Understanding the meaning of DFB in trading and its implications

What Does DFB Mean in Trading? DFB stands for daily funded bet, a term commonly used in trading to refer to a specific type of financial instrument. …

Read Article

In the field of data analysis and forecasting, various methods are employed to predict future trends and patterns. Two commonly used techniques are Moving Average Forecasting and Weighted Moving Average. While they both aim to predict future values based on past data, there are key differences in their approaches and outcomes.

Moving Average Forecasting is a simple and straightforward method that involves calculating the average of a set of data points over a specific time period. The time period can be days, weeks, or even months, depending on the context and the data being analyzed. This technique assumes that the future values will follow the same trend as the past data, and the average calculated reflects this trend.

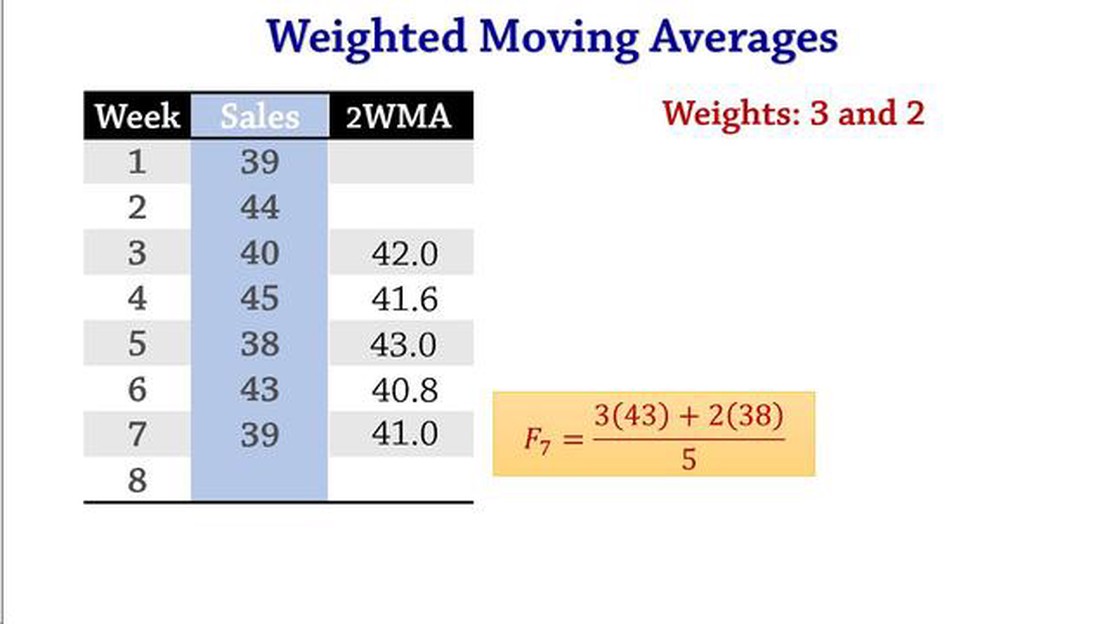

Weighted Moving Average is a more advanced version of Moving Average Forecasting, which assigns greater importance to recent data points. In this method, each data point is multiplied by a weighting factor that decreases as the data point gets older. The sum of these weighted data points is then divided by the sum of the weighting factors to get the weighted moving average. This technique gives more weight to recent data, making it more responsive to changes in trends.

While Moving Average Forecasting is simpler to calculate and interpret, Weighted Moving Average takes into account the changing nature of trends by giving more importance to recent data. This makes it more suitable for forecasting in situations where trends are constantly evolving. Both methods have their strengths and weaknesses, and the choice between them depends on the specific context and data being analyzed.

Moving average forecasting is a widely used method for analyzing and predicting future trends in data. It is based on the principle of calculating the average of a certain number of data points over a given period of time, referred to as the moving average period.

The moving average period can range from a few days to several months, depending on the specific analysis needs and the nature of the data being examined. The purpose of using a moving average is to smooth out short-term fluctuations and highlight long-term trends in the data.

The calculation of a moving average involves summing up a certain number of consecutive data points and dividing the sum by the total number of data points. The resulting value represents the moving average for that particular period.

One of the main advantages of using moving average forecasting is its simplicity and ease of interpretation. The moving average line provides a visual representation of the overall trend in the data, making it easier to identify patterns and make predictions.

In addition, moving average forecasting can be useful for filtering out noise in the data, which can be caused by random fluctuations or measurement errors. By smoothing out these short-term variations, the moving average can provide a more accurate representation of the underlying trend in the data.

However, it is important to note that moving average forecasting is not without limitations. It may not be suitable for analyzing data with rapid and unpredictable changes, as the moving average tends to lag behind sudden shifts in the data. In these cases, alternative methods such as exponential smoothing or weighted moving averages may be more appropriate.

Overall, moving average forecasting is a valuable tool for analyzing and predicting trends in data. It offers a simple yet effective way to identify patterns and make informed decisions based on historical data. By understanding the principles and limitations of moving average forecasting, analysts can leverage this method to gain insights into future trends and improve forecasting accuracy.

Moving average forecasting is a commonly used statistical technique in time series analysis. It is used to estimate the future values of a variable based on its past observations. The method involves calculating the average value of a variable over a defined period of time, and then using this average to forecast future values.

The moving average forecasting method assumes that the future values of a variable will be similar to its past values. This assumption is based on the idea that there is a certain level of stability and continuity in the variable’s behavior over time.

Read Also: Understanding Exponential Weighted Moving Average Decay: A Comprehensive Guide

To calculate a moving average forecast, one needs to choose a specific time period over which the average will be calculated. This time period is known as the “window” or “interval”. The choice of window size depends on the nature of the data and the desired level of accuracy in the forecast.

Once the window size is determined, the moving average forecast is calculated by taking the average of the variable’s values within the window. For example, if the window size is set to 5, the forecast for the next period will be the average of the last 5 observations.

The moving average forecast can be helpful in identifying trends and patterns in a variable’s behavior over time. It can be used to smooth out the noise and random fluctuations in the data, making it easier to identify the underlying patterns.

However, it is important to note that moving average forecasting has limitations. It tends to lag behind sudden changes or irregular patterns in the data. Additionally, it may not be suitable for variables with seasonality or rapid changes in trend.

In conclusion, moving average forecasting is a simple yet effective method for estimating future values based on past observations. It provides a smoothed representation of the data, allowing for the identification of underlying trends and patterns. However, it should be used with caution and considered in the context of other forecasting techniques for more accurate and reliable results.

Moving average forecasting is a commonly used technique in time series analysis. It offers several benefits and limitations that are essential to consider when using this method for forecasting.

Benefits:

Read Also: Trading Forex on Your Phone: A Complete Guide2. Smoothing: By taking the average of a series of historical data points, moving average forecasting helps in smoothing out short-term fluctuations and noise. This allows for a more accurate and stable forecast, especially in situations where random fluctuations can impact the data. 3. Trend Detection: Moving average forecasting can help in identifying trends in time series data. By using a longer time window for calculating the moving average, it becomes easier to identify long-term trends and patterns. This information is valuable for making informed decisions and predicting future trends.

Limitations:

Despite these limitations, moving average forecasting remains a popular and widely used technique due to its simplicity and effectiveness in many forecasting scenarios.

Moving average forecasting is a simple method that calculates the average of a given set of data points over a specified time period. Weighted moving average, on the other hand, assigns weights to each data point in the set, giving more importance to recent data points.

It depends on the specific data set and the purpose of the forecast. Moving average forecasting is more suitable for stable data sets, while weighted moving average is better for data sets with significant variations or trends.

The weights in weighted moving average are typically determined through exponential smoothing techniques or by assigning higher weights to more recent data points. The specific method used to determine the weights can vary depending on the requirements of the forecasting task.

Both moving average forecasting and weighted moving average methods can be applied to various types of data, such as financial data, sales data, and stock market data. However, the choice of method and the accuracy of the forecast may vary depending on the characteristics of the data set.

What Does DFB Mean in Trading? DFB stands for daily funded bet, a term commonly used in trading to refer to a specific type of financial instrument. …

Read ArticleHow to Buy or Sell to Open a Put Option Put options are financial derivatives that give the holder the right, but not the obligation, to sell an asset …

Read ArticleOptions position limits for OCC: What you need to know Options trading can be a profitable venture, but it’s important to understand the rules and …

Read ArticleForeign Exchange Dealers Association of India (FEDAI): Explained The Foreign Exchange Dealers Association of India (FEDAI) plays a crucial role in the …

Read ArticleCan I top up my travel card online? Traveling with a travel card has become increasingly popular as a convenient and secure way to pay for …

Read ArticleChoosing Between a Strangle and a Straddle: Which Options Trading Strategy is Better? When it comes to options trading, there are a multitude of …

Read Article