Learn How to Write a Script for MT4: A Step-by-Step Guide

Writing a script for MT4: a step-by-step guide If you are a trader using the MetaTrader 4 (MT4) platform, you may have already heard about scripts. …

Read Article

Centred moving average is a widely used statistical technique that is used to smooth out data and estimate underlying trends or patterns. It is commonly employed in various fields such as finance, economics, and engineering. The centred moving average is particularly useful when analyzing time series data, where observations are recorded at regular intervals over time.

The centred moving average involves calculating the average of a series of data points by taking the average of the values before and after each point. This helps to reduce the impact of short-term fluctuations and noise in the data, allowing for a more accurate representation of the underlying trend.

The centred moving average is also known as the “moving average with constant width” or “symmetrical moving average”. It is called “centred” because the moving average is centered around each data point, with the same number of data points on either side.

One of the main advantages of using the centred moving average is that it provides a smoothed representation of the data, which can be helpful in identifying long-term trends or patterns. It can also be used to remove outliers or unusual spikes in the data, making it easier to interpret and analyze.

Overall, the centred moving average is a powerful tool that can be used to enhance data analysis and visualization. By smoothing out noise and uncovering underlying patterns, it enables researchers and analysts to make more informed decisions and predictions based on their data.

A centred moving average is a statistical technique used to analyze time series data. It is a type of moving average that calculates the average of a specified number of data points, with the data points being equally weighted and centered around the current point. Unlike other moving averages, which are calculated based on past data points only, the centred moving average takes into account both past and future data points, providing a more accurate representation of the trend or pattern in the data.

The centred moving average is commonly used in finance, economics, and other fields where time series analysis is important. It is often used to smooth out fluctuations or noise in the data, making it easier to identify and interpret underlying trends or patterns. By calculating the average of the surrounding data points, the centred moving average provides a more stable and reliable measure of the overall trend, which can be helpful for making predictions or forecasting future values.

To calculate the centred moving average, the data points within the specified window are summed and then divided by the number of points in the window. The window can be of any size, depending on the specific application and the desired level of smoothing. Common choices for the window size include 3, 5, 7, or any odd number to ensure symmetry around the current point. The centred moving average can be calculated using various algorithms, such as the simple moving average or weighted moving average.

Read Also: Understanding the 80% Rule in Day Trading: Maximizing Profits and Minimizing Losses

In summary, the centred moving average is a useful statistical technique for analyzing time series data. It helps to smooth out fluctuations or noise in the data, providing a clearer picture of the underlying trend or pattern. By considering both past and future data points, the centred moving average provides a more accurate measure of the overall trend, making it a valuable tool for forecasting and prediction purposes.

The centred moving average is a commonly used method for smoothing time series data. It helps to remove noise and highlight underlying trends or patterns in the data. The centred moving average is calculated by taking the average of a data point and its nearby values. Unlike the simple moving average, which considers only past values, the centred moving average considers both past and future values, making it a better choice for identifying the overall trend in the data.

To calculate the centred moving average, follow these steps:

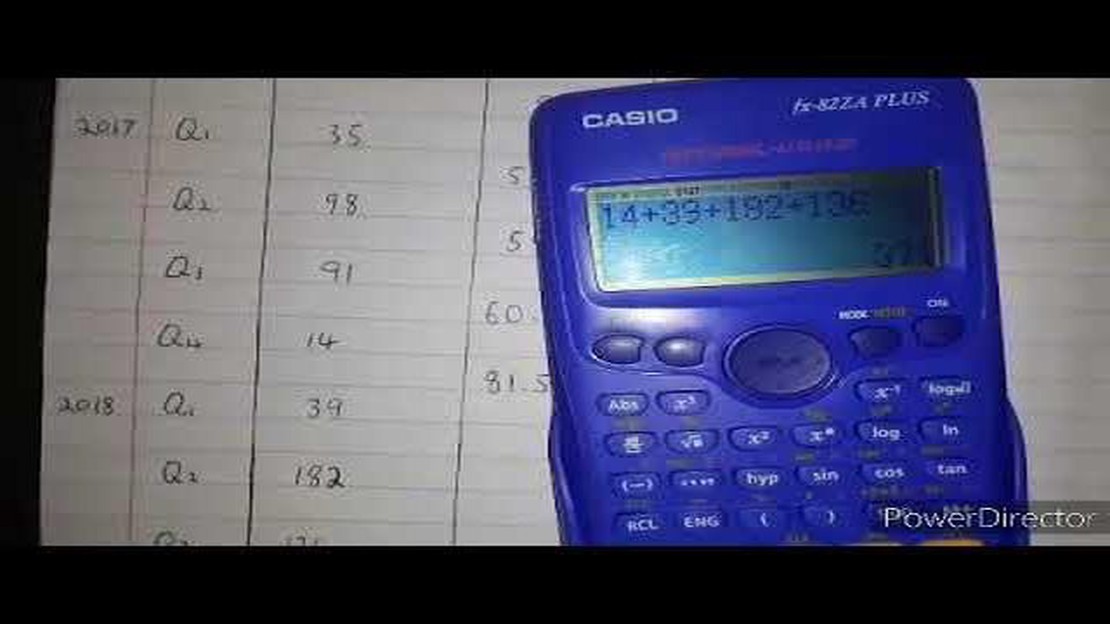

Here is an example calculation of the centred moving average:

| Time | Data | Window | Moving Average |

|---|---|---|---|

| 1 | 10 | 8, 10, 12 | 10 |

| 2 | 15 | 10, 12, 15, 17, 20 | 14.8 |

| 3 | 12 | 15, 17, 20, 12, 9 | 14.6 |

| 4 | 18 | 17, 20, 12, 9, 18, 15 | 14.2 |

| 5 | 20 | 20, 12, 9, 18, 15 | 14.8 |

In this example, the window size is 3, and the central data points are highlighted in each window. The moving average is calculated by taking the average of the data points in each window. As the window moves along the time series, the moving average values change, highlighting the underlying trend in the data.

Read Also: Is Joining IFA Free? Discover the Membership Options

A centered moving average is a statistical method used to analyze data by taking the average of a subset of data points within a given time frame, with an equal number of data points on either side. This helps to smooth out fluctuations and highlight trends in the data.

A centered moving average is calculated by taking the average of a subset of data points within a given time frame, with an equal number of data points on either side of the point being calculated. The average is taken by summing up the values of the data points in the subset and dividing by the number of data points in the subset.

The purpose of using a centered moving average is to smoothen data and highlight trends by reducing the impact of temporary fluctuations or outliers. It helps to provide a clearer picture of the overall pattern or trend in the data.

While a centered moving average can provide insights into past trends and patterns, it is not typically used for predicting future data. It is mainly used for analyzing and understanding historical data.

No, a centered moving average is not the same as a simple moving average. A centered moving average takes an equal number of data points on either side of the point being calculated, while a simple moving average takes a fixed number of data points before or after the point being calculated.

A centred moving average is a statistical measure used to assess the trend over a given period of time. It is calculated by taking the average of a set of values, with the value being the middle of the set. This helps to smooth out the data and highlight any patterns or trends that may exist.

Writing a script for MT4: a step-by-step guide If you are a trader using the MetaTrader 4 (MT4) platform, you may have already heard about scripts. …

Read ArticleDoes Pokemon X and Y Have GTS? Pokemon X and Y were released in 2013 as the first installment in the sixth generation of the Pokemon series. With its …

Read ArticleForex Market Closing Days in December December is a month filled with anticipation and excitement as the holiday season is in full swing. However, for …

Read ArticleBenefits of OCO Orders: Maximizing trading efficiency and managing risk Are you looking to optimize your trading strategy and make the most out of …

Read ArticleWhat is a GTE in WA? Are you considering studying in Washington State? If so, you may have come across the term “GTE.” But what does GTE stand for, …

Read ArticleNSO Taxation: How are NSO (Non-statutory Stock Options) taxed? When it comes to employee stock options, understanding the taxation of non-qualified …

Read Article