BNP Paribas fined by the SEC: Here's all you need to know

SEC Fines BNP for Violations In a recent development, global banking giant BNP Paribas has been slapped with a hefty fine by the US Securities and …

Read Article

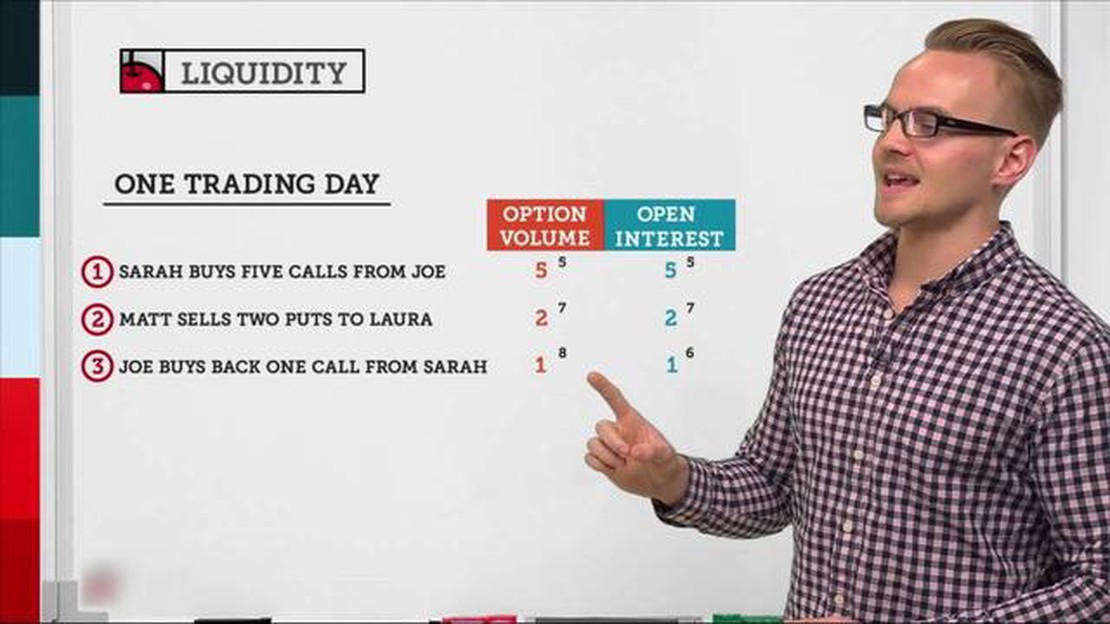

Options trading can be a complex endeavor, requiring careful analysis and understanding of various factors that can determine the success or failure of a trade. One important factor to consider is open interest liquidity.

Open interest liquidity refers to the number of contracts that are currently open, or outstanding, in a particular options market. It is a key indicator of market activity and can provide valuable insights into the supply and demand dynamics of a specific option.

When the open interest for a particular option is high, it suggests that there is a large number of market participants actively trading that option. This high level of activity can lead to increased liquidity, meaning that there is a greater chance of finding a buyer or seller for the option at a fair price.

On the other hand, when the open interest for a specific option is low, it indicates less market activity and liquidity. This can make it more difficult to enter or exit a position in that option, as there may be fewer buyers or sellers willing to trade at a desired price.

Open interest is a concept commonly used in options trading to measure the level of market activity and liquidity. It represents the total number of outstanding or open contracts for a particular option contract or in the options market as a whole.

Open interest is a dynamic figure that changes throughout the trading day as new contracts are created or existing contracts are closed or exercised. It reflects the total number of contracts that have not yet been offset by an opposite transaction or exercised.

Open interest is an important metric for traders and investors as it provides valuable insights into market sentiment and future price movements. A high open interest indicates active trading and a liquid market, which typically translates to better pricing and tighter bid-ask spreads. On the other hand, low open interest may indicate less activity and a less liquid market, which can lead to wider bid-ask spreads and potentially lower liquidity.

Furthermore, open interest can also be used to gauge the level of market participation and interest in a particular option contract. It can help identify popular or heavily traded options, which may be of interest to traders looking to take advantage of liquidity and trading opportunities.

Since open interest is a cumulative figure, it does not provide insight into the direction of trades or whether contracts are being bought or sold. Instead, it simply indicates the total number of outstanding contracts, regardless of their long or short positions. To determine whether contracts are being opened or closed, traders typically rely on other indicators such as volume and price movements.

Read Also: Best Times to Trade Forex: Maximizing Profit in the Currency Market

In summary, open interest is a valuable metric in options trading that provides insights into market activity, liquidity, and market sentiment. By understanding open interest, traders and investors can make more informed decisions and better navigate the options market.

Open interest is a crucial metric in options trading. It refers to the number of outstanding contracts for a particular options contract or strike price. It represents the total number of contracts that have not been closed or exercised by traders.

Open interest provides valuable information about the liquidity of an options contract. Higher open interest generally indicates a liquid market, with more active participants and higher trading volume. This is important because it means that there are more potential buyers and sellers for the options contract, making it easier to enter and exit trades at favorable prices.

Furthermore, open interest can also be used to gauge market sentiment and trends. If open interest increases along with a rise in the price of the underlying asset, it could be an indication of bullish sentiment and a potential uptrend. On the other hand, if open interest decreases while the price of the underlying asset is falling, it could suggest bearish sentiment and a potential downtrend.

Another key aspect of open interest is its role in determining options expiration. As options contracts approach their expiration date, traders will decide whether to exercise or close their positions. The open interest for different strike prices and expiration dates can help traders anticipate potential support or resistance levels.

It’s important to note that open interest should not be evaluated in isolation. It should be considered alongside other factors such as volume, bid-ask spread, and volatility. Additionally, open interest can vary significantly between different options contracts and strike prices, so it’s important to analyze the specific contract you are considering trading.

In conclusion, open interest plays a vital role in options trading. It provides insight into the liquidity of options contracts, helps gauge market sentiment, and can be used to anticipate potential support or resistance levels. Traders should pay close attention to open interest along with other relevant factors to make informed trading decisions.

Open interest is an important data point in options trading that can provide insights into market sentiment and liquidity. It represents the total number of outstanding contracts for a particular option contract.

Read Also: Is 22 too early to move out? Exploring the pros and cons of leaving home at a young age

When interpreting open interest data, there are a few key factors to consider:

It is important to note that open interest data should be used in conjunction with other technical and fundamental analysis tools. It provides valuable insights into market sentiment and liquidity, but it should not be solely relied upon for making investment decisions.

In summary, open interest data can provide valuable information about market sentiment and liquidity in options trading. Understanding how to interpret this data can help traders make more informed decisions and identify potential trading opportunities.

Open interest refers to the total number of open contracts for a particular options contract. It indicates the number of contracts that have been created but have not yet been offset or fulfilled by an opposing trade.

Open interest is a key indicator of liquidity in options trading. Higher open interest generally leads to higher liquidity, as there are more participants willing to buy or sell options contracts at a given price.

Liquidity is important in options trading as it allows traders to enter and exit positions easily. It ensures that there are enough buyers and sellers in the market, reducing the risk of slippage and enabling traders to execute their trades at desired prices.

To determine the liquidity of an options contract, you can look at the open interest and trading volume. Higher numbers indicate greater liquidity. Additionally, you can look at the bid-ask spread, with tighter spreads indicating higher liquidity.

Trading options with low liquidity can increase the risk of slippage, where the difference between the expected price and the actual execution price is larger. Additionally, low liquidity can make it difficult to exit a position or adjust strategies, leading to potential losses or missed opportunities.

SEC Fines BNP for Violations In a recent development, global banking giant BNP Paribas has been slapped with a hefty fine by the US Securities and …

Read ArticleUnderstanding the Concept of Exercising in Options Trading Options trading is a popular financial market activity that allows investors to profit from …

Read ArticleUnderstanding a stock option plan When it comes to investing in the stock market, many people are familiar with the concept of buying and selling …

Read ArticleWhat is the most popular trading method? Traders all over the world employ various trading strategies to try and gain an edge in the financial …

Read ArticleIs China a $20 trillion dollar economy? China has long been regarded as one of the world’s fastest-growing economies, but is it really worth $20 …

Read ArticleConvert 100 Swedish krona to euro The exchange rate between the Swedish krona (SEK) and the euro (EUR) is an important factor to consider for …

Read Article