How to Determine the Price of Spread Options: Understanding the Basics

Best practices for pricing spread options A spread option is a type of derivative financial instrument that gives the holder the right to buy or sell …

Read Article

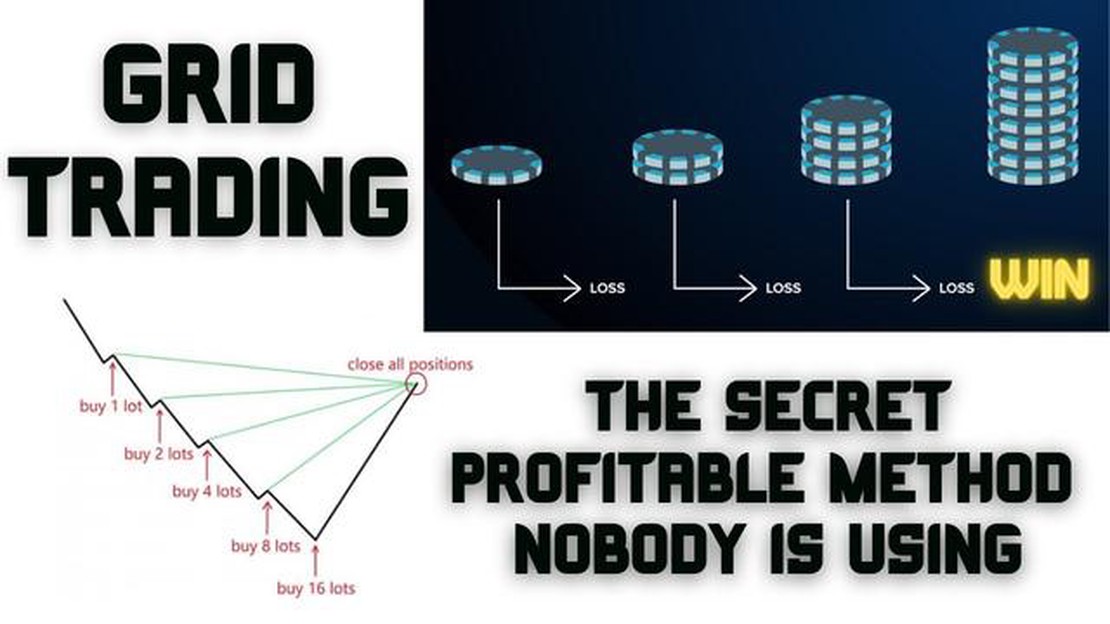

Grid trading strategy is a popular approach used by traders to capitalize on market fluctuations within a specific range. It involves placing buy and sell orders at predetermined intervals or price levels, creating a grid-like pattern on the price chart. However, just like any trading strategy, knowing when to exit is crucial for maximizing profits and minimizing losses.

Step 1: Define Your Target

Before entering into a grid trading strategy, it is essential to have a clear goal in mind. Determine the profit level you want to achieve or the price range within which you want to trade. This will help you set the groundwork for identifying the right exit points.

Step 2: Monitor Market Conditions

Keep a close eye on market conditions and how they impact the price movement. Look for signs of volatility or significant changes in market sentiment that could affect your grid trading strategy. By staying informed, you can make better decisions about when to exit.

Step 3: Use Technical Analysis

Technical analysis can provide valuable insights into price patterns and trends, helping you identify potential exit points. Utilize indicators such as moving averages, support and resistance levels, or oscillators to gauge market momentum and identify optimal exit opportunities.

Step 4: Set Stop Losses and Take Profits

To manage risk and protect your capital, it is crucial to set stop losses and take profit levels. These predetermined orders will automatically exit your trades when certain price thresholds are reached, ensuring you don’t incur excessive losses or miss out on potential profits.

Step 5: Adapt and Adjust

Read Also: Top Computer Specs for Day Trading: A Comprehensive Guide

No trading strategy is foolproof, and markets are constantly evolving. Monitor the performance of your grid trading strategy, assess its effectiveness, and make necessary adjustments. Stay flexible and be willing to adapt to changing market conditions to optimize your exit strategy.

Conclusion

Exiting a grid trading strategy requires careful planning, monitoring, and adapting. By defining your target, staying informed about market conditions, utilizing technical analysis, setting stop losses and take profits, as well as constantly evaluating and adjusting your strategy, you can increase your chances of successful grid trading.

Grid trading is a popular trading strategy that involves placing buy and sell orders at fixed intervals above and below a predetermined price level. These price intervals, known as grid levels, create a grid-like pattern on a price chart.

The grid trading strategy is based on the idea of profiting from fluctuations in the price of an asset within a predefined range. Traders who use this strategy believe that the price of an asset will eventually revert to the mean or average price within the range.

In a grid trading strategy, traders typically set up a grid of buy orders below the current price and a grid of sell orders above the current price. Each grid level represents a predetermined price distance from the current price.

When the price moves up, the sell orders are triggered one by one as the price reaches each higher level, while the buy orders remain untriggered. Conversely, when the price moves down, the buy orders are triggered one by one as the price reaches each lower level, while the sell orders remain untriggered.

The aim of the grid trading strategy is to profit from the price fluctuations within the predefined range. By buying at lower levels and selling at higher levels, traders can potentially make profits regardless of the direction of the price movement.

Read Also: How much is $100 worth in Baku?

However, it’s important to note that grid trading is not without risks. If the price continues to move in one direction without retracing, the open grid positions can lead to significant losses. Therefore, it’s crucial for traders to manage their risk by setting appropriate stop-loss levels and monitoring the market conditions.

In conclusion, grid trading strategy is a method of profiting from price fluctuations within a predefined range by placing buy and sell orders at fixed intervals. It offers traders the opportunity to make profits regardless of the direction of the price movement, but it also carries risks that need to be managed effectively.

Exiting the grid trading strategy is an essential step for traders to manage risk and maximize profits. There are several reasons why it is important to have a clear exit strategy in place:

Overall, having a well-planned exit grid trading strategy is crucial for traders to effectively manage risk, maximize profits, and maintain control of their trading activities.

The grid trading strategy is a technique used by traders to profit from market fluctuations within a specific price range. It involves placing buy and sell orders at predetermined levels, known as grid levels, in order to capture both upward and downward movements in the market.

The grid trading strategy works by placing a series of buy and sell orders at specific intervals above and below the current market price. As the price moves up or down, these orders are triggered, allowing the trader to profit from the price fluctuations.

There are several advantages of using the grid trading strategy. Firstly, it allows traders to profit from both bullish and bearish market conditions. Secondly, it can be automated, reducing the need for constant monitoring. Finally, it can be a highly scalable strategy, allowing traders to adjust their positions and grid levels based on market conditions.

Exiting the grid trading strategy involves closing the open positions and cancelling any pending orders. This can be done manually by monitoring the market and manually closing the positions, or it can be automated using specific criteria, such as reaching a certain profit target or a specific time limit.

Here are some tips for exiting the grid trading strategy: 1. Set a profit target and stick to it. This will help you avoid greed and ensure you take profits at the desired level. 2. Use stop-loss orders to limit potential losses. 3. Consider using trailing stop orders to protect profits and allow for further upside potential. 4. Monitor the market conditions and adjust your exit strategy accordingly. 5. Be patient and disciplined, as exiting the grid trading strategy can require precise timing and decision-making.

Best practices for pricing spread options A spread option is a type of derivative financial instrument that gives the holder the right to buy or sell …

Read ArticleIs the Forex Market Open Tomorrow? As an investor or trader in the foreign exchange market, knowing whether the market will be open or closed tomorrow …

Read ArticleDiscover the Best Alternative to 1000pip Builder If you’re in the world of forex trading, you’ve probably heard of 1000pip Builder. This signal …

Read ArticleApplication of Bollinger Bands: A Comprehensive Guide Bollinger Bands are a technical analysis tool that was developed by John Bollinger in the 1980s. …

Read ArticleHow much does the average forex trader earn in South Africa? Forex trading has become increasingly popular in South Africa, attracting a growing …

Read ArticleExplore the Best Alternatives to Forex Tester 5 Forex Tester 5 has been a popular choice for traders looking to test their trading strategies in a …

Read Article