Understanding the Meaning and Significance of a Double Bottom Pattern

Understanding the Meaning of Double Bottom Patterns in Trading The double bottom pattern is a popular and reliable chart pattern in technical …

Read Article

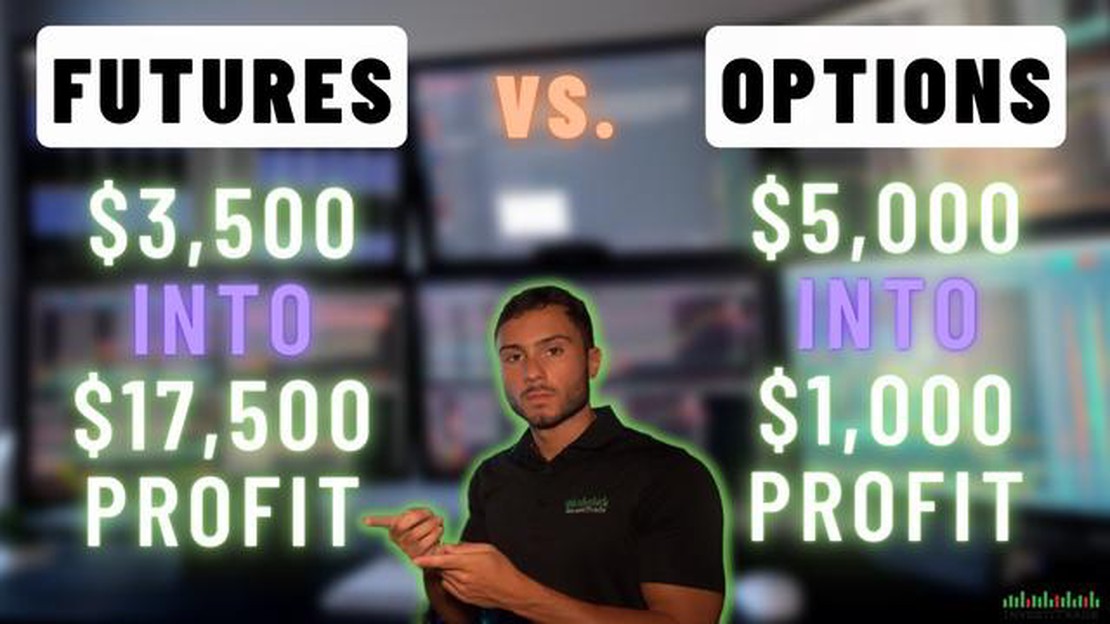

Day trading in the financial markets is a popular and exciting way to make profits. It involves buying and selling financial instruments such as stocks, currencies, or commodities within a short period, typically within a single day. Two common strategies that day traders use are futures and options trading. These are derivative instruments that allow traders to speculate on the price movements of an underlying asset without actually owning it.

Futures trading is a contract between two parties to buy or sell an asset at a predetermined price and date in the future. Traders speculate on the direction of the asset’s price and make profit or loss based on the difference between the agreed-upon price and the market price at the time of expiration. Futures trading provides the advantage of high leverage, meaning traders can control a large amount of assets with a relatively small investment. However, it also involves a higher level of risk due to the potentially unlimited loss.

Options trading is another popular strategy for day traders. It gives traders the right, but not the obligation, to buy or sell an asset at a predetermined price and date. Unlike futures trading, options trading provides traders with the opportunity to limit their risk by paying a premium for the option contract. If the price of the underlying asset moves favorably, the trader can exercise the option and make a profit. However, if the market moves against the trader, they can let the option expire and only lose the premium paid.

So which one is better for you?

The answer depends on various factors such as your risk tolerance, trading style, and market conditions. Futures trading offers high potential returns but also carries significant risks. It requires careful risk management and a deep understanding of the market. On the other hand, options trading allows for more flexibility and limited risk, making it a popular choice for beginners or those with a lower risk appetite. It is essential to thoroughly research and understand both trading strategies before deciding which one is better suited to your individual needs and goals.

Day trading futures involves buying and selling contracts for future delivery of a commodity or financial instrument. These contracts are standardized agreements to buy or sell a specified amount of the underlying asset at a predetermined price and date in the future.

Futures contracts are traded on various exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE). Traders can choose from a wide range of commodities, including oil, gold, corn, and natural gas, as well as financial instruments like stock indexes and currencies.

Day trading futures can offer several advantages over other trading instruments like stocks or options. The futures market is highly liquid, meaning there is a high volume of trades occurring, which can result in tighter bid-ask spreads and improved execution prices. Additionally, futures contracts often have leverage, allowing traders to control a larger position with a smaller amount of capital.

When day trading futures, it is essential to have a clear trading plan and strategy. Traders should focus on technical analysis and use tools like charts and indicators to identify potential entry and exit points. Emotion and impulsive decision-making should be avoided, as they can lead to costly mistakes.

Risk management is also crucial in day trading futures. Traders should set stop-loss orders to limit potential losses and adhere to proper position sizing techniques. It is essential to remember that trading futures involves a high level of risk, and capital can be lost quickly if proper precautions are not taken.

Overall, day trading futures can be a lucrative venture for experienced and disciplined traders who are willing to put in the time and effort to develop a solid trading plan. However, it is crucial to understand the risks involved and to approach the market with caution.

Read Also: Learn how to buy Novartis shares: a step-by-step guide

Day trading options is a popular strategy among traders due to their potential for high returns and the flexibility they offer. However, it is important to have a clear understanding of how options work before getting involved in day trading them.

Options are financial derivatives that give traders the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time frame. In day trading options, traders are looking to profit from the short-term price movements of these assets.

Read Also: Who Will Be on Hard Knocks 2023-2024? Predictions, Rumors, and Expectations

When day trading options, traders have two main types of options to choose from: call options and put options. A call option gives the trader the right to buy an asset at the strike price, while a put option gives the trader the right to sell an asset at the strike price.

One of the key advantages of day trading options is the ability to use leverage. With options, traders can control a larger amount of assets with a smaller amount of capital. This can amplify potential profits, but it can also increase the risk of losses. It is important for traders to carefully manage their risk and use proper risk management techniques when day trading options.

Another advantage of day trading options is the ability to profit in both bullish and bearish market conditions. While buying options allows traders to profit from upward price movements, they can also profit from downward price movements by selling options short.

However, day trading options also come with certain risks. Options have an expiration date, which means that if the price of the underlying asset does not move in the anticipated direction within the specified time frame, the options may become worthless. This time decay can erode the value of options, making it important for traders to carefully time their trades and choose options with the right expiration dates.

In conclusion, day trading options can be a profitable strategy for traders looking to take advantage of short-term price movements. However, it is important to have a solid understanding of how options work and to carefully manage risk when day trading them. With the right knowledge and strategy, day trading options can offer traders the potential for high returns and flexibility in their trading approach.

Futures are financial contracts that oblige the buyer to purchase an asset or the seller to sell an asset at a predetermined price and date in the future. Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period of time.

Day trading is a trading strategy where traders open and close positions in financial markets within the same trading day. The goal is to profit from short-term price movements rather than holding positions overnight.

Day trading futures offers high liquidity, tight spreads, and lower margin requirements compared to options. Futures also provide direct exposure to the underlying asset and allow traders to take advantage of leverage.

Day trading options offer the potential for higher returns and limited risk. Options provide traders with leverage and the ability to profit from both upward and downward price movements. They can also be used to hedge against other positions in a portfolio.

Both futures and options can be suitable for beginners, depending on their risk tolerance and trading objectives. However, futures may be easier to understand and trade for beginners due to their simplicity and more straightforward pricing.

Understanding the Meaning of Double Bottom Patterns in Trading The double bottom pattern is a popular and reliable chart pattern in technical …

Read ArticleDoes UPS offer stock options? Stock options are a popular form of employee compensation that many companies offer to attract and retain talented …

Read ArticleTop ETF Day Trading Strategies Exchange-Traded Funds (ETFs) have become increasingly popular amongst day traders due to their flexibility and …

Read ArticleCan I transfer money from forex card to US bank account? Transferring money from a Forex card to a US bank account can be a convenient and …

Read ArticleUnderstanding the Rule of 3, 5 and 7 in Trading When it comes to trading, understanding key principles and strategies is essential for success. One …

Read ArticleUnderstanding the Meaning of Three White Soldiers When it comes to analyzing price patterns in trading, Three White Soldiers is a well-known and …

Read Article