How to Find Average Code in Java: Step-by-Step Guide

How to Find Average Code in Java Calculating the average value of a set of numbers is a common task in many programming languages, including Java. …

Read Article

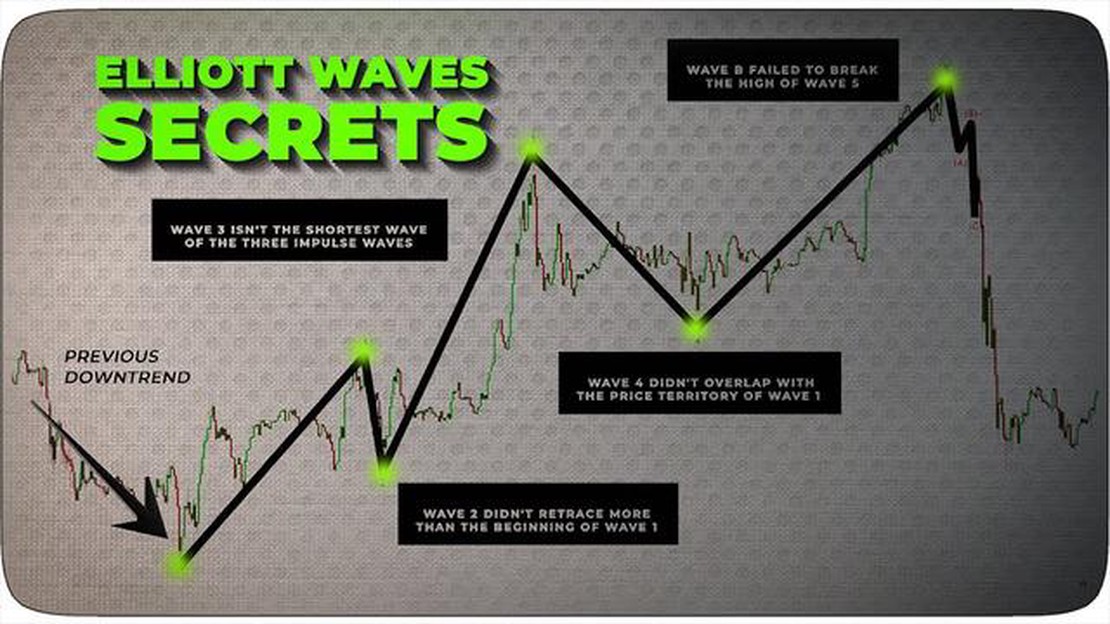

The Elliott Wave Theory is a powerful tool used by traders and analysts to predict future market movements. Developed in the 1930s by Ralph Nelson Elliott, this theory suggests that market prices follow specific patterns, which can be analyzed to forecast future price movements.

By studying wave patterns, traders can gain valuable insights into market trends, identify potential turning points, and make informed trading decisions. However, mastering Elliott Wave analysis requires knowledge of various techniques and principles.

In this article, we will explore some of the most effective Elliott Wave analysis techniques that can help you make accurate predictions in the financial markets. Whether you are a beginner or an experienced trader, understanding these techniques can greatly enhance your trading skills and improve your profitability.

From identifying impulse and corrective waves to analyzing Fibonacci retracement levels and wave extensions, we will delve into the key aspects of Elliott Wave analysis. By combining these techniques with other technical and fundamental indicators, you can create a robust trading strategy that gives you a competitive edge in the market.

“The Elliott Wave analysis provides a unique perspective on market dynamics, and when utilized correctly, can help traders identify high probability trading opportunities,” said John Smith, a renowned financial analyst. “By understanding the principles and techniques of Elliott Wave analysis, traders can stay ahead of the crowd and make profitable trades.”

Whether you are interested in short-term trading or long-term investing, incorporating Elliott Wave analysis into your trading toolbox can lead to more accurate predictions and improved trading outcomes. So, let’s dive into the world of Elliott Wave analysis and discover the techniques that can take your trading to the next level.

The Elliott Wave theory is a popular technical analysis tool used by traders to predict future price movements in financial markets. By identifying patterns in price charts, analysts can make predictions about the direction and timing of market trends.

There are a few key Elliott Wave analysis techniques that traders use to make accurate predictions:

1. Wave Identification: The first step in Elliott Wave analysis is identifying the different waves within a price chart. A complete Elliott Wave pattern consists of impulsive waves (which move in the direction of the overall trend) and corrective waves (which move against the overall trend).

Read Also: How to Generate Dividend Income with Options | The Ultimate Guide

2. Fibonacci Ratios: Elliott Wave analysts often use Fibonacci ratios to determine potential price targets and wave retracements. Common Fibonacci ratios include 38.2%, 50%, and 61.8%. These ratios can help traders identify areas of support and resistance.

3. Trend Channels: Trend channels are another important tool in Elliott Wave analysis. A trend channel is created by drawing parallel lines connecting the highs and lows of a price chart. These channels can help traders identify the boundaries of a trend and anticipate potential turning points.

4. Divergence: Divergence refers to a situation where the price of an asset and an oscillator (such as the Relative Strength Index or the Moving Average Convergence Divergence) move in different directions. Divergence can indicate a potential reversal in the price trend.

5. Wave Count Confirmation: To increase the accuracy of Elliott Wave predictions, traders often look for confirmation of wave counts from other technical indicators or chart patterns. This helps to validate the predicted direction and timing of market movements.

Elliott Wave analysis can be a powerful tool for traders looking to make accurate predictions in financial markets. By mastering these techniques, traders can gain an edge in their trading strategies and potentially increase their profitability.

Elliott Wave Analysis is a powerful tool for predicting market movements, but to achieve accurate predictions, it is important to employ effective strategies. Here are some proven strategies to enhance the accuracy of your Elliott Wave analysis:

Read Also: Learn How to Identify Support and Resistance in Forex Trading

By employing these effective strategies, you can significantly improve the accuracy of your Elliott Wave analysis and make more informed trading decisions. Remember to practice and refine your skills over time, as experience is key in mastering Elliott Wave analysis.

Elliott Wave analysis is a method of technical analysis that attempts to predict future price movements in financial markets by identifying patterns in the market’s price charts. It is based on the theory that market prices move in repetitive waves or cycles. This analysis technique can be effective in predicting market trends because it helps to identify key turning points in the market and provides a framework for understanding the psychology of market participants.

Elliott Wave analysis works by identifying specific patterns or waves in a market’s price chart. These waves are named after Ralph Nelson Elliott, who developed the Elliott Wave Theory in the 1930s. The theory postulates that market prices move in a series of five waves in the direction of the main trend, followed by three corrective waves. By analyzing the length and proportion of these waves, analysts can make predictions about future market movements.

While Elliott Wave analysis can be a useful tool for predicting market trends, it is not foolproof and has its limitations. One limitation is that it requires a high degree of subjectivity, as different analysts may interpret the waves differently. Additionally, it can be challenging to identify the exact start and end points of each wave, which can affect the accuracy of predictions. Furthermore, not all market movements can be accurately explained by Elliott Wave theory, and there are instances where the theory fails to provide accurate predictions.

There are several common techniques used in Elliott Wave analysis. One technique is wave counting, which involves identifying and labeling the waves on a price chart. Another technique is Fibonacci retracement, which is used to determine potential support and resistance levels based on the Fibonacci ratios. Trendlines and channels are also commonly used to confirm the validity of Elliott Wave patterns. Additionally, oscillators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can be used to provide additional confirmation signals.

Yes, it is possible to learn Elliott Wave analysis and apply it to your own trading. There are numerous educational resources available, including books, online courses, and video tutorials, that can help you understand the principles of Elliott Wave theory and learn how to apply it in practice. However, it is important to note that Elliott Wave analysis requires practice and experience to become proficient, and it is recommended to start with paper trading or using a demo account before applying it to real money trading.

Elliott Wave analysis is a method of market analysis based on the theory that market prices unfold in specific patterns called waves. These waves are influenced by investor psychology and go through repetitive cycles of expansion and contraction.

Elliott Wave analysis can help with accurate predictions by identifying the potential direction and magnitude of future price movements. By recognizing the patterns and cycles in market prices, traders can anticipate where the market is likely to go next and make well-informed trading decisions.

How to Find Average Code in Java Calculating the average value of a set of numbers is a common task in many programming languages, including Java. …

Read ArticleForex Trading in Islam: Haram or Halal? In the world of finance, Forex trading has gained significant popularity over the years. However, for …

Read ArticleCost of Trading Options on TD Ameritrade If you are looking to trade options on TD Ameritrade, it is important to understand the costs involved. …

Read ArticleWhat is the current Average True Range? The Average True Range (ATR) is a popular technical indicator used to measure the volatility of an asset. …

Read ArticleComparison of HotForex and Exness: Which Broker is the Best? When it comes to choosing a reputable and reliable forex broker, two names often come to …

Read ArticleIs 247 trading legit? With the rapid growth of online trading platforms, it’s important to be cautious and do thorough research before entrusting your …

Read Article