Understanding the Impact of Dilution on Stock Options

Impact of Dilution on Stock Options Stock options are a popular form of compensation offered to employees and executives, allowing them to purchase …

Read Article

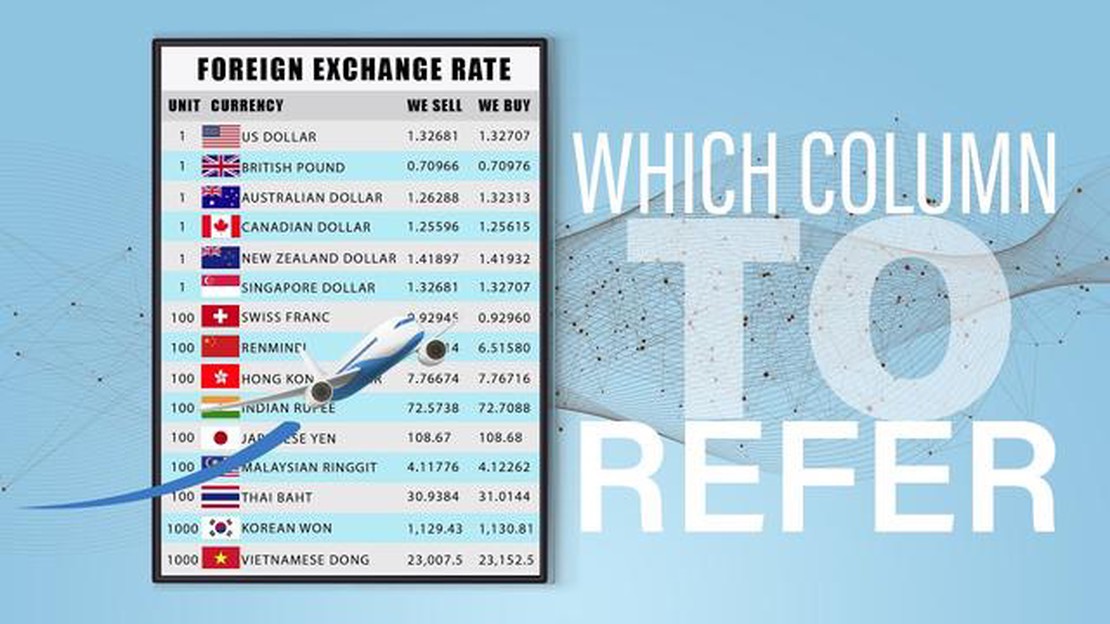

When it comes to traveling abroad or making international transactions, understanding currency exchange rates and fees is crucial. For customers of ING, a leading banking institution, it is essential to be aware of the currency exchange fees that may apply.

ING, known for its customer-centric approach, aims to provide transparency and ease when it comes to currency exchange. However, it is still important for customers to understand the fees involved to make informed decisions.

The currency exchange fee:

ING charges a currency exchange fee for converting currencies. This fee varies depending on the type of transaction and the currency being exchanged. It is important to note that ING uses the foreign exchange reference rates provided by international financial markets, and the exchange rate may fluctuate.

For currency conversions conducted in any ING branch or via ING’s Online Banking platform, a fee applies. This fee covers the cost of processing the transaction and accessing foreign currency. It is usually a percentage of the total transaction amount.

Customers can find more information about the specific currency exchange fees applicable to their transactions by visiting ING’s official website or contacting customer support.

ING is a well-known bank that provides a variety of financial services to its customers. One of the services offered by ING is currency exchange, which allows customers to convert one currency into another. However, when engaging in currency exchange with ING, it’s important to understand the currency exchange fee.

A currency exchange fee is a charge that is applied when converting one currency into another. This fee is typically a percentage of the total amount being exchanged and can vary depending on the bank or financial institution.

ING applies a currency exchange fee to transactions in which customers convert one currency into another. The exact fee charged by ING can vary depending on a number of factors, including the type of currency being exchanged, the amount being exchanged, and the specific terms of the transaction.

It’s important for customers to be aware of the currency exchange fee when using ING for international transactions, as this fee can impact the overall cost and value of the transaction.

Customers should also be aware that the currency exchange rate used by ING may be different from the current market rate. This difference, known as the exchange rate markup, is another factor that can impact the overall cost of the currency exchange transaction.

Read Also: Is HCA Stock Worth Buying? Exploring the Potential Returns and Risks

To minimize the impact of the currency exchange fee and exchange rate markup, customers can consider timing their currency exchanges strategically and exploring alternative options for currency exchange, such as using a different financial institution or a specialized currency exchange service.

In conclusion, understanding the ING currency exchange fee is essential for customers who plan to engage in international transactions or convert currencies. By being aware of this fee and considering alternative options, customers can make more informed decisions and potentially save on fees and charges.

The ING currency exchange fee is a charge applied by ING when you convert one currency into another using their services. When you use ING to exchange currencies, there are fees involved to cover the cost of the service and any associated risk.

The currency exchange fee is typically a percentage-based fee that is calculated based on the amount of currency being converted. The fee can vary depending on the specific currencies being exchanged and the market conditions at the time of conversion. It is important to note that the exchange rate offered by ING may also include a mark-up, which can further impact the cost of the transaction.

ING provides transparency regarding their fees, and you can find information on their website or by contacting their customer service. It is recommended to check the current fees and exchange rates before initiating a currency exchange with ING to ensure you have a clear understanding of the costs involved.

When comparing currency exchange fees between different providers, it is essential to consider not only the fee itself but also the overall cost, including any mark-ups to the exchange rate. Additionally, you should also consider the convenience, speed, and reliability of the provider’s services when making your decision.

| Currency | Exchange Fee |

|---|---|

| USD to EUR | 1.5% |

| GBP to EUR | 2% |

| AUD to EUR | 1.75% |

As an example, if you are converting USD to EUR and the exchange fee is 1.5%, for every 1000 USD exchanged, you would pay a fee of 15 EUR. It is essential to consider these fees when budgeting for an international transaction or when comparing the cost of different currency exchange providers.

Read Also: Understanding the High Option Premium: Factors and Implications

In summary, the ING currency exchange fee is a charge applied when converting one currency into another using their services. Understanding these fees and comparing them to other providers can help you make informed decisions and ensure you get the best value for your money.

The ING currency exchange fee is an important consideration for anyone who frequently travels or makes international transactions. When you exchange one currency for another, there is typically a fee charged by the bank or financial institution facilitating the transaction. Understanding the ING currency exchange fee is essential to ensuring you are getting the best deal and avoiding unnecessary costs.

Here are a few reasons why the ING currency exchange fee is important:

In summary, the ING currency exchange fee is important because it affects the cost of your international transactions, allows you to make informed decisions, helps with budgeting, provides options for finding competitive rates, and ensures transparency, allowing you to avoid hidden charges. By understanding and considering the currency exchange fee, you can optimize your financial transactions and save money in the process.

The ING currency exchange fee is a fee charged by ING bank for converting one currency into another. It is applied when you use your ING debit or credit card to make a purchase or withdrawal in a foreign currency.

The ING currency exchange fee is 2% of the transaction amount for all non-euro transactions. For euro transactions, there is no fee.

No, there is no minimum amount for the ING currency exchange fee. The fee is applied to the total transaction amount, regardless of its size.

Yes, you can avoid paying the ING currency exchange fee by using a card that does not charge foreign transaction fees or by using cash in the local currency. Additionally, you can consider opening a multi-currency account with ING to avoid conversion fees.

Yes, there may be other fees associated with currency exchange at ING, such as ATM withdrawal fees or fees charged by the merchant for using your card in a foreign currency. It’s important to check with ING for a complete list of fees and charges.

Impact of Dilution on Stock Options Stock options are a popular form of compensation offered to employees and executives, allowing them to purchase …

Read ArticleWhat is the RSI 2 Setting? The Relative Strength Index (RSI) is a popular technical indicator used by traders to assess the strength of an asset’s …

Read ArticleTips for Maximizing Profit on a Covered Call Investment A covered call is a popular options strategy that involves selling a call option on a stock …

Read ArticleAre nonqualified stock options subject to 409A? Nonqualified stock options (NQSOs) are an increasingly popular form of compensation offered by many …

Read ArticleHow is ADR calculated in Tradingview? Calculating Average Daily Range (ADR) is a crucial tool for traders, as it provides valuable insights into …

Read ArticleIs Forex Market an Over-the-Counter Market? The foreign exchange market, commonly known as the forex market, is the largest and most liquid financial …

Read Article