Understanding the Weighted Average Method of Forecasting: A Comprehensive Guide

Understanding the Weighted Average Method of Forecasting Forecasting is an essential tool for businesses to plan for the future and make informed …

Read Article

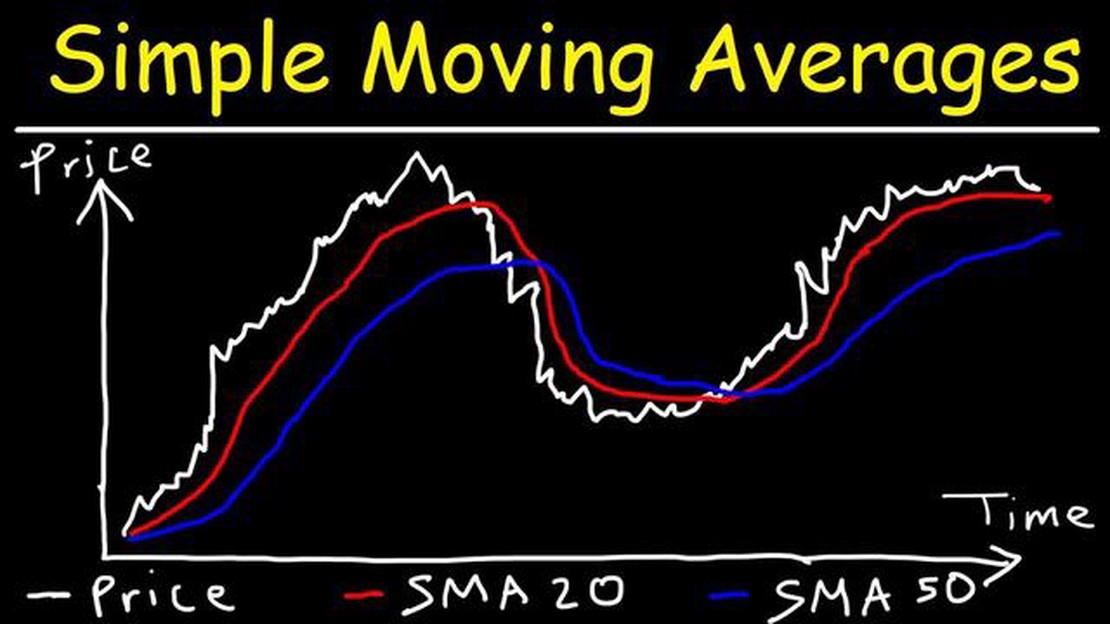

Moving averages are a popular tool used by traders and analysts to identify trends in financial markets. By smoothing out price fluctuations, moving averages provide a clearer picture of the underlying trend. Whether you are a novice trader or an experienced investor, understanding how moving averages work and how to interpret them is crucial for making informed decisions in the stock market.

In this comprehensive guide, we will delve into the world of moving averages and explore the different types, their calculations, and their applications. From simple moving averages (SMA) to exponential moving averages (EMA), we will break down the formulas and explain how each type of moving average can be used to analyze trends and generate trading signals. Understanding the differences between these moving averages and their strengths and weaknesses will equip you with the knowledge to adapt your trading strategies to different market conditions.

But moving averages are not just about calculating trends. They can also provide valuable insights into support and resistance levels, dynamic trendlines, and potential breakouts. By incorporating moving averages into your technical analysis toolkit, you can enhance your ability to identify key entry and exit points, set stop-loss orders, and effectively manage risks. In addition, we will explore advanced techniques such as moving average crossovers and multiple time frame analysis to further refine your trading strategies.

Whether you are a short-term trader or a long-term investor, understanding the trend in moving averages is essential for staying ahead in the markets. By mastering the art of interpreting moving averages, you can gain a competitive edge and improve your chances of success in the dynamic world of finance. So, let’s embark on this comprehensive journey into the world of moving averages and unlock the secrets of trend analysis.

Moving averages are a fundamental tool used in technical analysis to identify trends and potential trading opportunities. They are widely used by traders and investors to smooth out price data and provide a clearer picture of market trends.

Read Also: Understanding BMS: The Key to Mastering Forex Trading

A moving average, as the name suggests, is an average of a set of data points that are constantly updated as new data becomes available. It is calculated by adding up the values of the data points over a specified period of time and then dividing the sum by the number of data points used.

There are different types of moving averages that traders use, including simple moving averages (SMA) and exponential moving averages (EMA). The SMA is the most basic form of a moving average, where each data point is given equal weight. The EMA, on the other hand, assigns more weight to the recent data points, making it more sensitive to recent market movements.

Traders use moving averages to identify trends and potential areas of support and resistance. When the price is above the moving average, it is often considered a bullish signal, indicating that the price may continue to rise. Conversely, when the price is below the moving average, it is considered a bearish signal, suggesting that the price may continue to decline.

When using moving averages in technical analysis, there are several types of moving averages that traders and investors can utilize. Each type of moving average has its own unique characteristics and application, making it important to choose the right type of moving average for the specific trading strategy or analysis.

Each type of moving average has its own strengths and weaknesses, and traders and investors should choose the most appropriate type based on their specific trading strategy and preferences. Some common applications of moving averages include trend identification, support and resistance levels, and generating buy or sell signals.

It is important to note that moving averages are lagging indicators, meaning they provide information based on past price data. As a result, they may not always provide timely or accurate signals, especially in volatile market conditions. Traders and investors should use moving averages in conjunction with other technical indicators and analysis methods to make informed trading decisions.

Read Also: Understanding Indicators for Oversold Trading: Key Indicators to Look For

A moving average is a mathematical calculation that is used to analyze data points by creating a series of averages of different subsets of the full data set. It is commonly used in technical analysis to identify trends and smooth out price fluctuations in financial markets.

Moving averages can be used in technical analysis to identify trends, determine support and resistance levels, and generate buy or sell signals. Traders often use moving averages of different lengths to confirm or cross-reference each other and evaluate the strength of a trend.

There are several types of moving averages, including simple moving averages (SMA), exponential moving averages (EMA), weighted moving averages (WMA), and displaced moving averages (DMA). Each type has its own calculation method and characteristics.

The main difference between a simple moving average (SMA) and an exponential moving average (EMA) is that SMAs give equal weight to all data points within the chosen period, while EMAs place more weight on recent data points. This means that EMAs respond more quickly to price changes and are more sensitive to short-term trends compared to SMAs.

Understanding the Weighted Average Method of Forecasting Forecasting is an essential tool for businesses to plan for the future and make informed …

Read ArticleWho is the greatest forex trader of all time? Forex trading, often referred to as foreign exchange trading, is a global market where currencies are …

Read ArticleAre Apple Options American? Apple options are a popular investment tool that allows traders to speculate on the future price movements of Apple Inc. …

Read ArticleUnderstanding the Principle of VHF Very High Frequency (VHF) communication is a vital component of modern telecommunications. VHF operates on …

Read ArticleUnderstanding the User System Interface: Key Concepts and Functionality The User System Interface (USI) plays a vital role in the interaction between …

Read ArticleUnderstanding Fixed Income Etrading: Everything You Need to Know Welcome to the comprehensive guide on understanding the basics of fixed income …

Read Article