Discover How Much Kraken USDT Earns | Latest Insights and Analysis

How much does Kraken USDT earn? The use of cryptocurrencies has been gaining considerable popularity in recent years, with more and more people …

Read Article

Are you looking to optimize your trading strategy and make the most out of every opportunity in the market? One powerful tool that can help you achieve this is the OCO (One-Cancels-the-Other) order. OCO orders allow you to set multiple orders simultaneously, giving you the ability to automate your trading decisions and manage your risk effectively.

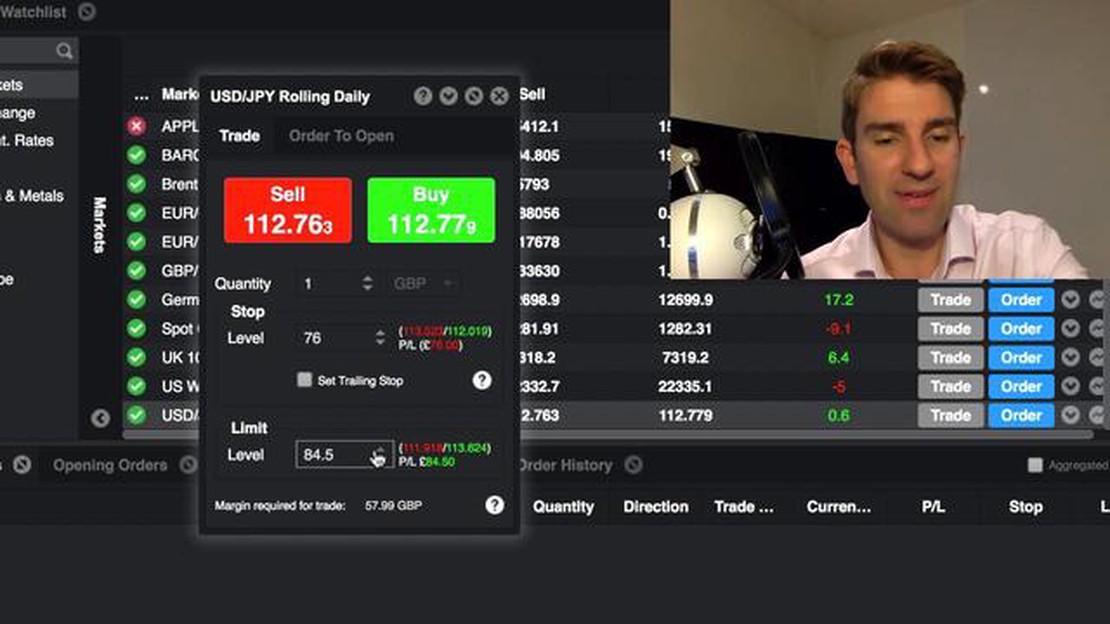

So how does it work? With OCO orders, you can place two orders at the same time: a stop order and a limit order. The stop order is designed to protect you from potential losses by triggering a market order when the price reaches a certain level. On the other hand, the limit order allows you to take profit by automatically selling your asset when it reaches a certain price.

By using OCO orders, you can define your entry and exit points in advance, eliminating the need to constantly monitor the market. This not only saves you time and effort but also helps you avoid making impulsive decisions based on emotions. OCO orders provide a level of automation and discipline that can significantly improve your trading performance.

OCO (One-Cancels-the-Other) orders can be a powerful tool in optimizing your trading strategy. These types of orders allow you to set up a strategy that automatically triggers specific actions based on market conditions, while also protecting your investments.

Here are some of the advantages of using OCO orders in your trading strategy:

Overall, incorporating OCO orders into your trading strategy can help streamline your decision-making process, protect your investments, and increase your profitability. By taking advantage of the benefits OCO orders offer, you can optimize your trading strategy and achieve greater success in the market.

Trading efficiency is crucial for success in the financial markets. With the use of OCO (one-cancels-the-other) orders, you can streamline your trading strategy and take advantage of market opportunities.

Here are some ways OCO orders can enhance your trading efficiency:

Overall, incorporating OCO orders into your trading strategy can greatly enhance your trading efficiency. By automating your trades, managing your risk effectively, and staying flexible and disciplined, you can optimize your trading performance and achieve better results in the financial markets.

Read Also: Exposing the Forex Scam Method: How to Spot and Avoid Fraudulent Trading Schemes

When it comes to trading, managing risk is crucial for long term success. OCO (One-Cancels-the-Other) orders offer traders an effective way to manage their risk in the market. By combining two orders, a stop loss order and a take profit order, traders can set predetermined levels at which their positions will be automatically closed.

Using OCO orders allows traders to set their risk tolerance and protect their capital. When placing a trade, a stop loss order can be set to limit potential losses, while a take profit order can be set to secure profits. This automated approach eliminates the need for constant monitoring of the market and the emotional decision-making that often leads to poor trading outcomes.

Read Also: 3 Common Hedging Strategies Explained: A Comprehensive Guide

Another advantage of using OCO orders to manage risk is the ability to take advantage of market volatility. By setting both a stop loss and take profit order, traders can ensure that they are able to capture profits and limit losses, even if the market moves in unexpected ways. This flexibility is essential for adapting to changing market conditions and reducing the impact of market fluctuations on trading outcomes.

| Advantages | Explanation |

|---|---|

| Risk management | OCO orders allow traders to set predetermined levels at which their positions will be automatically closed, enabling effective risk management. |

| Protection of capital | By setting a stop loss order, traders can limit potential losses and protect their capital. |

| Profit taking | A take profit order can be set to secure profits when the market reaches a predetermined level. |

| Market volatility | OCO orders allow traders to adapt to market changes and take advantage of volatility by capturing profits and limiting losses. |

OCO orders, or One Cancels the Other orders, are a type of trade order that allows you to set both a stop-loss order and a take-profit order at the same time. This means that if one order is executed, the other order is automatically canceled. By using OCO orders, you can automate your trading strategy and protect yourself from potential losses or lock in profits.

OCO orders can be used in many popular trading platforms and are supported by most brokerages. However, it’s always a good idea to check with your specific trading platform or brokerage to ensure that they support OCO orders before placing trades.

The advantages of using OCO orders include: 1) Automation: OCO orders allow you to automate your trading strategy by setting predefined stop-loss and take-profit levels. 2) Risk management: OCO orders help you manage risk by setting stop-loss levels to limit potential losses. 3) Locking in profits: OCO orders also allow you to set take-profit levels to lock in profits and exit trades at predetermined levels.

OCO orders can be suitable for both beginner and experienced traders. Beginner traders can benefit from the risk management aspect of OCO orders, while experienced traders can use them to automate their trading strategies and streamline their trading process. However, it’s always important to consider your own trading goals and risk tolerance before using any trading tool or strategy.

Yes, OCO orders can usually be modified or canceled after they have been placed, as long as the conditions for modification or cancellation are met. However, it’s important to check with your specific trading platform or brokerage to understand their rules and procedures for modifying or canceling OCO orders.

An OCO (One Cancels the Other) order is a type of order in trading that combines two or more orders. When one of the orders is executed, the other orders are automatically cancelled. This allows traders to set both a stop-loss order and a take-profit order simultaneously, ensuring that the trade is automatically closed at either the desired profit level or the acceptable loss level, whichever occurs first.

How much does Kraken USDT earn? The use of cryptocurrencies has been gaining considerable popularity in recent years, with more and more people …

Read ArticleHow Stock Options Work in a Company Stock options are a form of compensation that many companies offer to their employees. They provide employees with …

Read ArticleWhen to Start Trading Forex: Tips and Guidelines Forex trading, also known as foreign exchange trading, is a highly popular and potentially profitable …

Read ArticleImpact of Option Trading on Index Price Option trading plays a critical role in influencing the overall price movement of stock market indices. As …

Read ArticleIs Forex Trading banned in UK? Forex trading, also known as foreign exchange trading, is a popular investment activity that involves the buying and …

Read ArticleUnderstanding the Difference Between Index Options and Stock Options Options are a popular investment tool that allow individuals to profit from the …

Read Article