How Much Does a Trading Computer Cost? Find Out Here

Trading Computer Prices: How Much Does a Trading Computer Cost? When it comes to trading, having a powerful computer is essential. Traders need a …

Read Article

Forecasting is an essential component of decision making in various industries. Accurate predictions of future trends can help businesses plan their operations, optimize resources, and stay ahead of the competition. Two popular techniques for forecasting are moving average and exponential smoothing. While both methods aim to estimate future values based on past data, they differ in their approach and performance. In this article, we will compare the two techniques and determine which one is the better forecasting technique.

Moving average is a simple and intuitive method of forecasting. It calculates the average of a set of past data points within a given time period and uses it as the forecast for the next period. The number of data points included in the calculation is known as the window size. Moving average is easy to understand and implement, making it a popular choice for beginners and small businesses with limited data analysis capabilities. However, its simplicity comes at a cost. Moving average does not take into account the changing nature of data and tends to smooth out fluctuations, resulting in lagged forecasts.

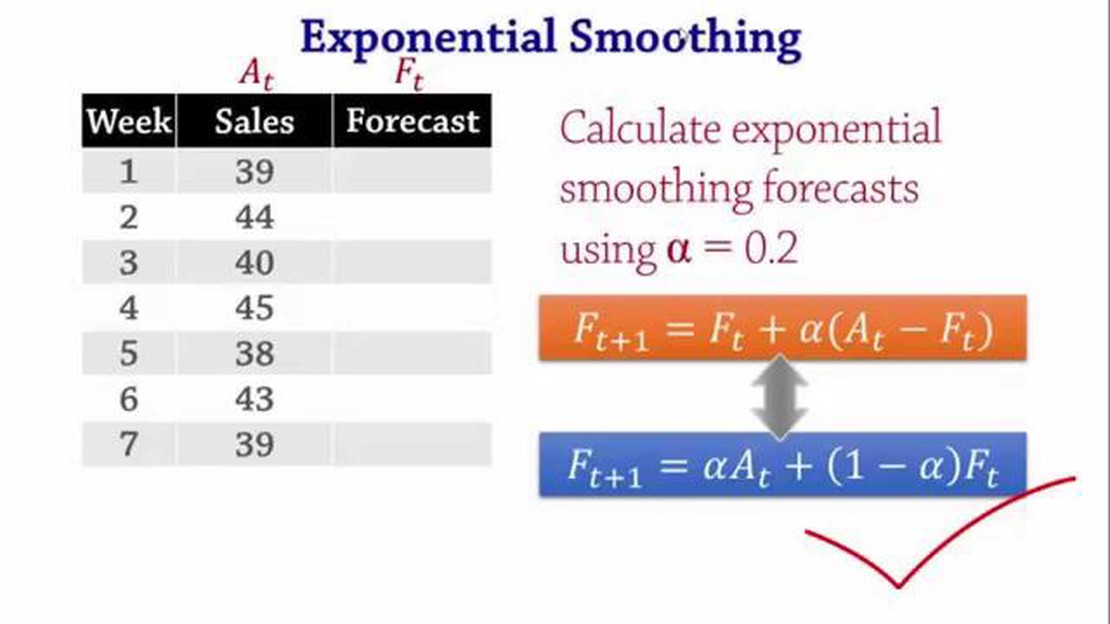

On the other hand, exponential smoothing is a more sophisticated technique that considers the weighted average of past observations, giving more importance to recent data points. The weighting factor, also known as the smoothing constant, determines the rate at which the influence of older observations diminishes. Exponential smoothing is particularly useful when there is a trend or seasonality in the data, as it provides a more accurate forecast by recognizing the changing patterns. However, it requires more advanced mathematical calculations and parameter tuning compared to moving average.

In conclusion, both moving average and exponential smoothing have their strengths and weaknesses. Moving average is a simple and easy-to-implement technique but may result in lagged forecasts due to its disregard for changing patterns. Exponential smoothing, on the other hand, takes into account the changing nature of data and provides more accurate forecasts, especially in the presence of trends or seasonality. The choice of the better forecasting technique depends on the specific requirements and complexity of the data. It is recommended to analyze the data characteristics and experiment with both methods to determine the most suitable technique for a given forecasting scenario.

Forecasting techniques are crucial for businesses to make informed decisions and plan for the future. Among the various forecasting techniques available, two popular options are moving average and exponential smoothing. This article aims to compare the two methods to determine which one is the better forecasting technique.

Read Also: Find Out if Metatrader 4 Supports Heikin Ashi Candles

| Features | Moving Average | Exponential Smoothing |

|---|---|---|

| Calculation | Calculates the average of a predefined number of past data points | Assigns different weights to past data points, with more recent data points having higher weights |

| Flexibility | Less flexible as it requires a fixed number of past data points to calculate the average | More flexible as it can adjust the weights assigned to past data points based on the desired level of smoothing |

| Adaptability | Suitable for stable and predictable time series data | Ideal for time series data with trend, seasonality, and irregular patterns |

| Accuracy | May result in lagging forecasts as it takes into account a larger number of past data points | Provides more accurate forecasts as it gives more weight to recent data points |

| Smoothness | Less smooth forecasts as it considers a wider range of past data points | Produces smoother forecasts as it focuses more on recent data points |

| Usage | Commonly used when historical data is stable and there are no significant variations | Preferred when time series data exhibits trend, seasonality, or other dynamic patterns |

Overall, the choice between moving average and exponential smoothing depends on the characteristics of the time series data and the desired level of forecasting accuracy. Moving average is suitable for stable and predictable data, while exponential smoothing is better for data with trend, seasonality, and irregular patterns. Exponential smoothing generally provides more accurate and smoother forecasts compared to moving average. However, the selection should be based on the specific requirements of the forecasting task and the nature of the data being analyzed.

The moving average is a statistical technique used in forecasting time series data. It is commonly used to identify and analyze trends by averaging out fluctuations over a specific period of time. This technique is particularly useful when dealing with data that contains seasonality or random fluctuations, as it smoothes out these variations, making it easier to identify underlying patterns.

At its core, the moving average works by calculating the average value of a subset of data points within a specific time frame. This subset “moves” through the entire dataset, continuously updating the average as it incorporates new data. The size of the subset, often referred to as the window size or the lag, determines the level of smoothing applied to the data. Smaller window sizes result in a more responsive moving average, capturing short-term fluctuations, while larger window sizes provide a more stable and smoothed average.

To calculate the moving average, the dataset is first divided into overlapping subsets of data points, each of which contains the window size of observations. The average of each subset is then computed and used as a single data point in the resulting moving average series. This process is repeated for each subsequent subset, thereby creating a new series of data points representing the moving average.

| Data Point | Moving Average |

|---|---|

| 1 | - |

| 2 | - |

| 3 | 2 |

| 4 | 3 |

| 5 | 4 |

| 6 | 5 |

| 7 | 6 |

| 8 | 7 |

In the example table above, the window size for calculating the moving average is set to 3. As the subset “moves” through the dataset, the corresponding moving average values are computed and added to the series. For instance, the moving average value for the first subset (1, 2, 3) is not calculated since it does not contain enough observations. The second subset (2, 3, 4) has a moving average of 3, and so on.

The moving average is a popular forecasting technique due to its simplicity and interpretability. It can be easily applied to various types of time series data and is often used as a baseline for comparing more advanced forecasting methods. However, it is worth noting that the moving average has limitations, such as not capturing sudden changes or outliers in the data.

Read Also: What is the Exponential Moving Average (EMA) formula?

The moving average forecasting technique is a method used to predict future values of a time series by calculating the average of a given number of past observations. It smooths out the fluctuations in the data and provides a more stable trend.

The exponential smoothing technique is a forecasting method that assigns exponentially decreasing weights to past observations. The most recent observations are given more weight, while older observations receive less weight. It provides a more weighted preference for the most recent data points.

The choice between moving average and exponential smoothing depends on the specific characteristics of the time series being analyzed. Moving averages may be more suitable for data with less variability, while exponential smoothing is more useful for data with a higher level of volatility. It’s important to consider the specific requirements and goals of the forecasting task to determine which technique is better.

Yes, moving average and exponential smoothing can be used together in a hybrid forecasting approach. This approach combines the strengths of both techniques and can provide more accurate predictions. For example, one could use exponential smoothing to capture short-term trends and then apply a moving average to smooth out any remaining fluctuations in the data.

Trading Computer Prices: How Much Does a Trading Computer Cost? When it comes to trading, having a powerful computer is essential. Traders need a …

Read ArticleLocation of GTS Trading Headquarters GTS Trading is a global company with its headquarters located in a prime business district. Situated in the heart …

Read ArticleIs IQ Option trading halal? IQ Option is one of the leading trading platforms in the online trading industry. With its advanced features and …

Read ArticleWhat is BBG Toms? If you’re a fitness enthusiast or have been into health and wellness for some time now, chances are you’ve heard of BBG Toms. But …

Read ArticleReporting a Cashless Exercise: Tips and Guidelines A cashless exercise is a common method used by employees to exercise their stock options without …

Read ArticleReasons for MetaTrader’s Removal from Play Store In recent news, the popular trading application MetaTrader has been removed from the Google Play …

Read Article