Investing in Stocks with your 401k: Everything You Need to Know

Using Your 401k to Invest in Stocks: What You Need to Know When it comes to planning for retirement, one of the most common methods is through a …

Read Article

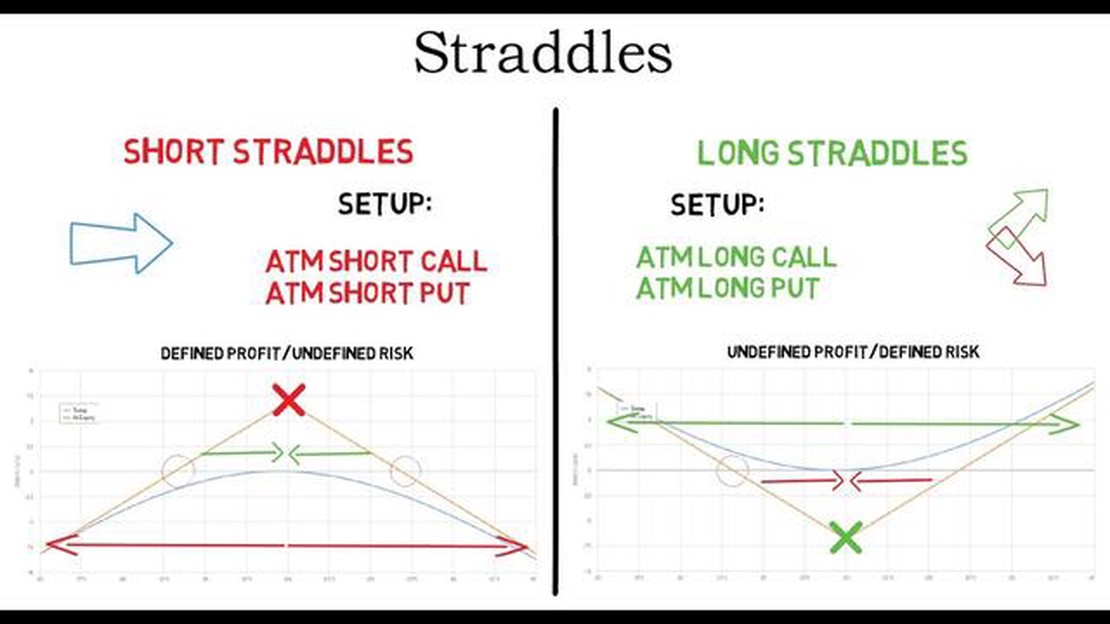

Investing in the financial markets can be a rewarding but complex endeavor. One popular strategy that investors often consider is the straddle. The straddle involves purchasing both a call option and a put option with the same strike price and expiration date. This strategy enables investors to profit from substantial price movements in either direction, regardless of the market’s overall trend.

However, it is essential to understand the risks associated with the straddle strategy before incorporating it into your investment plan. One significant risk is the cost of purchasing both options, which can be quite expensive compared to buying a single option. Additionally, if the underlying asset’s price does not move significantly enough in either direction, the options may expire worthless, resulting in a total loss of the investment.

Another risk to consider is volatility. Straddles can be highly sensitive to changes in market volatility. If the level of volatility decreases, the options’ value may decline, even if the underlying asset’s price remains relatively unchanged. Conversely, if volatility increases sharply, it can significantly boost the value of the options, potentially resulting in significant profits.

Furthermore, timing is essential when implementing a straddle strategy. Because options have expiration dates, investors must carefully consider the duration of their straddle position. If the price movement occurs too early or too late in the expiration cycle, the options’ value may be negatively affected. Therefore, it is crucial to conduct thorough research and analysis to determine the optimal time to enter and exit a straddle position.

In conclusion, while the straddle strategy offers the potential for significant profits, it is essential to understand and manage the associated risks. Careful consideration of the costs, volatility, and timing can help mitigate these risks and enhance the chances of a successful investment outcome.

Straddle is an investment strategy that involves buying both a call option and a put option on the same underlying asset, with the same strike price and expiration date. This strategy is often used when there is an expectation of significant price volatility in the underlying asset, but the direction of the price movement is uncertain.

While straddle can potentially lead to significant profits if the price of the underlying asset moves significantly in either direction, it also carries certain risks that investors need to be aware of.

| Risks | Explanation |

|---|---|

| Limited Profit Potential | Even if the price of the underlying asset moves significantly, the profit potential of a straddle is limited. This is because the cost of buying both the call option and the put option can be quite high, and this cost needs to be offset by a significant price movement in order to realize a profit. |

| Time Decay | Options have a limited lifespan, and as time passes, the value of the options decreases. This means that if the price of the underlying asset remains relatively stable, the value of the straddle will also decrease over time, leading to losses for the investor. |

| Volatility Requirement | In order for a straddle to be profitable, there needs to be enough price volatility in the underlying asset. If the price remains stable, the value of both the call option and the put option will decrease, resulting in losses for the investor. |

| Double Loss Potential | If the price of the underlying asset remains relatively stable, the investor can potentially incur losses on both the call option and the put option, resulting in a double loss. |

Read Also: Where to Place a Buy Stop Order in Trading: Best Strategies

It is important for investors to carefully consider these risks before implementing a straddle strategy. It may be wise to consult with a financial advisor or do thorough research to understand the potential outcomes and manage the risks involved.

When utilizing the straddle strategy in your investment approach, it is important to understand the impact it can have on your overall investment strategy.

A straddle involves purchasing both a call option and a put option with the same strike price and expiration date. This strategy is typically used when an investor expects a significant price movement in the underlying asset, but is unsure of the direction in which the price will move.

One impact of utilizing a straddle strategy is an increase in potential profit opportunities. By owning both a call and put option, you are positioned to benefit from significant price swings in either direction. If the price of the underlying asset moves significantly in one direction, the corresponding option will increase in value and potentially generate substantial profits.

However, it is important to note that utilizing a straddle strategy also increases your overall risk. If the price of the underlying asset does not move significantly or remains relatively stable, both the call and put options can lose value and result in potential losses. This increased risk must be carefully considered when implementing a straddle strategy.

Another impact of the straddle strategy is the cost associated with purchasing both a call and put option. This cost, known as the premium, can be significant and can erode potential profits if the price movement of the underlying asset is not substantial enough to outweigh the premium paid. It is important to carefully calculate and assess the potential costs and benefits of utilizing a straddle strategy before implementing it.

In summary, the impact of utilizing a straddle strategy on your investment approach can be significant. It provides the opportunity for increased profit potential, but also increases overall risk and can result in higher costs. It is essential to carefully analyze the market conditions and assess the potential risks and rewards before incorporating a straddle strategy into your investment strategy.

A straddle strategy involves buying both a call option and a put option with the same strike price and expiration date. This strategy is used when an investor expects a significant price movement in the underlying asset but is uncertain about the direction of the movement.

Read Also: Understanding the Mechanism of Forex Indicators: Exploring How They Work

The straddle strategy works by profiting from a significant price movement in the underlying asset. If the price goes up, the call option will generate profit, while if the price goes down, the put option will generate profit. The investor doesn’t need to predict the direction of the movement, but rather relies on the magnitude of the price change.

One of the main risks of using a straddle strategy is that the price movement may not be significant enough to generate profit. If the price remains relatively stable, both the call and put options may expire worthless, resulting in a loss. Additionally, if the price moves in one direction but then reverses, only one of the options may generate profit, while the other loses value.

Yes, there are advantages to using a straddle strategy. It can provide an opportunity for significant profit if there is a large price movement in either direction. It also allows investors to benefit from market volatility without having to predict the direction of the movement. This strategy can be particularly useful in uncertain market conditions or during events that are expected to cause volatility.

There are several alternative strategies to straddle that investors can consider. One such strategy is the strangle, which involves buying out-of-the-money call and put options with different strike prices. Another strategy is the butterfly spread, which involves combining long and short positions on options with different strike prices. Each of these strategies has its own advantages and disadvantages, so it’s important to carefully consider the market conditions and the investor’s objectives before choosing a strategy.

A straddle is an options strategy that involves buying both a call option and a put option on the same underlying asset with the same strike price and expiration date. It can impact an investment strategy by providing potential profit in both upward and downward market movements.

The main risk associated with straddle is the potential loss of the premium paid for both the call option and the put option if the underlying asset does not move significantly in price. There is also the risk of the options expiring worthless if the price of the underlying asset remains relatively stable.

Using Your 401k to Invest in Stocks: What You Need to Know When it comes to planning for retirement, one of the most common methods is through a …

Read ArticleUsing Options for Speculation: Is it Possible? In the world of finance, options are powerful tools that can be used for a variety of purposes. While …

Read ArticleHow to Become a High-Frequency Trading Developer High-frequency trading (HFT) has emerged as a popular and lucrative field within the finance …

Read ArticleForex Trader Job Description: What You Need to Know Forex trading, also known as foreign exchange trading, is a fast-paced and dynamic market that …

Read ArticleExploring the Differences Between Moving Average Forecast and Weighted Moving Average Methods In the field of data analysis and forecasting, various …

Read ArticleWhat is the best AI bot for forex? In today’s fast-paced world of forex trading, it can be challenging to keep up with the ever-changing market trends …

Read Article