Step-by-Step Guide: Installing VWAP Indicator on Your Trading Platform

Easy steps to install VWAP indicator If you’re a trader looking to enhance your technical analysis, the Volume Weighted Average Price (VWAP) indicator …

Read Article

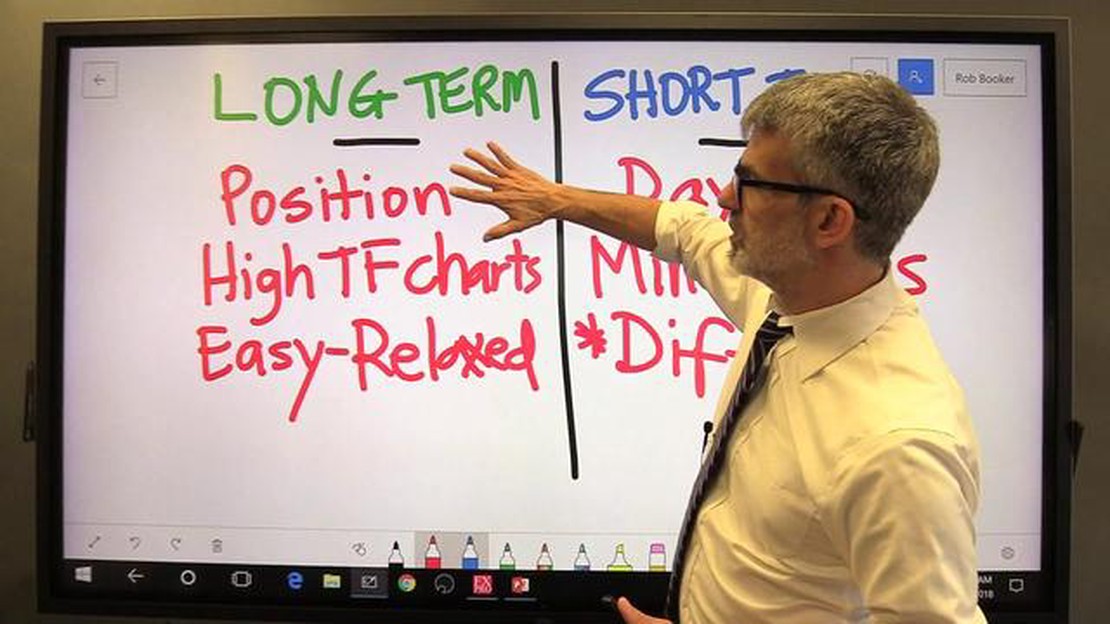

Forex, or foreign exchange, trading is a popular investment option that involves the buying and selling of currencies. While many traders focus on short-term trades to capture small price fluctuations, long term trading in forex offers a different approach. Long term trading involves holding positions for weeks, months, or even years, aiming to capitalize on larger market trends. This article explores the strategies, benefits, and risks associated with long term trading in forex.

One of the key strategies in long term forex trading is trend following. Traders analyze historical price data to identify long-term trends and enter positions in the direction of these trends. By riding the trend, traders can potentially capture substantial profits. Another strategy is fundamental analysis, where traders monitor economic and geopolitical events to predict long-term currency movements. This strategy requires a deep understanding of the factors that influence currency valuations.

Long term trading in forex offers several benefits. Firstly, it allows traders to avoid the stress and time commitment required for frequent monitoring of the market. Instead of constantly analyzing charts and placing trades, long term traders can take a more relaxed approach. Secondly, long term trading can provide substantial profits if traders can accurately identify and ride major market trends. Finally, long term trading allows traders to diversify their portfolios and potentially reduce risk by holding positions in different currencies.

However, long term trading in forex also carries certain risks. One of the main risks is the potential for significant market volatility. While long term traders aim to capitalize on trends, sudden market fluctuations can lead to unexpected losses. Another risk is the impact of economic and political events, which can cause currency values to change dramatically. Successful long term traders must carefully analyze these risks and implement risk management strategies, such as setting stop-loss orders and proper position sizing.

Overall, long term trading in forex can be a lucrative strategy for those who have the patience and discipline to hold positions for extended periods. By following the right strategies and managing risks effectively, traders can potentially benefit from the larger market movements and enjoy the advantages that long term trading offers.

Long term trading in the forex market refers to holding positions for a significant period of time, usually months to years, in order to take advantage of long-term market trends and potentially profit from them. While short term trading focuses on quick gains from short-lived market fluctuations, long term trading takes a more patient and strategic approach.

A long term forex trading strategy involves identifying and analyzing key economic and geopolitical factors that could influence currency values over an extended period of time. These factors can include interest rates, economic growth, political stability, and market sentiment. Traders use this information to make informed decisions about which currency pairs to trade and when to enter or exit positions.

One of the main benefits of long term trading in forex is the potential for higher profits. By staying in positions for longer periods, traders can ride out short-term market volatility and capture the full potential of major market trends. Long term trading also requires less frequent trading activity compared to short term trading, which can be less stressful and time-consuming for some traders.

However, long term trading also comes with its own set of risks. One of the main challenges is the uncertainty of the future market conditions. Economic and geopolitical factors can change quickly, and what may seem like a promising long term strategy at one point may become less favorable as circumstances evolve. Traders must carefully monitor and adjust their positions to adapt to changing market conditions.

In addition, long term trading requires a certain level of patience and discipline. It can be tempting to exit a trade prematurely when faced with short-term market fluctuations, but successful long term traders understand the importance of sticking to their strategy and riding out temporary setbacks.

| Benefits of Long Term Trading in Forex | Risks of Long Term Trading in Forex |

|---|---|

| 🌟 Higher profit potential🌟 Less frequent trading activity🌟 Reduced stress and time commitment | ⚠️ Uncertainty of future market conditions⚠️ Need for patience and discipline |

Read Also: Exploring the Pros and Cons of ESOPs: How Do They Affect Shareholders?

In conclusion, long term trading in forex can be a rewarding strategy for traders who are willing to take a patient and strategic approach. By analyzing key economic and geopolitical factors, traders can identify long-term market trends and potentially profit from them. However, traders must also be aware of the risks and challenges associated with long term trading and adapt their strategy accordingly.

Long term trading in forex requires careful planning and execution. Here are some strategies to help you succeed:

1. Develop a solid trading plan: Before you start trading, it’s important to have a well-defined plan. This plan should include your trading goals, risk tolerance, entry and exit strategies, and money management rules. Stick to your plan and avoid making impulsive decisions based on emotions.

2. Analyze the market: Long term traders need to have a good understanding of the market trends and factors that can impact currency movements. Conduct thorough technical and fundamental analysis to identify potential trading opportunities.

3. Use proper risk management techniques: Long term trading can be volatile, so it’s crucial to manage your risks effectively. Set stop-loss orders to limit potential losses and consider using trailing stops to protect your profits. Only risk a small percentage of your account balance on each trade.

4. Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different currency pairs and possibly other asset classes to reduce risk. This diversification can help protect your portfolio from major losses.

Read Also: Guide to Buying Wheat Options: Step-by-Step Process

5. Be patient and disciplined: Long term trading requires patience as positions can take months or even years to reach their targets. Stick to your trading plan and avoid the temptation to make impulsive trades based on short-term market fluctuations.

6. Keep a trading journal: Maintaining a journal of your trades can help you identify patterns, strengths, and weaknesses in your trading strategy. Review your journal regularly to learn from your past trades and make improvements for future trades.

7. Stay updated with market news: Be aware of major economic and political events that can impact the forex market. Stay updated with news and economic indicators to make informed trading decisions.

8. Continuously learn and adapt: The forex market is constantly evolving. Stay updated with new trading techniques, strategies, and market trends. Continuously improve your knowledge and adapt your trading strategies as needed.

By following these strategies, you can increase your chances of success in long term trading in the forex market.

Long term trading in forex refers to a strategy where traders hold their positions for an extended period of time, usually weeks, months, or even years. This approach involves analyzing macroeconomic factors, identifying trends, and making informed predictions about the future movements of currency pairs.

The benefits of long term trading in forex include higher profit potential, reduced stress, and less time required for monitoring the market. Traders can take advantage of larger price movements over an extended period, and they don’t have to make frequent trading decisions, allowing for more strategic and calculated moves.

Some long term trading strategies in forex include trend following, carry trading, and fundamental analysis. Trend following involves identifying and trading with the direction of a long-term trend. Carry trading involves taking advantage of interest rate differentials between currency pairs. Fundamental analysis involves analyzing economic data and news to make long-term trading decisions.

Some of the risks associated with long term trading in forex include market volatility, unexpected economic events, and overnight financing costs. Since positions are held for a longer period, there is a higher chance of being exposed to sudden and unpredictable market movements. Additionally, overnight financing costs may erode potential profits if the trader is paying high interest rates on borrowed funds.

Easy steps to install VWAP indicator If you’re a trader looking to enhance your technical analysis, the Volume Weighted Average Price (VWAP) indicator …

Read ArticleWhat is a Forex Broker? When it comes to trading on the foreign exchange market, having a reliable forex broker is crucial. One such broker that has …

Read ArticleBest Screeners for Swing Trading Swing trading is a popular trading strategy that aims to capture short-term price movements in the market. Unlike day …

Read ArticleExchange Rate in Myanmar 2023: Latest Updates and Projections As we enter into the new year, many are wondering what the future holds for the exchange …

Read ArticleUnderstanding the 1998 FX and Currency Option In the world of global finance, foreign exchange (FX) and currency options are two essential tools that …

Read ArticleInvesting 1000 rs in option trading: Is it possible and profitable? Option trading can be an exciting and potentially lucrative investment strategy. …

Read Article