networking opportunities and access to industry insights. Being an active member demonstrates your commitment to continuous learning and staying updated with market trends.

Advanced Technical Analysis Course Completion: Completing an advanced technical analysis course, such as the Chartered Market Technician (CMT) program, can equip you with the necessary skills to effectively analyze market data and make informed trading decisions. This certification shows that you have a deep understanding of technical analysis techniques.

Read Also: Is Binomo Legally Available in the USA? Discover the Answer Here!

Member of Professional Finance Associations: Being a member of professional finance associations, such as the CFA Institute or the Financial Planning Association, exhibits your commitment to professional development and staying connected to industry peers. These associations often provide resources, networking events, and access to industry-leading research.

Additional Certifications and Trainings: Any additional certifications or trainings related to trading, risk management, or financial modeling can further strengthen your resume. For example, certifications in options trading or derivatives trading can demonstrate your expertise in specific areas of the equity market.

Remember to include these certifications and memberships in your resume’s certifications section to showcase your commitment to professional growth and enhance your chances of success as an equity trader.

The key skills required for a successful equity trader resume include strong analytical skills, knowledge of financial markets and instruments, ability to make quick decisions, risk management skills, and proficiency in trading platforms and software.

In an equity trader resume, it is important to include experience in executing trades, managing portfolios, analyzing market trends, and developing trading strategies. It is also valuable to showcase any experience in risk management, compliance, and working with different asset classes.

To highlight your skills and experience in an equity trader resume headline, you can focus on specific achievements or certifications. For example, you can mention being a Certified Equity Trader or highlight your track record of successful trades or portfolio management. Additionally, you can mention your expertise in specific markets or trading strategies.

Examples of trading platforms and software that equity traders should be proficient in include Bloomberg Terminal, E*TRADE, Interactive Brokers, TradeStation, and thinkorswim. It is also important to be familiar with risk management tools and order execution systems.

In addition to the key skills mentioned earlier, other valuable skills for an equity trader to have include good communication skills, ability to work under pressure, flexibility in adapting to market changes, strong attention to detail, and the ability to work well in a team environment. Also, knowledge of financial modelling and programming languages like Python can be beneficial.

US Banks with Branches in Malaysia If you are an American expat living in Malaysia or a Malaysian resident looking for a bank with ties to the United …

Read ArticleShould You Pay for Trading Signals? In the world of trading, one of the biggest challenges is knowing when to buy and sell. This is where trading …

Read ArticleICICI Bank Forex Services: Everything You Need to Know ICICI Bank, one of the leading banks in India, offers a wide range of services to its …

Read ArticleIs MetaTrader Good? Complete Analysis and Reviews MetaTrader is one of the most popular trading platforms in the world, used by millions of traders …

Read ArticleCan Strategies Really Help in Forex Trading? Forex trading is a complex and highly volatile market that requires careful analysis and decision-making. …

Read ArticleSettlement of FX Options: A Comprehensive Guide When trading in the foreign exchange (FX) market, it is important to understand how FX options are …

Read Article