Understanding the GBP CHF Pair: What You Need to Know

Understanding the GBP CHF Pair The GBP CHF pair refers to the exchange rate between the British pound and the Swiss franc. This currency pair is …

Read Article

If you have an Individual Retirement Account (IRA), you may be wondering if it’s possible to sell call options within this type of account. Call options are a type of financial derivative that give the holder the right, but not the obligation, to purchase a specific asset at a predetermined price within a certain time period.

While IRAs offer the opportunity to grow your retirement savings tax-deferred or tax-free, they also come with certain restrictions and guidelines. The Internal Revenue Service (IRS) has established rules to ensure that IRAs are primarily used for retirement savings and not for speculative or risky trading activities.

When it comes to call options, the IRS permits the buying and holding of these derivatives within an IRA. However, the selling of call options, also known as writing or shorting call options, is subject to specific rules and limitations. These guidelines are in place to protect the retirement savings of IRA holders and to prevent excessive risk-taking.

One key consideration when selling call options in an IRA is that it can generate income that is subject to taxation. The premiums received from selling call options are considered as income, and depending on your tax bracket, may be subject to ordinary income tax rates. It’s important to factor in this potential tax liability when deciding whether to engage in option selling within an IRA.

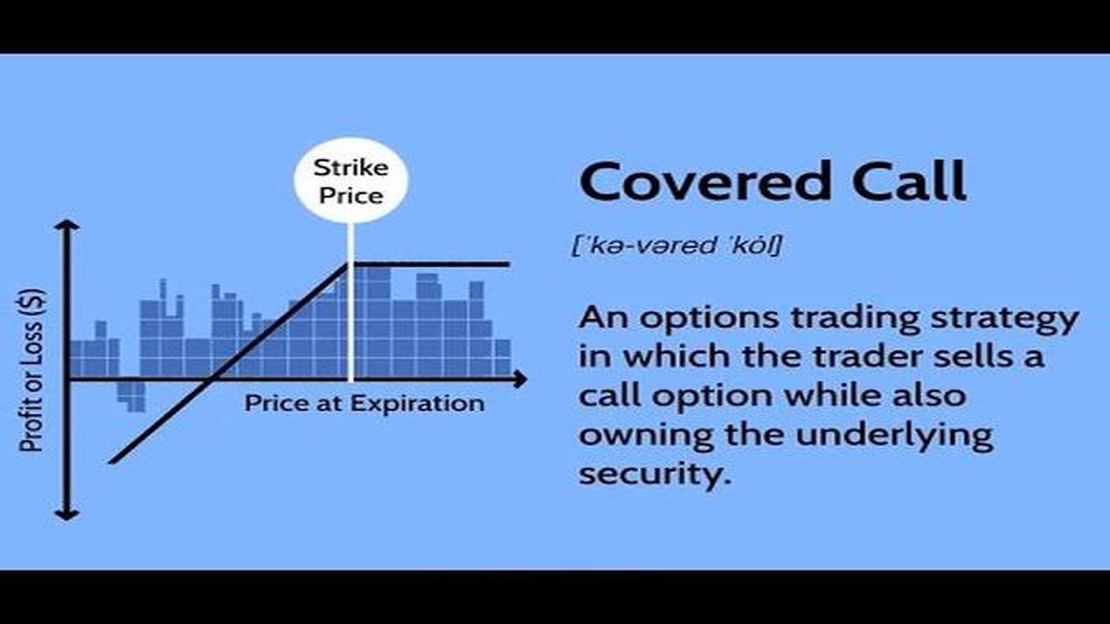

Additionally, the IRS imposes certain restrictions on the types of call options that can be sold within an IRA. For example, writing covered call options, where the underlying asset is already owned by the IRA, is generally allowed. However, writing naked call options, where the underlying asset is not owned, is typically prohibited. These restrictions are in place to mitigate the potential for large losses and excessive speculation within IRAs.

In conclusion, while you can buy and hold call options within an IRA, selling call options is subject to specific guidelines and limitations. It’s important to understand the rules established by the IRS and consider the potential tax implications before engaging in option selling within your IRA. Consulting with a financial advisor or tax professional is recommended to ensure that you are making informed decisions regarding your retirement savings.

When it comes to managing your Individual Retirement Account (IRA), it’s important to understand the rules and restrictions that apply. One question that often comes up is whether or not you can sell call options in an IRA. Let’s take a closer look at the key considerations and guidelines regarding this topic.

1. Options Trading in an IRA

Options trading in an IRA is allowed by the Internal Revenue Service (IRS), but there are some important factors to keep in mind. Selling call options is considered a type of options trading, so it’s crucial to understand the potential risks and rewards associated with this strategy.

2. Level of Approval

Read Also: Trading Hours for CET: Everything You Need to Know

Before you can sell call options in your IRA, you need to ensure that you have the necessary level of approval from your IRA custodian or broker. Typically, this involves obtaining options trading approval and completing any required paperwork or documentation.

3. Potential Risks

It’s important to remember that selling call options involves certain risks. If the price of the underlying stock rises above the strike price of the call option, you may be obligated to sell the shares at the lower price, resulting in a loss. Additionally, the value of the call option can decrease as it nears expiration.

4. Potential Rewards

On the flip side, selling call options can also offer potential rewards. By selling call options, you can generate income through the premium received. If the price of the underlying stock remains below the strike price of the call option, you can keep the premium and possibly sell more call options in the future.

5. Tax Implications

Read Also: Living and Trading Forex in Dubai: Is it Possible?

Finally, it’s important to consider the tax implications of selling call options in an IRA. Any income generated from selling options is generally considered taxable, but the tax treatment can vary depending on the type of IRA you have (traditional or Roth) and your individual tax situation. Consulting with a tax professional is recommended to fully understand the tax consequences.

Conclusion

In summary, selling call options in an IRA is allowed, but it’s important to understand the rules and restrictions surrounding this strategy. Be sure to obtain the necessary approval from your IRA custodian or broker, consider the potential risks and rewards, and consult with a tax professional for guidance on the tax implications. By doing so, you can make informed decisions and effectively manage your IRA portfolio.

Yes, you can sell call options in an IRA. However, there are certain considerations and guidelines that you need to keep in mind.

When selling call options in an IRA, it is important to be aware of the potential risks involved. You should have a good understanding of options trading and be prepared for potential losses.

Yes, there are guidelines that you need to follow when selling call options in an IRA. One of the main guidelines is that the IRA must be approved for options trading by the custodian or broker. Additionally, you should adhere to any specific rules set by the IRA custodian or broker.

Selling call options in an IRA can provide potential income and can be a way to generate additional returns on your investments. It can also be a strategy for managing risk in your portfolio.

Before selling call options in an IRA, it is important to do your research and fully understand the risks and potential rewards. It may also be beneficial to consult with a financial advisor who can help guide you through the process and ensure that it aligns with your overall investment goals and risk tolerance.

Yes, you can sell call options in your IRA. However, there are some important considerations and guidelines to keep in mind.

Understanding the GBP CHF Pair The GBP CHF pair refers to the exchange rate between the British pound and the Swiss franc. This currency pair is …

Read ArticleNSO Taxation: How are NSO (Non-statutory Stock Options) taxed? When it comes to employee stock options, understanding the taxation of non-qualified …

Read ArticleUnderstanding the Intrinsic Value of an Option: Explained with Examples Options are financial derivatives that give the holder the right, but not the …

Read ArticleDoes FXCM allow EA? FXCM, one of the leading forex brokers in the world, is known for its advanced trading platform and extensive range of trading …

Read ArticleChanging Currency on OCBC: A Step-by-Step Guide If you are an OCBC customer and would like to change your currency settings, you’ve come to the right …

Read ArticleOptions Account Approval Process: Everything You Need to Know Options trading can be a great way to diversify your investment portfolio and …

Read Article