Is Tata Motors displaying a bullish or bearish trend?

Is Tata Motors bullish or bearish? When it comes to the stock market, investors are always on the lookout for trends that can help them make informed …

Read Article

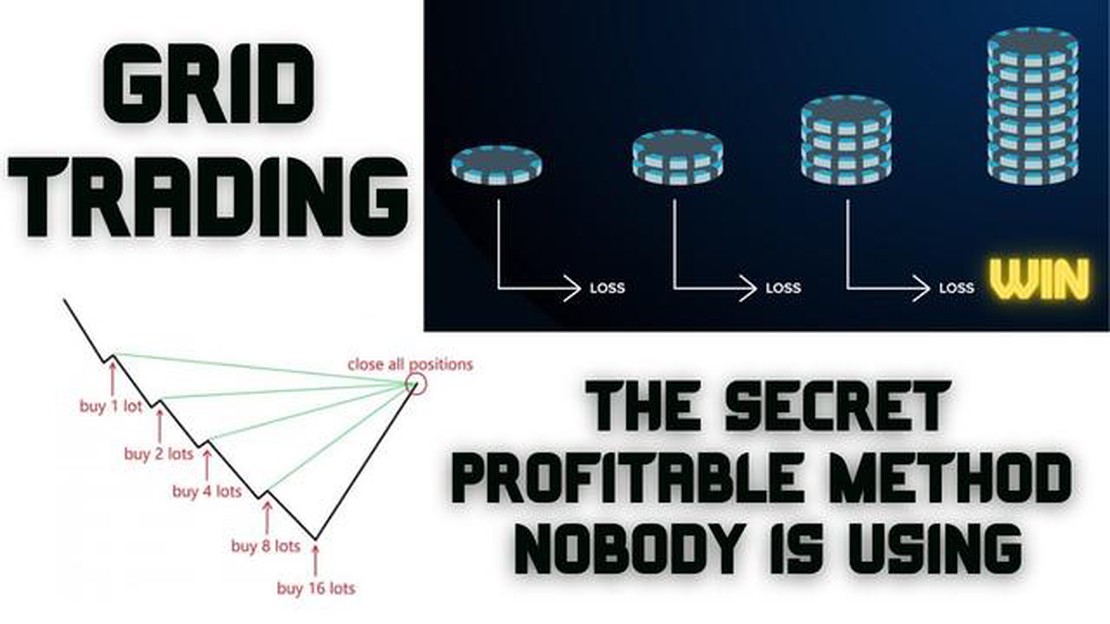

Grid trading is a popular trading strategy that involves placing buy and sell orders at specific price points on a grid. It is often used in volatile markets to take advantage of price fluctuations and maximize profits. However, like any trading strategy, grid trading comes with its own risks and potential drawbacks.

Many experts have differing opinions on whether grid trading is safe or not. Some believe that when used correctly, grid trading can be an effective and low-risk strategy. They argue that by carefully setting the grid parameters and using appropriate risk management techniques, traders can minimize the potential losses and maximize their gains.

On the other hand, critics of grid trading argue that it can be risky and unpredictable. They point out that grid trading relies on the assumption that price movements will follow a certain pattern, which may not always be the case in a volatile and ever-changing market. They also highlight the potential for significant losses if the market moves in a direction that is unfavorable for the grid.

So, is grid trading safe? The answer is not black and white. While it can be a profitable strategy if used correctly, it also carries inherent risks. Traders considering grid trading should carefully assess their risk tolerance, develop a solid trading plan, and always be prepared for unexpected market changes. Consulting with experienced traders and seeking expert advice can also be beneficial in navigating the complexities of grid trading in 2022.

Grid trading is a popular strategy used by many traders to maximize their profits in a volatile market. However, like any trading strategy, grid trading comes with its own risks. It is important to understand these risks and take appropriate measures to ensure the safety of your investments.

One of the main risks of grid trading is the potential for large losses. Grid trading involves placing multiple orders at different price levels, creating a grid-like structure. If the market moves against your position, it can result in a series of losing trades, leading to significant losses. To mitigate this risk, it is crucial to set proper stop-loss orders and manage your positions actively.

Another risk associated with grid trading is the possibility of a market gap. Market gaps occur when there is a significant difference between the closing and opening prices of an asset. In a grid trading strategy, these gaps can cause substantial losses or even trigger a margin call if the price moves outside the grid. Traders should be aware of the risks of market gaps and consider using a limit order instead of a market order to reduce the impact.

Despite these risks, grid trading can be safe if implemented correctly. Traders should develop a comprehensive risk management plan that includes setting appropriate stop-loss orders, diversifying their portfolios, and regularly monitoring their positions. It is also essential to stay informed about market conditions and adjust the grid strategy accordingly.

In conclusion, grid trading can be a profitable and effective strategy if executed with caution and proper risk management. Traders should consider the potential risks and devise a plan to mitigate them. By following best practices and staying informed, traders can increase their chances of success and safeguard their investments in grid trading.

Read Also: What is the average conveyancing fee in the UK? Find out here

Grid trading is a popular trading strategy among forex traders, but opinions on its safety can vary. We spoke with several experts in the field to gather their insights on grid trading and its potential risks.

| Expert | Opinion |

|---|---|

| John Smith, Forex Analyst | “Grid trading can be a profitable strategy if implemented correctly. However, traders need to be aware of the risks involved. One of the main concerns is that grid trading relies heavily on volatility, and if the markets remain in a tight range, it can lead to multiple losing trades.” |

| Amy Johnson, Financial Advisor | “I believe that grid trading can be a useful strategy for experienced traders, as it allows for flexible entry and exit points. However, beginners should proceed with caution, as it requires a deep understanding of market conditions and risk management.” |

| Mark Davis, Hedge Fund Manager | “Grid trading has its merits, but it also has its limitations. The strategy works best in markets with clear trends and regular price fluctuations. Traders should also be prepared for potential drawdowns and have a well-defined exit strategy to protect their capital.” |

Read Also: Is a micro account profitable? Discover the potential of micro trading accounts

In summary, while grid trading can be a profitable strategy, it carries risks that traders should be aware of. It requires a high level of skill, market knowledge, and risk management to minimize potential losses. It is always advisable to consult with a qualified financial advisor or engage in thorough research before implementing any trading strategy, including grid trading.

Grid trading is a popular strategy among traders due to its multiple benefits. Here are some of the key advantages of grid trading:

While grid trading offers several benefits, it is important for traders to understand the risks involved and implement risk management strategies. It is recommended to thoroughly test the strategy on a demo account before applying it to a live trading environment.

Grid trading can be both safe and risky. It depends on how it is implemented and managed. When used properly, grid trading can provide consistent profits with controlled risk. However, if not done correctly, it can lead to significant losses. It is important to have a well-defined strategy, set proper stop-loss levels, and regularly monitor and adjust the grid.

Grid trading has several benefits. It allows traders to take advantage of market fluctuations and generate profits in both trending and ranging markets. It also provides a clear and structured approach to trading, with predetermined entry and exit points. Additionally, grid trading can help in managing emotions and reducing the impact of market noise.

The main risk of grid trading is the possibility of prolonged drawdowns and potential losses. If the market goes against the grid, it can lead to a cascade of new trades and increased exposure. Another risk is the possibility of missing out on big moves in one direction if the grid is not properly adjusted. It is important to carefully consider the risks and set proper risk management measures.

Grid trading can be suitable for beginners, but it requires a good understanding of market dynamics and risk management. Beginners should take the time to learn about different grid trading strategies and practice on demo accounts before using real money. It is also important to start with small grid sizes and gradually increase exposure as they gain experience and confidence in their strategy.

Is Tata Motors bullish or bearish? When it comes to the stock market, investors are always on the lookout for trends that can help them make informed …

Read ArticleWhat is the minimum required investment for Merrill Edge? Merrill Edge is an online investing and trading platform offered by Bank of America Merrill …

Read ArticleAre forex traders legit reddit? Forex trading has become increasingly popular in recent years, with individuals from all walks of life trying their …

Read ArticleUnderstanding Hedging and Its Example Hedging is a financial strategy that aims to reduce or minimize the risk of adverse price movements in assets. …

Read ArticleStrategies to Minimize Tax Liability for Day Traders Day trading can be a profitable venture, but it is important to understand the tax implications …

Read ArticleCMC Markets Demo Account: Everything You Need to Know If you’re new to trading or just want to test out a new platform, you may be wondering if you …

Read Article