When is the Best Time to Trade NZD/USD? Discover the Optimal Trading Hours

When is the Best Time to Trade NZD USD? Trading the NZD/USD currency pair can be a profitable venture, but it is crucial to understand the best time …

Read Article

In the field of weight recognition, one of the commonly used tools is the Weighted Moving Average (WMA). This statistical method is used to analyze and interpret the fluctuations in weight data over time. By giving more weight to recent data points, the WMA provides a more accurate representation of changing trends and patterns in weight.

The concept of weighted moving average is based on the idea that more recent data points are more relevant and should carry more weight in determining the overall trend. This is especially useful in weight recognition, where fluctuations in weight can occur due to various factors such as diet, exercise, and other lifestyle changes.

Using the weighted moving average, weight recognition systems can identify and track long-term trends in weight data, making it easier to detect meaningful changes and patterns. The WMA helps to smoothen out short-term noise and focus on the underlying trend, allowing for better analysis and interpretation of weight data.

Weighted moving average can be calculated using different weighting factors, depending on the specific needs and requirements of the weight recognition system. By adjusting the weights assigned to different data points, weight recognition systems can emphasize certain periods or trends and give them more significance in the analysis.

In conclusion, understanding the concept of weighted moving average is crucial in weight recognition as it allows for a more accurate interpretation of weight data. By giving more weight to recent data points, the weighted moving average helps to identify long-term trends and patterns while filtering out short-term noise. This statistical tool is an essential component of weight recognition systems and plays a key role in analyzing and interpreting weight data effectively.

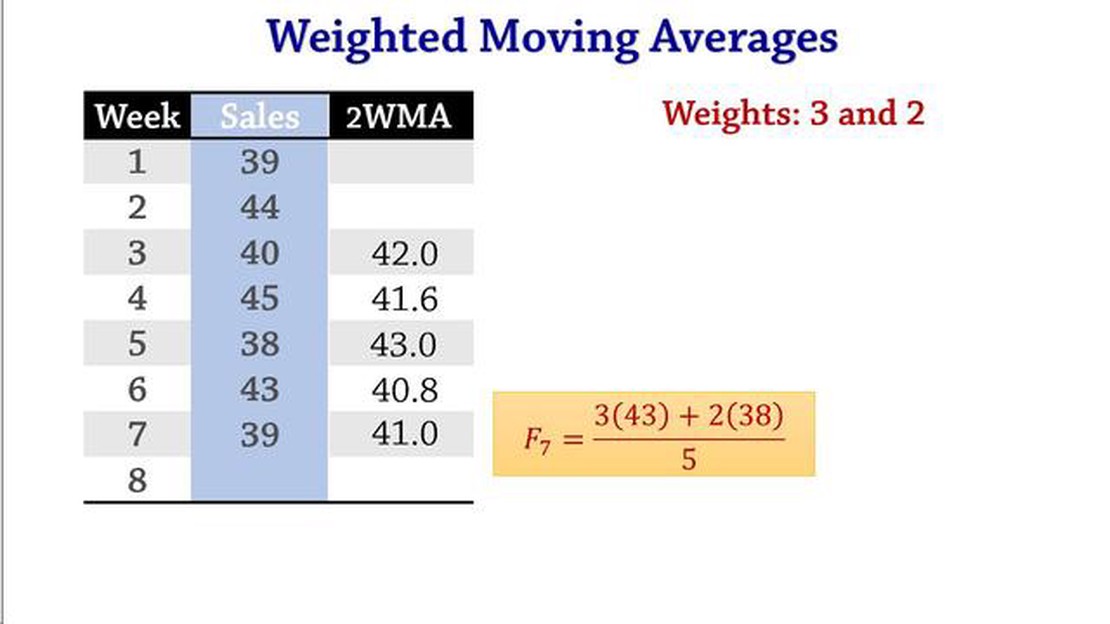

Weighted Moving Average (WMA) is a method of calculating the average of a set of data points by assigning different weights to each data point. The weights assigned to the data points determine the significance or importance of each data point in the calculation of the average.

In a regular moving average, all data points are assigned equal weights, meaning that each data point contributes equally to the calculation of the average. However, in a weighted moving average, different weights are assigned to each data point based on certain criteria.

The weights can be based on factors such as the recency of the data point, the volatility of the data, or any other relevant factor. By assigning different weights, the weighted moving average emphasizes certain data points over others, providing more accurate and relevant information.

The weighted moving average is commonly used in various fields, including finance, stock analysis, and statistics. It is particularly useful when dealing with time series data, where the importance of data points may change over time.

The formula for calculating the weighted moving average involves multiplying each data point by its corresponding weight, summing up the weighted data points, and dividing the result by the sum of the weights. This gives a weighted average that reflects the significance of each data point in the calculation.

Overall, the weighted moving average is a powerful tool for analyzing and forecasting data, as it allows for the consideration of different weights and factors in the calculation of the average. By using this method, analysts can better understand trends, patterns, and outliers in the data.

A weighted moving average (WMA) is a calculation method that gives different weights to different data points in a time series. It is a type of moving average where each data point in the series is assigned a weight based on certain criteria. The purpose of using a weighted moving average is to give more importance or significance to recent data points compared to older ones.

The weights assigned to each data point in the series are usually determined by a specific formula or set of rules. The weights can be based on factors such as the time period, the significance of the data point, or the level of volatility in the series. The purpose of assigning weights is to reflect the importance of each data point in capturing the underlying trend or pattern in the time series.

Read Also: Understanding the Momentum Meter Indicator: How It Works and How to Use It

When calculating a weighted moving average, the most recent data points are given higher weights, while older data points receive lower weights. This means that the WMA responds more quickly to recent changes in the time series compared to a simple moving average (SMA), which assigns equal weights to each data point.

The purpose of using a weighted moving average in weight recognition is to improve the accuracy and responsiveness of weight estimation algorithms. By assigning higher weights to recent weight measurements, the WMA can better track changes in weight over time, making it useful in applications such as weight tracking, health monitoring, and weight recognition systems.

Read Also: Where to Find Options on iPad: A Comprehensive Guide

In summary, the weighted moving average is a calculation method that assigns different weights to different data points in a time series. Its purpose is to give more importance to recent data points and accurately capture the underlying trend or pattern. In weight recognition, the WMA is used to improve weight estimation accuracy and responsiveness.

Weighted Moving Average (WMA) is a type of moving average that assigns different weights to each data point in the time series. It is used to analyze time-based data and identify trends and patterns.

The calculation of WMA involves multiplying each data point by a corresponding weight and then summing up the results. The weights are generally assigned in a way that gives more importance to recent data points compared to older ones.

Here’s how the weighted moving average calculation works:

The advantage of using weighted moving average over simple moving average is that it gives more weight to recent data points and reduces the impact of older data points. This makes WMA more responsive to changes in the time series data and helps in capturing short-term trends and fluctuations.

Weighted moving average is commonly used in technical analysis and financial forecasting to analyze stock prices, market trends, and other time-based data. It can also be applied in various other fields such as weather forecasting, sales forecasting, and demand forecasting.

Overall, weighted moving average is a useful tool for understanding the trends and patterns in time-based data and can provide valuable insights for decision making.

Weighted moving average is a statistical calculation that assigns different weights to different data points in a time series, with the weights decreasing or increasing based on specific criteria.

Weighted moving average is used in weight recognition to assign more importance to recent weight data and reduce the effect of outliers or noise in the measurements.

The benefits of using weighted moving average in weight recognition include improved accuracy, reduced impact of outliers, and the ability to capture trends or patterns in weight data more effectively.

Yes, weighted moving average can be used for other types of data analysis, such as financial forecasting, inventory management, and demand planning.

When is the Best Time to Trade NZD USD? Trading the NZD/USD currency pair can be a profitable venture, but it is crucial to understand the best time …

Read ArticleWhat Happened to Knight Trading? In the fast-paced world of Wall Street, few companies have experienced the rollercoaster ride that Knight Trading …

Read ArticleUnderstanding the Application of Forex Trading Forex, short for Foreign Exchange, is an international decentralized market where different currencies …

Read ArticleAre Australian Cattle Dogs High Maintenance? Australian Cattle Dogs, also known as Blue Heelers or Queensland Heelers, are intelligent and energetic …

Read ArticleCurrent Euro Rate in India Today If you’re planning a trip to India or you’re a business person who needs to make financial transactions, knowing the …

Read ArticleIs 3% a good commission? When it comes to real estate transactions, commission rates are a hot topic of discussion. Many agents and brokers charge a …

Read Article