Understanding Open Interest Liquidity for Options: A Comprehensive Guide

What is open interest liquidity for options? Options trading can be a complex endeavor, requiring careful analysis and understanding of various …

Read Article

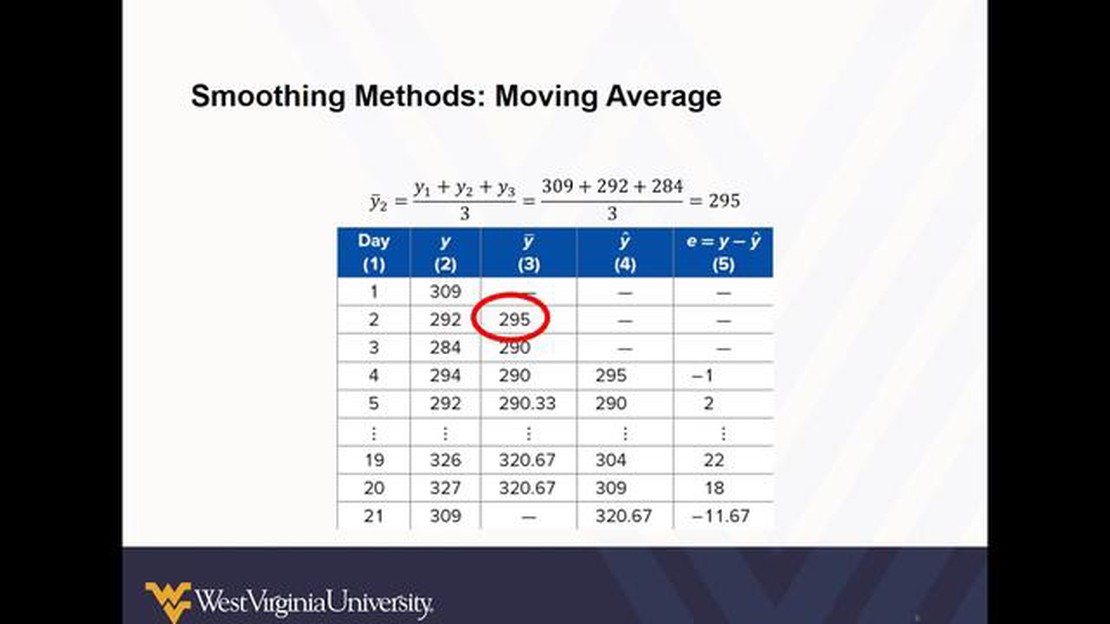

A moving average (MA) is a commonly used statistical method for smoothing time series data. It is widely used in areas such as finance, economics, and signal processing. The purpose of smoothing is to reduce noise and random fluctuations in the data, making it easier to identify trends and patterns.

In a moving average, a set of data points are averaged over a specified number of periods. This average is then used as a single point to represent that period. The number of periods over which the average is calculated is referred to as the “window size” or “number of periods.”

One common question that arises when using moving averages is whether increasing the number of periods in the moving average improves its smoothing abilities. In theory, a larger window size should result in smoother data because it incorporates more data points into the average. This can help to filter out short-term fluctuations and provide a clearer picture of the underlying trend.

However, increasing the number of periods in a moving average also introduces a trade-off. A larger window size leads to a slower response to changes in the data because it takes more periods to “catch up” to the new information. This can result in a delay in detecting and responding to trend reversals or other significant changes in the data.

Therefore, the optimal choice of window size depends on the specific application and the characteristics of the data. A smaller window size may be more appropriate for quickly capturing short-term variations, while a larger window size may be preferred for identifying long-term trends. Ultimately, finding the right balance between smoothing and responsiveness is essential for effectively using a moving average.

One common technique used in time series analysis is moving average smoothing, a method that helps remove random variation from data to reveal underlying trends and patterns. The moving average is calculated by taking the average of a sliding window of data points, with the window size defining the number of periods included in the average.

A key question that arises when using moving average smoothing is whether increasing the number of periods in the moving average will improve the effectiveness of the smoothing process. In other words, does a larger window size lead to better results?

The answer to this question depends on the characteristics of the data and the purpose of the analysis. Increasing the number of periods included in the moving average can have both positive and negative effects.

On one hand, a larger window size can provide a smoother and more stable estimate of the underlying trend. By considering more data points, the moving average is less sensitive to short-term fluctuations, resulting in a more robust estimation of the long-term pattern. This can be particularly useful when the data contains a high level of noise or random variation.

Read Also: Can You Trade Options with an IRA Account? Find Out Here!

On the other hand, increasing the window size can also lead to a loss of responsiveness to recent changes in the data. A larger moving average lags behind the actual data more than a smaller moving average, which means that significant shifts or trends that occur within the window may not be captured as quickly.

Additionally, larger window sizes can introduce greater smoothing and dampening effects. This can be problematic when analyzing time series data with sharp changes or rapid fluctuations, as the moving average may not accurately reflect the true behavior of the data at certain points.

Ultimately, finding the optimal window size for a moving average requires careful consideration of the data characteristics and analysis goals. It is important to strike a balance between the desire for a smoother estimate and the need to capture recent changes in the data. Conducting sensitivity analyses with different window sizes can help assess the trade-offs and choose the most appropriate option for the specific analysis at hand.

Increasing the number of periods in a moving average can have a significant impact on the smoothing effect of the line. As the number of periods increases, the moving average line becomes less sensitive to short-term fluctuations and provides a smoother representation of the underlying trend.

When the number of periods is small, the moving average line tends to closely follow the raw data, resulting in a more volatile line with more noticeable ups and downs. This can be useful for identifying short-term changes or patterns in the data, but it may not accurately reflect the overall trend over a longer timeframe.

However, as the number of periods in the moving average increases, the line becomes less responsive to individual data points and reflects the underlying trend more accurately. This means that longer-term patterns and trends are more easily identified and the line is less affected by temporary fluctuations or outliers.

Read Also: What is needed to trade Forex? | Essential tools and knowledge

It is important to note that increasing the number of periods also introduces a lag in the moving average line. This means that changes in the underlying trend may not be immediately reflected in the line, as it takes time for the average to adjust to new data points. The larger the number of periods, the greater the lag in the line.

When choosing the number of periods for a moving average, it is important to strike a balance between smoothing the line and accurately reflecting the underlying trend. A larger number of periods will provide a smoother line but may also introduce more lag, while a smaller number of periods will be more responsive to short-term changes but may result in a more volatile line.

In conclusion, increasing the number of periods in a moving average can improve the smoothing effect of the line and provide a more accurate representation of the underlying trend. However, it also introduces a lag in the line and must be balanced with the need for responsiveness to short-term changes.

A moving average is a statistical calculation used to analyze data points by creating a series of averages over different subsets of the full data set.

Increasing the number of periods in a moving average can improve smoothing to a certain extent. However, there is a trade-off between smoothing and responsiveness. Longer moving averages provide smoother results but may lag behind recent data points.

Moving averages can help identify trends, filter out noise, and provide a smoother representation of the underlying data. They are commonly used in financial analysis, forecasting, and various other fields.

There is no single optimal number of periods for a moving average as it depends on the specific data set and analysis goals. Different numbers of periods can be used to achieve different levels of smoothing and responsiveness.

One potential drawback of using a moving average is that it can introduce a lag in the analysis, especially with longer moving averages. This lag can make it more difficult to quickly react to changes in the data. Additionally, moving averages may not be suitable for all types of data and analysis goals.

What is open interest liquidity for options? Options trading can be a complex endeavor, requiring careful analysis and understanding of various …

Read ArticleCommodities in the Forex Market Welcome to our comprehensive guide to understanding commodities in the forex market! Commodities play a crucial role …

Read ArticleWhat is the highest pound to peso rate in history? The pound to peso exchange rate reached its highest level ever recorded, causing a wave of …

Read ArticleShould you sell stock before or after a split? Stock splits can be an exciting event for investors, but they also raise a lot of questions. One of the …

Read ArticleWho did the SF Giants get at the trade deadline? The San Francisco Giants have been making moves ahead of the trade deadline, bolstering their roster …

Read ArticleBest Way to Trade the Dow Jones: Tips and Strategies Trading the Dow Jones is an exciting and potentially profitable endeavor. However, it can also be …

Read Article