Understanding the Distinction: Options Trading versus Gambling Explained

Exploring the Distinction between Options and Gambling When it comes to investing, there is often a fine line between options trading and gambling. …

Read Article

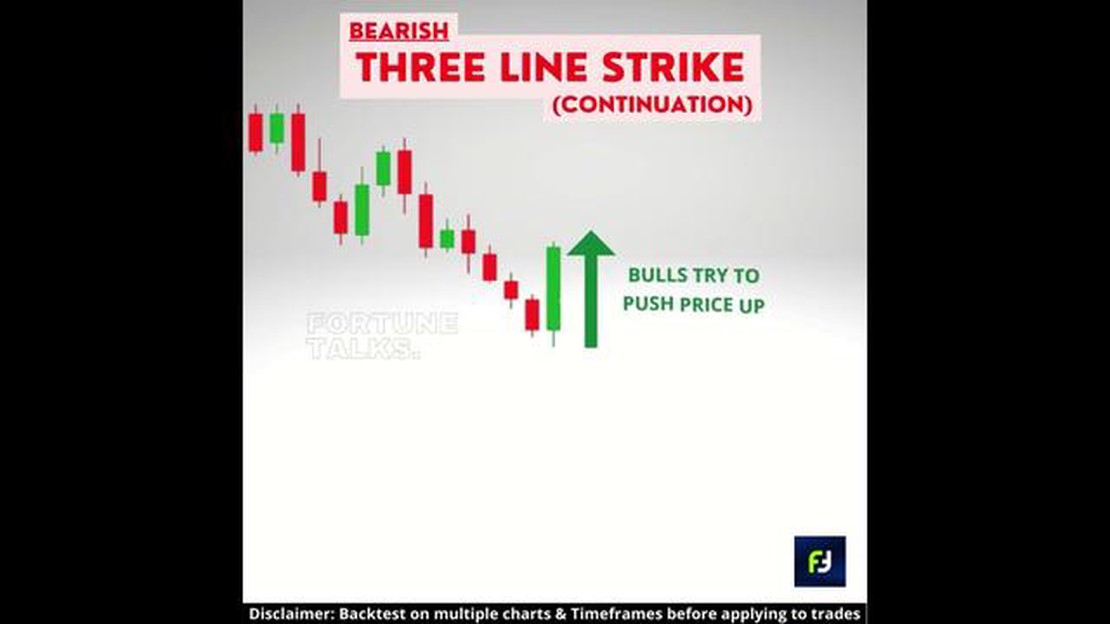

When it comes to analyzing candlestick patterns, traders often encounter similar-looking patterns that can cause confusion. Two such patterns are the Three Line Strike and the Three Black Crows. While they may appear similar at first glance, it is important for traders to understand the key differences between these patterns in order to make informed trading decisions.

The Three Line Strike is a bullish reversal pattern that consists of four candlesticks. The first candlestick is a long bearish candle, followed by three consecutive bullish candlesticks that open within the range of the previous day’s candlestick and close at a higher price. This pattern indicates a strong shift in market sentiment from bearish to bullish and can signal a potential trend reversal.

On the other hand, the Three Black Crows is a bearish reversal pattern that also consists of four candlesticks. In this pattern, the first candlestick is a long bullish candle, followed by three consecutive bearish candlesticks that open within the range of the previous day’s candlestick and close at a lower price. This pattern indicates a strong shift in market sentiment from bullish to bearish and can signal a potential trend reversal.

While both patterns involve three consecutive candlesticks and a shift in market sentiment, the key difference lies in the direction of the overall trend. The Three Line Strike occurs within a downtrend and signals a potential reversal to an uptrend, while the Three Black Crows occurs within an uptrend and signals a potential reversal to a downtrend.

By understanding the differences between the Three Line Strike and Three Black Crows candlestick patterns, traders can avoid confusion and make more accurate trading decisions. It is important to carefully analyze the overall trend and consider other technical indicators before making any trading decisions based on candlestick patterns.

Candlestick patterns are a popular tool used in technical analysis to help identify potential trend reversals or continuations in price movements. These patterns are formed by the open, high, low, and close prices of an asset over a specific period of time, typically represented by a candlestick chart.

Each candlestick on a chart represents a specific time period, such as a day, week, or hour, and provides valuable information about the market sentiment and price action during that period. By studying the different candlestick patterns, traders can gain insights into the psychology of market participants and make informed trading decisions.

There are numerous candlestick patterns, each with its own unique characteristics and potential interpretations. Some of the most commonly used patterns include the doji, hammer, shooting star, engulfing pattern, and the three line strike and three black crows patterns.

The three line strike and three black crows patterns are examples of bearish reversal patterns. The three line strike pattern consists of three long bullish candles followed by a fourth bearish candle that engulfs the previous three candles, indicating a potential trend reversal from bullish to bearish. On the other hand, the three black crows pattern consists of three consecutive long bearish candles, which suggest a strong bearish sentiment in the market.

It is important for traders to understand and correctly identify candlestick patterns to avoid making false assumptions or misinterpreting signals. Traders often use various rules and guidelines to confirm the validity of a pattern, such as the size of the candles, the presence of other technical indicators, or the overall market conditions.

| Pattern | Description | Interpretation |

|---|---|---|

| Doji | A candlestick with a small body and equal or almost equal open and close prices. | Indicates indecision or a potential trend reversal. |

| Hammer | A candlestick with a small body and a long lower shadow, resembling a hammer. | Suggests a potential trend reversal from bearish to bullish. |

| Shooting Star | A candlestick with a small body and a long upper shadow, resembling a shooting star. | Indicates a potential trend reversal from bullish to bearish. |

| Engulfing Pattern | A bearish engulfing pattern consists of a small bullish candle followed by a larger bearish candle that engulfs the previous candle. | Suggests a potential trend reversal from bullish to bearish. |

Read Also: Trade Forex Anytime, Anywhere: Exploring Mobile Trading Options

By understanding the different candlestick patterns and their interpretations, traders can enhance their technical analysis skills and improve their ability to identify potential trading opportunities.

The Three Line Strike candlestick pattern is a bullish reversal pattern that consists of three consecutive bearish candlesticks followed by a fourth bullish candlestick. This pattern is considered to be a strong signal that a bullish trend reversal may be imminent.

To identify a Three Line Strike pattern, look for the following:

The Three Line Strike pattern is significant because it shows a shift in momentum from bearish to bullish. The fourth bullish candlestick indicates that buyers have started to gain control and are overpowering the sellers. This shift in momentum can lead to a strong uptrend.

However, it is important to confirm the pattern with other technical indicators or price action signals to avoid false signals. Traders should wait for confirmation before making any trading decisions.

Overall, the Three Line Strike candlestick pattern is a powerful tool for identifying potential trend reversals and can be a valuable addition to a trader’s arsenal of technical analysis tools.

Read Also: Is Trading in a Bear Market More Difficult? Expert Insights and Strategies

The Three Black Crows candlestick pattern is a bearish reversal pattern that appears on a price chart. It consists of three consecutive long black (or filled) candlesticks with each candlestick opening within the body of the previous candlestick and closing lower. The pattern suggests a period of strong selling pressure and often indicates a potential trend reversal from bullish to bearish.

The first black candlestick in the pattern opens near the previous session’s closing price and closes lower. The second and third candlesticks continue the downward trend, with each opening near the previous session’s closing price and closing lower. The length and strength of each candlestick in the pattern can vary, but the overall visual effect of three consecutive long black candlesticks is usually what determines the pattern’s significance.

The Three Black Crows pattern is especially powerful when it occurs after a strong uptrend, as it signals a potential shift in market sentiment and a possible end to the bullish trend. Traders and investors often use this pattern as a sell signal or a confirmation of a bearish reversal.

However, it’s important to note that the Three Black Crows pattern should not be used as the sole basis for making trading decisions. It is always recommended to consider other technical indicators, chart patterns, and fundamental factors before entering or exiting a trade.

In conclusion, the Three Black Crows candlestick pattern is a bearish reversal pattern that consists of three consecutive long black candlesticks. It signals a potential trend reversal from bullish to bearish, especially when it occurs after a strong uptrend. Traders and investors use this pattern as a sell signal or a confirmation of a bearish reversal, but it should always be used in conjunction with other analysis tools.

The three line strike pattern is a bullish reversal pattern that consists of three consecutive bullish candlesticks followed by a bearish candlestick that engulfs the previous three. On the other hand, the three black crows pattern is a bearish reversal pattern that consists of three consecutive long bearish candlesticks.

To identify the three line strike pattern, look for a series of three bullish candlesticks in an upward trend. The fourth candlestick should be bearish and should completely engulf the previous three candlesticks.

The three black crows pattern is a bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. It suggests that the market sentiment has shifted from bullish to bearish, and indicates a possible downturn in prices.

No, the three line strike pattern is a bullish reversal pattern that typically occurs in an uptrend. It signals a potential trend reversal from a bearish to a bullish trend.

Yes, traders often look for additional confirmation signals to increase the accuracy of these patterns. These can include volume analysis, support and resistance levels, and other technical indicators.

Exploring the Distinction between Options and Gambling When it comes to investing, there is often a fine line between options trading and gambling. …

Read ArticleUnderstanding the Difference Between Currency Futures and FX Forward When it comes to managing currency risk, there are several financial instruments …

Read ArticlePalantir’s 50-day Moving Average: Explained Palantir Technologies is a data analytics company that has gained significant attention in recent years. …

Read ArticleCan cyclones be predicted? Cyclones are one of the most powerful and destructive natural disasters on our planet. These violent storms, also known as …

Read ArticleUnderstanding the Average Convergence Divergence Indicator The Average Convergence Divergence (ACD) indicator is a popular technical analysis tool …

Read ArticleShould You Exchange Money in Iceland? When traveling to Iceland, it is important to consider the best options for exchanging money. While some …

Read Article