Can You Create an AI Trading Bot? Find Out Here

How to Create an AI Trading Bot: Step-by-Step Guide Artificial Intelligence (AI) has revolutionized many industries, and the world of trading is no …

Read Article

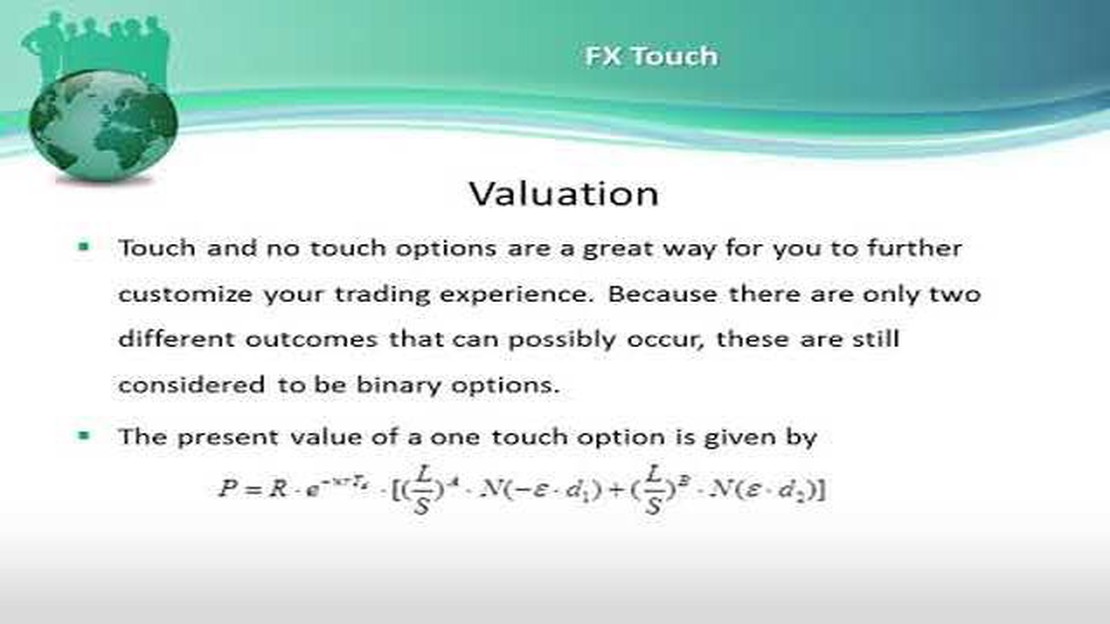

Touch options are a type of financial instrument that offers a unique way of trading. They provide traders with the opportunity to profit from the price movement of an underlying asset, without necessarily having to predict the exact price level at which the asset will reach.

Unlike traditional binary options, touch options have two possible outcomes: touch and no-touch. A touch option will result in a payout if the price of the underlying asset reaches a certain level before the option expires. On the other hand, a no-touch option will result in a payout if the price of the underlying asset does not reach a certain level before the option expires.

Touch options can be a valuable tool for both beginner and experienced traders. They allow traders to take advantage of market volatility and potentially earn significant profits. However, it is important to understand the risks associated with touch options and to have a solid trading strategy in place.

This comprehensive guide will cover everything you need to know about touch options, including:

Touch options are a type of financial contract that derive their value from the price movements of an underlying asset. Unlike traditional options, which require the price of the underlying asset to reach or exceed a certain level, touch options only need to touch a specified price level within a given time frame to be profitable.

Touch options are popular among traders because they offer a unique way to profit from the market. Traders can choose between two main types of touch options: one-touch options and no-touch options. One-touch options require the price of the underlying asset to touch a specified price level at least once before the option expires, while no-touch options require the price to not touch a certain level during the option’s lifetime.

One-touch options are often used by traders who expect a significant price movement in the near future. If the trader believes that the price will touch the specified level, they can buy a one-touch option. If the price does indeed touch that level, the option will be profitable. On the other hand, no-touch options are utilized by traders who anticipate a period of reduced volatility. By buying a no-touch option, the trader is betting that the price will not touch a certain level, thus making the option profitable.

When trading touch options, it’s important to carefully consider the expiration time and the specified price level. The expiration time determines the duration of the option, while the specified price level determines the conditions required for the option to be profitable. Traders should also consider the volatility of the underlying asset, as higher volatility can increase the likelihood of the price touching the specified level.

In conclusion, touch options provide traders with an alternative way to profit from the financial markets. By understanding the different types of touch options and carefully considering the expiration time and specified price level, traders can make informed decisions and potentially earn profits from their trades.

Touch options are a type of binary options that offer traders the opportunity to profit from price movements in the underlying asset. These options are called “touch” options because they give traders the ability to predict whether the price of the underlying asset will touch a specific price level before the option’s expiry time.

Touch options have two possible outcomes – they can expire “in the money” or “out of the money”. If the price of the underlying asset touches the predetermined price level at any time before the option’s expiry time, the option expires “in the money” and the trader receives a fixed payout. If the price does not touch the predetermined price level, the option expires “out of the money” and the trader loses their initial investment.

Read Also: Understanding RBI Guidelines and Regulations on Forex Trading

There are two main types of touch options: one touch options and no touch options. One touch options have a predetermined price level that the underlying asset must touch before the option expires. No touch options, on the other hand, have a price level that the underlying asset must not touch before the option expires.

One touch options can be further categorized into two subtypes: “up” options and “down” options. Up options require the price of the underlying asset to touch the predetermined price level from below, while down options require the price to touch the level from above.

Touch options are popular among traders because they offer high potential returns. Traders can earn significant profits if they accurately predict whether the price of the underlying asset will touch the predetermined price level within the option’s expiry time.

| Advantages of Touch Options | Disadvantages of Touch Options |

|---|---|

| - High potential returns | - Higher risk compared to other option types |

| - Ability to profit from market volatility | - Limited timeframe for price movement |

| - Flexibility to choose different price levels | - Requires accurate prediction of price movement |

Traders should carefully consider their risk tolerance and market analysis before trading touch options. It is important to understand the underlying asset’s price movement and market conditions in order to make informed trading decisions.

Overall, touch options provide traders with an alternative way to profit from price movements in the financial markets. With proper research and analysis, traders can potentially maximize their returns with touch options.

Touch options are a popular type of binary options that offer unique benefits to traders. Here are some of the advantages of using touch options in your trading strategy:

1. Higher Potential Returns: Touch options provide the opportunity for higher potential returns compared to traditional binary options. With touch options, traders can earn substantial profits if the price of the underlying asset reaches a predetermined level within a specified time frame.

Read Also: Understanding Peru's Foreign Exchange Reserves: Key Factors and Implications

2. Flexibility: Touch options offer flexibility in terms of trade duration and asset selection. Traders can choose short-term or long-term touch options based on their trading preferences. Additionally, touch options are available for a wide range of assets including stocks, currencies, commodities, and indices.

3. Reduced Risk: Touch options allow traders to limit their downside risk by setting a specified boundary level. If the price of the underlying asset does not touch or exceed this level within the specified time frame, the trader’s investment is returned. This risk management feature is particularly appealing to traders who want to protect their capital.

4. Market Volatility Opportunities: Touch options can be extremely profitable in volatile market conditions. Increased market volatility can lead to rapid price movements, making it more likely for the touch option to be triggered. This presents opportunities for traders to capitalize on short-term price fluctuations and make quick profits.

5. Diversification: Touch options allow traders to diversify their trading portfolio by adding different types of options to their strategy. By incorporating touch options along with other types of binary options, traders can spread their risk and increase their chances of success in the market.

Overall, touch options offer unique advantages that can enhance your trading experience. Whether you are a beginner or an experienced trader, incorporating touch options into your trading strategy can help you achieve your financial goals.

Touch options are a type of binary options where traders are required to predict whether the price of an underlying asset will touch a predetermined strike price before the option’s expiration time.

Touch options work by giving traders the opportunity to profit if the price of an underlying asset reaches a specific level within a set period of time. Traders can choose a strike price and if the asset’s price reaches or “touches” that level, they will earn a profit.

The main difference between touch options and traditional binary options is that touch options require the price of an asset to reach a specific level, while traditional binary options only require the price to move in a certain direction. Touch options offer higher potential returns, but also come with a higher level of risk.

Trading touch options offers several advantages, including the potential for high returns on investment, the ability to profit from both rising and falling markets, and the flexibility to choose strike prices and expiration times that best suit your trading strategy.

While touch options can offer high potential returns, they also come with a higher level of risk. If the price of the underlying asset does not reach the predetermined strike price before the option expires, the trader will lose their investment. It is important to carefully consider your trading strategy and risk tolerance before trading touch options.

How to Create an AI Trading Bot: Step-by-Step Guide Artificial Intelligence (AI) has revolutionized many industries, and the world of trading is no …

Read ArticleStrategies for Fixing a Troubled Stock Portfolio If you are facing a poor stock portfolio, you are not alone. Many investors find themselves in a …

Read ArticleIs there an interest rate on margin? Margin trading is a popular investment strategy that allows investors to borrow funds from a brokerage firm to …

Read ArticleUnderstanding the 9 times rule in HKEx The Hong Kong Exchange and Clearing Limited (HKEx) has introduced the 9 Times Rule to regulate stock trading in …

Read ArticleHow to Open a Forex Account Are you interested in trading foreign currencies and exploring the world of forex? Starting a forex account can be an …

Read ArticleBritish Dollar to PKR: Exchange Rate and Conversion The British dollar, also known as the pound sterling, is the official currency of the United …

Read Article