Discover MLM Forex: The Revolutionary Way to Trade Forex

Exploring MLM Forex Opportunities Are you tired of the traditional methods of trading forex? Do you want a new and innovative approach to maximize …

Read Article

Forex trading is a complex and ever-changing market, with various indicators and tools that traders can use to analyze and predict market movements. One such indicator is the Quarters Theory, which focuses on identifying key levels in the price action.

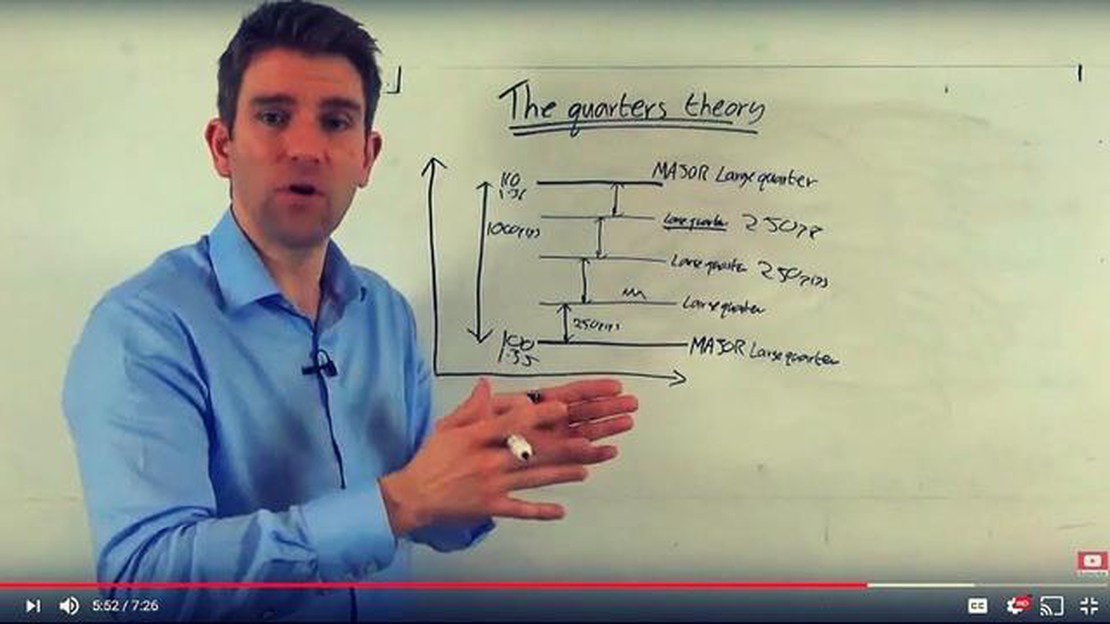

The Quarters Theory is based on the concept that the price of a currency pair tends to move in “quarters” or 25-pip increments. These levels are believed to have significance in the market, as they often act as support or resistance levels. Traders who understand and utilize this theory can potentially improve their trading decisions and increase their chances of profitability.

By identifying and analyzing the quarters, traders can gain insight into the overall market trend and find potential entry and exit points for their trades. This indicator can be used on any timeframe, from short-term scalping to long-term investing, and can be applied to various currency pairs.

Furthermore, the Quarters Theory can be used in conjunction with other indicators and technical analysis tools to further enhance trading strategies. It provides a framework for understanding price movements and can help traders make more informed decisions based on the current market conditions.

The Quarters Theory Indicator is a forex trading tool that is based on the concept of market cycles and price behavior. Developed by Ilian Yotov, a professional trader and author, the Quarters Theory Indicator aims to help traders identify potential trading opportunities by analyzing the relationship between the four major currency pairs (EUR/USD, GBP/USD, USD/JPY, USD/CHF).

The indicator is designed to take advantage of the fact that these currency pairs tend to move in a synchronized manner due to their close correlation with the US Dollar. By understanding the relationship between these pairs, traders can gain insights into the overall strength or weakness of the US Dollar and make more informed trading decisions.

The Quarters Theory Indicator divides the forex market into four “quarters”: the US Dollar Quarter, the Euro Quarter, the Sterling Quarter, and the Yen Quarter. Each of these quarters represents a group of currency pairs that are correlated with a specific currency. By analyzing the behavior of these quarters, traders can identify potential trading opportunities.

The indicator uses various tools and techniques to analyze the market, including price action analysis, trend analysis, and support and resistance levels. It also takes into account economic and geopolitical factors that can impact currency prices.

Overall, the Quarters Theory Indicator is a powerful tool that can help traders gain a deeper understanding of the forex market and make more accurate predictions. However, like any trading tool, it is important to use it in conjunction with other technical and fundamental analysis techniques to maximize its effectiveness.

The Quarters Theory is a trading strategy that aims to predict market movement based on the concept of market quarters. It is based on the belief that the markets move in a cyclical pattern, with each cycle consisting of four quarters.

The Quarters Theory divides the market into four main quarters: the first, second, third, and fourth quarter. Each quarter represents a different market condition and is characterized by its own set of rules and trading strategies.

In the first quarter, also known as the accumulation quarter, there is a low level of volatility and trading activity. This is the period when institutional traders and market makers accumulate positions before the market starts to move. Traders using the Quarters Theory will look for opportunities to buy low during this phase.

Read Also: Is Binary Options Better than Forex Trading? - A Detailed Comparison

The second quarter, known as the trending quarter, is characterized by a significant increase in volatility and trading volume. This is when the market starts to move in a specific direction, and traders using the Quarters Theory will look to ride the trend and profit from the momentum.

The third quarter, or transition quarter, is a period of consolidation and uncertainty. It is a transitional phase between the trending quarter and the reversal quarter. Traders using the Quarters Theory may choose to stay out of the market or reduce their positions during this phase.

The fourth quarter, also known as the reversal quarter, is characterized by a reversal in the market trend. It is a period when the market is expected to change direction, and traders using the Quarters Theory will look for opportunities to sell high and profit from the reversal.

By understanding the concept of the Quarters Theory and analyzing the current market conditions, traders can make more informed decisions and improve their chances of success in Forex trading. However, it is important to note that no trading strategy is foolproof, and traders should always exercise caution and risk management when implementing any trading strategy.

Overall, the Quarters Theory provides a framework for understanding market cycles and can be a useful tool for Forex traders looking to analyze market conditions and make informed trading decisions.

The Quarters Theory Indicator is a powerful tool used by forex traders to analyze price movement and identify potential trading opportunities. It is based on the concept of market structure and applies a unique approach to interpreting price action.

The indicator divides the price movement into four zones known as quarters, each representing a different level of market sentiment. These quarters are defined by key round numbers, such as 25, 50, 75, and 100, which are significant psychological levels for traders. By analyzing price action in relation to these quarters, traders can gain insights into the market’s overall sentiment and make more informed trading decisions.

When using the Quarters Theory Indicator, traders look for specific price patterns and formations within each quarter to identify potential trade setups. These patterns may include support and resistance levels, breakouts, trendlines, and chart patterns. By understanding how price behaves in relation to each quarter, traders can anticipate potential price movements and adjust their trading strategies accordingly.

Read Also: Are stock options taxed as a bonus? Understanding the tax implications of stock options

The Quarters Theory Indicator also provides valuable information about market trends and reversals. When price is consistently trading within a particular quarter, it suggests a strong trend in that direction. However, if price starts to approach or break through a key quarter, it may indicate a potential trend reversal or market turning point. Traders can use this information to enter or exit trades, depending on their trading strategy.

It is important to note that the Quarters Theory Indicator is not a standalone trading system but rather a tool to complement other technical analysis techniques. It should be used in conjunction with other indicators, such as moving averages, oscillators, and volume analysis, to confirm trade signals and increase the probability of success.

In conclusion, the Quarters Theory Indicator is a valuable tool for forex traders to analyze price movement and identify potential trading opportunities. By understanding the market sentiment and key price levels defined by the quarters, traders can make more informed decisions and improve their trading strategies.

The Quarters Theory Indicator is a trading tool that helps traders in the foreign exchange market to identify potential price levels and trends based on the concept of “quarters”. It divides the price action into four quarters, which are further divided into sub-quarters, creating a grid-like structure that can be used to make trading decisions.

The Quarters Theory Indicator works by analyzing price levels and trends using the concept of quarters. The indicator divides the price action into four quarters, which are based on specific price levels. These quarters are further divided into sub-quarters, providing a precise grid-like structure for identifying potential support and resistance levels. Traders can use this information to make trading decisions and anticipate potential price movements.

The Quarters Theory Indicator offers several advantages for Forex traders. Firstly, it provides a clear and visual representation of price levels and trends, making it easier to identify potential support and resistance areas. Secondly, it helps traders to anticipate price movements and make more informed trading decisions. Additionally, the indicator can be customized to suit individual trading styles and preferences, allowing for greater flexibility in trading strategies.

Yes, the Quarters Theory Indicator can be used in conjunction with other trading tools and indicators. Traders often combine it with popular technical analysis tools such as moving averages, trend lines, and Fibonacci retracements to confirm potential support and resistance levels identified by the Quarters Theory Indicator. By using multiple tools together, traders can have a more comprehensive view of the market and make more accurate trading decisions.

The Quarters Theory Indicator can be used with various trading strategies, but its effectiveness may depend on the individual trader’s style and preferences. Some traders may find it more suitable for longer-term trend following strategies, while others may use it for shorter-term scalping or day trading strategies. It is important for traders to understand how the indicator works and test it with their chosen strategy before relying on it for real-time trading decisions.

The Quarters Theory Indicator is a forex trading tool that helps traders identify potential support and resistance levels based on the psychological levels of price quarters.

The Quarters Theory Indicator is important in forex trading because it provides traders with a visual representation of potential support and resistance levels, which can help them make more informed trading decisions.

Exploring MLM Forex Opportunities Are you tired of the traditional methods of trading forex? Do you want a new and innovative approach to maximize …

Read ArticleMaximizing Your Potential Losses When Trading Options Options trading can be an exciting and potentially profitable investment strategy. However, like …

Read ArticleHow to Play Nifty Options: A Comprehensive Guide Nifty options are a popular financial derivative product in India, typically used for trading …

Read ArticleWhat is the outlook for USD to CHF? The USD to CHF exchange rate has been closely watched by investors and analysts in recent months. The Swiss franc, …

Read ArticleIs trading a potential addiction? Trading, especially in the financial markets, can be an exciting and potentially lucrative activity. However, it can …

Read ArticleExploring the Benefits of a Virtual Trading Simulator A virtual trading simulator is a platform that allows individuals to practice trading in the …

Read Article