Today's Price of 24 Carat Gold in Pakistan - Current Gold Rates 2022

Current Price of 24 Carat Gold in Pakistan Today Gold has always been a valuable commodity, and its price has been subject to fluctuations in the …

Read Article

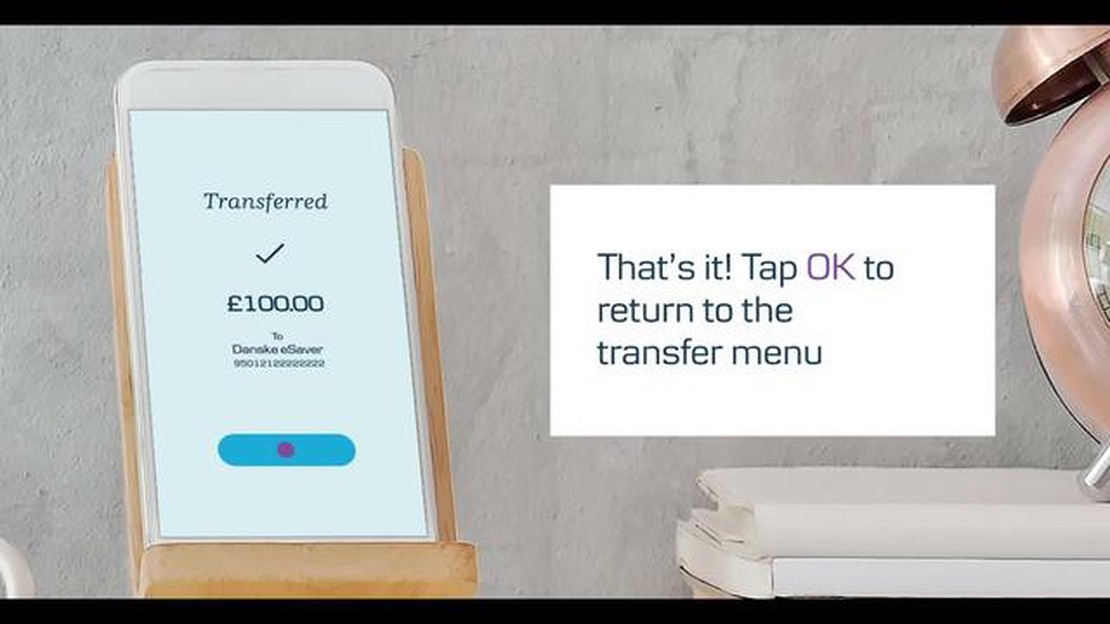

Are you a Danske Bank customer and need to withdraw British pounds? You’re in the right place! Danske Bank offers a wide range of options for withdrawing pounds to meet your currency needs.

Whether you’re planning a trip to the United Kingdom, need pounds for business purposes, or simply want to exchange your currency for pounds, Danske Bank has you covered. With our convenient locations and dedicated staff, we make it easy for you to get the pounds you need.

At Danske Bank, you can withdraw pounds at any of our branches throughout the country. Simply visit your nearest branch with your Danske Bank card and valid identification, and our friendly team will assist you with your transaction. We strive to provide a seamless experience, ensuring that you have access to the currency you need when you need it.

In addition to our branches, Danske Bank offers a range of other options for withdrawing pounds. You can use our online banking platform to exchange your currency and have pounds delivered to your doorstep. Alternatively, you can withdraw pounds from our extensive network of ATMs conveniently located throughout the country. Our ATMs provide 24/7 access to pounds, making it convenient for you to withdraw cash whenever you need it.

If you’re a Danske Bank customer in need of British pounds, look no further. With our wide range of options for withdrawing pounds, including branches, online banking, and ATMs, we make it easy for you to access the currency you need. Visit your nearest Danske Bank branch or explore our online banking platform today to get started!

If you are looking to exchange your currency at Danske Bank, you can find their currency exchange services at the following locations:

Danske Bank operates branches throughout various cities and towns, where you can visit their physical location and exchange your currency. They also have foreign exchange offices dedicated to currency exchange services.

Airports and travel hubs often have Danske Bank currency exchange kiosks where you can conveniently exchange your money before or after your journey.

If you prefer to handle your currency exchange online, Danske Bank offers online currency exchange services as well. You can easily convert your currency to pounds from the comfort of your own home.

Whether you choose to visit a Danske Bank branch, use a foreign exchange office, stop by an airport kiosk, or exchange online, Danske Bank provides various options to exchange your currency and obtain pounds.

If you’re looking to withdraw pounds at Danske Bank, it’s important to know where the branches are located in your area. Luckily, Danske Bank has a wide network of branches throughout the UK.

Read Also: Is Binary Option Trading Legal in Canada? Find Out Now!

To find a Danske Bank branch near you, you can visit the bank’s official website and use their branch locator tool. Simply enter your postcode or town name, and the tool will provide you with a list of branches in your area.

In addition to the online tool, you can also call Danske Bank’s customer service hotline for assistance. The customer service representatives can help you locate the nearest branch and provide you with any additional information you may need.

Once you’ve located a Danske Bank branch in your area, you can visit the branch and use their ATM to withdraw pounds. It’s important to note that some branches may have limited operating hours, so it’s best to check the opening hours before visiting.

Overall, Danske Bank provides convenient options for withdrawing pounds at their branches. By using their branch locator tool or contacting their customer service hotline, you can easily find a Danske Bank branch in your area and access the currency you need.

If you need to withdraw pounds at Danske Bank, their ATMs offer a convenient solution. Danske Bank ATMs are widely available throughout their branches, making it easy for customers to access their funds in pounds. Here’s some information on how to use Danske Bank ATMs to withdraw pounds:

| Step | Description |

|---|---|

| 1 | Locate the nearest Danske Bank branch with an ATM. You can use their website or mobile app to find the nearest branch. |

| 2 | Once you arrive at the branch, look for the ATM area. Danske Bank ATMs usually have clear signage and are easily accessible. |

| 3 | Insert your Danske Bank card into the ATM. Make sure the card is inserted with the chip facing up or as directed by the ATM screen. |

| 4 | Follow the instructions on the ATM screen to select your language and enter your PIN. |

| 5 | After entering your PIN, select the “Withdraw” option from the main menu. |

| 6 | Choose the amount of pounds you wish to withdraw from your account. Some ATMs may have preset options, while others allow you to enter a custom amount. |

| 7 | Confirm your withdrawal and wait for the ATM to dispense the pounds. Remember to take your card and any printed receipts before leaving. |

| 8 | Count your withdrawn pounds and keep them in a safe place. |

Read Also: OTCEI Trading Start Date: A Look Into the Beginning of OTCEI

It’s important to note that Danske Bank may have withdrawal limits and fees associated with using their ATMs. Make sure to check the terms and conditions of your account or contact Danske Bank for more information about any potential fees or restrictions.

Using Danske Bank ATMs to withdraw pounds is a convenient way to access your funds and can be done quickly and securely at any time. Just remember to keep your PIN safe and be aware of any potential charges. Happy withdrawing!

Yes, you can withdraw pounds at any Danske Bank branch. Danske Bank allows its customers to withdraw pounds from their accounts at any of their branches located throughout the United Kingdom.

Yes, there may be fees associated with withdrawing pounds at Danske Bank. The fees may vary depending on your account type and the specific branch you are using. It is recommended to check with Danske Bank directly or refer to their fee schedule for the most accurate information.

Yes, you can withdraw pounds at Danske Bank ATMs. Danske Bank has a network of ATMs where you can access your account and withdraw pounds in cash. You can easily locate Danske Bank ATMs by using their online branch locator or mobile banking app.

No, you cannot withdraw pounds at Danske Bank if you don’t have an account with them. Danske Bank only allows withdrawals from accounts held with them. If you don’t have an account at Danske Bank, you may need to consider other options such as currency exchange services or using ATMs from your own bank.

In order to withdraw pounds at Danske Bank, you will typically need to provide valid identification documents such as a passport or driver’s license. You may also be required to provide your account details to complete the transaction. It is recommended to contact Danske Bank directly or visit their website for the most up-to-date requirements.

You can withdraw pounds at Danske Bank from any of their ATMs located across the country. Just look for the nearest Danske Bank ATM and follow the instructions to withdraw your pounds.

Yes, you can withdraw pounds at any bank in the UK. However, fees may vary depending on your bank and the bank you are using the ATM of. It is always a good idea to check with your bank beforehand to see if they have any partnerships or alliances with UK banks that offer reduced or no fees for withdrawals.

Current Price of 24 Carat Gold in Pakistan Today Gold has always been a valuable commodity, and its price has been subject to fluctuations in the …

Read ArticleWhen do 4-hour candles close? Understanding the timing of candlestick charts is essential for successful trading in the financial markets. One key …

Read ArticleWhat is the minimum deposit for Tifia? When trading in the financial markets, it is important to find a broker that suits your needs and offers …

Read ArticleInsider Trading and its Applicability to Stock Options Insider trading is a highly debated issue in the world of finance and investing. It refers to …

Read ArticleUnderstanding the Gap Between Moving Averages When it comes to technical analysis in trading, moving averages play a crucial role in identifying …

Read ArticleAre exercise options taxable? Stock options can be a valuable perk for employees, allowing them the opportunity to purchase company stock at a …

Read Article