The Ultimate Guide: Discovering the Trading Strategy with the Highest Win Rate

What is the Best Trading Strategy with the Highest Win Rate? Trading in financial markets can be a highly rewarding endeavor, but it is also fraught …

Read Article

Discretionary and algorithmic trading are two distinct approaches used in the financial markets. While both aim to generate profits, they differ in terms of strategy and decision-making. Understanding the differences between these two approaches is crucial for investors and traders looking to navigate the complexities of the financial world.

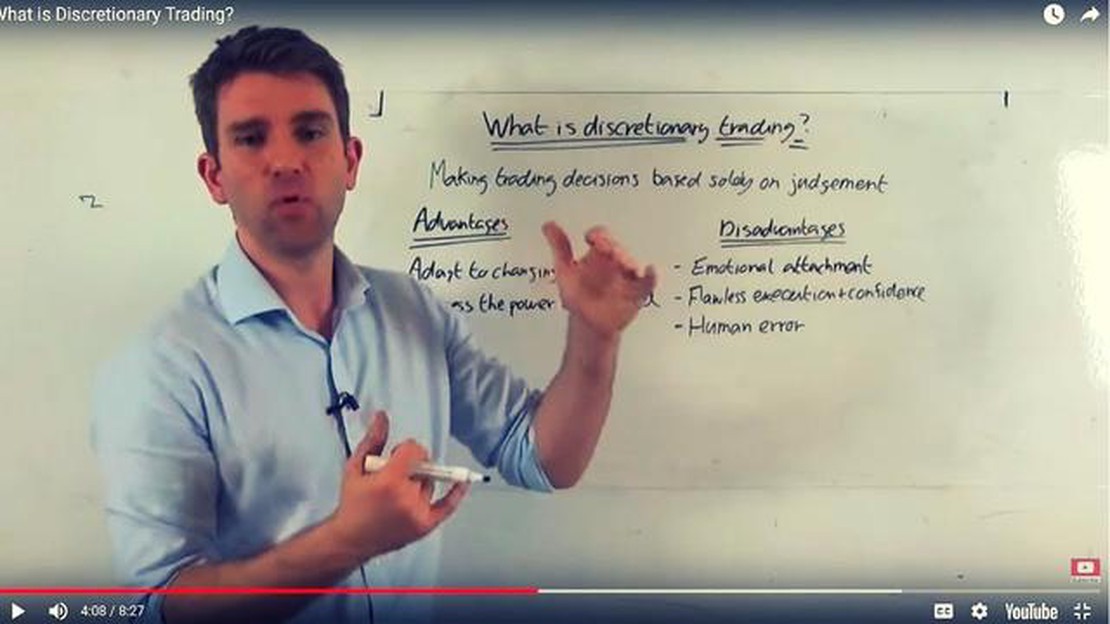

Discretionary trading, also known as manual trading, involves making trading decisions based on the trader’s subjective analysis and judgment. Traders choose investments and execute trades based on their experience, market knowledge, and qualitative factors. This approach allows for flexibility and adaptability, as traders can adjust their strategy in real-time to take advantage of market movements.

On the other hand, algorithmic trading, also known as automated trading, relies on computer programs and algorithms to execute trades. These algorithms are designed to follow specific rules and strategies, analyzing vast amounts of data to identify profitable trading opportunities. Algorithmic traders aim to remove emotional bias and human error from the decision-making process, as the computer executes trades based on pre-determined criteria.

While discretionary trading offers the potential for intuitive decision-making and the ability to quickly adapt to changing market conditions, it can be influenced by emotions and biases. Algorithmic trading, with its systematic and data-driven approach, minimizes the impact of human emotions and can execute trades faster and more efficiently. However, it lacks the ability to respond to market news and events that may require quick decision-making.

Understanding the distinction between discretionary and algorithmic trading is essential for traders and investors to choose the approach that best aligns with their goals and risk tolerance. Each approach has its advantages and drawbacks, and often, a combination of both can provide a more robust trading strategy.

Algorithmic trading, also known as automated trading or black-box trading, is a trading strategy that uses advanced mathematical models and algorithms to make trading decisions. It leverages the power of technology to execute trades at high speeds and with precision.

With algorithmic trading, traders can analyze vast amounts of historical data, market trends, and other relevant factors to identify profitable trading opportunities. This allows them to react quickly to market changes and execute trades in fractions of a second.

One of the key advantages of algorithmic trading is its ability to eliminate human emotions from trading decisions. Emotions such as fear, greed, or panic can often lead to irrational trading decisions, resulting in losses. Algorithmic trading removes the emotional element and relies solely on objective data and mathematical models.

This technology-driven trading approach has revolutionized financial markets by increasing liquidity and improving market efficiency. It has allowed for the execution of complex trading strategies that would be difficult or impossible to implement manually.

Algorithmic trading is widely used by institutional investors, such as hedge funds and investment banks, as well as individual traders. Its popularity continues to grow as advancements in technology and access to market data become more widespread.

However, algorithmic trading is not without its risks. The speed and complexity of algorithmic trading systems can sometimes result in unintended consequences, such as flash crashes or market manipulation. Regulators have implemented measures to mitigate these risks, such as circuit breakers and monitoring of trading activities.

In conclusion, algorithmic trading has transformed the financial markets by harnessing the power of technology. It has allowed for faster, more precise, and efficient trading, benefiting both institutional and individual investors. While it comes with its own set of risks, the potential rewards make algorithmic trading an attractive strategy for those looking to capitalize on market opportunities.

When it comes to trading in financial markets, there are two main approaches that traders can take: discretionary trading and algorithmic trading. While both methods aim to generate profits from trading activities, they differ in terms of strategy and execution.

Discretionary Trading:

Read Also: Is Binary Options Trading Open on Weekends? Find out Now!

Discretionary trading is a manual approach where traders rely on their own judgment and analysis to make trading decisions. These traders use their experience, knowledge, and intuition to identify opportunities and execute trades. They spend time analyzing market trends, studying financial news, and conducting fundamental and technical analysis to make informed decisions based on their interpretation of the market.

One of the main advantages of discretionary trading is the flexibility it offers. Traders are not bound by a specific set of rules or algorithms and have the freedom to adapt their strategies based on changing market conditions. However, this flexibility also comes with increased risk as trading decisions rely solely on the trader’s expertise and judgment.

Algorithmic Trading:

Algorithmic trading, also known as automated trading, involves using computer algorithms to make trading decisions. These algorithms are coded with specific rules and criteria that help traders identify trading opportunities and execute trades automatically. Algorithmic traders focus on quantitative analysis and use mathematical models to identify patterns and trends in the market.

One of the main advantages of algorithmic trading is its ability to process large amounts of data quickly and execute trades at high speeds. This can lead to more precise and timely trading decisions compared to discretionary trading. Algorithmic trading also helps remove emotion and human error from the trading process.

Differences:

Read Also: Understanding the Significance of MAT in Business

One key difference between discretionary and algorithmic trading is the level of human involvement. Discretionary trading relies heavily on the trader’s judgment, experience, and intuition, while algorithmic trading relies on predefined rules and criteria.

Another difference is the time frame in which trading decisions are made. Discretionary trading often involves analyzing longer-term trends and making decisions based on fundamental analysis, while algorithmic trading focuses on shorter-term trends and uses quantitative analysis to identify patterns.

Additionally, the level of automation differs between the two approaches. Discretionary trading involves manual execution of trades, while algorithmic trading automates the trading process and executes trades automatically based on predefined rules.

Similarities:

Despite their differences, discretionary and algorithmic trading share some similarities. Both approaches aim to generate profits from trading activities and require a deep understanding of the market. Both methods also involve risk management strategies to protect against potential losses.

Moreover, both discretionary and algorithmic traders need to stay updated with market news and events that can impact trading decisions. They also need to continuously monitor and analyze market data to identify opportunities and adjust their trading strategies accordingly.

In conclusion, while discretionary and algorithmic trading differ in terms of strategy and execution, both approaches have their own advantages and disadvantages. The choice between the two depends on the trader’s preferences, expertise, and the specific market conditions they wish to trade in.

Discretionary trading is when a trader uses their own judgment and analysis to make decisions about when to enter or exit a trade. Algorithmic trading, on the other hand, involves using pre-programmed algorithms to automatically execute trades based on predetermined criteria.

For a beginner trader, discretionary trading may be more suitable as it allows for a more hands-on approach and the ability to learn and develop trading skills. Algorithmic trading often requires a deeper understanding of programming and data analysis.

Algorithmic trading offers several advantages. It can execute trades at a much faster speed than discretionary trading, which can be especially beneficial in high-frequency trading. It also removes the emotional bias that can affect discretionary traders and allows for backtesting and optimization of strategies.

Yes, discretionary traders can incorporate elements of algorithmic trading into their strategy. They can use automated tools and indicators to assist with their decision-making process or even develop their own simple algorithms to execute trades based on certain conditions.

Some of the risks associated with algorithmic trading include technical malfunctions or errors in the algorithms themselves, which can lead to large losses. There is also the risk of over-optimization, where a strategy performs well in backtesting but fails to deliver similar results in live trading. Additionally, algorithmic trading can be affected by sudden market changes or events that the algorithms may not have been programmed to anticipate.

Discretionary trading is a method of trading where investment decisions are made by a human trader based on their own judgment and analysis of market conditions. It involves the use of personal judgment and intuition to determine when to enter or exit trades.

What is the Best Trading Strategy with the Highest Win Rate? Trading in financial markets can be a highly rewarding endeavor, but it is also fraught …

Read ArticleImplementing a Filter in MATLAB: Step-by-Step Guide Trying to make sense of large amounts of data can be a daunting task. Thankfully, MATLAB provides …

Read ArticleTradeStation Data Feed: Which One Does It Use? If you are a trader or investor, having access to real-time and accurate market data is crucial for …

Read ArticlePrediction for NMDC NMDC is a public sector undertaking (PSU) in India engaged in the exploration, mining, and processing of iron ore. As one of the …

Read ArticleUpgrading Your Options Level on Questrade If you’re an active investor or trader, you may be interested in exploring options trading. Options can …

Read ArticleForex Market Size in 2023: A Comprehensive Overview The foreign exchange, or forex, market is an essential part of the global financial landscape. …

Read Article