Exploring the Three Moving Average Settings: A Comprehensive Guide

Understanding the Three Moving Average Settings Many traders rely on moving averages to identify trends and make informed trading decisions. Moving …

Read Article

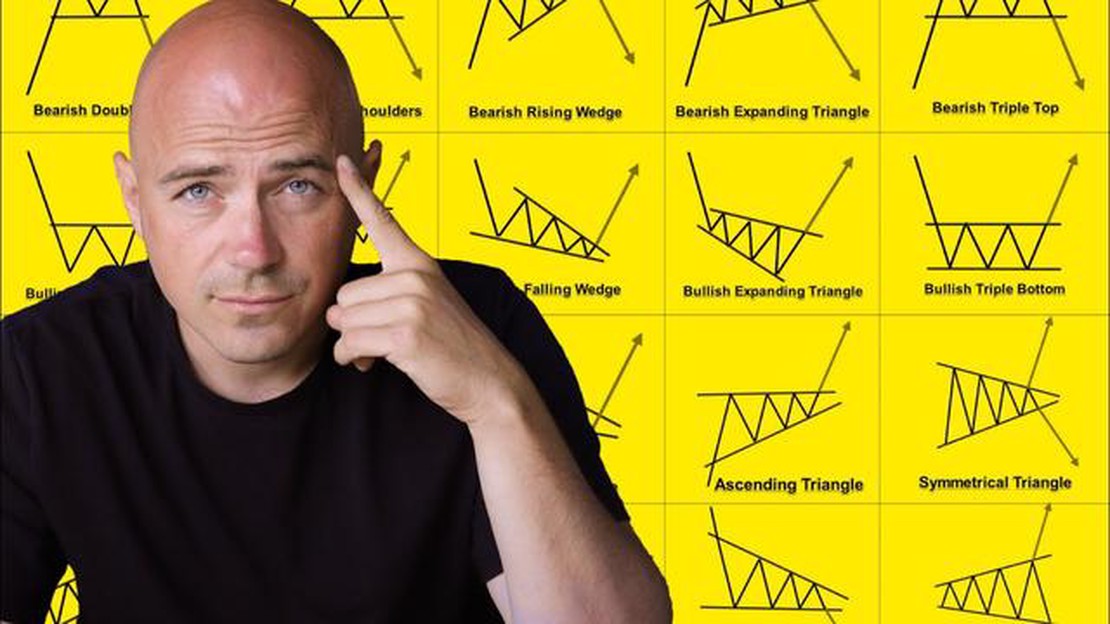

If you are a trader or investor, you might have come across various chart patterns that are used to predict future price movements in the financial markets. One such pattern is the M pattern, which is considered bullish. In this comprehensive guide, we will explore what exactly is an M pattern and how it can be used to identify potential bullish trends.

An M pattern is a chart pattern that resembles the letter “M” and is formed by price action in the financial markets. It is typically characterized by two downward price movements, separated by a brief period of consolidation, followed by a third downward movement. The M pattern is considered to be bullish because it often signals a potential reversal of a previous downtrend and the start of an uptrend.

Traders and investors use the M pattern to identify potential buying opportunities. When the price breaks out above the consolidation period after the formation of the M pattern, it is seen as a bullish signal. This breakout confirms that the sellers have exhausted their selling pressure and that buyers are stepping in, leading to a potential uptrend. Traders often use additional technical indicators and tools to confirm the validity of the M pattern and to time their entry and exit points.

It is important to note that not all M patterns are created equal. Some M patterns may not lead to a bullish reversal and could result in further downward movement. Therefore, it is crucial to analyze other factors such as volume, trend lines, and support and resistance levels to validate the M pattern and make informed trading decisions.

In conclusion, the M pattern is a bullish chart pattern that can be used by traders and investors to identify potential buying opportunities. By understanding how the M pattern is formed and analyzing additional technical indicators, traders can increase their chances of making successful trades. However, it is important to exercise caution and consider other factors before solely relying on the M pattern for trading decisions.

The bullish M pattern is a technical analysis chart pattern that can indicate a potential bullish reversal in a financial market. It is shaped like the letter “M,” hence its name. The pattern typically forms after a downtrend and can signal a reversal in price direction.

To identify a bullish M pattern, traders look for two consecutive troughs, with the second trough lower than the first. These troughs create the characteristic “M” shape on the chart. The pattern is considered a bullish signal because it suggests that the market has found support and is likely to reverse its downward trend.

Once the bullish M pattern is identified, traders typically wait for the price to break above the high point between the two troughs, known as the pattern’s neckline. This breakout is seen as confirmation of the pattern and can be used as a trigger to enter a long position.

Read Also: Does Forex Work at Night? Understanding Trading Hours and Strategies

The target for the bullish M pattern is usually determined by measuring the height of the pattern from the neckline to the lowest point of the pattern (the second trough). This measurement is then added to the neckline breakout point to estimate the potential upside target.

It’s important to note that the bullish M pattern is not a guaranteed indication of a bullish reversal. Traders should always consider other technical indicators and market factors before making any trading decisions. False signals can occur, especially in volatile markets.

In conclusion, understanding the bullish M pattern can be a valuable tool for traders looking to identify potential bullish reversals. By recognizing this pattern and applying appropriate analysis, traders can potentially enhance their trading strategies and improve their chances of success.

The M pattern is a technical analysis chart pattern that resembles the shape of the letter M. It is considered a bearish reversal pattern, indicating a potential trend reversal from an uptrend to a downtrend. The M pattern is formed by two consecutive peaks, separated by a trough in the middle.

To identify the M pattern, traders often look for specific characteristics. Firstly, the two peaks should be of similar height, forming the two arms of the M. The trough between the peaks should also be significant, indicating a temporary pause in the uptrend.

Furthermore, the volume can play a role in confirming the M pattern. Traders typically observe a decrease in volume during the first peak and an increase in volume during the second peak. This volume pattern suggests a weakening buying pressure followed by a stronger selling pressure, reinforcing the bearish sentiment.

Once the M pattern is confirmed, traders may consider taking bearish positions or exiting long positions. They often set price targets based on the height of the pattern, projecting a potential downside move. Stop-loss orders are usually placed above the highest peak of the pattern to manage risks in case of a breakout.

It is important to note that while the M pattern is commonly associated with bearish reversals, it is not a foolproof signal. Traders should always consider other technical indicators, market context, and risk management strategies before making trading decisions based solely on the M pattern.

Read Also: Current Remit Rate for INR to USD: Find the Best Exchange Rates

| Advantages of the M Pattern | Disadvantages of the M Pattern |

|---|---|

| Provides a clear visual signal of a potential trend reversal | Can be subjective and open to interpretation |

| Can be used in combination with other technical indicators for confirmation | May lead to false signals or whipsaws in volatile markets |

| Offers a defined entry and exit strategy | Does not guarantee the extent or duration of the subsequent downtrend |

The M pattern in trading is a technical analysis pattern that appears on a price chart in the form of two consecutive peaks followed by a trough. It is typically considered to be a bearish pattern, indicating a potential reversal in an uptrend.

An M pattern is generally considered to be a bearish pattern. It indicates a potential reversal in an uptrend, suggesting that prices may start to decline after reaching a peak. However, it’s important to consider other factors and confirmations before making trading decisions based solely on the M pattern.

A bullish M pattern is a variation of the M pattern where the two peaks are higher than the previous peaks. It indicates a potential reversal in a downtrend and a possible trend reversal to the upside. This pattern is less commonly seen compared to the bearish M pattern.

The M pattern can be used as a tool for identifying potential trend reversals and determining entry and exit points in a trading strategy. Traders can look for confirmation indicators such as volume, support and resistance levels, and other chart patterns to validate the M pattern and make more informed trading decisions.

While the M pattern can be a useful technical analysis tool, it is not always accurate and should not be relied upon solely for making trading decisions. It is important to consider other factors and confirmations such as market fundamentals, trend lines, and other chart patterns before taking any positions based on the M pattern.

The M pattern in bullish trading refers to a chart pattern formed by price movements that resemble the shape of the letter M. It is considered a reversal pattern, indicating a potential change in trend from bearish to bullish.

Understanding the Three Moving Average Settings Many traders rely on moving averages to identify trends and make informed trading decisions. Moving …

Read ArticleHow to Create a Forex Signal: A Step-by-Step Guide Forex trading is a popular investment option that allows traders to earn profits by speculating on …

Read ArticleStep-by-Step Guide: How to do Option Trading in ICICIdirect Option trading is a popular investment strategy that allows traders to speculate on the …

Read ArticleIntroduction to Zig Zag Signal Indicator in Forex Forex trading can be a daunting task, with so many indicators and tools available to help traders …

Read ArticleTax on Stock Options in Belgium: Everything You Need to Know Stock options are a popular form of compensation for employees, allowing them to purchase …

Read ArticleUnderstanding the Amortization of Stock Options Stock options are a popular form of compensation for employees in many companies, especially in the …

Read Article