CBOT Trading: Can You Trade Stocks on the Chicago Board of Trade?

CBOT and Stock Trading: Everything You Need to Know The Chicago Board of Trade, commonly known as CBOT, is one of the oldest and largest futures and …

Read Article

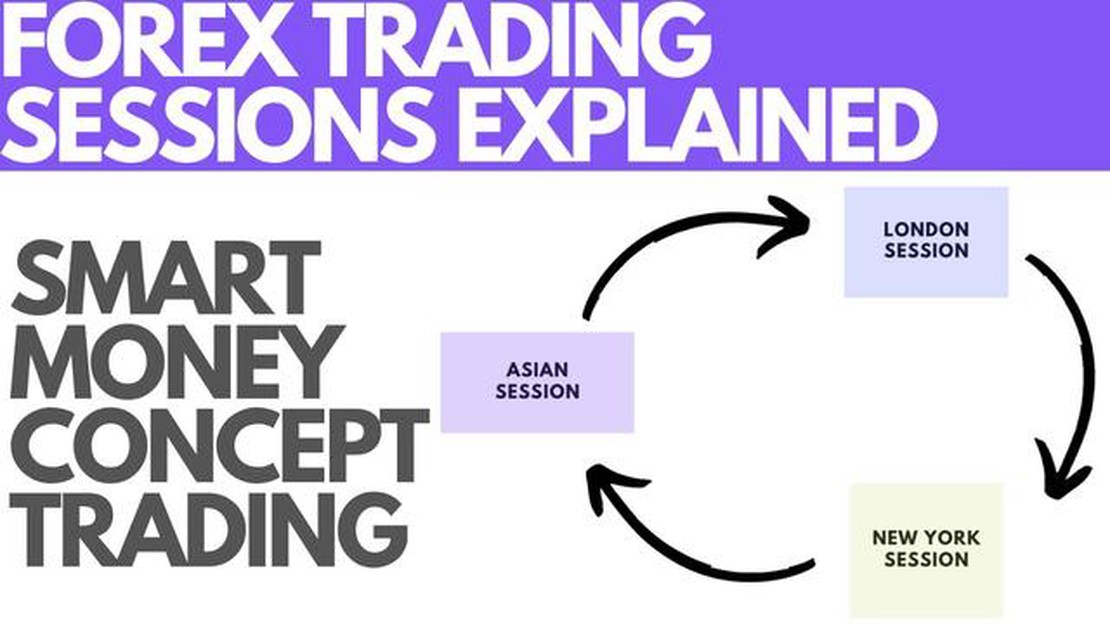

Tokyo, the capital city of Japan, is a major financial hub in Asia, and its trading session is one of the most important in the global financial markets. The Tokyo trading session, also known as the Asian session, starts at midnight UTC and lasts for about 9 hours. During this period, market participants from all over the world are actively trading various financial instruments, such as currencies, stocks, and commodities.

The Tokyo trading session is significant for several reasons. Firstly, it overlaps with the trading sessions in other major financial centers, such as London and New York, creating increased trading volume and liquidity. This makes it an attractive time for traders looking to take advantage of price movements and volatility. Secondly, many important economic data releases from Japan and other Asian countries are scheduled during this session, which can have a significant impact on the financial markets. Traders closely monitor these releases to make informed trading decisions.

The Tokyo trading session is characterized by the participation of major market players, including banks, hedge funds, and institutional investors. The session is known for its efficiency and professionalism, with traders utilizing advanced trading strategies and technologies. It is also known for its high level of discipline and adherence to strict trading regulations. The Tokyo Stock Exchange, located in the heart of the city, is one of the largest stock exchanges in the world and serves as a key platform for trading equities.

In conclusion, understanding the Tokyo trading session is essential for anyone involved in the global financial markets. Its strategic location, overlapping with other major trading sessions, and the presence of significant market players make it a crucial time for trading. Traders need to be aware of the economic data releases during this session and stay updated with the latest news and market developments. By doing so, they can make informed trading decisions and take advantage of the opportunities presented during the Tokyo trading session.

The Tokyo Trading Session refers to the period of time during which the financial markets in Tokyo, Japan are open for trading. It is one of the major trading sessions in the global forex market, along with the London and New York sessions.

The Tokyo Trading Session starts at 9:00 AM local time (JST) and ends at 6:00 PM local time. This time period coincides with the business hours of major financial institutions, banks, and companies in Tokyo.

Read Also: Understanding the RSI with MA Strategy: A Comprehensive Guide

As the capital and one of the largest financial centers in Asia, Tokyo plays a crucial role in the forex market. Many major Japanese corporations and institutional investors participate in the Tokyo Trading Session, making it an important hub for trading the Japanese yen (JPY) and other Asian currencies.

The Tokyo Trading Session also overlaps with the opening of other major trading sessions, such as the opening of the London session, creating increased trading activity and liquidity during this period. Traders and investors from around the world actively participate in the Tokyo session to take advantage of the opportunities offered by the Asian markets.

It is important to note that the volatility and trading volume in the Tokyo Trading Session can vary depending on various factors, such as economic data releases, geopolitical events, and market sentiment. Traders should be aware of these factors and adjust their trading strategies accordingly.

The Tokyo trading session is one of the most important and active trading sessions in the world. It is known for its high liquidity and volatility, making it an attractive market for traders around the globe. The Tokyo session is also significant because it is the first major session to open after the weekend, setting the tone for the trading week.

The Tokyo session begins at 12:00 AM GMT and lasts for approximately 9 hours, with trading activity peaking during the first few hours. This session overlaps with the Sydney session for a few hours, resulting in increased trading volume and volatility. Traders from the Asia-Pacific region, as well as international traders looking to capture the early market moves, actively participate in the Tokyo session.

The Tokyo session is dominated by the Japanese yen (JPY), as Japan is the third-largest forex trading center in the world. The USD/JPY currency pair is particularly popular during this session. Additionally, other major currency pairs, such as the EUR/JPY and GBP/JPY, also see significant trading activity.

The Tokyo session is heavily influenced by economic data and news releases from Japan and other Asian countries. Traders closely monitor indicators like GDP, inflation, interest rates, and employment data, as they can have a significant impact on the currency markets. Central bank announcements, such as those from the Bank of Japan, also play a vital role in shaping market sentiment during the Tokyo session.

| Key Features of the Tokyo Trading Session |

|---|

| Start time: 12:00 AM GMT |

| Dominant currency: Japanese yen (JPY) |

| Active trading hours: Approximately 9 hours |

| High liquidity and volatility |

| Overlaps with the Sydney session |

| Significant trading of USD/JPY, EUR/JPY, and GBP/JPY currency pairs |

| Strong impact of economic data and central bank announcements |

Read Also: Which Currency Should I Buy? A Guide to Choosing the Right Currency for Your Investments

Overall, the Tokyo trading session offers ample opportunities for traders to profit from market fluctuations. However, it is crucial to be aware of the significant role played by economic releases and news events to make informed trading decisions during this session.

The Tokyo trading session is a specific time period during the day when trading activity is focused on the Asian markets, particularly in Tokyo, Japan. It is one of the major trading sessions in the global forex market.

The trading hours of the Tokyo session are from 12:00 AM GMT to 9:00 AM GMT. However, these hours may vary depending on daylight saving time changes and other factors.

The Tokyo session is important because it represents the Asian markets, which are major players in the global economy. Many important economic and financial news releases from Japan and other Asian countries are also released during this session, which can significantly impact the forex market.

The most traded currency pairs during the Tokyo session are USD/JPY, EUR/JPY, and GBP/JPY. These pairs involve the Japanese yen and are popular among traders due to the high liquidity and volatility during this session.

CBOT and Stock Trading: Everything You Need to Know The Chicago Board of Trade, commonly known as CBOT, is one of the oldest and largest futures and …

Read ArticleIs it still possible to use a BlackBerry PlayBook? Once considered a formidable competitor in the tablet market, the BlackBerry PlayBook has seen a …

Read ArticleIs ARMA 1 1 Stationary? ARMA 11, the latest advanced robotic arm developed by cutting-edge technology, has revolutionized the field of robotics. This …

Read ArticleImportant Questions to Ask Before Accepting Options as Compensation When considering a job offer, it’s important to carefully evaluate all aspects of …

Read Article5 Steps to Finding the Mean Absolute Deviation When analyzing data, it’s important to have a measure that describes the variability of the data set. …

Read ArticleBest Time to Trade EURUSD The EUR/USD is one of the most popular currency pairs traded in the forex market. As such, knowing when to trade this pair …

Read Article