What is the value of a micro lot in forex trading?

What is the value of a micro lot? Forex trading is a popular way for individuals to engage in the global currency market and potentially earn profits. …

Read Article

The moving average is a commonly used statistical technique for analyzing time series data. It is widely used in various fields, including finance, economics, and engineering. However, despite its popularity, there are several challenges and issues that researchers and analysts need to be aware of when using moving averages.

One of the main challenges is determining the appropriate time period for the moving average. Choosing the right time period can significantly impact the accuracy of the calculations and the insights obtained from the data. A shorter time period may provide more timely information but may also lead to increased volatility and noise in the results. On the other hand, a longer time period may smooth out the data but can also result in delayed signals.

Another challenge is dealing with missing data points.

When calculating the moving average, missing data points can distort the results and introduce bias. Therefore, it is crucial to handle missing values appropriately, either by imputing them or by using alternative techniques such as exponential smoothing.

The choice of the type of moving average can also pose challenges. There are different types of moving averages, including simple moving average (SMA), weighted moving average (WMA), and exponential moving average (EMA). Each type has its own advantages and disadvantages and is suitable for different types of data and analysis objectives. Selecting the most appropriate type of moving average requires careful consideration of the data characteristics and the specific research or analysis goals.

Finally, it is important to be cautious and avoid overreliance on moving averages. Moving averages are useful tools for trend analysis and forecasting, but they have limitations. They are based on past data and may not necessarily reflect the future behavior of the data. Therefore, it is essential to complement the analysis with other techniques and indicators and to interpret the results in the context of the specific data and research objectives.

Moving average is a commonly used statistical calculation that helps in analyzing the trend or pattern in a set of data points over a specified period of time. It is widely used in financial analysis, time series analysis, and forecasting.

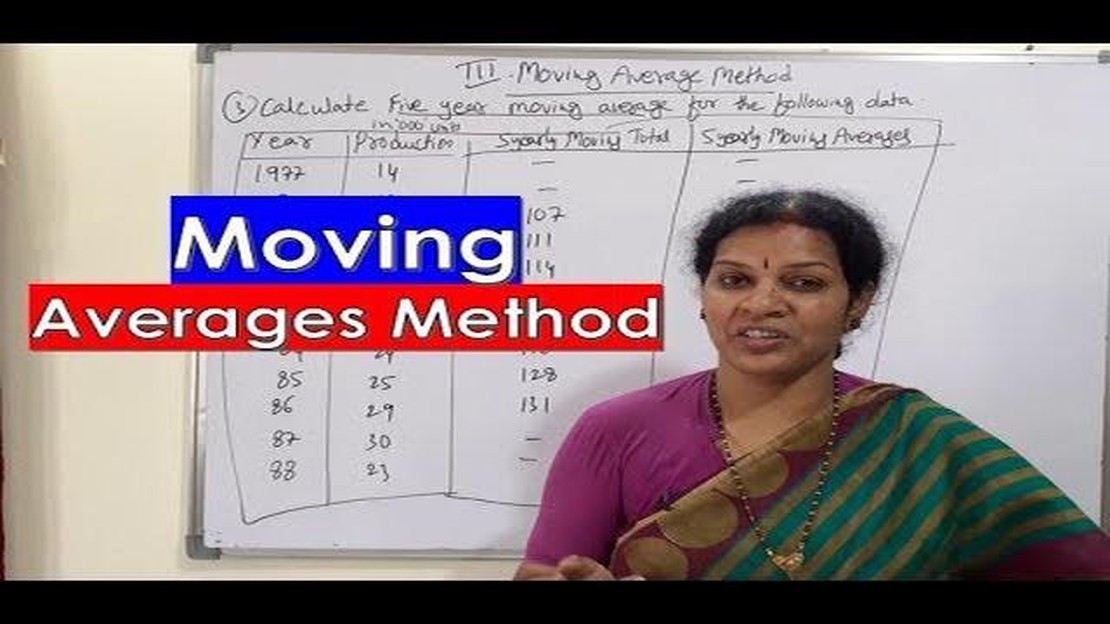

The moving average calculation involves taking the average of a certain number of data points within a given time period. This creates a smoothed representation of the data, which helps in identifying the underlying trend or pattern.

There are different types of moving averages, such as simple moving average (SMA), exponential moving average (EMA), and weighted moving average (WMA). The choice of moving average type depends on the specific requirements and characteristics of the dataset being analyzed.

To calculate a simple moving average, you need to sum up the values of the data points over a specified time period and divide it by the number of data points. For example, to calculate a 5-day SMA, you would add up the values of the past 5 days and divide it by 5.

Exponential moving average, on the other hand, gives more weightage to the recent data points compared to the older ones. This results in a faster reaction to the changing trends in the data. EMA is calculated using a smoothing factor that determines the weight assigned to each data point.

Weighted moving average assigns different weights to each data point based on its position in the time series. This allows more emphasis on certain data points, which can be useful in certain cases where recent data is considered more important.

Read Also: Does Google Offer Stock Options or RSU for Employees? | Find out More

It is important to understand the characteristics of the dataset and the specific requirements of the analysis before choosing the appropriate moving average calculation method. The choice of moving average type can have a significant impact on the results and interpretation of the analysis.

In conclusion, moving average calculation is a powerful tool for analyzing trends and patterns in data. It helps in providing a smoothed representation of the data and identifying the underlying trend. The choice of moving average type depends on the specific requirements and characteristics of the dataset being analyzed.

When calculating moving averages, there are several common issues that can arise. These issues can affect the accuracy and reliability of the calculated moving averages.

1. Outliers: Moving averages can be sensitive to outliers, which are data points that are significantly different from the rest of the data set. Outliers can skew the moving average calculation and make it less representative of the underlying data trend.

Read Also: The Ultimate Guide: How to Best Use the RSI Indicator for Trading

2. Time Period Selection: The choice of time period for calculating the moving average can greatly impact the results. If the time period is too short, the moving average may be too volatile and fail to capture the long-term trend. Conversely, if the time period is too long, the moving average may be too smooth and fail to reflect more recent changes in the data.

3. Missing Data: Moving average calculations require a continuous series of data points. If there are missing data points within the time period, it can lead to inaccuracies in the moving average calculation. Different methods, such as interpolation or data imputation, can be used to handle missing data, but these methods can introduce their own biases.

4. Seasonality: Moving averages can be affected by seasonality, which is the regular pattern of variation in a time series over the course of a year or other fixed time period. If the data exhibits a strong seasonal pattern, a simple moving average may not be sufficient to capture this pattern. Seasonal adjustment techniques, such as seasonal differencing or seasonal moving averages, may be necessary to account for seasonality.

5. Lagging Indicator: Moving averages are lagging indicators, meaning that they reflect past data rather than current or future data. This can be a limitation in certain situations where real-time or forward-looking information is crucial. Other technical indicators, such as exponential moving averages or weighted moving averages, may be more suitable for capturing current trends.

By being aware of these common issues, analysts can make more informed decisions when using moving averages and take appropriate steps to mitigate any potential problems.

A moving average is a calculation used to analyze data over a certain period of time by creating a series of averages of different subsets of the full data set.

Moving average calculation is important because it can help smooth out fluctuations in data and provide a clearer picture of trends and patterns over time.

Some common issues with moving average calculation include the choice of time period, the inclusion of outliers, and the interpretation of trends based on moving averages.

The right time period for moving average calculation depends on the specific analysis and data being studied. It is important to consider the desired level of smoothness versus responsiveness to changes.

Outliers can significantly affect moving average calculation by skewing the averages and potentially leading to incorrect interpretations of trends. It is important to consider outlier detection and treatment methods when using moving averages.

A moving average is a statistical technique used to analyze data points by creating a series of averages of different subsets of the full data set. It is commonly used in finance and time series analysis to identify trends and smooth out fluctuations in data.

What is the value of a micro lot? Forex trading is a popular way for individuals to engage in the global currency market and potentially earn profits. …

Read ArticleFTMO: Slippage Issues and How to Deal with Them Trading in the financial markets is a highly dynamic and complex endeavor, where every second counts. …

Read ArticleUnderstanding Pivoting in Trading: A Comprehensive Guide When it comes to trading in the financial markets, being able to identify and understand key …

Read ArticleUsing American Express (Amex) Cards in India: Everything You Need to Know India, known for its rich culture and diverse landscape, is a popular …

Read ArticleIs ABCD Pattern Effective? The ABCD pattern is a popular technical analysis tool used by traders to identify potential price reversals and …

Read ArticleExploring the Distinction between Front Office and Back Office Trading The world of trading is a complex and dynamic one, with many moving parts. Two …

Read Article