Is the ZigZag Indicator Lagging? Exploring its Accuracy and Effectiveness

Is the ZigZag indicator lagging? The ZigZag indicator is a popular technical analysis tool used by traders to identify potential reversal points in …

Read Article

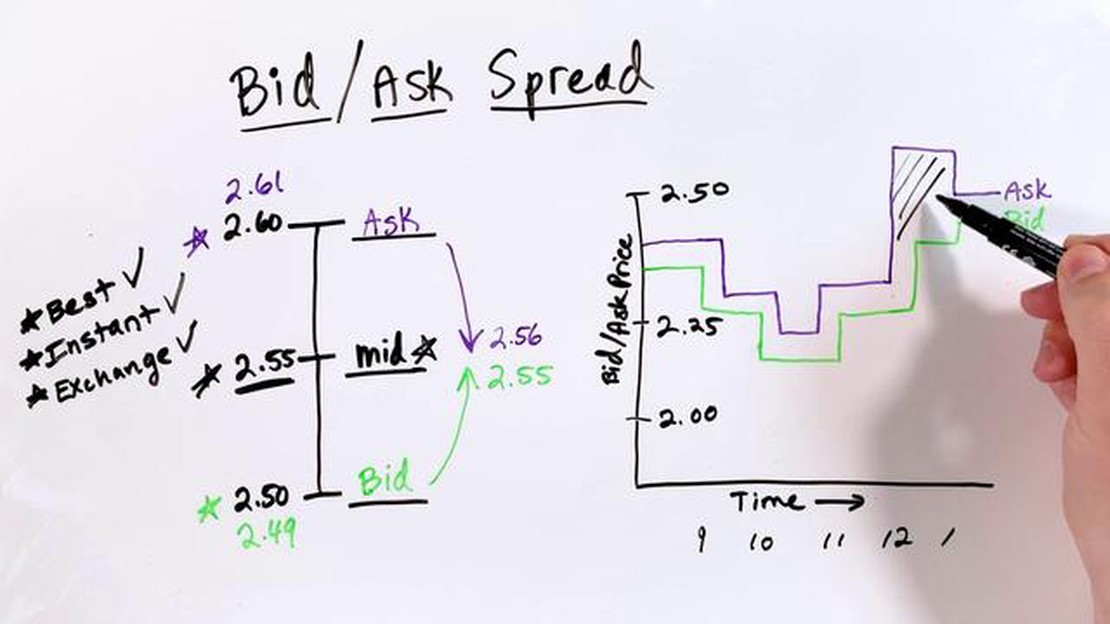

The bid-ask spread is an important concept in the world of trading. It refers to the difference between the highest price that a buyer is willing to pay for an asset (the bid) and the lowest price that a seller is willing to accept (the ask). The bid-ask spread represents the cost of trading and is a key factor that traders consider when making investment decisions.

Understanding the importance of bid-ask spread is crucial for traders as it directly affects their profitability. A narrow bid-ask spread indicates a highly liquid market, where there is a high volume of trades and minimal price volatility. On the other hand, a wide bid-ask spread suggests a less liquid market with fewer buyers and sellers, resulting in higher costs for traders.

For traders, the ideal bid-ask spread is one that is consistently narrow and reflects a balance between buyers and sellers. This ensures accessibility to liquidity and minimizes transaction costs. A tight bid-ask spread allows traders to enter and exit positions easily, without significantly affecting the asset’s price. Therefore, it is important for traders to choose markets with low bid-ask spreads to maximize their profitability and efficiency.

In conclusion, the bid-ask spread plays a crucial role in trading as it determines the cost of executing trades and reflects the liquidity of a market. Traders should aim to trade in markets with narrow bid-ask spreads to minimize costs and improve their overall trading experience.

The bid-ask spread is an important concept in trading. It refers to the difference between the highest price a buyer is willing to pay for a security (the bid) and the lowest price a seller is willing to accept (the ask). The bid-ask spread represents the cost of trading and is a key factor that affects the profitability and liquidity of a market.

While there is no fixed ideal bid-ask spread that applies to all markets and securities, a narrower spread is generally seen as more favorable. A narrow spread indicates a high level of liquidity in the market, which means that there are many buyers and sellers actively trading the security. This makes it easier and cheaper for traders to enter or exit positions, as they can buy at the ask price and sell at the bid price without incurring significant transaction costs.

In contrast, a wider spread is often associated with illiquid markets where there are fewer participants and trading activity is limited. This can make it more difficult and expensive to buy or sell securities, as traders may have to accept a less favorable price to complete their trades. Consequently, a wider bid-ask spread can reduce the profitability of trading and discourage market participation.

The ideal bid-ask spread will vary depending on the specific market and security being traded. Highly liquid markets, such as major currency pairs in the foreign exchange market or large-cap stocks on major exchanges, tend to have very narrow spreads. On the other hand, less liquid markets, such as small-cap stocks or exotic currency pairs, may have wider spreads due to lower trading volumes.

Ultimately, the ideal bid-ask spread is one that strikes a balance between liquidity and transaction costs. Traders should aim to minimize the spread while still being able to execute trades efficiently and at reasonable prices. By understanding the dynamics of the bid-ask spread and monitoring it closely, traders can make more informed decisions and improve their trading performance.

Read Also: Discover the Secrets of Future and Option Trading | Exclusive Guide

In the world of trading, the bid-ask spread plays a crucial role in determining the cost of executing trades. The bid-ask spread is the difference between the highest price that a buyer is willing to pay (bid) and the lowest price that a seller is willing to accept (ask) for a particular security.

The bid-ask spread is influenced by various factors, including liquidity, market volatility, and trading volume. A narrow bid-ask spread indicates a highly liquid market with a large number of buyers and sellers, making it easier and cheaper to execute trades. On the other hand, a wide bid-ask spread suggests a less liquid market with fewer participants, resulting in higher transaction costs.

For traders, understanding and monitoring the bid-ask spread is crucial as it directly impacts their profitability. When buying a security, traders must pay the ask price, which is usually higher than the bid price. Conversely, when selling a security, traders receive the bid price, which is generally lower than the ask price. This difference in prices represents a cost that traders need to account for.

Additionally, the bid-ask spread can also provide valuable information about market sentiment and supply and demand dynamics. A narrow spread indicates a high level of market confidence and a balanced supply and demand, while a wide spread suggests uncertainty and an imbalance between buyers and sellers.

Read Also: Are options always 100 shares? Understanding the basics of options trading

Traders should also be aware that the bid-ask spread can vary across different markets, securities, and trading platforms. It is advisable to choose markets and platforms that offer competitive bid-ask spreads to minimize trading costs and maximize profitability.

In conclusion, the bid-ask spread is an essential concept in trading that affects the cost and efficiency of executing trades. Traders must understand the factors influencing the bid-ask spread and monitor it closely to make informed trading decisions and optimize their profitability.

Bid-ask spread is the difference between the highest price a buyer is willing to pay for a security (the bid) and the lowest price a seller is willing to accept (the ask).

The bid-ask spread is important because it represents the cost of trading. It is the difference between the buying and selling price of a security, and it is how market makers earn a profit. A narrow bid-ask spread is generally preferred because it means lower transaction costs for traders.

An ideal bid-ask spread is subjective and can vary depending on the security being traded and market conditions. In general, a bid-ask spread that is less than 1% of the security’s price is considered tight, while a spread that is more than 1% can be considered wide. However, it is important to note that what is considered ideal can vary between different traders and trading strategies.

The bid-ask spread is an indicator of a security’s liquidity. A narrow bid-ask spread indicates that there is a high level of liquidity, meaning that there are many buyers and sellers actively trading the security. On the other hand, a wide bid-ask spread suggests lower liquidity and can make it more difficult to execute trades at desired prices.

There are several factors that can cause the bid-ask spread to widen. Some factors include low trading volume, high volatility, market uncertainty, and illiquid securities. Additionally, wider spreads can also occur during non-trading hours or when the market is less active.

Is the ZigZag indicator lagging? The ZigZag indicator is a popular technical analysis tool used by traders to identify potential reversal points in …

Read ArticleNumber of Children who died in 9/11 The September 11 attacks, also known as 9/11, were a series of coordinated terrorist attacks carried out by the …

Read ArticleReasons to Avoid Trading Options Options trading can be an enticing investment strategy, promising high returns and the potential to make quick …

Read ArticleUnderstanding the Weighted Moving Average: What Does It Indicate? The weighted moving average is a widely used statistical technique that provides …

Read ArticleEffective Strategies for Trading VIX 75 The VIX 75 is a popular volatility index that tracks the expected volatility of the S&P 500 index. Traders can …

Read ArticleIs scalping safe? Scalping, a trading strategy that involves buying and selling securities within a short timeframe to profit from small price …

Read Article