How to Exercise ISO Stock Options: A Step-by-Step Guide

Exercising ISO Stock Options: A Comprehensive Guide ISO stock options can be a valuable component of your overall compensation package, allowing you …

Read Article

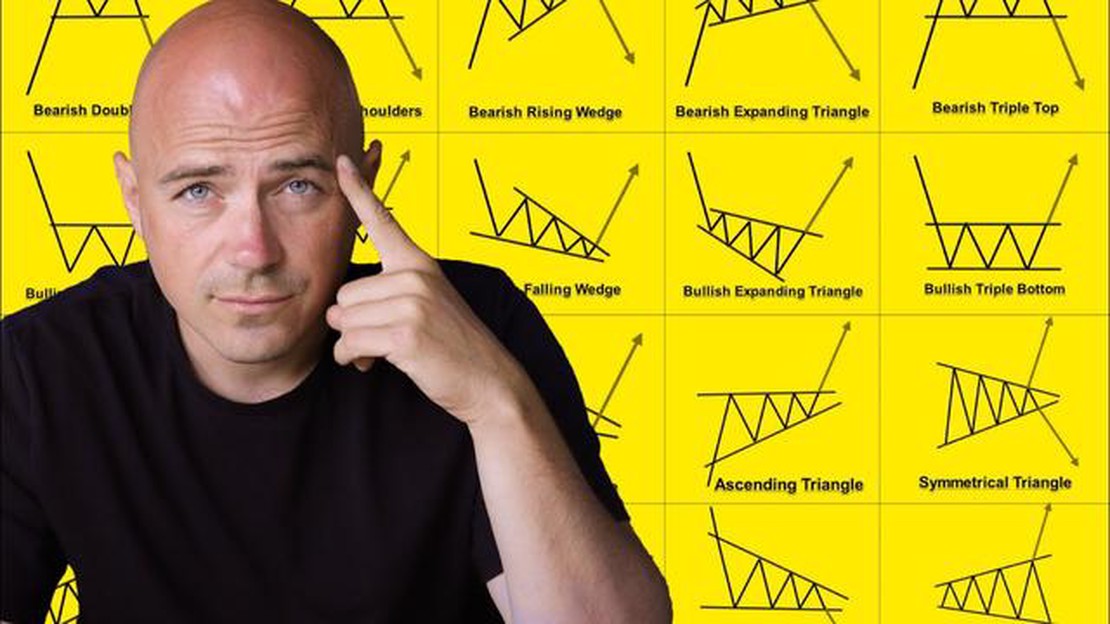

Forex trading is a complex and dynamic market, where traders analyze various patterns and indicators to predict price movements. One of the most reliable and frequently observed chart patterns is the flag pattern. Understanding how flags work can provide valuable insights into future price trends and help traders make more informed decisions.

The flag pattern is a continuation chart pattern that occurs when there is a brief pause or consolidation in the price movement after a strong trend. It is characterized by a rectangular-shaped formation that resembles a flag on a pole. The pole represents the initial price movement, while the flag represents the consolidation period.

Traders use flag patterns to identify potential breakouts or reversals in the market. When a flag pattern is formed, it suggests that the price is likely to continue in the direction of the previous trend after the consolidation period ends. This means that if there was an uptrend before the flag, traders would anticipate a continuation of the uptrend after the flag pattern is broken. Conversely, if there was a downtrend before the flag, traders would anticipate a continuation of the downtrend.

It is important to note that flags are not always easy to spot, and traders need to develop a keen eye for identifying them. They need to pay close attention to price charts and look for patterns that meet the criteria of a flag pattern. Additionally, flags should be confirmed by other technical indicators or chart patterns to increase the probability of a successful trade.

When it comes to forex trading, understanding the various chart patterns is crucial for making informed decisions. One such pattern that traders often look out for is the flag pattern.

A flag pattern in forex trading is a continuation pattern that typically occurs after a significant price movement. It is called a flag because the pattern resembles a flag waving in the wind, with its price action forming a rectangular shape.

The flag pattern consists of two main components - the flagpole and the flag itself. The flagpole is the initial strong price movement that creates the pattern, while the flag is a period of consolidation, where the price moves in a narrow range.

Traders often look for flag patterns as they provide valuable insights into future price movements. When a flag pattern forms, it suggests that the market is taking a breather after a strong directional move, and traders expect the price to continue in the same direction.

The length of the flagpole can vary, but it is usually a sharp and significant move in price. The flag portion of the pattern is characterized by lower volume and narrower price range, indicating a period of indecision in the market.

Once the flag pattern is identified, traders can use various technical indicators and tools to confirm the pattern and plan their trades. They often look for a breakout in the direction of the previous trend, as this is seen as a potential continuation of the price movement.

It is important to note that not all flag patterns result in a continuation of the previous trend. Sometimes, the price may break in the opposite direction, indicating a trend reversal. Therefore, it is crucial to consider other factors and use proper risk management techniques when trading flag patterns.

In conclusion, understanding the role of flags in forex trading is essential for identifying potential trading opportunities and making informed decisions. Flag patterns provide valuable insights into market sentiment and can be a useful tool for traders to anticipate future price movements.

Flag patterns are important technical analysis tools used by forex traders to identify potential continuation trends in the market. These patterns are formed after a strong price movement followed by a period of consolidation, creating a rectangular shape on the price chart. The flag pattern consists of two components: a flagpole and a flag.

The flagpole is the initial strong price movement that establishes the trend. It is formed by a sharp upward or downward move in the market, indicating increased buying or selling pressure. The flag, on the other hand, is the consolidation phase that follows the flagpole. It is characterized by price fluctuations within a narrow range and presents an opportunity for traders to enter or exit positions.

Forex flag patterns can be either bullish or bearish, depending on the direction of the previous trend. A bullish flag pattern occurs after an uptrend and suggests a continuation of the upward movement, while a bearish flag pattern forms after a downtrend and indicates a potential continuation of the downward movement.

Read Also: Is the Thomas Cook Forex Card Free of Charge?

Traders look for specific criteria to confirm the validity of a flag pattern, such as the duration of the consolidation period, price volatility, and breakout confirmation. Once these criteria are met, traders can use the flag pattern to determine potential price targets and set entry and exit points for their trades.

Flag patterns are considered reliable technical indicators as they provide valuable information about market sentiment and can help traders make informed decisions. However, it is important to note that flag patterns are not guaranteed to produce accurate predictions and should be used in conjunction with other technical tools and analysis methods.

In conclusion, understanding forex flag patterns is essential for traders looking to identify potential continuation trends in the market. These patterns provide valuable insights into market sentiment and can help traders make informed trading decisions. By mastering the art of recognizing and analyzing flag patterns, traders can improve their overall trading success in the forex market.

The forex market is known for its various chart patterns that traders use to identify potential trading opportunities. One of the common chart patterns is the flag pattern. Flags are continuation patterns that indicate a temporary pause or consolidation in the ongoing trend before it continues in the same direction. To successfully trade forex flag patterns, it is important to be able to identify them correctly.

Here are some key steps to identify and trade forex flag patterns:

| Step 1: | Identify the Flagpole |

| Step 2: | Identify the Flag |

| Step 3: | Confirm the Breakout |

| Step 4: | Set Stop Loss and Take Profit Levels |

Step 1: Identify the Flagpole

The flagpole is the initial strong move in price that forms the flag pattern. It can be a bullish or bearish move. The flagpole should be relatively sharp and have a noticeable increase in volume. This forms the foundation for the flag pattern.

Read Also: What does R mean in trading? Understanding the concept of R in trading

Step 2: Identify the Flag

The flag is the consolidation phase or the pause in price after the flagpole. It forms a rectangular shape and is characterized by price moving in a narrow range. The flag should slope against the direction of the flagpole. This indicates a temporary pause or consolidation before the trend continues.

Step 3: Confirm the Breakout

Once the flag pattern is formed, it is important to wait for a breakout in price. A breakout occurs when price breaks above or below the flag pattern. This signals the continuation of the trend. Traders should wait for a confirmed breakout before entering a trade.

Step 4: Set Stop Loss and Take Profit Levels

After entering a trade, it is important to set appropriate stop loss and take profit levels. Stop loss orders should be placed below the flag pattern (for long trades) or above the flag pattern (for short trades) to protect against potential losses. Take profit levels can be set based on previous support and resistance levels or using a risk-to-reward ratio.

Overall, forex flag patterns can be profitable trading opportunities if identified and traded correctly. By following the steps outlined above, traders can improve their chances of successfully trading flag patterns in the forex market.

Forex flag patterns are technical analysis patterns that appear on price charts of currency pairs. They resemble a flagpole and a flag and usually occur after a strong price movement. The flag represents a temporary pause or consolidation before the continuation of the prior trend.

Forex flag patterns form when a currency pair experiences a rapid and significant price movement. After the movement, the price enters a period of consolidation where it trades within a narrow range. This consolidation phase creates the flag pattern when the price forms two parallel trendlines that resemble a flagpole and a flag.

Forex flag patterns are considered significant in trading as they often indicate a continuation of the prior trend. Traders look for these patterns as they provide opportunities to enter trades with favorable risk-reward ratios. The breakout from a flag pattern can result in a strong price movement, allowing traders to profit from the trend continuation.

Forex flag patterns are generally considered reliable technical analysis patterns. However, like any other pattern, they are not foolproof and can fail at times. It is important to combine flag patterns with other technical indicators and analysis techniques to increase the probability of successful trades.

To trade forex flag patterns, traders typically wait for a breakout from the pattern. A bullish breakout occurs when the price breaks above the upper trendline of the flag, signaling a potential long trade. Conversely, a bearish breakout occurs when the price breaks below the lower trendline of the flag, indicating a potential short trade. Traders can set stop-loss orders below the flag pattern and target profits based on the length of the prior price movement.

Flag patterns in forex trading are a common technical analysis pattern that traders use to identify potential market reversals or continuations. They are called flag patterns because they resemble the shape of a flag on a flagpole.

Flag patterns form after a strong price movement in one direction, which is called the flagpole. The flag pattern is then formed when the price consolidates in a tight range, creating parallel trendlines that resemble a flag. This consolidation usually indicates that the market is taking a breather before continuing in the same direction.

Exercising ISO Stock Options: A Comprehensive Guide ISO stock options can be a valuable component of your overall compensation package, allowing you …

Read ArticleWhat are non-qualified stock options for contractors? Non-qualified stock options (NQSOs) can be a valuable tool for contractors who want to align …

Read ArticleCalculate MAD: A Step-by-Step Guide When it comes to analyzing data, the Mean Absolute Deviation (MAD) is a commonly used statistic that measures the …

Read ArticleUnderstanding Pivoting in Trading: A Comprehensive Guide When it comes to trading in the financial markets, being able to identify and understand key …

Read ArticleIs the Forex Market Open on Labor Day? Labor Day is a public holiday celebrated in many countries around the world. It is a day to honor the …

Read ArticleUnderstanding FX Swap Examples and Their Application Foreign exchange (FX) swaps are an essential tool in the global financial markets. They allow …

Read Article