How to Spot a Reversal in Forex: Key Indicators and Strategies

Identifying Reversals in Forex: A Comprehensive Guide Spotting a reversal in the forex market can be a challenging task for even the most experienced …

Read Article

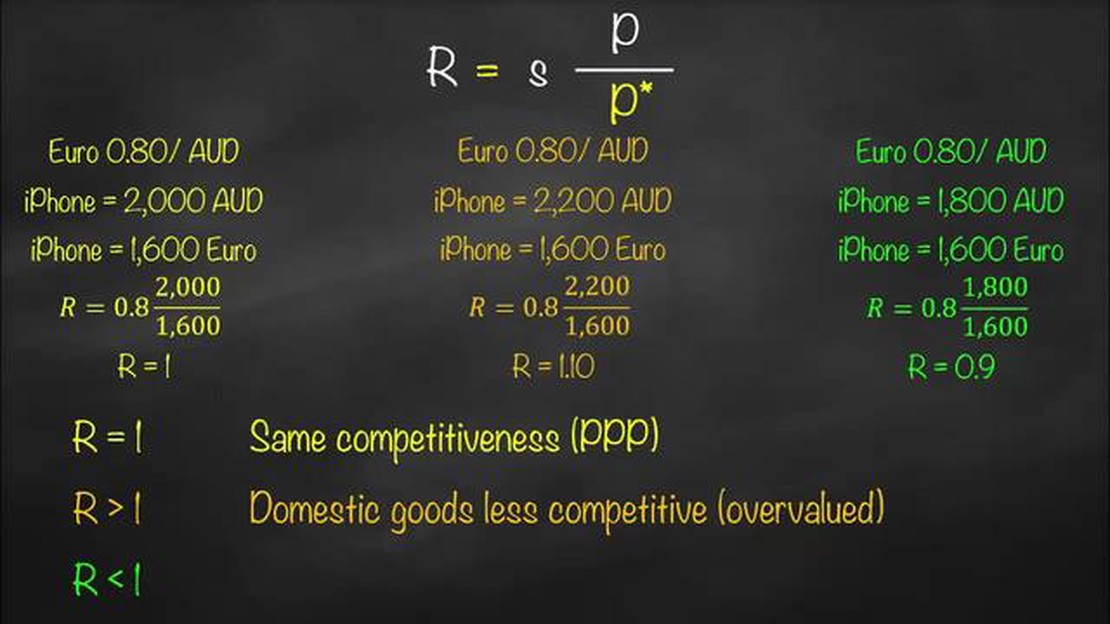

The real exchange rate is a crucial measurement in international finance as it reflects the true value between two currencies, taking into account not only the nominal exchange rate but also the relative prices of goods and services in each country. Calculating the real exchange rate accurately is essential for various economic analyses, such as determining the competitiveness of a country’s exports, assessing the impact of exchange rate fluctuations on inflation, and making informed investment decisions.

There are several methods to calculate the real exchange rate accurately. One commonly used approach is the purchasing power parity (PPP) method, which compares the price levels of a basket of identical goods in different countries. The PPP method assumes that in the long run, the exchange rate will adjust to equalize the prices of goods across countries.

Another method is the relative productivity approach, which considers the productivity levels of each country’s economy. The idea behind this approach is that countries with higher productivity tend to have stronger currencies as their goods and services are more attractive to international buyers. By comparing the productivity levels of two countries, an estimation of the real exchange rate can be derived.

It is important to note that calculating the real exchange rate accurately requires reliable data on price levels, productivity levels, and other economic indicators. Additionally, economic factors such as inflation, interest rates, and trade imbalances can also influence the real exchange rate. Therefore, a comprehensive analysis of these factors is necessary to obtain a more accurate assessment of the real exchange rate.

In conclusion, accurately calculating the real exchange rate is crucial for understanding the dynamics of international trade, evaluating a country’s economic performance, and making informed investment decisions. The PPP method and the relative productivity approach are two commonly used methods, but it is essential to consider other economic factors and reliable data to obtain a more accurate assessment. By using these methods, economists, policymakers, and investors can gain valuable insights into the true value of currencies and make more informed decisions in the global financial landscape.

Calculating the real exchange rate accurately is essential for businesses and individuals involved in international trade, investments, or traveling. The real exchange rate represents the actual purchasing power of a currency in relation to another currency, considering factors such as inflation, interest rates, and other economic indicators.

There are several strategies and methods available to compute the actual currency conversion rate with precision:

It is important to note that these strategies should be used in conjunction with comprehensive economic analysis, market research, and expert opinions to determine the most accurate actual currency conversion rates. Additionally, market fluctuations and unforeseen events can impact exchange rates, making it essential to stay updated and adapt strategies accordingly.

By leveraging these strategies and staying informed about the global economic landscape, businesses and individuals can make informed decisions when it comes to international trade, investments, and currency conversions.

The accurate calculation of exchange rates is of utmost importance in the global financial market. It plays a crucial role in international trade, investment decisions, and economic policy formulation. Understanding and accurately calculating exchange rates help investors, businesses, and governments make informed decisions and effectively manage risks.

Exchange rate is commonly defined as the rate at which one currency can be exchanged for another. However, calculating the real exchange rate requires taking into account various factors like inflation, interest rates, government policies, and market forces. This real exchange rate reflects the true purchasing power of a currency and determines its competitiveness in the international market.

Read Also: Discover the Alpari Fee: How Much Does It Cost to Trade with Alpari?

An accurate exchange rate calculation ensures fair trade practices and prevents manipulative actions in the market. A misaligned or misjudged exchange rate can lead to imbalances in trade, as it affects the cost of imports and exports. Accurate exchange rate calculation helps identify any exchange rate misalignments and allows for timely adjustments to maintain equilibrium in the market.

Accurate exchange rate calculation also enables investors to make informed decisions regarding international investments. Investors rely on exchange rates to evaluate potential returns and risks associated with foreign investments. A miscalculated exchange rate can lead to inaccurate projections and misinformed investment decisions.

Read Also: Understanding the Binomial Option Pricing Model: Assumptions and Applications

In addition, accurate exchange rate calculation is crucial for governments to formulate appropriate economic policies and manage monetary and fiscal stability. Governments use exchange rates to determine the value of their currency relative to other currencies. This allows them to manage inflation, support export competitiveness, and attract foreign investments.

In conclusion, accurate exchange rate calculation is essential for maintaining the stability of the global financial market and facilitating fair trade practices. It empowers investors, businesses, and governments to make informed decisions and effectively manage risks. By understanding the factors that influence exchange rates and employing accurate calculation methods, stakeholders can navigate the complexities of the international market with confidence.

The real exchange rate is the rate at which one country’s currency can be exchanged for another country’s currency, adjusted for the differences in price levels between the two countries.

The real exchange rate can be calculated using a formula that takes into account the nominal exchange rate and the relative price levels between two countries. The formula is: Real Exchange Rate = (Nominal Exchange Rate * Domestic Price Level) / Foreign Price Level

Calculating the real exchange rate accurately is important because it helps determine the true value of a country’s currency. It also provides insights into the competitiveness of a country’s products in the international market and helps understand the potential impact on trade and investment flows.

There are several methods used to calculate the real exchange rate, including the Relative Purchasing Power Parity (PPP) method, the Relative Economic Strength method, and the Balassa-Samuelson effect method. Each method has its own assumptions and limitations, but they all aim to provide a more accurate measure of the real exchange rate.

Several factors can affect the accuracy of calculating the real exchange rate, including data quality and availability, the choice of methodology, the assumptions made, and the time period considered. It is important to carefully consider these factors and use appropriate data sources and models to ensure a more accurate calculation.

The real exchange rate is the value of one country’s currency in relation to another country’s currency, adjusted for differences in inflation rates between the two countries.

Accurate calculation of the real exchange rate is important because it allows for a better understanding of a country’s competitiveness in international trade. It helps in determining whether a country’s currency is overvalued or undervalued, which can have significant implications for its economy.

Identifying Reversals in Forex: A Comprehensive Guide Spotting a reversal in the forex market can be a challenging task for even the most experienced …

Read ArticleImpact of Stock Options on EPS Stock options are a type of financial instrument that companies use to incentivize and retain employees. These options …

Read ArticleTD Ameritrade Trading: Everything You Need to Know TD Ameritrade is a leading online brokerage firm that offers a wide range of investment options and …

Read ArticleUsing Moving Average in Data Analysis: A Comprehensive Guide The moving average is a widely used statistical technique in data analysis that helps in …

Read ArticleOptions during market crash: What you need to know A market crash refers to a sudden and significant decline in the value of stocks and other …

Read ArticleIs it good to sell put options? Put options are financial instruments that give the holder the right, but not the obligation, to sell an underlying …

Read Article