What is the 26 Moving Average and How to Use It for Technical Analysis

Understanding the 26 Moving Average: A Comprehensive Guide In the world of technical analysis, moving averages are a popular tool used by traders to …

Read Article

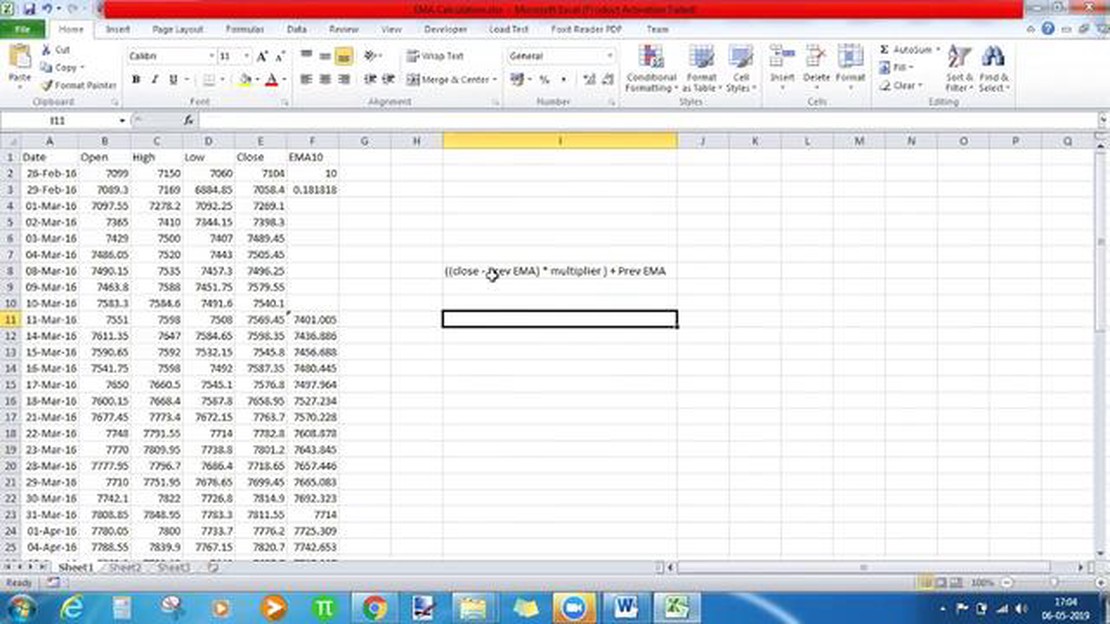

Excel is a widely used spreadsheet program that offers a variety of functions to help users analyze and manipulate data more efficiently. One of the most commonly used functions is the EMA function, which stands for Exponential Moving Average. This function is particularly useful in financial analysis and forecasting, as it helps identify trends and patterns in data.

The EMA function calculates the average of a series of data points over a specified period of time, giving more weight to recent data points. This makes it particularly useful for analyzing time-series data, such as stock prices or sales figures, where recent data points may be more relevant for predicting future trends.

To use the EMA function in Excel, you need to provide two arguments: the range of cells containing the data points and the number of periods to include in the calculation. The function then returns the exponential moving average of the data points.

Excel also offers a variety of options to customize the EMA function, such as specifying the starting value for the calculation or adjusting the smoothing factor. By experimenting with these options, you can fine-tune the EMA calculation to fit your specific needs.

Overall, the EMA function in Excel is a powerful tool for analyzing and forecasting data. Whether you’re a financial analyst looking to predict stock prices or a business owner trying to forecast sales, understanding how to use the EMA function can greatly enhance your data analysis skills.

The Exponential Moving Average (EMA) function is a powerful tool in Excel that helps analyze and interpret data trends over time. By giving more weight to recent values, the EMA function provides a smoother and more responsive indicator compared to other moving averages.

To calculate the EMA, Excel uses a formula that takes into account the previous EMA value, the current data point, and a smoothing factor. The smoothing factor, also known as the EMA period, determines the weight given to each data point. The shorter the period, the more weight is assigned to recent data and the faster the EMA reacts to changes.

The EMA function is particularly useful when analyzing financial data, such as stock prices, where past performance can impact future trends. By calculating the EMA of historical price data, traders and analysts can identify potential buying or selling opportunities, as well as gauge market volatility and trend strength.

To use the EMA function in Excel, you need a data range that represents the values over time. You also need to specify the EMA period, which determines the level of smoothing. Once you have this information, you can enter the EMA formula in a cell and drag it across the desired range to calculate the EMA values for each data point.

Here is an example of the EMA formula syntax in Excel: =EMA(data_range, EMA_period). The “data_range” refers to the range of cells containing the data values, and the “EMA_period” represents the number of data points used to calculate the EMA.

It’s important to note that the EMA function in Excel is a volatile function, meaning it can change its value each time the workbook is recalculated. Therefore, it’s recommended to freeze the EMA value by copying and pasting it as a static value, especially when analyzing historical data.

Read Also: Does Lloyds Bank offer foreign exchange services? Find out now! | Lloyds Bank

In conclusion, the EMA function in Excel is a valuable tool for analyzing trends and patterns in data over time. By giving more weight to recent values, it provides a smooth and responsive indicator that can be used in various industries, including finance and economics.

For more advanced analysis, the EMA function can be combined with other Excel functions and formulas to create customized indicators and strategies. Its versatility and flexibility make it an essential tool for anyone working with time series data in Excel.

The EMA (Exponential Moving Average) function in Excel is a useful tool for calculating the average value of a series of numbers over a specific time period, giving more weight to recent data points. It is commonly used in financial analysis to identify trends and predict future values.

To use the EMA function in Excel, follow these step-by-step instructions:

Read Also: How to identify vintage silver: Tips and tricks

=EMA(range, periods)range with the range of cells containing the data you want to calculate the EMA for.periods with the number of periods you want to include in the calculation.For example, let’s say you have a series of closing prices for a stock in cells A2 to A10, and you want to calculate the 5-day EMA. In cell B2, you would enter the formula =EMA(A2:A10, 5).

After pressing Enter, Excel will calculate the EMA and display the result in the selected cell. The EMA gives more weight to recent data points, so it will be closer to the actual value of the stock at the end of the 5-day period.

If you want to calculate the EMA for a different time period, simply change the range and the number of periods in the formula. This allows you to analyze trends over different time periods and make more accurate predictions.

Using the EMA function in Excel can help you make informed decisions based on historical data and predict future values with greater accuracy. Experiment with different time periods and ranges to find the optimal parameters for your analysis.

Remember, the EMA is just one of many tools available in Excel for financial analysis. Combine it with other functions and features to gain deeper insights into your data and make more informed decisions.

The EMA function in Excel stands for Exponential Moving Average. It is a statistical calculation used to analyze and smooth out time-series data. It is commonly used in finance and technical analysis to identify trends and predict future values.

The EMA function works by giving more weight to recent data points while calculating the average. It uses a formula that takes into account the previous EMA value and the current data point to calculate the new EMA value. This way, the EMA places more emphasis on the recent values and reacts more quickly to changes in the data.

The EMA function in Excel requires three arguments: the range of values, the period, and an optional value for the initial EMA. The range of values is the data on which you want to calculate the EMA. The period is the number of data points to consider in the calculation. The optional initial EMA value is used to provide the starting point for the EMA calculation.

The EMA function can be used in financial analysis to analyze stock prices, market trends, and other time-series data. It can help identify potential buying or selling opportunities by indicating when the price is likely to reverse or continue its current trend. Traders and investors often use the EMA in conjunction with other technical indicators to make informed decisions.

Yes, the EMA function in Excel can be applied to any time-series data, not just financial data. It is commonly used in various fields such as sales forecasting, demand analysis, weather prediction, and more. The EMA can help smooth out the data and identify patterns or trends that may not be easily apparent in the raw data.

Understanding the 26 Moving Average: A Comprehensive Guide In the world of technical analysis, moving averages are a popular tool used by traders to …

Read ArticleMaximum Forex Deposit: What are the Limits? Forex trading is a popular investment method that allows individuals to trade currencies in the global …

Read ArticleUnderstanding the Seagull Option Structure In the world of investing, there are many different strategies and structures that traders and investors …

Read ArticleUnderstanding relative value strategies in CFA Relative value strategies are an important tool for investors looking to capitalize on pricing …

Read ArticleDoes UPS offer stock options? Stock options are a popular form of employee compensation that many companies offer to attract and retain talented …

Read ArticleCan you pay in euros in England? When planning a trip to England, one of the first questions that may come to mind is whether you can pay in euros. …

Read Article