Understanding equity derivatives trading: A comprehensive guide

Understanding Equity Derivatives Trading Equity derivatives trading is a complex and dynamic segment of the financial market. It involves the trading …

Read Article

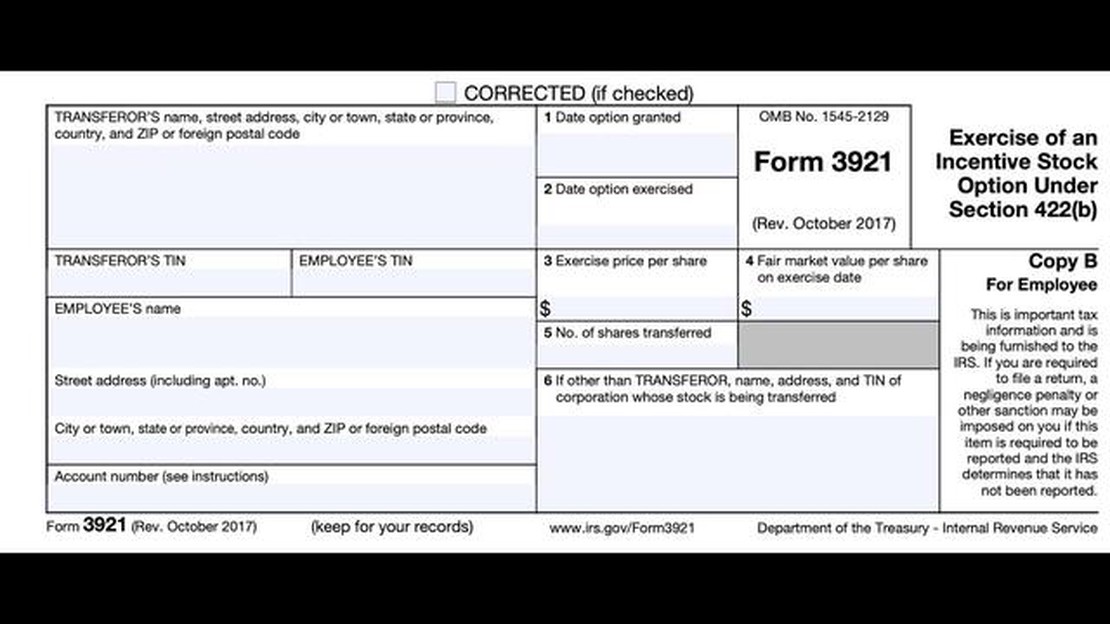

Each year, taxpayers are required to file various tax forms to report their income, deductions, and credits to the Internal Revenue Service (IRS). One such form that taxpayers might encounter is the 3921 tax form, also known as the “Exercise of an Incentive Stock Option Under Section 422(b)” form. This form is typically used by employees who exercise incentive stock options granted to them by their employers.

The 3921 tax form serves as a tool for both employees and the IRS to track and report the exercise of incentive stock options. It provides detailed information about the transaction, including the date of the option grant, the exercise price per share, the fair market value of the stock at the time of exercise, and the number of shares acquired. By filing this form, employees can ensure they meet their reporting obligations and potentially take advantage of tax benefits associated with the exercise of stock options.

Understanding the 3921 tax form is essential for employees who have exercised incentive stock options. Failing to accurately complete and file this form may result in penalties or an incorrect tax assessment. In this comprehensive guide, we will walk you through each section of the form, highlighting key information and providing insights into how to properly fill it out. Additionally, we will explain the tax implications and potential benefits associated with exercising incentive stock options.

Note: This guide is intended for informational purposes only and should not be considered as tax advice. It is always recommended to consult with a qualified tax professional or the IRS for guidance on your specific tax situation.

Whether you are a first-time filer or have been filing taxes for years, understanding the 3921 tax form can seem daunting. However, with the help of this comprehensive guide, you will gain the knowledge and confidence to navigate this form and fulfill your reporting obligations accurately. Let’s dive in and demystify the 3921 tax form together!

A 3921 tax form is a document that is used to report exercises of incentive stock options (ISOs) to the Internal Revenue Service (IRS). It is provided by an employer to an employee who exercised ISOs during the calendar year.

Read Also: How to effectively use a Super Trend indicator for better trading results

The purpose of the 3921 tax form is to ensure that employees who exercise ISOs accurately report their income and pay the appropriate taxes on any stock options they exercise.

The form provides information about the ISOs that were exercised, including the date of exercise, the exercise price per share, the fair market value of the stock on the date of exercise, and the number of shares acquired.

Employees who receive a 3921 tax form are required to report the information provided on the form when filing their individual tax returns. This ensures that the income from the exercise of ISOs is properly reported and taxed.

It’s important for employees to carefully review the information on the 3921 tax form and consult with a tax professional if they have any questions or concerns. Failing to report ISO exercises accurately can result in penalties and potential audits from the IRS.

Overall, the 3921 tax form plays a crucial role in ensuring that employees accurately report income from the exercise of ISOs and pay the appropriate taxes, helping to maintain the integrity of the tax system.

The 3921 Tax Form is a crucial document that needs to be filed if you have exercised incentive stock options (ISOs) during the year. It provides detailed information about the exercise and sale of ISOs, which is necessary for calculating the correct amount of taxes owed to the Internal Revenue Service (IRS).

Here are a few reasons why you need to file a 3921 Tax Form:

Overall, filing the 3921 Tax Form is essential for individuals who have exercised ISOs. It ensures compliance with tax laws, accurately reports taxable income, and helps in tax planning. To avoid penalties and potential audits, it is crucial to file the form correctly and on time.

Read Also: Unlock the Secrets of 123 Method Trading and Skyrocket Your Profits

The purpose of the 3921 tax form is to report any exercise of an incentive stock option (ISO) during the year.

Employees who exercised incentive stock options (ISOs) need to file the 3921 tax form.

To fill out the 3921 tax form, you need to provide details such as the employer’s identifying information, the employee’s information, the grant date of the stock option, the exercise price, fair market value on the exercise date, and the number of shares exercised.

The deadline to file the 3921 tax form is usually January 31st of the year following the year in which the ISO was exercised. However, if January 31st falls on a weekend or holiday, the deadline is the next business day.

If you fail to file the 3921 tax form or file an incomplete or incorrect form, the IRS may impose penalties. The penalty for late filing ranges from $30 to $100 per form, depending on how late the form is filed.

Understanding Equity Derivatives Trading Equity derivatives trading is a complex and dynamic segment of the financial market. It involves the trading …

Read ArticleUnderstanding IRS Taxation of Options Options are a popular investment vehicle that allow individuals to speculate on the future price movements of …

Read ArticleCan you short lumber futures? Shorting lumber futures can be a profitable strategy for traders and investors looking to capitalize on the potential …

Read ArticleWhat happens to options if a stock goes private? When a publicly traded company decides to go private, it can have significant implications for its …

Read ArticleIs Korean won cheaper than rupee? When it comes to comparing currency values, many factors come into play. One of the most important factors is the …

Read ArticleNumber of Regulators in UAE The United Arab Emirates (UAE) is known for its thriving economy and business-friendly environment. With a diverse range …

Read Article