Understanding the Role of FX Traders: Key Responsibilities and Strategies

Exploring the Role of FX Traders in the Financial Market Foreign exchange (FX) traders play a crucial role in the global financial markets, …

Read Article

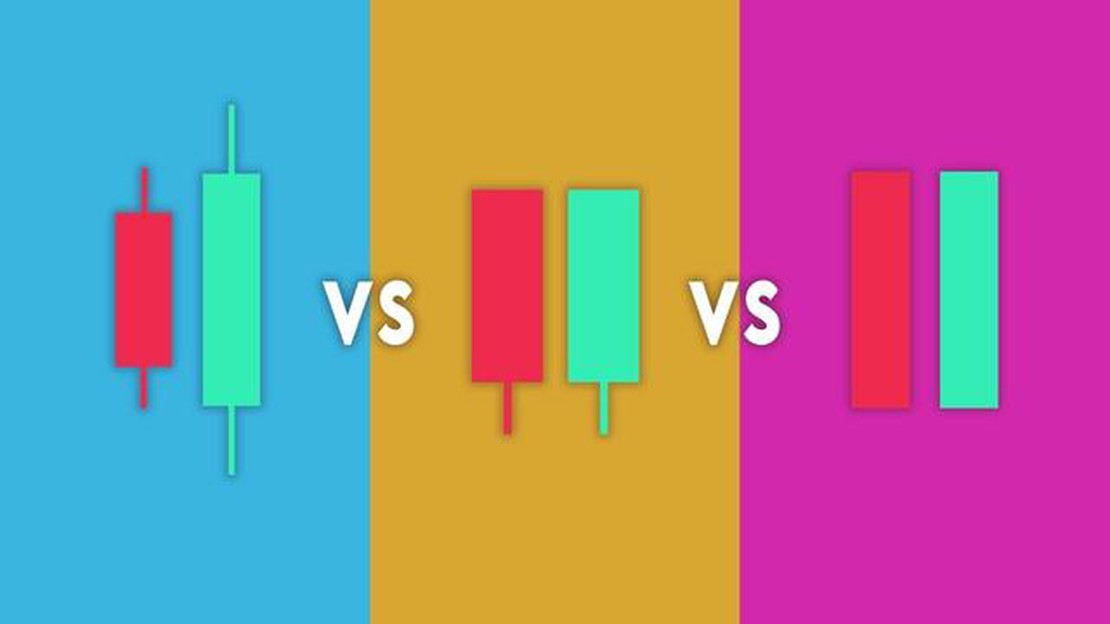

Intraday trading, also known as day trading, is a popular strategy among traders looking to capitalize on short-term price movements. To successfully navigate the fast-paced world of intraday trading, it is crucial to have a deep understanding of different candlestick patterns and their implications.

Candlestick charts provide valuable insights into market sentiment and can help traders make informed decisions. However, with a wide range of candle types available, choosing the right one for intraday trading can be overwhelming. This comprehensive guide aims to simplify the process by discussing some of the most commonly used candle types and their significance in intraday trading.

One of the most popular candle types for intraday traders is the “doji” candlestick. This candlestick pattern indicates indecision in the market and is characterized by a small body and long wicks on both ends. Traders interpret the appearance of a doji candle as a sign that neither buyers nor sellers have control, suggesting a potential reversal or consolidation in price.

Another important candle type to consider is the “marubozu” candlestick. Marubozu candles have no wicks or shadows, indicating that the market opened at one price and closed at another without significant price retracement during the trading session. This type of candle is often seen as a strong indicator of market momentum and can signal the continuation of an existing trend.

Ultimately, choosing the best candle type for intraday trading depends on various factors, including the trader’s preferred strategy, risk tolerance, and market conditions. By familiarizing themselves with different candlestick patterns and their implications, traders can enhance their ability to make informed trading decisions and improve their overall profitability in the intraday trading arena.

When it comes to intraday trading, understanding the different types of candlestick patterns is crucial. Candlestick charts provide valuable information about the market’s behavior and can help traders make informed decisions.

There are several types of candlestick patterns that traders should be familiar with:

| Candlestick Pattern | Description |

|---|---|

| Doji | A doji candle has a small body, indicating indecision between buyers and sellers. |

| Hammer | A hammer candle has a small body at the top and a long lower shadow, indicating a potential reversal to the upside. |

| Shooting Star | A shooting star candle has a small body at the bottom and a long upper shadow, indicating a potential reversal to the downside. |

| Engulfing | An engulfing candle has a larger body that completely engulfs the previous candle, indicating a potential trend reversal. |

| Morning Star | A morning star pattern consists of three candles: a large bearish candle, a small bullish or bearish candle, and a large bullish candle. It indicates a potential reversal from a downtrend to an uptrend. |

| Evening Star | An evening star pattern consists of three candles: a large bullish candle, a small bullish or bearish candle, and a large bearish candle. It indicates a potential reversal from an uptrend to a downtrend. |

| Hanging Man | A hanging man candle has a small body at the top and a long lower shadow, indicating a potential reversal to the downside. |

| Inverted Hammer | An inverted hammer candle has a small body at the bottom and a long upper shadow, indicating a potential reversal to the upside. |

These are just a few examples of candlestick patterns that traders use to identify potential entry and exit points. It’s important to remember that no single pattern guarantees success, and it’s always recommended to use these patterns in conjunction with other technical analysis tools and indicators.

Read Also: Beginner's Guide: How to Learn Technical Indicators and Improve Trading Skills

When it comes to intraday trading, candlestick patterns can provide valuable insights into price dynamics and potential trading opportunities. These patterns, formed by the open, high, low, and close prices of a particular time period, can help traders identify market trends and reversals.

To evaluate candle patterns for intraday trading strategies, it is important to understand the different types of patterns and their significance. Here are a few common candle patterns that traders often look for:

1. Doji: A doji candle is characterized by a small or nonexistent body, where the open and close prices are very close. This pattern suggests indecision in the market and a potential reversal.

2. Hammer: A hammer candle has a small body and a long lower wick, with little to no upper wick. This pattern indicates a potential bullish reversal, as buyers step in after a period of selling pressure.

3. Shooting Star: The shooting star candle has a small body and a long upper wick, with little to no lower wick. It is considered a bearish reversal pattern, as it suggests that sellers have taken control after an uptrend.

4. Engulfing: An engulfing candle pattern occurs when a smaller candle is completely engulfed by the following larger candle. A bullish engulfing pattern suggests a potential bullish reversal, while a bearish engulfing pattern indicates a potential bearish reversal.

5. Morning Star/Evening Star: The morning star pattern consists of three candles: a long bearish candle, a small bullish or bearish candle, and a long bullish candle. This pattern indicates a potential bullish reversal. The evening star pattern is the opposite, signaling a potential bearish reversal.

It is important to note that these are just a few examples of candlestick patterns, and there are many more that traders use in their analysis. Furthermore, it is recommended to combine candle patterns with other technical indicators and analysis techniques to improve the accuracy of trading strategies.

Read Also: The Future of Forex Trading: What to Expect and How to Prepare

When evaluating candle patterns, it is crucial to consider the overall market context, such as support and resistance levels, trendlines, and volume. Traders should also pay attention to the timeframe they are trading on, as candle patterns may have different meanings on different timeframes.

By effectively evaluating candle patterns, traders can gain a better understanding of market sentiment and make more informed decisions when developing their intraday trading strategies. However, it is important to practice and backtest these strategies before implementing them in live trading to ensure their effectiveness and suitability for individual trading styles and risk tolerances.

Intraday trading, also known as day trading, is a trading strategy where traders buy and sell financial assets within the same trading day, taking advantage of short-term price movements.

There are several types of candlesticks used in intraday trading, including the doji, hammer, shooting star, engulfing pattern, and spinning top. Each candlestick pattern provides valuable information about the price action and can help traders make informed trading decisions.

Choosing the best candle type for intraday trading depends on various factors such as market conditions, trading style, and personal preference. Traders can use technical analysis tools and indicators to identify potential candlestick patterns and select the ones that align with their trading strategy.

Candlestick patterns are significant in intraday trading as they provide valuable insights into market sentiment and price movements. By understanding and recognizing these patterns, traders can anticipate potential reversals or continuation of trends and make informed trading decisions.

Candlestick patterns are widely used by traders as they have been proven to be reliable indicators in intraday trading. However, it is essential to combine candlestick patterns with other technical analysis tools and indicators for a more comprehensive analysis and confirmation of potential trading opportunities.

Exploring the Role of FX Traders in the Financial Market Foreign exchange (FX) traders play a crucial role in the global financial markets, …

Read ArticleHow to Enter a Forex Entry Welcome to your ultimate forex trading tutorial, where we will guide you through the step by step process of entering a …

Read ArticleBest Timeframe for Accurate RSI Signals The Relative Strength Index (RSI) is a popular technical indicator used by traders to identify overbought and …

Read ArticleWhat is ETS in shipping? When it comes to shipping, there are certain terms and abbreviations that can be confusing to newcomers. One such term is …

Read ArticleIs Forex4you legal in India? Forex trading has gained significant popularity in India in recent years. Many people are attracted to the potential …

Read ArticleHow many days is a moving average? In the world of finance and investing, the moving average is a popular tool used to analyze and predict market …

Read Article