Discover How Profitly works: The ultimate guide

How does Profitly work? Welcome to Profitly, the ultimate financial tool designed to help you manage and grow your investments. Whether you’re a …

Read Article

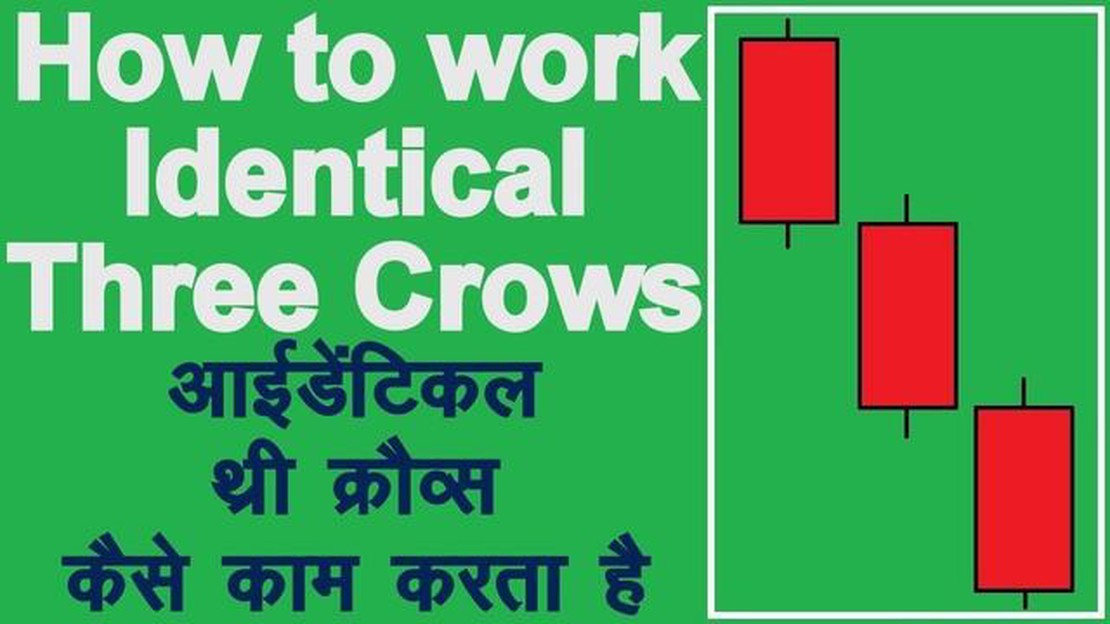

Identical Three Crows is a three-bar candlestick pattern that appears in technical analysis of financial markets. It is considered a bearish reversal pattern, indicating a potential trend reversal from an uptrend to a downtrend.

The pattern consists of three consecutive long black (or red) candlesticks with small or nonexistent shadows, each closing near its low. The opening price of each candlestick is within the body of the previous candlestick, creating a pattern of three declining candles that are visually identical.

The Identical Three Crows pattern is significant because it suggests that market sentiment has shifted from bullishness to bearishness. It indicates that sellers are gaining control and pushing prices lower. Traders and investors often interpret this pattern as a sign to sell or take short positions.

When analyzing the Identical Three Crows pattern, it is important to consider the context in which it appears. Factors such as the overall trend, volume, and support and resistance levels should be taken into account to confirm the validity of the pattern. Additionally, other technical indicators and chart patterns can be used to enhance the analysis and make more informed trading decisions.

In conclusion, Identical Three Crows is a bearish reversal pattern that can provide valuable insights into market dynamics. Traders and investors should be cautious and use additional analysis tools to confirm the pattern and make well-informed trading decisions.

The identical three crows candlestick pattern is a bearish reversal pattern that can provide valuable insights into price movements in the financial markets. It consists of three consecutive long black candlesticks with similar opening and closing prices, indicating a strong selling pressure and a potential trend reversal.

Each candlestick in the pattern opens at or near the previous candlestick’s closing price and closes near its own low. This shows that the bears are in control throughout the entire trading session, pushing the prices lower with little to no resistance from the bulls.

The identical three crows pattern is often formed after an uptrend, signaling the end of the bullish momentum and suggesting a likely shift towards a bearish trend. Traders and investors use this pattern as a signal to exit long positions and consider initiating short positions or selling their assets.

While the identical three crows pattern is a reliable indicator of a potential trend reversal, it is essential to confirm its validity by considering other technical indicators and price action signals. Traders often look for additional confirmation from volume indicators, trendlines, and other candlestick patterns before making a trading decision based solely on the identical three crows pattern.

It is important to note that although the identical three crows pattern suggests a bearish reversal, it is not foolproof, and there may be instances where it fails to accurately predict a trend reversal. Therefore, it is always advisable to use risk management techniques and stop-loss orders to mitigate potential losses in case the pattern does not play out as expected.

In conclusion, understanding the identical three crows candlestick pattern can be a valuable tool for technical analysis in the financial markets. By recognizing this pattern and combining it with other indicators, traders can enhance their decision-making process and improve their overall trading strategy.

A candlestick pattern is a graphical representation of price movements in financial markets, commonly used in technical analysis. It is formed by a combination of bars or candlesticks that indicate the open, close, high, and low prices of a security over a specific time period.

The basic structure of a candlestick includes a rectangular body and two thin lines, known as wicks or shadows, extending from the body. The body represents the price range between the opening and closing prices, with different colors or shades indicating whether the closing price was higher or lower than the opening price.

Read Also: Is It Possible for a Bearish Pin Bar to be Green?

Candlestick patterns provide valuable insights into market sentiment and can help traders make predictions about future price movements. They allow traders to identify potential reversals, continuations, and trend formations in the market.

There are numerous candlestick patterns, each with its own unique characteristics and implications. Some patterns, such as the “engulfing pattern” or the “hammer” pattern, indicate potential trend reversals, while others, like the “doji” or the “shooting star” pattern, suggest indecision or potential trend continuation.

Traders often combine the use of candlestick patterns with other technical analysis tools and indicators to enhance their trading strategies and improve the accuracy of their predictions. By recognizing and interpreting these patterns, traders can gain a deeper understanding of market dynamics and potentially increase their profitability.

Key Points:

Read Also: How to Change the Default Stock Option in Magento 2 | Step-by-Step Guide

In conclusion, candlestick patterns are valuable tools for traders to analyze price movements and make informed trading decisions. By understanding the different patterns and their implications, traders can have a better understanding of market dynamics and improve their overall trading performance.

The Identical Three Crows candlestick pattern is a bearish reversal signal that appears in technical analysis of stock charts. It consists of three consecutive long black candlesticks, each with a close near the low of the day and minimal or no lower shadow.

This pattern suggests that a downtrend is continuing or going to reverse soon. It indicates strong selling pressure and a loss of control by the bulls, as each candlestick shows a steady decline in price throughout the trading session.

The formation of three black candlesticks in a row implies that market sentiment has turned extremely negative, and the bears have taken control. Traders often see this pattern as a sign to sell or go short on a stock or asset.

However, it is important to confirm the pattern with other technical indicators or chart patterns before making any trading decisions. False signals can occur, so it is crucial to consider other factors such as volume, support and resistance levels, and trendlines.

It’s worth noting that the Identical Three Crows candlestick pattern is just one of many candlestick patterns used by technical analysts to predict potential changes in price direction. Traders and investors should use this pattern along with other analysis tools for more accurate results.

In conclusion, the Identical Three Crows candlestick pattern is a bearish signal that indicates a possible reversal or continuation of a downtrend. Traders should consider this pattern alongside other technical indicators to make informed trading decisions.

Identical Three Crows is a bearish reversal pattern that appears in a downtrend. It consists of three consecutive long black candlesticks with small or no upper and lower shadows. This pattern signals a strong selling pressure and indicates a potential trend reversal.

The Identical Three Crows pattern is characterized by three long black candlesticks in a row, with small or no upper and lower shadows. Each candlestick should open within the body of the previous candle and close near its low. The pattern shows consistent selling pressure and suggests that the bears are in control of the market.

The Identical Three Crows pattern indicates a strong reversal of an existing uptrend. It suggests that the bears have taken control of the market and are pushing prices lower. This pattern is often seen as a bearish signal and traders may consider selling or shorting positions.

The reliability of the Identical Three Crows pattern depends on the context in which it appears. If this pattern occurs after a strong uptrend, it is considered more reliable as a reversal signal. However, it is always recommended to use this pattern in conjunction with other technical indicators and analysis to confirm the reversal and avoid false signals.

How does Profitly work? Welcome to Profitly, the ultimate financial tool designed to help you manage and grow your investments. Whether you’re a …

Read ArticleBest practices for pricing spread options A spread option is a type of derivative financial instrument that gives the holder the right to buy or sell …

Read ArticleBest Places to Exchange Cash in Hong Kong When visiting Hong Kong, it’s important to know where to exchange your cash in order to get the best rates …

Read ArticleWho is a swap dealer under Dodd-Frank? The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, brought significant changes to …

Read ArticleHow to Get FIB on Tradingview Tradingview is a widely used platform among traders to analyze financial markets and make trading decisions. One of the …

Read ArticleUsing MACD for Swing Trading: Pros and Cons Swing trading is a popular trading strategy among traders who want to take advantage of short-term price …

Read Article