Understanding the Role of Q in Time Series Analysis

Understanding Q in time series analysis When it comes to analyzing time series data, it is important to understand the concept of Q, also known as …

Read Article

Put options are a popular financial instrument used by investors to protect against potential losses in the stock market. However, understanding how to calculate gains and losses on put options can be a complex task for many traders. In this comprehensive guide, we will break down the process of calculating gains and losses on put options, providing you with the knowledge and tools you need to make informed decisions.

Firstly, let’s define what a put option is. A put option gives the holder the right, but not the obligation, to sell a specific asset (such as a stock) at a predetermined price within a certain timeframe. In essence, put options act as insurance policies on stocks. If the price of the underlying asset falls below the predetermined price (also known as the strike price), the put option can be exercised to sell the asset at a higher price, thus minimizing potential losses.

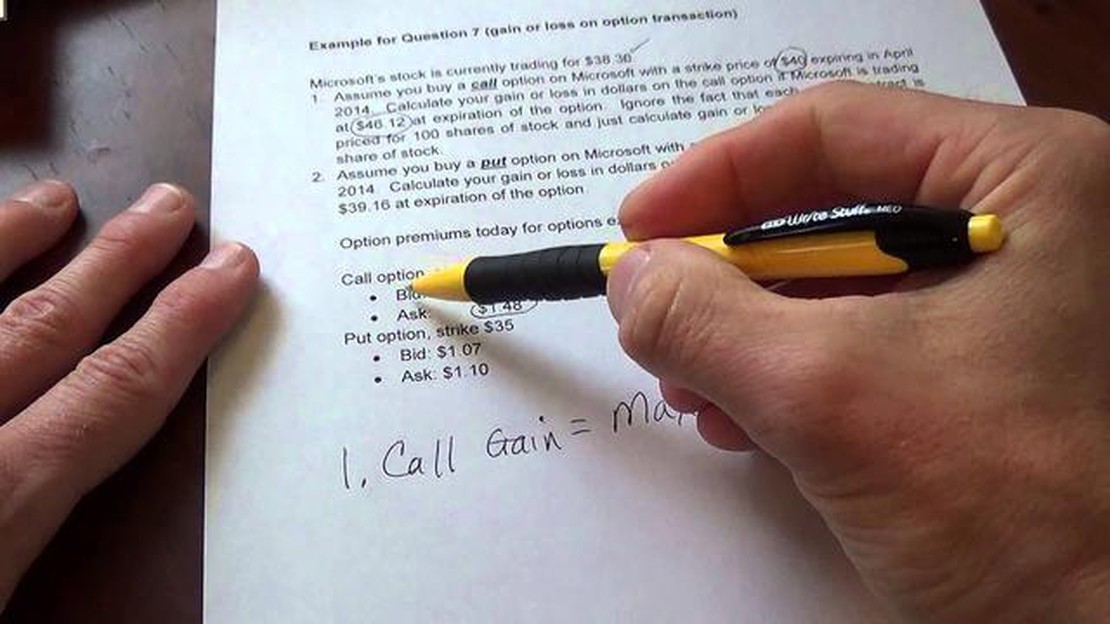

When it comes to calculating gains and losses on put options, there are several factors to consider. These include the premium paid for the option, the strike price, the price of the underlying asset at expiration, and any transaction costs. By understanding how these variables interact, traders can determine whether their put options have generated gains or losses.

To calculate gains or losses on a put option, one must compare the strike price with the price of the underlying asset at expiration. If the price of the asset is below the strike price, the put option is in-the-money and has generated a gain. Conversely, if the price of the asset is above the strike price, the put option is out-of-the-money and has generated a loss. Additionally, transaction costs must be subtracted from any gains or added to any losses to obtain the net gain or loss.

It is important to note that calculating gains and losses on put options can be more complex than this simple explanation. Factors such as time decay, implied volatility, and changes in the price of the underlying asset can all impact the value of a put option. Therefore, it is crucial to have a thorough understanding of these factors and consider them when evaluating the performance of your put options.

In conclusion, calculating gains and losses on put options requires careful consideration of various factors. By understanding the basics of put options and how to assess their profitability, traders can make more informed decisions in the stock market. It is important to stay informed and continuously refine your knowledge to maximize the potential gains and minimize the losses on your put options.

Put options are a type of financial derivative that give the holder the right, but not the obligation, to sell an asset at a specified price (known as the strike price) within a specified period of time.

Put options are typically used as a form of insurance against a decline in the value of an underlying asset, such as stocks or commodities. When the price of the underlying asset decreases, the value of a put option increases. This allows the holder of the put option to sell the asset at a higher price than its current market value, generating a profit.

The strike price of a put option is an important factor in determining its value. If the strike price is set below the current market price of the underlying asset, the put option is said to be “in the money.” This means that the holder of the put option can sell the asset at a higher price than its current market value, resulting in a profit. Conversely, if the strike price is set above the current market price, the put option is “out of the money” and has no intrinsic value.

Put options are traded on options exchanges, just like call options. They can be bought or sold by investors, speculators, and hedgers. Investors use put options to protect their portfolios from potential losses, while speculators take positions based on their belief that the underlying asset’s price will decline. Hedgers, on the other hand, use put options to mitigate the risk of adverse price movements in the underlying asset.

Read Also: Discovering the Top Italian Trader: Unveiling the Best in the Market

When trading put options, it is important to understand the various factors that can affect their value, such as the time remaining until expiration, the volatility of the underlying asset, and the level of interest rates. By carefully considering these factors, investors and traders can make more informed decisions and potentially profit from changes in the price of the underlying asset.

A put option is a financial contract that gives the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a specified price within a specified time period. Put options are typically used by traders and investors as a form of insurance against a decline in the value of the underlying asset.

When you buy a put option, you are essentially purchasing the right to sell the underlying asset at the strike price, regardless of its current market price. If the price of the underlying asset decreases below the strike price, the put option becomes profitable as you can sell the asset at a higher price than its current market value.

On the other hand, if the price of the underlying asset is above the strike price, the put option expires worthless and you lose the premium paid for the option contract. This is known as the maximum loss.

Read Also: Uncover the Hidden Power of the 2-Period RSI Strategy

Put options can be bought and sold on various financial exchanges, such as the stock market or options market. The price of a put option is influenced by factors such as the current price of the underlying asset, the strike price, the time until expiration, and the volatility of the underlying asset.

It is important to note that trading options involves risks and it is essential to have a thorough understanding of how put options work before engaging in options trading. Consulting a financial professional or doing extensive research is recommended before making any investment decisions.

To calculate gains and losses on put options, you need to subtract the cost of purchasing the put option from the difference between the strike price and the current market price of the underlying asset. If the result is positive, it represents a gain, and if it is negative, it represents a loss.

A put option is a financial instrument that gives the holder the right, but not the obligation, to sell a specific quantity of an underlying asset at a predetermined price (strike price) within a specified period of time.

Sure! Let’s say you purchased a put option for $500 with a strike price of $50 and the current market price of the underlying asset is $40. In this case, if you exercise the put option, you can sell the asset for $50, giving you a gain of $10 per share ($50 - $40), or $1,000 in total (($50 - $40) * 100 shares).

The gains and losses on put options are influenced by several factors, including the difference between the strike price and the market price of the underlying asset, the cost of purchasing the put option, the time remaining until expiration, and volatility in the market.

Yes, gains and losses on put options are typically taxed as short-term or long-term capital gains, depending on the holding period. If you hold the put option for less than a year before selling it, any gains or losses will be considered short-term. If you hold it for more than a year, they will be considered long-term.

Put options are financial contracts that give the holder the right, but not the obligation, to sell a specified asset (such as a stock) at a predetermined price within a specified time period.

Understanding Q in time series analysis When it comes to analyzing time series data, it is important to understand the concept of Q, also known as …

Read ArticleIs Option Trading Safer Than Futures? When it comes to trading in the financial markets, investors have a wide range of options to choose from. Two …

Read ArticleCan You Trade Options Internationally? In today’s global economy, trading options internationally has become an increasingly popular investment …

Read ArticleThe Most Popular Carry Trade Explained Forex trading is a popular investment strategy that involves buying and selling currencies to profit from …

Read Article5 Effective Ways to Make Forex Predictions Making accurate predictions in the foreign exchange market, also known as Forex, can be a complex and …

Read ArticleWhat is the most affordable method of currency exchange in India? When traveling to India, finding the most affordable currency exchange options is …

Read Article