Using Python for Stock Trading: Pros, Cons, and Best Practices

Python for Stock Trading: Can You Use it to Make Profit? Python has gained popularity among traders and investors for its versatility and ease of use …

Read Article

Forex trading, short for foreign exchange trading, is a highly lucrative market where traders buy and sell different currencies. To be successful in this complex and fast-paced environment, traders rely on various strategies and tools to make informed decisions. One such tool is harmonic patterns.

Harmonic patterns are recurring price patterns that have proven to be reliable indicators of future price movements. These patterns, which are based on Fibonacci ratios and symmetry, can help traders identify potential buy or sell opportunities in the forex market. By understanding and harnessing harmonic patterns, traders can improve their odds of making profitable trades.

One of the most well-known harmonic patterns is the Gartley pattern. This pattern consists of a series of retracements and extensions, forming specific geometric shapes. When correctly identified, these patterns can signal potential trend reversals or continuations, giving traders an edge in their decision-making process.

Another popular harmonic pattern is the Butterfly pattern. This pattern also follows specific retracement and extension levels, forming a butterfly-like shape on the price chart. Traders who can accurately spot these patterns can take advantage of potential turning points in the forex market, optimizing their profits and minimizing their risks.

While harmonic patterns offer a powerful tool for forex traders, it is essential to combine them with other technical analysis tools and indicators. Traders should also consider fundamental factors, market sentiment, and risk management strategies when using harmonic patterns. By integrating these different elements, traders can unlock the secrets of harmonic patterns and enhance their overall trading performance in the forex market.

Forex trading can be a complex and challenging endeavor. Traders are constantly looking for ways to increase their chances of success in the dynamic and volatile forex market. One powerful tool that traders can add to their arsenal is the use of harmonic patterns.

Harmonic patterns are geometric price patterns that can provide valuable insights into potential future price movements. These patterns occur when there is a specific alignment of Fibonacci retracement levels and extension levels. By identifying these harmonic patterns, traders can gain an edge in the market and make more informed trading decisions.

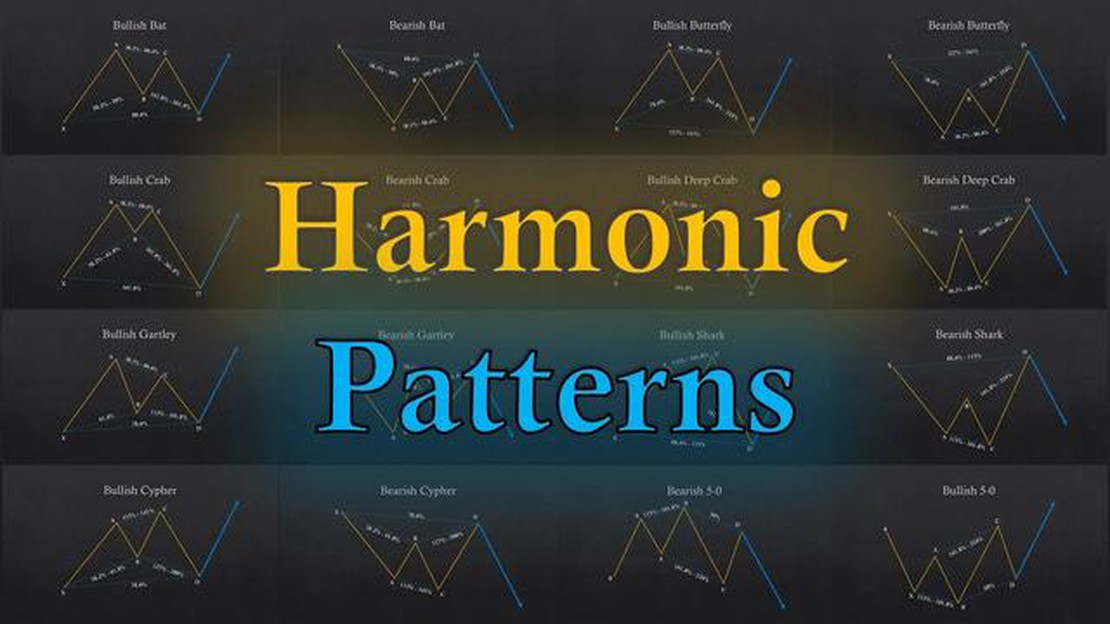

There are several types of harmonic patterns, including the Gartley pattern, the Butterfly pattern, and the Bat pattern. Each pattern has its own unique characteristics and provides traders with valuable information about potential price reversals or continuations.

For example, the Gartley pattern is a bullish pattern that indicates a potential buying opportunity. It consists of four price swings, and the Fibonacci retracement and extension levels help to identify the potential entry and exit points. When a Gartley pattern is identified, traders can place a long trade and take advantage of the potential upward price movement.

Similarly, the Butterfly pattern is a bearish pattern that indicates a potential selling opportunity. It also consists of four price swings, and the Fibonacci levels help to identify the potential entry and exit points. When a Butterfly pattern is identified, traders can place a short trade and take advantage of the potential downward price movement.

Read Also: Can MLB Make Trades After the Deadline? Explained

The Bat pattern is another type of harmonic pattern that can provide valuable insights into potential price movements. It is similar to the Gartley pattern, but with a different structure. When a Bat pattern is identified, traders can take advantage of the potential price reversal.

By studying and understanding harmonic patterns, traders can improve their ability to identify potential trade setups and increase their chances of success in the forex market. However, it is important to note that harmonic patterns should not be used in isolation. They should be used in conjunction with other technical analysis tools and indicators to confirm the validity of the pattern.

In conclusion, harmonic patterns can be a powerful tool for forex traders. By understanding and utilizing these patterns, traders can gain valuable insights into potential price movements and increase their chances of success in the market. Whether you are a beginner or an experienced trader, adding harmonic patterns to your trading strategy can help unlock the secrets of the forex market.

Harmonic patterns are a powerful tool in the world of forex trading. They provide traders with important insights into market behavior and can help identify potential turning points in price action. By understanding these patterns and learning how to spot them, traders can unlock opportunities for profit.

A harmonic pattern is a geometric price pattern that repeats itself across different time frames and markets. These patterns are based on Fibonacci ratios and have been observed by traders for many years. Traders use these patterns to predict future price movements and make informed trading decisions.

There are several different types of harmonic patterns, including the Gartley pattern, the Butterfly pattern, and the Bat pattern. Each pattern has its own unique characteristics and can be used to identify different market conditions. By learning to recognize these patterns, traders can develop a deeper understanding of market dynamics.

To spot a harmonic pattern, traders look for a specific sequence of price swings and Fibonacci retracement levels. These patterns form when there is a confluence of these levels and can provide valuable information about potential reversals or continuations in price. Traders often use additional technical indicators and tools to confirm the presence of a harmonic pattern.

Once a pattern has been identified, traders can use it to make trading decisions. For example, if a bullish harmonic pattern is identified, a trader might look for opportunities to enter long positions. Conversely, if a bearish harmonic pattern is identified, a trader might look for opportunities to enter short positions. By aligning their trades with the direction of the pattern, traders can increase their chances of success.

Read Also: Understanding the Mechanics of FX Spread: A Comprehensive Guide

However, it is important to note that harmonic patterns are not foolproof. Like any trading strategy, they have their limitations and can produce false signals. It is essential for traders to use proper risk management techniques and to consider other factors, such as fundamental analysis and market sentiment, when making trading decisions.

In conclusion, understanding harmonic patterns is key to unlocking profit in forex trading. By learning to spot these patterns and using them in conjunction with other technical indicators, traders can gain valuable insights into market behavior and make informed trading decisions. However, it is important to approach these patterns with caution and to consider other factors before entering trades. With practice and experience, traders can harness the power of harmonic patterns to achieve profitable results.

Harmonic patterns in forex trading are specific price patterns that indicate potential reversals or continuation of trends. These patterns are based on geometric formations found in Fibonacci ratios and can help traders identify key levels and entry points.

Harmonic patterns can be harnessed in forex trading by using them as a tool to analyze price action and make trading decisions. Traders can identify harmonic patterns in the market, confirm them with other technical indicators, and use them to determine potential entry and exit points for trades.

The most common harmonic patterns in forex trading are the Gartley pattern, the Butterfly pattern, the Bat pattern, and the Crab pattern. These patterns have specific ratios and geometric formations that traders look for in order to identify potential trading opportunities.

Harmonic patterns can be reliable indicators of future price movements, but they are not foolproof. Traders should always confirm harmonic patterns with other technical analysis tools and consider other factors such as market conditions and news events before making trading decisions.

Traders can spot harmonic patterns on forex charts by using specific tools and indicators designed for this purpose. There are various harmonic pattern detection indicators available that can automatically identify and highlight these patterns on charts, making it easier for traders to spot and analyze them.

Harmonic patterns are geometric price patterns that use Fibonacci retracements and extensions to identify potential reversal levels in the market. They are named after the ratios found in the Fibonacci sequence, such as the 0.382, 0.618, and 1.618 ratios. These patterns can help traders anticipate future price movements and make more informed trading decisions.

Harmonic patterns can be harnessed in forex trading by using them as a tool for identifying potential entry and exit points in the market. Traders can look for harmonic patterns such as the Gartley pattern, Butterfly pattern, or Bat pattern, and use them in conjunction with other technical indicators to confirm signals. By understanding and recognizing these patterns, traders can improve their trading accuracy and increase their chances of making profitable trades.

Python for Stock Trading: Can You Use it to Make Profit? Python has gained popularity among traders and investors for its versatility and ease of use …

Read ArticleDiscover an Alternative to Forex for Better Returns Forex, short for foreign exchange, is a popular way to trade currencies and make profits based on …

Read ArticleWhat is Sanjeev Kapoor’s net worth? Sanjeev Kapoor, the renowned Indian chef, has gained worldwide recognition for his culinary expertise and …

Read ArticleShould I Move Out at 22? Consider the Pros and Cons Leaving home and moving out on your own is a major life decision, and one that many young adults …

Read ArticleIs it Possible to Live on $3000 a Month in Thailand? Thailand has long been a popular destination for expatriates looking to live a comfortable and …

Read ArticleIs Forex Trading Legal in United Kingdom? Forex trading, also known as foreign exchange trading, is a popular investment activity worldwide. However, …

Read Article