Current exchange rate: $1 US Dollar to Pakistani Rupees

Value of $1 US Dollar in Pakistani Rupees In today’s globalized world, currencies play a crucial role in international trade and finance. One such …

Read Article

Foreign exchange (FX) spot transactions are a common form of currency trading in the global financial markets. These transactions involve the buying and selling of currencies at the current exchange rate, with delivery usually taking place within two business days.

While FX spot transactions can be a lucrative investment opportunity, they also carry significant risks. One of the main risks associated with these transactions is exchange rate volatility. The value of currencies can fluctuate rapidly due to various factors such as economic indicators, geopolitical events, and central bank policies. These fluctuations can lead to significant gains or losses for investors.

Another risk is counterparty risk, which refers to the possibility that the other party in the transaction may default on their obligations. In FX spot transactions, counterparty risk arises when the buyer or seller fails to deliver or pay for the agreed-upon currency on the settlement date. This risk can be mitigated by conducting transactions with reputable financial institutions and implementing proper risk management strategies.

Additionally, liquidity risk is a concern in FX spot transactions. Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. In times of market stress or during periods of low trading volume, liquidity can dry up, making it difficult to execute transactions at favorable prices. Traders should be aware of this risk and take it into consideration when entering into FX spot transactions.

In conclusion, FX spot transactions offer the potential for significant returns, but they also come with their fair share of risks. Understanding and managing these risks is crucial for investors and traders in order to protect their capital and achieve their financial goals.

FX spot transactions are a type of foreign exchange trade where two parties exchange currencies at the current market price, with the settlement taking place “on the spot.” This means that the transaction is typically settled within two business days from the trade date.

These transactions are commonly used by individuals, businesses, and financial institutions to buy or sell foreign currencies for various purposes such as travel, import/export, speculation, and hedging against currency risk.

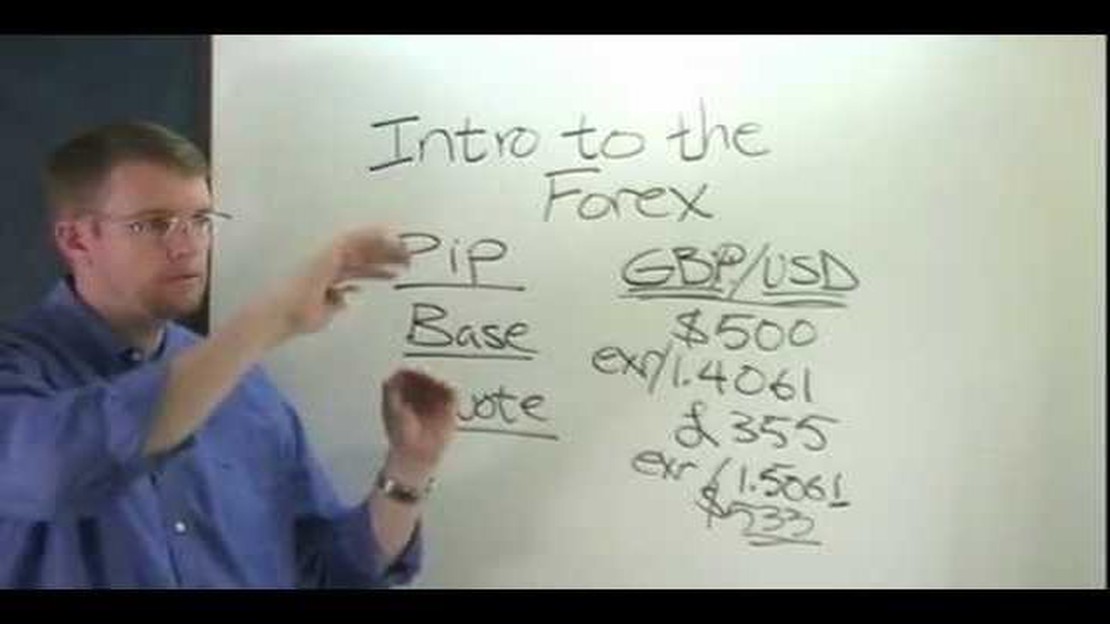

FX spot transactions involve the exchange of two currencies, referred to as the base currency and the counter currency. The exchange rate between these two currencies is determined by the prevailing market conditions, including supply and demand factors, interest rates, and geopolitical events.

The settlement of FX spot transactions is typically done electronically through various trading platforms, such as interbank trading systems or electronic communication networks. These platforms provide access to a global network of participants, including banks, brokers, and other financial institutions.

One of the benefits of FX spot transactions is their liquidity. The forex market is the largest and most liquid financial market in the world, with trillions of dollars traded on a daily basis. This high liquidity ensures that buyers and sellers can easily find counterparties to execute their trades at competitive prices.

Read Also: Increasing the Sharpe Ratio of Your Trading Strategy: Strategies and Techniques

However, FX spot transactions also carry certain risks. The most significant risk is the exchange rate risk, as the value of currencies can fluctuate over time. Changes in exchange rates can result in gains or losses for the parties involved in the transaction.

To mitigate exchange rate risk, market participants can use various strategies, such as entering into forward contracts or option contracts. These derivative instruments allow parties to lock in a specific exchange rate for a future date, providing protection against adverse currency movements.

In conclusion, FX spot transactions play a vital role in the global foreign exchange market. They provide a means for individuals and businesses to buy or sell foreign currencies for different purposes. However, it is essential for market participants to be aware of the risks associated with these transactions and to employ risk management strategies to mitigate potential losses.

FX spot transactions are a type of foreign exchange transaction that involves the purchase or sale of one currency for another on the spot market. In a spot transaction, the exchange of currencies takes place immediately or “on the spot” at the prevailing exchange rate.

These transactions are typically settled within two business days, although some currencies may have different settlement periods. FX spot transactions are commonly used by individuals, businesses, and financial institutions to facilitate international trade, manage foreign currency exposure, and speculate on currency exchange rate movements.

The spot market is the most liquid and actively traded segment of the foreign exchange market, with trades executed directly between market participants or through electronic trading platforms. The exchange rate for an FX spot transaction is determined by the supply and demand dynamics of the market, and it can fluctuate rapidly throughout the trading day.

Read Also: Top Companies in NLP: Finding the Best Provider for Natural Language Processing Solutions

FX spot transactions carry certain risks, primarily related to exchange rate fluctuations. As currencies can strengthen or weaken against each other, the value of the currency exchanged in the transaction may change before funds are settled. This exposes participants to the risk of adverse movements in exchange rates, which can result in financial losses or reduced profits.

To manage these risks, market participants can use various hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. Additionally, they can stay informed about economic and political developments that may impact currency exchange rates and make timely decisions based on market analysis and risk management techniques.

| Advantages of FX Spot Transactions | Disadvantages of FX Spot Transactions |

|---|---|

| * Immediate settlement of trades |

In conclusion, FX spot transactions are an essential part of the foreign exchange market, providing participants with a means to exchange currencies at the prevailing exchange rate. While these transactions offer advantages such as immediate settlement and liquidity, they also come with risks related to exchange rate fluctuations. By employing hedging strategies and staying informed, market participants can mitigate these risks and make informed decisions in their FX spot transactions.

FX spot transactions are the most common and basic type of foreign exchange transaction. They involve the immediate exchange of one currency for another at the current exchange rate, with delivery of the currencies usually taking place within two business days.

FX spot transactions are considered risky because they are subject to exchange rate fluctuations. The value of currencies can change rapidly, and if the exchange rate moves against the trader, they can suffer losses. The risk is particularly high when trading in volatile or illiquid markets.

There are several ways to manage the risk associated with FX spot transactions. One common method is to use stop-loss orders, which automatically close out a position if the exchange rate reaches a certain level. Hedging strategies, such as using forward contracts or currency options, can also be employed to mitigate risk. Additionally, staying informed about economic and political developments that can impact exchange rates is crucial.

The main advantages of FX spot transactions are their simplicity and liquidity. Spot transactions are straightforward and easy to execute, making them accessible to a wide range of market participants. Additionally, the forex market is highly liquid, meaning that there is a large number of buyers and sellers, making it easier to enter or exit positions at any time.

Value of $1 US Dollar in Pakistani Rupees In today’s globalized world, currencies play a crucial role in international trade and finance. One such …

Read ArticleIs SBI forex card a good option for currency exchange? When it comes to traveling abroad, one of the most important things to consider is how you are …

Read ArticleIs MT4 forex legit? With the rapid growth of online Forex trading, it is essential to understand the legitimacy of different trading platforms. One …

Read ArticleImpulse response of the moving average system When it comes to analyzing and understanding signals in various fields, the impulse response of a system …

Read ArticleThe Risk-Reward Ratio in Binary Trading: What You Need to Know Binary trading is a popular form of investing that offers potential for high returns. …

Read ArticleDid MF Global customers get their money back? The collapse of MF Global, a global financial services firm, in October 2011 sent shockwaves throughout …

Read Article