What is LH in trading? Understanding the concept of LH in financial markets

Understanding LH in trading In the world of finance, there are numerous terms and abbreviations that can seem confusing to those who are new to …

Read Article

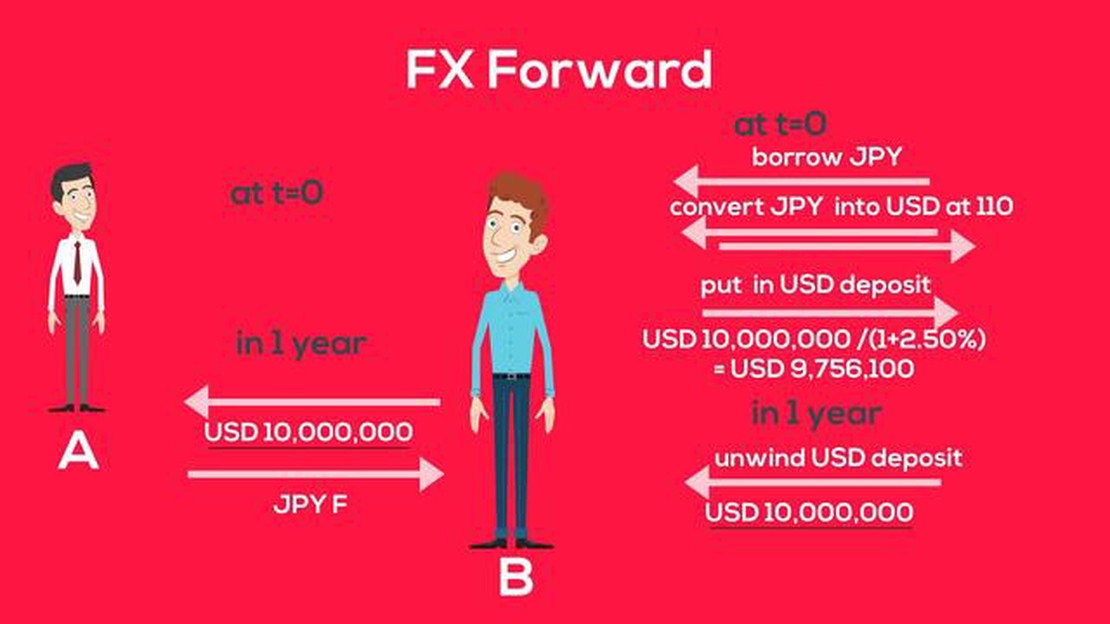

An FX forward, also known as a foreign exchange forward or simply a forward contract, is a financial instrument used in the foreign exchange market. It is an agreement between two parties to exchange a specified amount of one currency for another at a future date, at a predetermined exchange rate.

OTC, or over-the-counter, derivatives are financial contracts that are not traded on a centralized exchange. Instead, they are privately negotiated and traded directly between two parties. OTC derivatives include a wide range of financial instruments, such as swaps, options, and forwards.

So, is an FX forward an OTC derivative? The answer is yes. An FX forward is considered an OTC derivative because it is a privately negotiated contract between two parties. It is not traded on a centralized exchange like a futures contract, but rather traded directly between the two parties involved.

It is important to note that OTC derivatives, including FX forwards, can be subject to various risks, such as counterparty risk and liquidity risk. These risks can be mitigated through proper risk management practices and the use of appropriate hedging strategies.

In conclusion, an FX forward is considered an OTC derivative as it is a privately negotiated contract between two parties in the foreign exchange market. Understanding the risks associated with OTC derivatives and employing risk management techniques is crucial for participants in this market.

Overall, FX forwards play an important role in the foreign exchange market, allowing market participants to manage their currency risk and hedge against potential currency fluctuations. Understanding the nature of these instruments and their classification as OTC derivatives is essential for investors and traders operating in this market.

FX forwards, also known as foreign exchange forwards, are financial contracts that allow two parties to exchange a specific amount of one currency for another at a predetermined exchange rate on a future date. These contracts are typically used by individuals, corporations, and institutional investors to hedge against currency risk or speculate on future exchange rate movements.

FX forwards are considered over-the-counter (OTC) derivatives, which means they are traded directly between two parties rather than on a regulated exchange. As OTC derivatives, FX forwards are customizable and can be tailored to the specific needs of the parties involved.

FX forwards have a maturity date, which is the date on which the exchange of the currencies takes place. They can have a maturity ranging from a few days to several years, depending on the needs of the parties involved. The exchange rate agreed upon in an FX forward is called the forward rate. This rate is determined based on various factors such as interest rate differentials between the two currencies, market expectations, and supply and demand dynamics.

FX forwards are commonly used for hedging purposes to manage currency risk. For example, a company that imports goods from another country may enter into an FX forward contract to lock in a specific exchange rate, protecting themselves from unfavorable currency movements. On the other hand, speculators may use FX forwards to take advantage of anticipated exchange rate movements and profit from currency fluctuations.

Overall, FX forwards are important instruments in the foreign exchange market and play a significant role in managing currency risk and facilitating international trade and investment.

An FX forward is a financial contract between two parties to exchange a specified amount of one currency for another currency at an agreed-upon exchange rate on a future date. FX forwards are commonly used by businesses and investors to manage the risk associated with fluctuations in foreign exchange rates.

Unlike a spot transaction, which involves the immediate exchange of currencies, an FX forward allows the exchange to occur at a future date. The future date, known as the forward date, is agreed upon by the two parties at the time of entering into the contract.

Read Also: Can You Hedge with the VIX? Exploring the Potential of VIX as a Hedging Strategy

FX forwards are typically traded over-the-counter (OTC), which means the contracts are privately negotiated between the parties involved, rather than being traded on a centralized exchange. This allows for more flexibility in terms of the terms and conditions of the contract, as well as the customization of the contract to suit the specific needs of the parties involved.

One of the key characteristics of FX forwards is the determination of the exchange rate at the time the contract is entered into. The exchange rate, also known as the forward rate, is agreed upon by the two parties and is used to calculate the amount of one currency that will be exchanged for another on the forward date.

Read Also: How to Choose Stock Options: A Comprehensive Guide

Another characteristic of FX forwards is that they are generally settled by a payment of the difference between the agreed-upon forward rate and the spot rate, which is the prevailing exchange rate at the time of settlement. This difference in exchange rates is known as the forward points or forward premium/discount.

Overall, FX forwards provide a means for businesses and investors to hedge against currency risk and manage their exposure to fluctuations in foreign exchange rates. These contracts are popular due to their flexibility and customization options, which allow parties to tailor the terms to their specific needs.

Over-the-counter (OTC) derivatives are financial instruments that are traded directly between two parties, without going through an exchange or centralized clearinghouse. They are typically customized contracts that are tailored to the specific needs of the parties involved.

One of the main features of OTC derivatives is their flexibility. They can be structured to meet the specific risk management and investment objectives of the parties, allowing for greater customization than exchange-traded derivatives. This flexibility also means that the terms and conditions of OTC derivatives can vary widely between different contracts.

Another key feature of OTC derivatives is that they are privately negotiated and traded. This means that the terms of the contract, such as the price, quantity, and maturity date, are determined through direct negotiation between the parties involved. This allows for more confidentiality and privacy compared to exchange-traded derivatives, where transaction details are publicly available.

OTC derivatives also have a wide range of underlying assets. They can be based on various financial instruments, including stocks, bonds, currencies, commodities, and indices. This allows market participants to hedge against specific risks or gain exposure to different markets and asset classes.

However, it’s important to note that OTC derivatives can be complex and carry certain risks. Due to their customized nature and lack of centralized oversight, there is a potential for counterparty risk, as the creditworthiness of the other party involved must be considered. Additionally, the lack of transparency and standardization in OTC derivative contracts can make it more difficult to value and assess these instruments accurately.

Overall, OTC derivatives play an important role in the financial markets, providing market participants with flexibility and the ability to tailor contracts to their specific needs. However, it’s crucial for market participants to understand and manage the risks associated with these instruments effectively.

Yes, an FX forward is indeed considered an OTC (Over-the-Counter) derivative. OTC derivatives are contracts that are privately negotiated and traded directly between two parties, without the use of a centralized exchange. An FX forward is an agreement between two parties to exchange a specified amount of one currency for another at a future date, at a predetermined exchange rate. Since it is privately traded and not standardized, it falls under the category of OTC derivatives.

No, not all OTC derivatives are the same as FX forwards. OTC derivatives are a broad category of financial contracts that include various types of agreements, such as interest rate swaps, credit default swaps, and options. FX forwards are specifically contracts that involve the exchange of currencies at a future date. While FX forwards are considered OTC derivatives, not all OTC derivatives are FX forwards.

FX forwards are classified as OTC derivatives because they are privately negotiated and traded directly between two parties. OTC derivatives, including FX forwards, are not traded on a centralized exchange, unlike exchange-traded derivatives. Instead, they are customized contracts created to meet the specific needs of the parties involved. The lack of standardization and centralized exchange trading makes FX forwards fall under the category of OTC derivatives.

There are several advantages to trading FX forwards as OTC derivatives. Firstly, OTC derivatives, including FX forwards, offer flexibility and customization since they are privately negotiated contracts. Parties can tailor the terms of the contract to their specific requirements. Secondly, trading FX forwards as OTC derivatives allows for direct negotiations between the parties involved, which can lead to more efficient pricing and execution. Finally, OTC trading provides confidentiality, as transactions are not publicly disclosed, which may be beneficial for certain market participants.

Understanding LH in trading In the world of finance, there are numerous terms and abbreviations that can seem confusing to those who are new to …

Read ArticleAre there any forex robots that work on the MT4 app? Forex trading has become increasingly popular in recent years, with millions of traders around …

Read ArticleWhat is the rule of Bollinger Bands? When it comes to technical analysis in financial markets, Bollinger Bands are a widely used tool. Developed by …

Read ArticleIs Divergence a good strategy? Divergence is a widely debated strategy in the financial world, with proponents arguing that it can be a profitable …

Read ArticleWill the NZ Dollar Rise? The New Zealand dollar, also known as the Kiwi, is closely watched by investors and traders around the world. With its unique …

Read ArticleIs Forex Shariah Compliance? Foreign exchange, commonly known as Forex, is a decentralized global market where currencies are traded. With its immense …

Read Article