Discover the Lowest Exchange Rate of Euro to PHP and Save Big

Lowest Euro to PHP Exchange Rate: Discover the Latest Figures Are you planning a trip to the Philippines? Or maybe you have family living there and …

Read Article

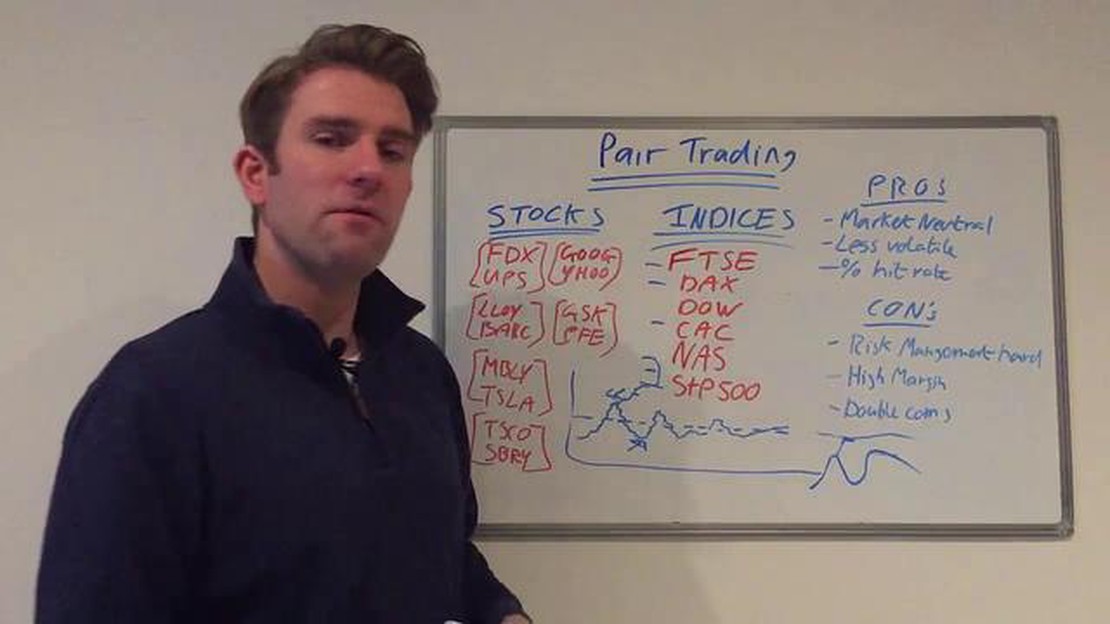

A pairs trade strategy is a type of investment strategy that involves taking positions in two related securities with the goal of profiting from the relative performance between the two securities. This strategy is based on the idea that certain pairs of securities tend to move together over time, and deviations from their normal or expected relationship can create opportunities for profit.

To implement a pairs trade strategy, an investor first identifies a pair of securities that they believe have a strong correlation. This can be done using various methods, such as analyzing historical price data or using statistical techniques. Once a pair has been identified, the investor takes a long position in one security and a short position in the other security. The long position benefits from an increase in value of the security, while the short position benefits from a decrease in value.

For example, let’s say an investor believes that two technology stocks, Company A and Company B, have a strong correlation. The investor may decide to take a long position in Company A and a short position in Company B. If the price of Company A increases and the price of Company B decreases, the investor can profit from the relative performance between the two stocks.

It is important to note that a pairs trade strategy is typically market neutral, meaning that it is designed to be profitable regardless of whether the overall market is going up or down. Instead, the strategy relies on the relative performance between the two securities. This can make pairs trading an attractive option for investors looking to diversify their portfolio or hedge against market volatility.

In conclusion, a pairs trade strategy is an investment strategy that involves taking positions in two related securities with the aim of profiting from the relative performance between the two securities. By identifying pairs of securities with a strong correlation and taking long and short positions, investors can potentially profit from changes in the relationship between the two securities. This strategy is designed to be market neutral and can be used as a way to diversify a portfolio or hedge against market volatility.

Pairs trading is a trading strategy that involves the simultaneous purchase and sale of two related financial instruments. The goal of this strategy is to profit from the relative performance of the two instruments.

The two instruments involved in a pairs trade are typically highly correlated, meaning that they tend to move in sync with each other. However, at times, when there is a temporary divergence in their prices, a pairs trader can take advantage of this opportunity.

The pairs trade strategy is based on the principles of mean reversion, which is the theory that the prices of two assets that are related will move back towards their long-term average after diverging. In other words, if one instrument in the pair is overvalued and the other is undervalued, the trader will take a long position in the undervalued instrument and a short position in the overvalued instrument.

In order to implement a pairs trade, a trader will identify a pair of instruments with a historically high correlation and establish a trading ratio. This ratio determines the number of shares or contracts to be traded for each instrument. The trader will then monitor the prices of the two instruments and execute the trade when the prices diverge by a predetermined threshold.

Pairs trading requires careful monitoring and risk management, as the strategy relies on the assumption that the correlation between the instruments will eventually revert to its historical mean. If the correlation does not behave as expected, the trader may experience losses.

Read Also: What are the 5 Performance Appraisal Criteria? - A Complete Guide

Overall, pairs trading can be a profitable strategy for traders who have a strong understanding of the instruments they are trading and have the ability to identify and act on pricing anomalies.

Pairs trading strategy is a popular trading technique that involves selecting two assets that are traditionally correlated and taking opposing positions on them. This strategy takes advantage of the deviation from the mean of the two assets to generate profits.

Let’s consider an example to understand how the pairs trading strategy works:

It is important to note that while pairs trading strategy can be profitable, it also involves risks. The strategy relies on the assumption that the historical correlation between the two assets will continue in the future. However, market conditions and correlations can change, leading to potential losses.

Read Also: What is the Official Exchange Rate for AUD EUR?

In conclusion, pairs trading strategy is a popular technique among traders to take advantage of the mean reversion behavior of two correlated assets. By monitoring deviations from the mean and taking opposing positions, traders aim to generate profits. However, thorough research and analysis are required to identify suitable pairs and manage risks effectively.

A pairs trade strategy is a trading strategy that involves taking a long position in one stock and a short position in another stock in the same industry or sector. The idea behind this strategy is to profit from the relative performance of the two stocks, rather than the overall direction of the market.

In a pairs trade strategy, an investor identifies two stocks that are expected to have a high correlation in their price movements. The investor then goes long on the stock that is expected to outperform and simultaneously goes short on the stock that is expected to underperform. This creates a market-neutral position, as any gains from the long position are offset by losses in the short position.

Sure! Let’s say an investor believes that two companies, Company A and Company B, in the technology sector have a high correlation in their stock price movements. The investor goes long on Company A, buying shares in the company, and simultaneously goes short on Company B by borrowing shares from a broker and selling them in the market. If Company A’s stock price increases and outperforms Company B, the investor will profit from the long position and incur losses from the short position.

A pairs trade strategy can provide several advantages. Firstly, it allows investors to profit from the relative performance of two stocks in the same industry or sector, rather than relying on the overall direction of the market. Secondly, the strategy is market-neutral, which means it is not affected by broad market movements. Lastly, pairs trade strategies can help to reduce risk as the investor is hedging their positions by going long and short simultaneously.

Yes, like any investment strategy, there are risks involved in pairs trade strategies. One of the main risks is that the correlation between the two stocks may change, leading to losses in both the long and short positions. Additionally, unexpected events or news related to either stock can disrupt the correlation and result in unexpected losses. It’s important for investors to carefully research and analyze the stocks before implementing a pairs trade strategy.

A pairs trade strategy is a trading strategy that involves taking a long position in one security and a short position in another security that is highly correlated. The goal of this strategy is to profit from the relative performance of the two securities, rather than the overall direction of the market.

In a pairs trade strategy, the trader identifies two securities that have a historically high correlation. The trader will then take a long position in one security and a short position in the other security. The idea is that if one of the securities outperforms the other, the trader will make a profit from the trade.

Lowest Euro to PHP Exchange Rate: Discover the Latest Figures Are you planning a trip to the Philippines? Or maybe you have family living there and …

Read ArticleUnderstanding the Commission of a Forex Broker When it comes to trading in the forex market, understanding the commission structure of a forex broker …

Read ArticleDoes Arduino Have a Standard Library? Arduino is a popular open-source electronics platform that is widely used by hobbyists, students, and …

Read ArticleBinomo Legality in the USA: A Complete Guide Binomo is a popular online trading platform that offers various financial instruments for traders around …

Read ArticleAdvantages and Disadvantages of the Average of Averages The concept of using the average of averages is a common practice in statistical analysis, but …

Read ArticleRegulator of the National Australia Bank Limited When it comes to overseeing the financial industry in Australia, there are a number of regulatory …

Read Article