Understanding Call Spread Options: A Complete Guide

Understanding Call Spread Options Call spread options are a popular investment strategy that allows traders to take advantage of both bullish and …

Read Article

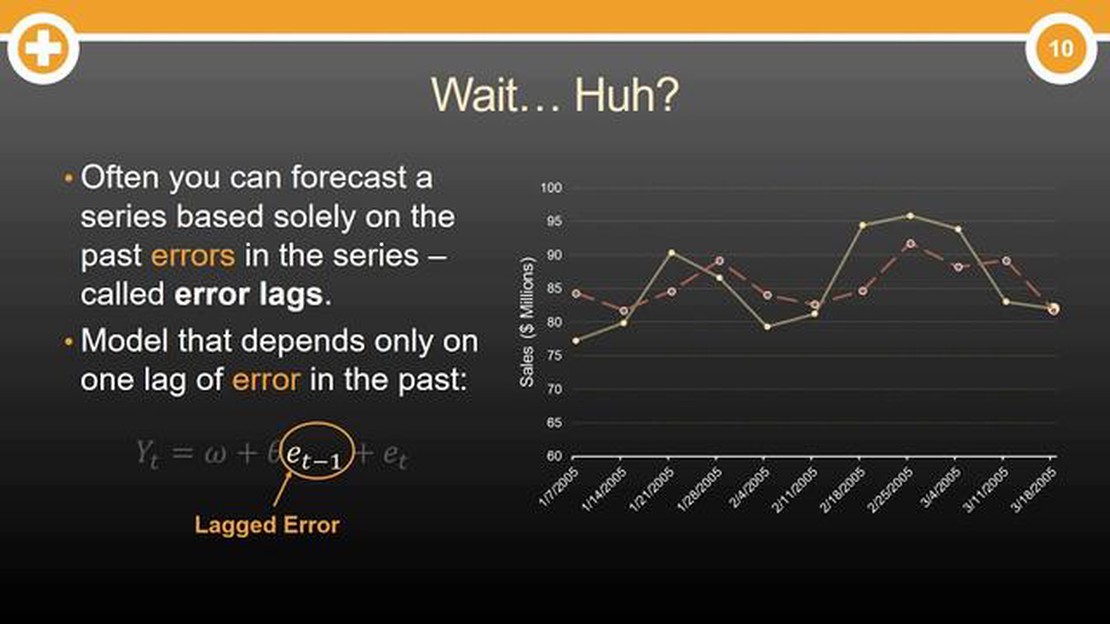

The MA model, or Moving Average model, is a commonly used forecasting method in econometrics. It is widely used in business and finance to predict future trends and analyze historical data. However, like any model, the MA model has its limitations and drawbacks that need to be taken into account when using it for decision-making purposes.

One of the main disadvantages of the MA model is its inability to take into account the long-term trend or seasonality of the data. The model only considers the past observations and derives future forecasts based on the average of these observations. As a result, the MA model may fail to capture the underlying patterns and patterns that are present in the data, leading to inaccurate predictions.

Another drawback of the MA model is its sensitivity to outliers or extreme values in the data. Since the model relies solely on the average of the past observations, any sudden and unexpected changes in the data can significantly impact the forecast. This can be problematic in situations where the data is volatile or subject to sudden shifts, as the MA model may fail to accurately capture these changes and provide reliable forecasts.

Furthermore, the MA model assumes that the future values of the data will be linearly related to the past values. This assumption may not hold true in many real-world scenarios, where the relationship between variables is nonlinear or subject to change over time. In such cases, the MA model may not be able to capture the complex dynamics of the data, resulting in less accurate forecasts.

Despite its limitations, the MA model can still be a valuable tool in certain situations. However, it is important for practitioners and researchers to be aware of its drawbacks and consider them when using the model to make decisions or predictions. By understanding the limitations of the MA model, users can make more informed choices and explore alternative models or techniques that may better suit their specific needs and requirements.

The MA (Moving Average) model is a commonly used time series forecasting model that has its limitations and drawbacks. It is important to understand these limitations in order to make informed decisions when using the MA model for forecasting.

One limitation of the MA model is that it assumes stationarity in the data. Stationarity refers to a situation where the statistical properties of a time series, such as mean and variance, remain constant over time. However, in real-world scenarios, time series data often exhibit trends, seasonality, and other forms of non-stationarity. The MA model may not be appropriate for forecasting such non-stationary data.

Another limitation is that the MA model only considers the historical values of the time series. It does not take into account any external factors or explanatory variables that may influence the future values of the time series. This can be a drawback in situations where external factors have a significant impact on the time series, such as economic indicators or policy changes.

The MA model is also limited in its ability to capture long-term trends or patterns in the data. As it only considers a fixed number of historical values, it may fail to capture complex patterns or changes in the data that occur over a longer time period. This can lead to less accurate forecasts, especially in situations where long-term trends are important.

Additionally, the MA model assumes that the errors in the forecast are uncorrelated and have constant variance. However, in practice, time series data often exhibit autocorrelation, where the errors are correlated with each other, and heteroscedasticity, where the variance of the errors changes over time. Violation of these assumptions can lead to inaccurate forecasts.

Lastly, the MA model is a purely descriptive model that does not provide any causal explanation for the relationship between the historical and future values of the time series. It does not consider the underlying mechanisms or dynamics that drive the behavior of the time series. This can limit its usefulness in situations where understanding the causal relationships is important.

Read Also: How to Withdraw Money from FXOpen: Step-by-Step Guide

In conclusion, while the MA model is a useful tool for time series forecasting, it is important to be aware of its limitations. It may not be appropriate for non-stationary data, it does not consider external factors or long-term trends, and it makes certain assumptions about the errors in the forecast. Understanding these limitations can help researchers and practitioners make more informed decisions when using the MA model.

One of the main disadvantages of the MA model is the lack of flexibility in decision making. The traditional top-down approach of the MA model often restricts organizations from quickly adapting to changes in the business environment.

Under the MA model, decision making is typically centralized and delegated to senior management. This hierarchical structure can often be slow and bureaucratic, making it difficult for organizations to respond swiftly to emerging opportunities or threats.

Furthermore, the rigidity of the MA model can limit creativity and innovation within an organization, as decision making is often based on predetermined goals and objectives. This can stifle employee autonomy and discourage them from thinking outside the box.

In contrast, organizations that embrace a more flexible approach to decision making, such as the agile management model, are often better equipped to respond to market shifts and quickly adapt their strategies. These organizations prioritize collaboration and empower employees at all levels to make decisions and take ownership of their work.

In conclusion, while the MA model provides structure and control, its lack of flexibility in decision making can be a significant drawback. Organizations that seek to stay competitive and innovative may need to explore alternative management approaches that promote agility and empower employees to make decisions.

The MA model, also known as the managed account model, can be a costly investment option due to its high initial investment costs. Setting up a managed account typically requires significant capital, making it inaccessible for many individuals and small businesses.

The expenses associated with establishing a managed account include legal fees, administrative costs, and fees charged by the investment manager. These costs can be substantial, and they may outweigh the potential benefits of the MA model for some investors.

Read Also: Is the World Trade Organization (WTO) a Trading Organization?

Additionally, ongoing expenses such as account maintenance fees and performance-based fees can further add to the overall cost of maintaining a managed account. These fees often depend on the size of the account, making it more expensive for investors with larger portfolios.

For small investors or those with limited resources, the high initial investment costs of the MA model can pose a significant barrier to entry. This limitation may prevent many individuals from taking advantage of the benefits offered by managed accounts, such as professional investment management and diversification.

While the high initial investment costs are a disadvantage of the MA model, it’s important to consider the potential long-term benefits before making a decision. Investors should carefully evaluate their financial situation and investment goals to determine if the costs associated with a managed account are justified.

The MA model has several limitations, including the assumption of constant parameters, the lack of consideration for external factors, and the inability to capture long-term trends.

The assumption of constant parameters means that the MA model does not account for changes in the underlying data over time. This can lead to inaccuracies in the forecasted values and a poor fit to the actual data.

The MA model does not take into account any external factors that may influence the time series being analyzed. This means that it cannot account for events such as economic crises, natural disasters, or changes in government policies.

The MA model is not able to capture long-term trends in the data. It is designed to model short-term fluctuations and random variations in the time series, but it does not have the ability to capture underlying patterns or trends that occur over extended periods of time.

Yes, there are several other drawbacks to using the MA model. These include the risk of overfitting the data, the inability to handle missing values, and the lack of interpretability in the model coefficients.

The MA (Moving Average) model has several limitations. Firstly, it assumes that past observations have equal importance, which may not be the case in reality. Secondly, it does not account for trend and seasonality in the data, which can be important factors in many time series. Finally, the MA model is not suitable for forecasting long-term trends as it only takes into account a limited number of past observations.

Understanding Call Spread Options Call spread options are a popular investment strategy that allows traders to take advantage of both bullish and …

Read ArticleIs it possible to trade FX in China? China, known for its booming economy and global trade influence, has a significant impact on the global foreign …

Read ArticleBeginner’s Guide to Option Trading in the Indian Market Option trading can be a lucrative investment strategy in the Indian market, but it also …

Read ArticleDiscretionary vs. Algorithmic Trading: Understanding the Difference Discretionary and algorithmic trading are two distinct approaches used in the …

Read ArticleStocks with High Options Volume Options trading is a popular strategy among investors looking to diversify and maximize their returns. When it comes …

Read ArticleEffective Ways to Promote Your Forex Business In today’s highly competitive online forex market, effectively marketing and promoting your forex …

Read Article