Fixed vs Flexible Exchange Rate: Which is the Better Option?

Pros and Cons of Fixed and Flexible Exchange Rates: Which is Better? The choice between fixed and flexible exchange rates is a topic of great debate …

Read Article

Gold has long been considered a safe-haven investment, providing stability and security in times of economic uncertainty. However, its price can fluctuate, and understanding the support levels of gold is essential for informed decision-making in the precious metals market.

Support levels refer to the price points at which buyers tend to enter the market and prevent the price of an asset from falling further. In the case of gold, these support levels are influenced by various factors, including investor sentiment, economic indicators, and geopolitical events.

One key support level for gold is the psychological barrier of $1,000 per ounce. Historically, gold has found solid support at this level, as investors view it as a significant buying opportunity. When the price approaches this level, demand tends to increase, providing a floor for the market and potentially leading to a price rebound.

Another important support level for gold is the 200-day moving average. This technical indicator represents the average price of gold over the past 200 days and is widely used by traders to identify trends. When the price drops near this moving average, it often attracts buying interest and provides support for the gold price.

Understanding these support levels is crucial for gold investors and traders. By monitoring market dynamics and analyzing relevant data, individuals can make more informed decisions about buying, selling, or holding gold based on the likelihood of support levels being maintained or broken. In times of volatility, the ability to interpret support levels can help protect investments and capitalize on price movements.

In gold trading, the support level refers to a price level where buyers are expected to enter the market and prevent further declines in price. It is a psychological and technical level that acts as a floor for the price of gold. When the price of gold approaches this level, buyers are more likely to step in and start buying, creating demand and preventing the price from dropping further.

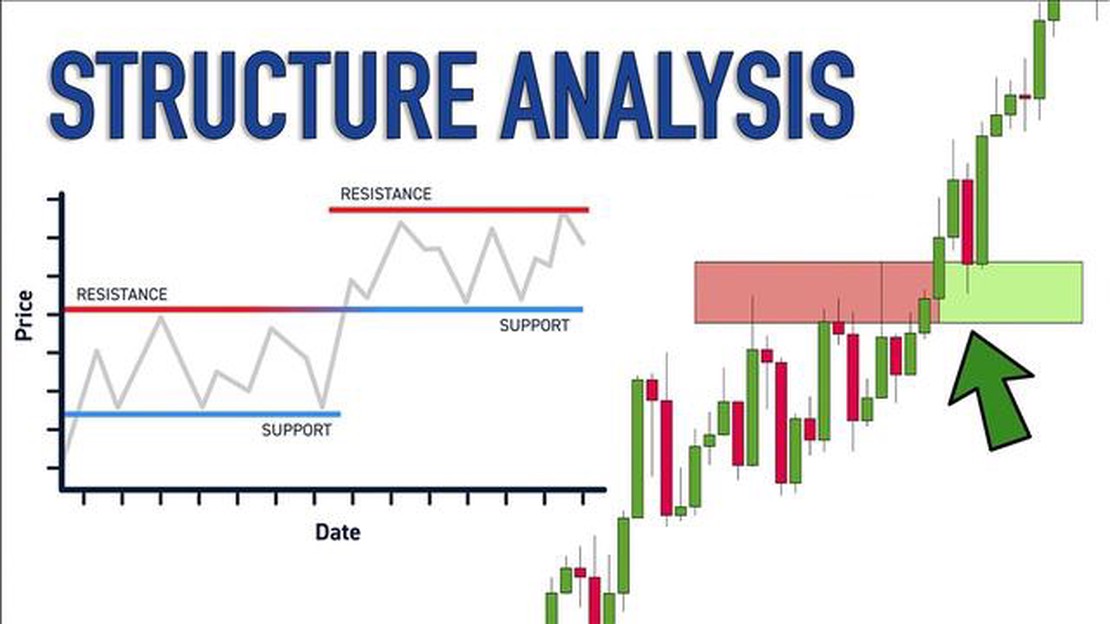

The support level is a key concept in technical analysis, which is the study of historical price and volume data to predict future price movements. Traders and investors use support levels to make decisions about buying or selling gold. If a support level holds and prices bounce higher, it can be a signal to buy gold. On the other hand, if a support level is broken, it can indicate a bearish trend and be a signal to sell or short gold.

The support level is determined by analyzing the price chart and looking for areas where the price has previously bounced higher or where significant buying pressure has occurred. These areas are marked as support levels because there is evidence that buyers have been active at these prices in the past.

Support levels can also be influenced by other factors such as market sentiment, economic news, and geopolitical events. Positive news or strong economic data can increase buying interest and strengthen the support level. On the other hand, negative news or economic uncertainty can weaken the support level as buyers become less confident and more inclined to sell.

It is important to note that support levels are not guaranteed to hold. Market conditions can change, and prices can break through support levels, leading to further declines. Therefore, it is essential to use other technical indicators and analysis techniques to confirm the validity of a support level before making trading decisions.

In conclusion, the support level in gold trading is a price level where buyers are expected to enter the market and prevent further price declines. It is a key concept in technical analysis and is used by traders and investors to make buying or selling decisions. Support levels are determined by analyzing price charts and can be influenced by market sentiment and economic factors. However, it is important to use other indicators and analysis techniques to confirm the validity of a support level before making trading decisions.

There are several key factors that can affect the support level of gold. These factors include:

1. Global Economic Conditions: The overall health of the global economy is a major factor that can impact the support level of gold. When economic conditions are uncertain or weak, investors often turn to gold as a safe-haven investment, driving up demand and supporting its price.

2. Inflation and Currency Fluctuations: Gold is often viewed as a hedge against inflation. When inflation rises or the value of a currency weakens, the price of gold tends to increase, as investors seek to protect their wealth from eroding purchasing power.

Read Also: Parameters of the Moving Average Model: Explained and Analyzed

3. Geopolitical Risks: Political instability and geopolitical tensions can have a significant impact on the support level of gold. During times of crisis or conflict, investors tend to flock to gold as a safe-haven asset, driving up demand and supporting its price.

4. Central Bank Policies: Changes in monetary policy, such as interest rate adjustments and quantitative easing measures, can influence the support level of gold. When central banks implement expansionary policies or lower interest rates, the price of gold may rise due to increased liquidity and reduced opportunity cost.

Read Also: How to list options on a platform: step-by-step guide

5. Investor Sentiment and Speculation: Investor sentiment and market speculation can also affect the support level of gold. Positive sentiment and bullish speculation can drive up demand and support the price of gold, while negative sentiment and bearish speculation can have the opposite effect.

6. Technical Analysis: Technical analysis, which involves studying past price patterns and trends, can play a role in determining the support level of gold. Traders and investors often use technical indicators and chart patterns to make buying and selling decisions, which can influence the overall demand and price of gold.

In conclusion, the support level of gold is influenced by a range of factors, including global economic conditions, inflation, geopolitical risks, central bank policies, investor sentiment, and technical analysis. Understanding these factors can help investors better assess and predict the support level of gold.

Gold is a highly liquid and popular asset for traders around the world. Understanding how to identify and utilize support levels can be crucial for success in gold trading. Support levels are price levels at which the market has historically shown a tendency to reverse course and start moving upwards. Traders often use these support levels as potential buying opportunities.

There are several ways to identify support levels in gold trading. One method is to use technical analysis tools such as trendlines and moving averages. Trendlines are lines that connect the lows of an uptrend, while moving averages smooth out price data to identify trends. By using these tools, traders can identify areas where the price of gold has historically found support and potentially reverse direction.

Another method to identify support levels is by observing price patterns. Patterns such as double bottoms or ascending triangles can indicate areas where the market has found support in the past. These patterns occur when the price reaches a certain level and bounces back, creating a pattern that traders can use to predict a potential future support level.

Once a trader has identified a support level, it can be utilized in several ways. One strategy is to place a buy order just above the support level, anticipating a potential reversal in price. Traders can also set a stop-loss order just below the support level to limit potential losses if the price breaks below the support level and continues falling.

Support levels can also be used as a reference point for profit-taking. If the price of gold starts to move upwards after reaching a support level, traders can set a profit target just below the next resistance level. This allows traders to capture potential gains while still being mindful of potential resistance levels.

In conclusion, identifying and utilizing support levels is essential for successful gold trading. Traders can use technical analysis tools and price patterns to identify these levels and use them as potential buying opportunities. Traders can also set stop-loss orders to limit potential losses and profit targets to lock in gains. By incorporating support levels into their trading strategy, traders can improve their chances of success in the gold market.

The support level of gold is a price level at which there is historically strong demand for the metal. It is a level where buyers are willing to step in and purchase gold, thus preventing the price from falling further.

The support level of gold is determined by analyzing historical price data and identifying levels at which there was strong buying interest in the past. Traders and analysts use various technical analysis tools and indicators to identify these levels.

The support level of gold is important because it provides an indication of where buyers are likely to enter the market and support the price. Traders use this information to make decisions about buying or selling gold, as the support level can act as a potential entry point for long positions.

If the support level of gold is broken, it could signal a change in market sentiment and a potential further decline in price. It may indicate that buyers have lost confidence and are no longer willing to support the price at that level, which could lead to a downward trend.

Pros and Cons of Fixed and Flexible Exchange Rates: Which is Better? The choice between fixed and flexible exchange rates is a topic of great debate …

Read ArticleWho is the world’s No 1 trader? When it comes to trading, finding the best of the best is crucial. Every trader wants to know who the top trader in …

Read ArticleHow many USD is 1 SDR? The Special Drawing Right (SDR) is an international reserve asset created by the International Monetary Fund (IMF). It is a …

Read ArticleExample of Forecasting Forecasting is a valuable tool in planning and decision-making, used across various industries and fields. It involves the …

Read ArticleHow much is $1 US in rubles? The exchange rate between the US dollar (USD) and the Russian ruble (RUB) is an important factor for individuals, …

Read ArticleReporting a Cashless Exercise: Tips and Guidelines A cashless exercise is a common method used by employees to exercise their stock options without …

Read Article