Understanding and Trading LH and LL Patterns: A Comprehensive Guide

Understanding LH and LL Trading: A Comprehensive Guide In the world of trading, identifying and understanding chart patterns is crucial for making …

Read Article

A record of issuance is a crucial document that provides valuable insight into the history and details of a particular issuance. Whether it’s a stock, bond, or any other financial instrument, understanding the record of issuance is essential for investors, regulators, and other stakeholders. This comprehensive guide will walk you through everything you need to know about this important document.

What is a record of issuance?

A record of issuance is a legal document that outlines the key details of a security issuance. It includes information such as the date of issuance, the number of securities issued, their unique identification numbers, and any other relevant information regarding the issuance. This document serves as a historical record and helps track the ownership and movement of securities over time.

Why is the record of issuance important?

The record of issuance is important for several reasons. First and foremost, it helps establish a clear ownership chain for the securities. By maintaining a comprehensive record, it becomes easier to track the movement of securities, which is crucial for maintaining transparency and preventing fraud.

Furthermore, the record of issuance is crucial for regulatory compliance. Regulators often require issuers to maintain accurate and up-to-date records to ensure that securities are being issued and traded in a fair and transparent manner.

Key takeaways:

How is the record of issuance created and maintained?

The record of issuance is typically created by the issuer at the time of issuance. It is often maintained by a central depository or a trusted third-party entity. This ensures that the record is secure and accessible to all relevant stakeholders.

The record of issuance can be in electronic or physical form, depending on the preference of the issuer and the applicable regulations.

In conclusion, understanding the record of issuance is crucial for anyone involved in the securities market. Whether you are an investor, regulator, or issuer, being familiar with this document is essential for maintaining transparency, preventing fraud, and ensuring compliance with regulatory requirements.

The Record of Issuance is a document that provides a comprehensive record of all the issuances made by an organization. It serves as a repository of information about the issuance process, including details such as the date, time, and location of issuance, the reasons for issuance, the individuals or entities involved, and the status of the issuance.

The Record of Issuance is usually maintained by the issuer or a designated department within the organization. It is used to track and monitor the issuance activities, ensure compliance with regulations and internal policies, and provide a reference for future inquiries or audits.

Read Also: Understanding the LSE Closing Auction: How It Works and Why It Matters

The record includes various types of issuances, such as permits, licenses, certificates, tickets, and other official documents. It can also include non-official issuances, such as internal memos, notices, and communications.

Having a thorough record of issuance is crucial for organizations as it allows them to maintain transparency, accountability, and accuracy in their processes. It helps identify any discrepancies or irregularities and facilitates timely resolution of issues.

Read Also: VWAP vs VWMA: Uncovering the Better Indicator for Trading

The Record of Issuance can be in different formats, such as physical documents, electronic databases, or a combination of both. It should be regularly updated and securely stored to ensure its integrity and accessibility.

In summary, the Record of Issuance is a vital tool for organizations to keep track of their issuances and ensure compliance with regulations. It provides a comprehensive record of all the issuances made, facilitating transparency, accountability, and accuracy in the issuance process.

The record of issuance is a crucial document that provides a detailed account of all the shares or securities issued by a company. This document plays a vital role in corporate governance and financial accounting.

One of the significant reasons why understanding the record of issuance is essential is that it helps in maintaining transparency and accuracy in a company’s financial statements. This document ensures that all the shares or securities issued by the company are properly recorded, allowing investors and stakeholders to have an accurate understanding of the company’s capital structure.

Moreover, the record of issuance is important for legal and regulatory compliance. It allows companies to demonstrate that they have complied with all the necessary legal requirements and regulations regarding the issuance of shares or securities. This document can be crucial during audits and other regulatory inspections.

Additionally, the record of issuance serves as a valuable source of information for a company’s management. It provides insights into the company’s shareholding structure, including details such as the number of shares issued, the classes of shares, the shareholders’ names, and the dates of issuance. This information can aid in decision-making processes, strategic planning, and corporate governance.

Furthermore, the record of issuance can be relevant in cases of mergers, acquisitions, or other corporate transactions. It helps in determining the ownership and control of the company during such transactions and ensures that all parties involved have accurate and reliable information.

In summary, understanding the record of issuance is crucial for maintaining transparency, complying with legal requirements, making informed decisions, and facilitating corporate transactions. It is an essential document that provides valuable information about a company’s shareholding structure and plays a significant role in corporate governance and financial accounting.

| Company Name | Date of Issuance | Number of Shares | Class of Shares |

|---|---|---|---|

| ABC Corporation | January 1, 2022 | 10,000 | Common Shares |

| XYZ Inc. | March 15, 2022 | 5,000 | Preferred Shares |

| 123 Company | June 30, 2022 | 20,000 | Common Shares |

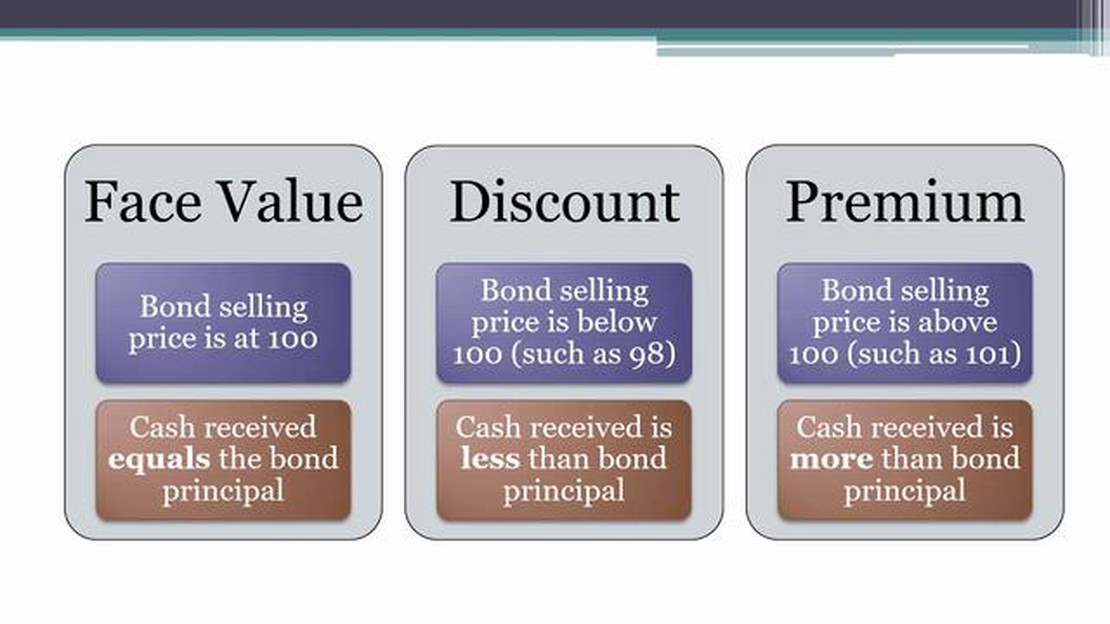

A record of issuance is a document that provides a detailed account of the creation and distribution of a particular item, such as a financial security, a bond, or a stock. It contains information about the date of issuance, the number of items issued, and any additional terms or conditions.

A record of issuance is important for several reasons. Firstly, it provides a clear and transparent history of the creation and distribution of a particular item, which is crucial for accurate record-keeping and accountability. It also helps to prevent fraud and ensure compliance with relevant laws and regulations. Additionally, a record of issuance serves as a valuable source of information for investors and other stakeholders who may need to verify the authenticity and ownership of a particular item.

A record of issuance typically includes the name of the issuer, the date of issuance, the number of items issued, the face value or price of each item, any additional terms or conditions, and the signatures of authorized individuals. It may also include information about the purpose or use of the item, any restrictions on transfer or sale, and any relevant legal or regulatory requirements.

The responsibility for maintaining a record of issuance typically lies with the issuer, whether it is a government agency, a corporation, or another entity. The issuer is required to keep accurate and up-to-date records of all items issued, including any changes or modifications that may occur over time. In some cases, the issuer may also enlist the services of a registrar or transfer agent to help manage and maintain the record of issuance.

A record of issuance can be verified by reviewing the original document and comparing it with any supporting documentation, such as receipts, invoices, or other records. It is also possible to verify the authenticity of a record of issuance by contacting the issuer directly or utilizing any online verification tools or platforms that may be available. Additionally, investors and other stakeholders may seek independent verification or confirmation from trusted third parties, such as auditors or legal professionals.

Understanding LH and LL Trading: A Comprehensive Guide In the world of trading, identifying and understanding chart patterns is crucial for making …

Read ArticleAdvantages of Moving Average in Time Series Analysis Time series analysis is a statistical technique that helps analyze patterns and trends in data …

Read ArticlePredictions for the Currency Exchange Rate in 2023 As we approach the year 2023, financial analysts and economists have started making predictions …

Read ArticleConversion: How much is $1000 Canadian in pesos? If you are planning a trip to Mexico or have friends or family living there, you may be wondering how …

Read ArticleRuger Mini 14 Magazine Capacity: How Many Rounds Can It Hold? The Ruger Mini 14 is a popular choice among firearm enthusiasts due to its reliability …

Read ArticleFree options trading practice: a comprehensive guide Options trading can be a lucrative and exciting way to diversify your investment portfolio, but …

Read Article