Top Crypto Stocks to Invest in: A Comprehensive Guide

What are the best crypto stocks to invest in? With the growing popularity and increasing value of cryptocurrencies, investing in crypto stocks has …

Read Article

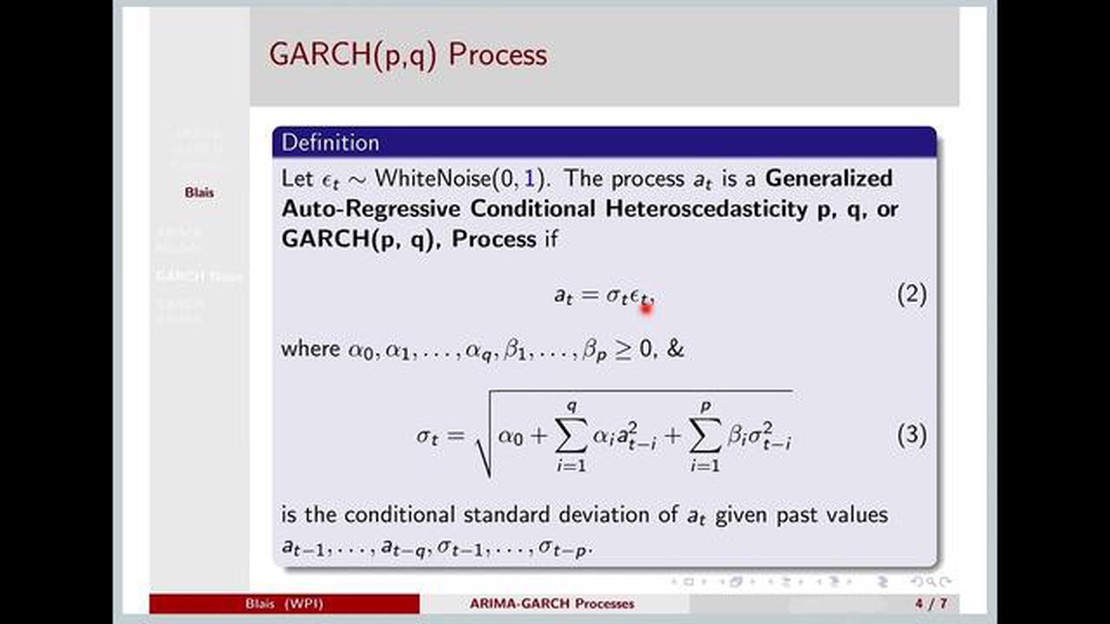

Time series analysis is an important tool in forecasting financial markets. Two popular methods for modeling and predicting market volatility are ARIMA (Autoregressive Integrated Moving Average) and GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models. While both models have their merits, recent studies have shown that GARCH outperforms ARIMA in terms of accuracy and forecasting performance.

ARIMA models are widely used in forecasting time series data, as they capture the trend, seasonality, and autocorrelation of the data. However, ARIMA models assume that the residuals, or the errors of the model, are normally distributed and have constant variance over time. This assumption may not hold true in financial markets, where volatility can be highly irregular and subject to sudden changes.

GARCH models, on the other hand, are specifically designed to capture the volatility clustering and time-varying nature of financial markets. GARCH models allow for the conditional variance of the residuals to depend on past values, capturing the persistence and asymmetry in volatility. This makes GARCH models more suitable for modeling and predicting market volatility, especially during periods of high volatility.

This comparative analysis aims to demonstrate the superior performance of GARCH models over ARIMA models in forecasting market volatility. By comparing the accuracy and forecast errors of both models on historical financial data, we provide empirical evidence that GARCH models outperform ARIMA models in capturing the complex dynamics of financial markets.

In conclusion, while ARIMA models are useful in capturing the trend and autocorrelation of time series data, GARCH models are better suited for modeling and predicting market volatility. The ability of GARCH models to capture the time-varying nature of volatility makes them more accurate and reliable in forecasting financial markets. This study emphasizes the importance of considering GARCH models as an alternative to ARIMA models in volatility forecasting and provides insights for researchers and practitioners in the field of financial analysis.

GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models have several advantages over ARIMA (Autoregressive Integrated Moving Average) models in the field of financial time series analysis.

Read Also: Discover the Effective Binary 5 Minute Strategy for Successful Trading4. Forecasting accuracy: GARCH models have been found to outperform ARIMA models in terms of forecasting accuracy for financial time series. The ability of GARCH models to capture volatility clustering and time-varying volatility leads to more accurate volatility forecasts, which in turn improves the accuracy of asset price forecasts.

Overall, GARCH models offer several advantages over ARIMA models in the field of financial time series analysis, making them a preferred choice for modeling and forecasting financial data.

Read Also: Understanding US30 in forex trading: A comprehensive guide

Although ARIMA models have been widely used in time series forecasting, there are several limitations to consider:

Despite these limitations, ARIMA models continue to be used in many applications due to their simplicity, interpretability, and robustness in certain scenarios. However, for time series with non-linear, non-stationary, or complex patterns, alternative models such as GARCH may be more suitable and yield better forecasting results.

The main difference between GARCH (Generalized Autoregressive Conditional Heteroskedasticity) and ARIMA (Autoregressive Integrated Moving Average) models is that GARCH models are specifically designed to capture and model the volatility clustering and time-varying volatility patterns in financial and economic time series data, while ARIMA models are generally used to model the underlying trend and seasonality in the data.

GARCH models are generally considered to outperform ARIMA models in terms of forecasting accuracy for financial and economic time series data because they are able to capture and model the volatility clustering and time-varying volatility patterns that are commonly observed in such data. The ability of GARCH models to capture these characteristics of the data allows them to make more accurate forecasts compared to ARIMA models.

Yes, GARCH models can be used for short-term forecasting. In fact, one of the advantages of GARCH models is that they are able to capture short-term volatility patterns and provide accurate forecasts for shorter time horizons. However, it is important to note that the accuracy of the forecasts may decrease as the forecasting horizon increases.

GARCH models were originally developed and are widely used in the field of finance and economics to model volatility in financial and economic time series data. However, they can also be applied to other types of time series data that exhibit volatility clustering and time-varying volatility patterns. Examples include weather data, stock prices, and exchange rates.

There are several limitations of using GARCH models. Firstly, GARCH models assume that the conditional variance is only influenced by past values of the conditional variance and the past squared residuals. This assumption may not hold true in all cases and can lead to inaccurate forecasts. Additionally, GARCH models may require a large amount of data to estimate the parameters accurately. Lastly, GARCH models are computationally intensive and may require advanced statistical software to implement.

The main focus of the article is to compare the performance of GARCH (Generalized Autoregressive Conditional Heteroskedasticity) and ARIMA (Autoregressive Integrated Moving Average) models in predicting financial time series data.

What are the best crypto stocks to invest in? With the growing popularity and increasing value of cryptocurrencies, investing in crypto stocks has …

Read ArticleHow to Code Bollinger Band in Python? The Bollinger Bands are a widely used technical indicator in financial analysis. They were developed by John …

Read ArticleBest Time to Trade Oil Futures: A Comprehensive Guide Trading oil futures can be a highly profitable venture, but it requires careful analysis of the …

Read ArticleHistory of Forex Market in India: When Did It Start? The foreign exchange market, also known as Forex or FX, has a long and rich history in India. The …

Read ArticleIs there a stock exchange in Ukraine? Ukraine, with its rapidly growing economy and European aspirations, has a thriving financial market. One of the …

Read ArticleIs life insurance tax deductible? When it comes to managing your finances, understanding the tax implications of certain expenses is crucial. Life …

Read Article