What are the advantages of pyramiding? | Exploring the benefits of pyramid schemes

Benefits of Pyramiding: Maximizing Returns in Investments Pyramiding, also known as a pyramid scheme, is a controversial business model that promises …

Read Article

Options trading is a complex financial instrument that involves buying and selling contracts based on the future price of an underlying asset. One important aspect of options pricing is the skew, which refers to the difference in implied volatility between out-of-the-money (OTM) and in-the-money (ITM) options.

In this in-depth analysis, we will delve into the concept of skew and its implications for options traders. We will explore the reasons behind the skew, the factors that influence its magnitude, and the strategies that traders can employ to take advantage of it.

The skew is a reflection of the market’s perception of risk. Generally, OTM options are considered riskier compared to ITM options. This is because the probability of an OTM option expiring worthless is higher, leading to a higher implied volatility and therefore a higher option price. Conversely, ITM options have a higher probability of expiring in the money, which lowers their implied volatility and option price.

Understanding the skew is crucial for options traders as it provides insights into market sentiment and potential trading opportunities. By analyzing and interpreting the skew, traders can make informed decisions regarding their options strategies, such as generating income through option writing or hedging their portfolios. This in-depth analysis aims to equip traders with the knowledge and tools to navigate the complexities of options pricing and make well-informed trading decisions.

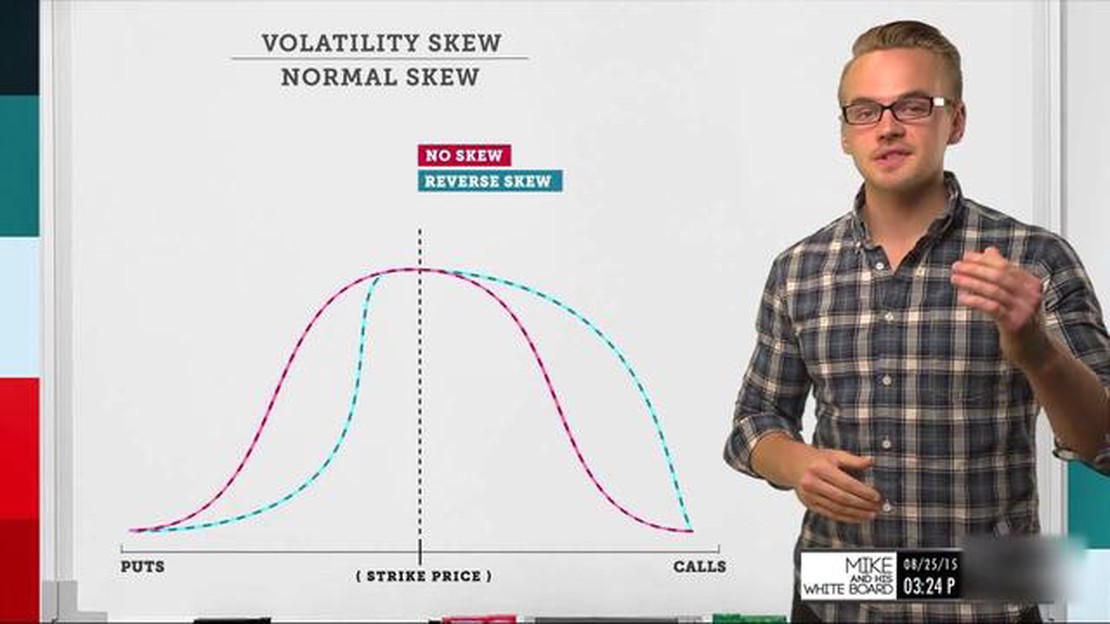

In options pricing, the skew refers to the asymmetry in the implied volatility (IV) of options with different strike prices but the same expiration date. It represents the market’s expectation of future price movements in the underlying asset.

The skew is commonly represented graphically as a curve that shows the relationship between the strike prices of options and their corresponding implied volatilities. Typically, the curve is downward sloping, indicating that options with lower strike prices have higher implied volatilities than those with higher strike prices.

The significance of skew in options pricing lies in its ability to provide valuable insights into market sentiment and risk. Skew can indicate whether market participants anticipate large price movements in the future, and it can also reflect investors’ preferences for certain strike prices.

A steep skew, where options with lower strike prices have significantly higher implied volatilities, suggests that the market anticipates a potential downturn in the underlying asset’s price. This skew can be driven by factors such as market uncertainty, upcoming events, or negative news about the asset or industry.

Conversely, a flat or shallow skew, where options with different strike prices have similar implied volatilities, implies that market participants expect minimal price fluctuations in the near future. This skew can be influenced by factors such as market stability, positive news, or a lack of significant events impacting the asset or industry.

Understanding and analyzing skew can help options traders make informed decisions. For instance, if a trader expects a significant price movement in the underlying asset, they may consider buying options with lower strike prices, which typically have higher implied volatilities and may provide greater profit potential.

Read Also: Top Places for Free Backtesting in Forex Trading

Additionally, skew can be used to assess the relative valuation of options. Options with higher implied volatilities are generally more expensive, reflecting the increased risk associated with anticipating larger price movements. By comparing the skew of different options, traders can evaluate their costs and potential returns.

In summary, the concept of skew in options pricing captures the market’s expectations of future price movements. It offers valuable insights into market sentiment and risk, helping options traders make strategic decisions and assess the relative value of different options.

The skew in options pricing refers to the asymmetrical shape of the implied volatility curve for different strike prices. This skew can be influenced by various factors that affect how market participants perceive and price the risk associated with options.

Some of the key factors that influence the skew in options pricing include:

Read Also: What is K2? | Exploring the Full Form of K2

| Factor | Description |

|---|---|

| Market Sentiment | Market sentiment and expectations can have a significant impact on options pricing skew. When market participants have a negative outlook, they may demand higher premiums for out-of-the-money put options, causing a downward slope in the skew. |

| Supply and Demand | Supply and demand dynamics for specific options contracts can also influence the skew. If there is high demand for out-of-the-money call options, their premiums may increase, causing an upward slope in the skew. |

| Underlying Asset Price | The price of the underlying asset can impact the options pricing skew. If the underlying asset experiences significant price movements, market participants may adjust their expectations of future volatility, leading to changes in the skew. |

| Time to Expiration | Options with different expiration dates can exhibit different skews. As time to expiration decreases, market participants may become more uncertain about future price movements, leading to changes in the skew. |

| Market Volatility | Overall market volatility can also impact the options pricing skew. Higher levels of volatility can increase demand for out-of-the-money options as investors seek to hedge their positions, causing the skew to become more pronounced. |

| Interest Rates | Changes in interest rates can affect the cost of carrying an underlying asset and impact options pricing skew. Higher interest rates can increase the cost of holding options, leading to changes in the skew. |

It is important for options traders and investors to understand these factors and how they can influence the skew in options pricing. By monitoring and analyzing these factors, market participants can make more informed decisions when trading options and managing risk.

Skew in options pricing refers to the asymmetrical shape of the implied volatility curve. It shows that the market assigns different levels of volatility to options with the same expiration, but different strike prices. Generally, the volatility tends to be higher for out-of-the-money options compared to in-the-money options. This skew reflects market expectations and perceptions of potential risks.

The skew in options pricing is primarily caused by market participants’ perceptions of risk. Investors and traders are generally more concerned about potential downside risks and are willing to pay higher prices for out-of-the-money put options to protect their portfolios. This increased demand for out-of-the-money put options leads to higher implied volatilities and, thus, creates the skew in options pricing.

The skew in options pricing can have significant implications for options traders and investors. It influences the relative values of different options contracts and can impact trading strategies. For example, the skew can result in higher prices for protective put options, making them more expensive to buy. It also affects the pricing of hedging strategies and can impact the profitability of certain trading strategies, particularly those that involve buying or selling options with different strike prices.

Yes, there can be differences in skew between different types of options. For example, equity options may have a different skew compared to index options. Additionally, skew can vary depending on market conditions, such as economic indicators, political events, or sector-specific factors. It is important for options traders and investors to analyze and understand the specific skew patterns for the options they are trading in order to effectively manage their positions.

Options traders can take advantage of skew in options pricing by implementing specific trading strategies. They can consider selling out-of-the-money put options to capture the higher premiums caused by the skew. Alternatively, they can design strategies that involve buying options with different strike prices to benefit from the skew. It is important to note that trading options involves risks, and traders should carefully assess their risk tolerance and market conditions before implementing any strategy.

Options skew refers to the unevenness in implied volatility across different strike prices of options with the same expiration date. It means that the market is assigning different probabilities and risks to different price levels of the underlying asset.

Options skew exists due to market participants’ differing expectations and perceptions of risk. Traders and investors may be willing to pay higher premiums for options with strike prices that are further away from the current price of the underlying asset, as they believe there is a greater chance of a significant move in that direction.

Benefits of Pyramiding: Maximizing Returns in Investments Pyramiding, also known as a pyramid scheme, is a controversial business model that promises …

Read ArticleIs a double moving average crossover bearish? A moving average crossover is a technical analysis tool used by traders to identify potential trend …

Read ArticleIs Quotex Legal in Bangladesh? Quotex is an online trading platform that allows individuals to engage in various financial activities, such as trading …

Read ArticleCurrent Trends in the Colombian Forex Market Foreign exchange (forex) plays a crucial role in the global economy, and Colombia is no exception. The …

Read ArticleASB international transaction fees: how much do they charge? When it comes to international transactions, many banks charge fees to cover the costs …

Read ArticleBest platforms for paper trading options in India If you are an options trader in India, it is essential to practice and refine your trading skills …

Read Article