Find the Best Exchange Rates in Qatar and Save Money

Find the best exchange rate in Qatar Are you planning a trip to Qatar? One important thing to consider when traveling abroad is how to get the best …

Read Article

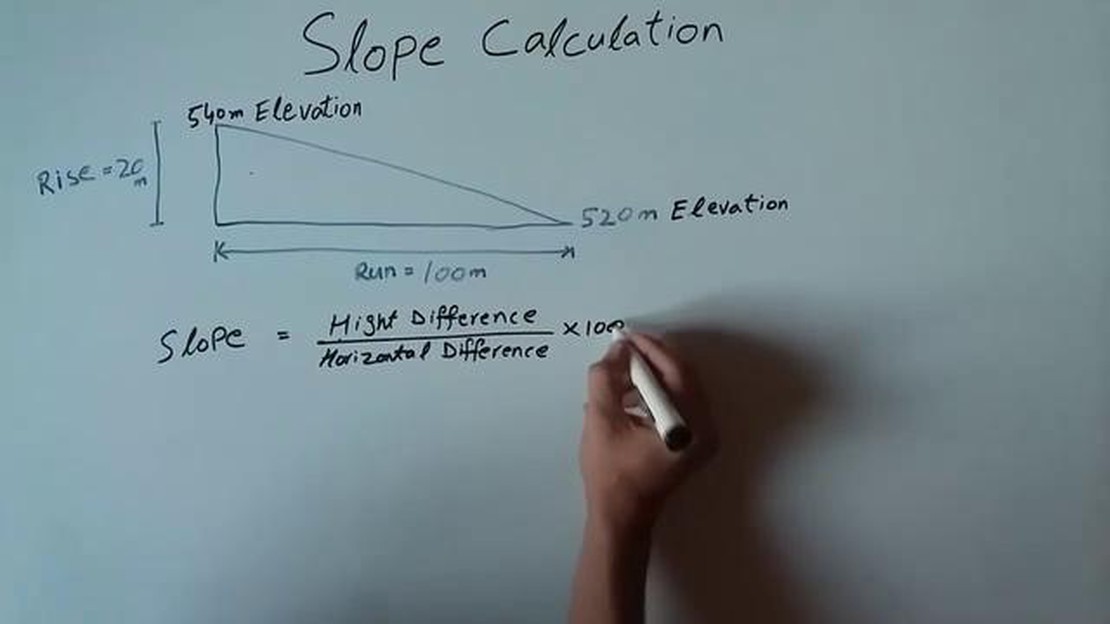

Gaining insights into price trends can be crucial for businesses and investors. One powerful tool for understanding these trends is calculating the price slope. The price slope measures the rate at which the price of a product or asset changes over time, helping analysts and traders identify patterns and make informed decisions.

Calculating the price slope involves determining the change in price between two points and dividing it by the corresponding change in time. This simple yet effective formula provides a quantitative measure of the price movement and allows for comparisons across different time periods or assets.

To calculate the price slope, start by selecting two points in time that you want to analyze. These points can be any two data points on your price chart, such as the opening and closing prices for a specific period. Next, determine the price difference between these two points by subtracting the initial price from the final price. Then, divide the price difference by the time difference between the two points. The resulting value is the price slope.

Interpreting the price slope is essential for understanding the direction and intensity of price movements. A positive price slope indicates an upward trend, as the price is increasing over time. Conversely, a negative price slope suggests a downward trend, with the price decreasing. A slope of zero indicates no change in price.

By calculating the price slope, analysts and traders can gain valuable insights into price movements and make data-driven decisions. This step-by-step guide provides a straightforward method for quantifying and interpreting price trends, enabling businesses and investors to navigate the market with confidence.

Price slope is a measure of the rate at which the price of a product or asset is changing over time. It is used in technical analysis to assess the strength and direction of a trend.

The price slope is calculated by determining the change in price over a specific time period and dividing it by the number of time units. This calculation provides a ratio that represents the average price movement per time unit.

A positive price slope indicates an upward trend, with prices increasing over time. Conversely, a negative price slope suggests a downward trend, with prices decreasing over time.

Traders and investors use price slope to identify potential buying or selling opportunities. A steeper price slope indicates a stronger trend, which may present a good opportunity for traders to enter or exit a position. On the other hand, a shallow or flat price slope may suggest a weakening trend, signaling caution or a possible reversal of the trend.

It’s important to note that price slope is just one of many tools used in technical analysis, and it should be used in conjunction with other indicators and analysis methods to make informed trading decisions.

Read Also: How to Stay Updated on Forex News: Expert Tips and Strategies

To calculate the price slope, you can use a simple formula:

| Price slope formula |

|---|

| (Current price - Previous price) / Number of time units |

Calculating price slope is an important tool for investors and traders in analyzing market trends and making informed decisions. The price slope represents the rate of change in a security’s price over time, indicating the direction and strength of the trend.

One of the main reasons why calculating price slope is important is that it helps in identifying potential buying and selling opportunities. By analyzing the slope, traders can determine whether a security’s price is increasing, decreasing, or moving sideways. A positive slope suggests an upward trend, indicating that the security’s price is rising, while a negative slope suggests a downward trend, indicating that the price is falling. This information can be used to make decisions on when to buy or sell a security.

Another reason why calculating price slope is important is that it can provide insights into the strength of a trend. A steep slope indicates a strong trend, while a shallow slope suggests a weak or gradual trend. Understanding the slope can help traders gauge the momentum of the market and adjust their trading strategies accordingly.

Furthermore, calculating price slope can help in identifying potential support and resistance levels. Support levels are price levels at which a security tends to find buying interest and rebound, while resistance levels are price levels at which a security tends to find selling pressure and reverse. By analyzing the slope, traders can identify key levels where price may react, providing valuable information for setting stop-loss orders or profit targets.

Read Also: Understanding the Moving Average Cloud Indicator in MT4 for Smarter Trading Decisions

In summary, calculating price slope is important because it helps traders and investors identify potential buying and selling opportunities, gauge the strength of a trend, and identify key levels of support and resistance. By understanding price slope, traders can make more informed decisions and improve their chances of success in the market.

Price slope is a measure of the steepness or incline of a price trend in a financial market. It tells us how fast or slow the price of an asset is changing over a period of time.

Calculating price slope is important because it helps traders and investors understand the direction and strength of price trends. It can be used to identify bullish or bearish market conditions and make informed decisions about buying or selling assets.

To calculate price slope, you need to determine the change in price over a specific period of time and divide it by the number of periods. For example, if the price increased by $10 over a period of 5 days, the price slope would be $2 per day.

A positive price slope indicates an upward price trend, where the price is increasing over time. It suggests that buying the asset may be profitable as the price is expected to continue rising.

While price slope can provide insights into the current trend direction, it should not be solely relied upon as a predictor of future price movements. Market conditions can change, and other factors such as market sentiment and economic events can influence price movements.

Price slope refers to the rate at which the price of a product or asset changes over time. It measures the direction and steepness of the price movement, indicating whether it is increasing, decreasing, or remaining stable.

Calculating price slope is important because it helps investors and traders analyze the trend and momentum of a stock or asset. By understanding the price slope, they can make informed decisions about buying or selling, and identify potential opportunities for profit.

Find the best exchange rate in Qatar Are you planning a trip to Qatar? One important thing to consider when traveling abroad is how to get the best …

Read ArticleExploring the Apple covered call strategy The Apple covered call strategy is a popular options trading strategy that can be used by investors to …

Read ArticleHow does CME generate revenue? CME Group is one of the world’s largest and most diverse derivatives marketplaces, operating globally across a wide …

Read ArticleUnderstanding the Concept of Moving Average Monthly Data When analyzing monthly data, it can often be difficult to discern underlying trends due to …

Read ArticleMinimum Fund Requirement for Forex Trading Forex, or foreign exchange, is a decentralized market where currencies are traded. It’s a popular …

Read ArticleTMGM vs IC Markets: Which Broker is Better? When it comes to forex trading, choosing the right broker is essential for success. Two popular options in …

Read Article