What is the IQ Option multiplier? Find out how to use leverage on the IQ Option platform

Understanding the IQ Option Multiplier: Everything You Need to Know IQ Option is a popular online trading platform that allows users to trade a …

Read Article

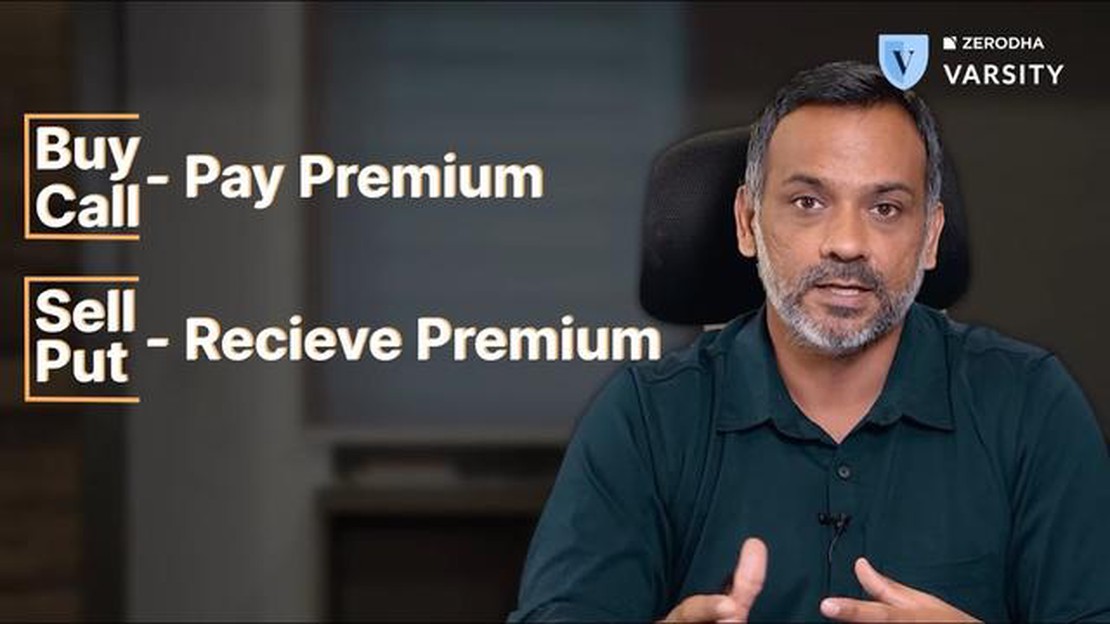

Options trading can be a complex and intricate strategy for investors looking to profit from the movements in the markets. While buying call options is a common strategy to bet on an increase in the price of an underlying asset, selling put options can be a more advantageous approach.

When you sell a put option, you are essentially taking on the obligation to buy the underlying asset at a predetermined price, known as the strike price, if the option buyer decides to exercise their right. This means that you are collecting a premium upfront, which can be a source of income. On the other hand, buying a call option requires you to pay a premium upfront without any guarantee of profit if the price of the underlying asset does not increase.

By selling a put option, you have the potential to profit in three different scenarios. First, if the price of the underlying asset remains above the strike price, the option expires worthless and you get to keep the premium you collected. Second, if the price of the underlying asset decreases but remains above the strike price, you still get to keep the premium and you can potentially sell another put option to continue generating income. Lastly, if the price of the underlying asset falls below the strike price, you are obligated to buy the asset at a discount, which can be advantageous if you believe in the long-term potential of the asset.

In conclusion, selling a put option can be a more profitable strategy compared to buying a call option due to the ability to generate income through the collection of premiums and the potential for profit in multiple scenarios. However, it is important to thoroughly understand the risks and rewards of options trading before engaging in any trading activity.

Remember to consult with a financial advisor or professional before making any investment decisions, as options trading involves significant risk and may not be suitable for all investors.

Selling a put option can be a more advantageous strategy compared to buying a call option in certain market conditions. Here are some reasons why:

| 1. Income Generation: | When you sell a put option, you receive a premium from the buyer. This premium serves as income and can enhance your overall returns. |

| 2. Lower Breakeven Point: | Selling a put option allows you to have a lower breakeven point compared to buying a call option. This means that the underlying stock has to fall further before you start losing money. |

| 3. Higher Probability of Success: | Since the seller of a put option benefits when the underlying stock price remains above the strike price, there is a higher probability of success compared to buying a call option, which requires the stock price to rise. |

| 4. Flexibility and Control: | As a seller of a put option, you have more control over your position. You can choose the strike price, expiration date, and underlying stock, allowing for more flexibility in your trading strategy. |

| 5. Time Decay Advantage: | When you sell a put option, you benefit from time decay. As time passes, the value of the option decreases, allowing you to buy it back at a lower price or let it expire worthless, earning the entire premium. |

While selling a put option can have its advantages, it is important to note that it also carries risks. If the underlying stock price falls significantly, you may be forced to buy the stock at a higher price than the current market value. Therefore, it is crucial to thoroughly evaluate your risk tolerance and market conditions before engaging in put option selling strategies.

Selling a put option offers a lower level of risk compared to buying a call option. When you sell a put option, you are essentially entering into an agreement to buy the underlying asset at a predetermined price, known as the strike price, if the option is exercised by the buyer.

This strategy allows you to profit from the decrease in the price of the underlying asset, which can be advantageous in a bearish market. If the price of the asset remains above the strike price, the option will expire worthless and you will keep the premium received from selling the option.

On the other hand, buying a call option involves paying a premium for the right to purchase the underlying asset at a predetermined price, known as the strike price, before the option’s expiration date. If the price of the asset does not increase above the strike price, the option will expire worthless and you will lose the premium paid.

By selling a put option, you are not required to own the underlying asset, which further reduces your risk. Additionally, you have the potential to profit even if the price of the asset remains the same, as long as the option expires worthless. In contrast, buying a call option requires the price of the asset to increase above the strike price in order to be profitable.

Read Also: Ice Futures: A Guide to the Most Popular Futures Traded on ICE

Overall, selling a put option provides a lower risk profile and greater potential for profit compared to buying a call option. This strategy allows you to capitalize on downward price movements and generate income from the premium, making it an attractive alternative for investors looking to minimize risk and maximize returns.

One of the benefits of selling a put option is that it provides an income stream for the option seller. When you sell a put option, you receive a premium for taking on the obligation to buy the underlying stock at a predetermined price, known as the strike price.

Read Also: Understanding the Stock Index Signals: Everything You Need to Know

This premium is immediately added to your account as income, regardless of whether the option is exercised or expires worthless. This income can be a valuable source of cash flow, especially for investors looking to generate additional income from their portfolio.

In comparison, buying a call option requires an upfront payment of the option premium, meaning you need to invest money to buy the option. While buying a call option can be profitable if the underlying stock’s price increases, it does not provide a consistent income stream like selling a put option does.

By selling put options, investors can potentially generate income from their portfolio even if the stock price does not move significantly or remains stagnant. This can be particularly attractive in a sideways or bearish market, where stocks are not experiencing significant price increases.

Overall, the income stream provided by selling put options makes it a more attractive strategy for investors seeking to generate consistent income from their investment portfolio.

A put option is a financial contract that gives the holder the right, but not the obligation, to sell a specific amount of an underlying security at a predetermined price within a certain time frame.

Someone would sell a put option if they believe that the price of the underlying security will either remain stable or increase. By selling a put option, they receive a premium upfront and if the price of the security remains above the predetermined price, they keep the premium. However, if the price falls below the predetermined price, they are obligated to buy the security at the predetermined price.

Selling a put option allows the seller to generate income through the premiums received. Additionally, it can be a less risky strategy compared to buying a call option because the seller is not speculating on price increases. Selling a put option also gives the seller the opportunity to potentially acquire the underlying security at a lower price if the price falls below the predetermined price.

Yes, there are risks involved in selling a put option. If the price of the underlying security falls below the predetermined price, the seller is obligated to buy the security at the predetermined price, regardless of its current market value. Additionally, the seller may miss out on potential gains if the price of the security increases significantly.

Selling a put option can be a suitable strategy for investors who have a neutral to bullish outlook on the market and are willing to potentially acquire the underlying security at a lower price. However, it is important for investors to fully understand the risks involved and to have sufficient capital to fulfill their obligations if the market moves against them.

A put option is a financial derivative that gives the holder the right, but not the obligation, to sell an underlying asset at a specified price within a specific time frame.

Understanding the IQ Option Multiplier: Everything You Need to Know IQ Option is a popular online trading platform that allows users to trade a …

Read ArticleHow much is a C stock? If you’re keen to invest and wondering about the current price of C Stock, you’re in the right place. The stock market can be a …

Read ArticleUnderstanding Legs in Options Trading Options trading is a complex and often misunderstood form of investment. As traders delve into the world of …

Read ArticleWhat is the payment for order flow? Payment for Order Flow (PFOF) is a practice used in financial markets that involves a brokerage firm receiving …

Read ArticleUnderstanding the Dynamics of the Bid-Ask Spread When it comes to financial markets, one important concept that traders need to understand is the …

Read ArticleWho is the best Italian trader? When it comes to trading, Italy has some of the most skilled and successful traders in the market. With a rich history …

Read Article