Understanding the Symbol for Silver Commodities: A Guide for Investors

What is the symbol for silver commodities? When it comes to investing in commodities, silver is a popular choice among investors. As with any …

Read Article

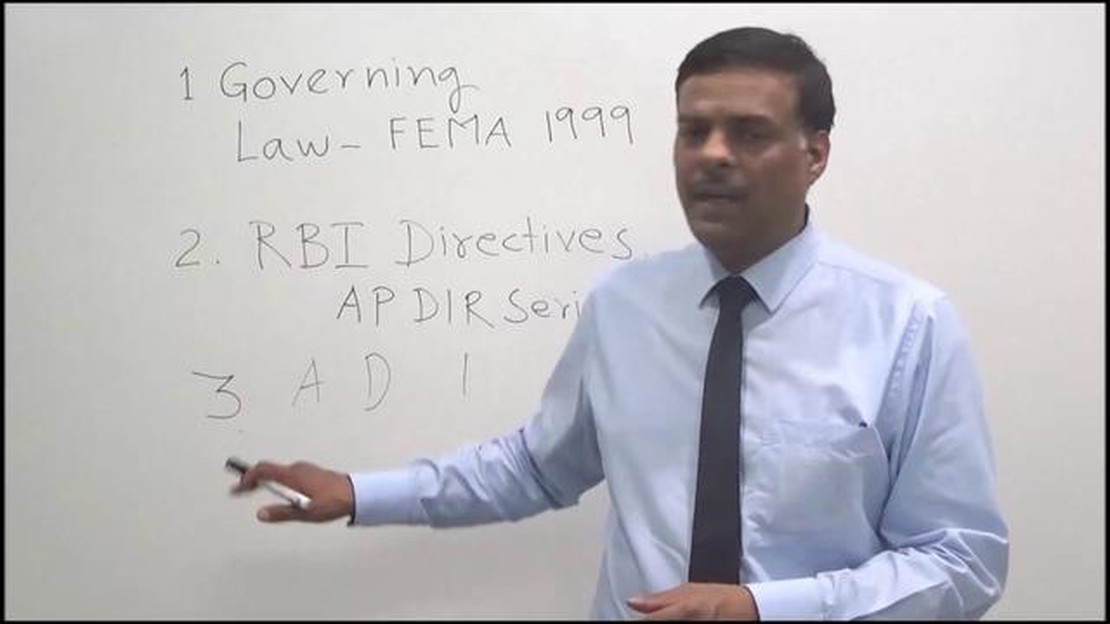

A bank’s forex department plays a crucial role in conducting foreign exchange transactions and managing currency risks. Forex, short for foreign exchange, refers to the buying and selling of currencies on the global market.

Forex transactions are an integral part of international trade and finance. As businesses and individuals engage in cross-border transactions, they often need to convert one currency into another. This is where a bank’s forex department comes in, facilitating these transactions and providing currency exchange services.

The forex department of a bank is responsible for executing currency trades at market rates, ensuring timely conversions, and minimizing currency risks. It collaborates with various stakeholders, such as corporate clients, individual customers, central banks, and other financial institutions, to meet their foreign exchange needs.

In addition to facilitating currency conversion, the forex department also helps companies and individuals hedge against currency risks. By using various financial instruments, such as forward contracts, options, and swaps, the department allows its clients to protect themselves from adverse movements in exchange rates and manage their exposure to foreign currencies.

Overall, a bank’s forex department serves as a vital link between the global currency markets and its clients, providing them with efficient and reliable foreign exchange services while assisting in managing currency-related risks.

The Forex department of a bank plays a crucial role in facilitating foreign exchange transactions for its clients. Forex, short for foreign exchange, refers to the global marketplace where currencies are bought and sold. Understanding the functions and responsibilities of a bank’s Forex department is essential for individuals and businesses looking to transact in different currencies.

One of the main functions of the Forex department is to provide pricing for various currency pairs. This involves monitoring the foreign exchange market and determining exchange rates. The department also handles the execution of currency trades, ensuring that clients’ orders are matched with counterparties in the market.

Read Also: Understanding the mechanics of loan sales: A comprehensive guide

Additionally, the Forex department is responsible for managing currency risk. This involves evaluating and mitigating the potential impact of currency fluctuations on the bank’s financial position. The department may employ various hedging strategies, such as forward contracts or options, to protect against adverse currency movements.

Another key role of the Forex department is to provide market research and analysis to clients. This includes keeping clients informed about the latest market trends, economic indicators, and geopolitical developments that may affect currency values. By providing insights and recommendations, the department helps clients make informed decisions when transacting in foreign currencies.

The Forex department also plays a vital role in compliance and regulatory matters. It ensures that all transactions adhere to local and international regulations, such as anti-money laundering laws and capital flow restrictions. In addition, the department may collaborate with other departments within the bank to address customer inquiries or resolve any issues that arise during currency transactions.

In conclusion, the Forex department of a bank is responsible for facilitating foreign exchange transactions, managing currency risk, providing market research and analysis, and ensuring compliance with regulations. Understanding the role and functions of this department is important for individuals and businesses engaging in international trade or investing in foreign assets.

The foreign exchange (forex) department plays a crucial role in the economic development of a bank. It is responsible for managing and facilitating foreign exchange transactions, which are essential for international trade and investment.

One of the main roles of the forex department is to provide currency exchange services to customers. This allows individuals and businesses to convert one currency into another, facilitating cross-border transactions. By offering competitive exchange rates and efficient services, the forex department helps to promote international trade and investment, which in turn contributes to economic growth.

In addition to currency exchange services, the forex department also plays a role in managing foreign exchange risk. It helps clients, including individuals, corporations, and governments, to hedge against currency fluctuations. By offering products such as forward contracts, options, and swaps, the forex department enables clients to protect themselves from potential losses due to exchange rate volatility. This risk management function contributes to economic stability and fosters an environment conducive to investment and growth.

Moreover, the forex department serves as a source of information and expertise regarding foreign exchange markets. It monitors market trends, analyzes economic data, and provides insights and recommendations to clients. By staying informed about global economic developments and advising clients on the best strategies and timing for foreign exchange transactions, the forex department helps to optimize financial decision-making. This, in turn, contributes to overall economic efficiency and productivity.

Read Also: Understanding the Discrepancy: Why Is My Equity Bigger Than My Balance?

In conclusion, the forex department of a bank plays a vital role in economic development. Through its currency exchange services, risk management functions, and expert analysis, it supports international trade and investment, fosters economic stability, and promotes efficient financial decision-making. A well-functioning forex department is crucial for a bank to contribute to the development and growth of an economy.

A bank’s Forex department is responsible for managing foreign exchange transactions for the bank and its clients. This involves buying and selling different currencies to facilitate international trade and investment, as well as hedging currency risks.

A bank’s Forex department facilitates international trade by providing currency exchange services. When companies need to make payments in different currencies for imports or exports, they can use the services of the Forex department to convert one currency into another at competitive exchange rates.

The Forex department plays a crucial role in helping businesses manage currency risks. They offer various hedging instruments, such as forward contracts, options, and swaps, which enable businesses to protect themselves against adverse currency movements. By using these instruments, companies can lock in exchange rates and minimize the impact of currency fluctuations on their profits.

Yes, banks typically charge fees for their Forex services. These fees vary depending on the type and size of the transaction. Banks may charge a percentage of the transaction amount or a fixed fee. It is important for clients to understand the fees involved and compare them with other providers to ensure they are getting the best deal.

Yes, individuals can also use the Forex services of a bank. Banks offer currency exchange services for individuals who need to buy or sell foreign currencies for personal reasons, such as travel or investments. Individuals can visit the bank’s Forex department or use online platforms to carry out these transactions.

What is the symbol for silver commodities? When it comes to investing in commodities, silver is a popular choice among investors. As with any …

Read ArticleWhat is the Most Popular Strategy in Automated Trading? In recent years, automated trading has gained significant popularity among investors and …

Read ArticleBest Shares Below 1 Rs Investing in shares is a great way to make your money work for you. While many people believe that investing in shares requires …

Read ArticleIs Delta always 0.5 at-the-money? When it comes to options trading, delta plays a crucial role in understanding how the price of an option will move …

Read ArticleTrading Options with a Margin Account: What You Need to Know If you are an investor looking to trade options, you may be wondering if you can do so …

Read ArticleUnderstanding Incentive Stock Options Incentive Stock Options (ISOs) are a type of stock option that companies grant to their employees as a form of …

Read Article