Discover the Advantages of Trading the EUR USD Pair - Increase Your Profits Today!

Discover the Advantages of Trading EUR USD Are you looking for a profitable trading opportunity? Look no further than the EUR USD pair! This currency …

Read Article

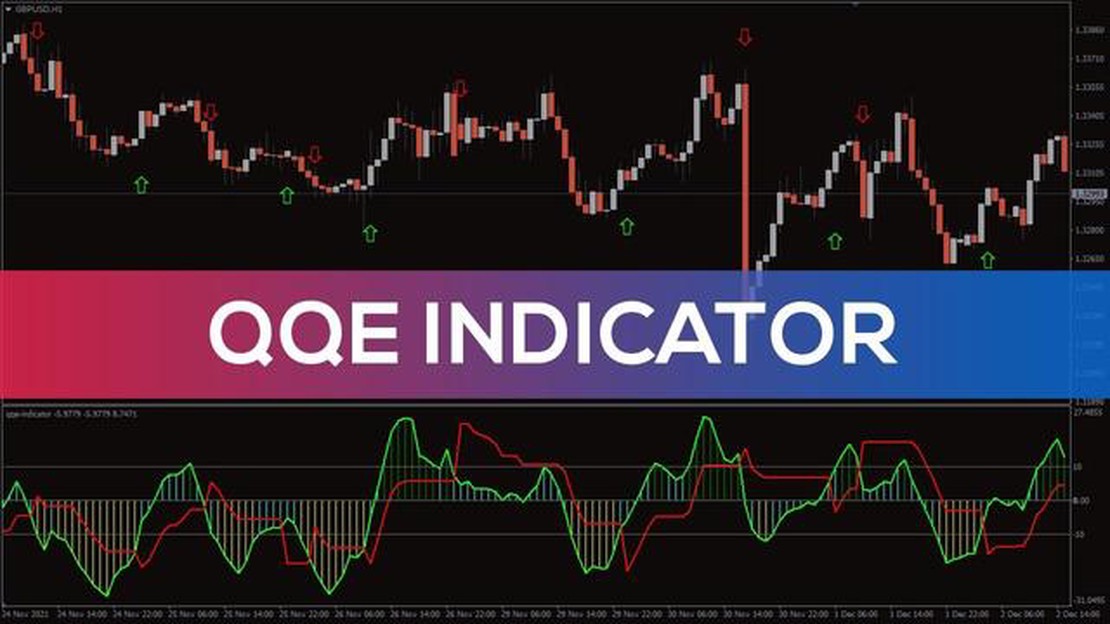

When it comes to successful trading in the foreign exchange market, having the right tools and indicators at your disposal is crucial. One such indicator that has gained popularity among traders is the QQE indicator. This comprehensive guide aims to provide a thorough understanding of the QQE indicator in MT4 and how it can be effectively used to enhance trading strategies.

The QQE indicator, which stands for Quantitative Qualitative Estimation, is a versatile technical analysis tool that is used to identify potential trading opportunities. It combines a moving average of the RSI (Relative Strength Index) with a smoothed RSI, creating a visual representation of the RSI’s trend and overbought/oversold conditions.

By using the QQE indicator, traders can easily identify trend reversals, divergences, and overbought/oversold conditions in the market. It is particularly useful in volatile markets where price movements can be erratic. Additionally, the QQE indicator can be customized to suit individual trading preferences, making it a versatile tool for both beginner and experienced traders.

This comprehensive guide will cover the basic concept and calculation of the QQE indicator, how to interpret its signals, and provide practical examples of how to use it in real trading scenarios. Whether you are new to trading or looking to enhance your existing trading strategy, this guide will provide you with the knowledge and skills to effectively use the QQE indicator in MT4.

The QQE indicator, also known as the Qualitative Quantitative Estimation indicator, is a technical analysis tool that is used to identify trends and potential buy or sell signals in the Forex market. It is derived from a combination of moving averages and the Relative Strength Index (RSI), and is commonly used by traders to make informed trading decisions.

The QQE indicator consists of a main line and a signal line, both of which are displayed on the MT4 chart. The main line reflects the overall trend direction, while the signal line indicates the entry and exit points for trades. When the main line crosses above the signal line, it is considered a bullish signal and traders may look for buying opportunities. Conversely, when the main line crosses below the signal line, it is considered a bearish signal and traders may look for selling opportunities.

In addition to trend identification, the QQE indicator also provides traders with an estimation of the market volatility. The histogram displayed below the main line indicates the degree of volatility in the market. A wider histogram suggests high volatility, while a narrower histogram suggests low volatility. This information can be useful for determining the appropriate position size and risk management strategies.

Traders can customize the settings of the QQE indicator in MT4 according to their individual preferences and trading strategies. The default settings are typically a 14-period RSI and a 10-period smoothed RSI, but traders can adjust these values to suit their needs.

Overall, the QQE indicator in MT4 is a versatile tool that can help traders identify trends, generate buy or sell signals, and manage risk. It can be used in conjunction with other technical indicators and fundamental analysis to enhance trading decisions and improve overall profitability.

The QQE indicator, also known as the Quantitative Qualitative Estimation indicator, is a popular technical analysis tool used in MetaTrader 4 (MT4) for determining trend strength and potential trade opportunities. It is based on a combination of moving averages and the Relative Strength Index (RSI).

The QQE indicator consists of two lines: the blue line (fast line) and the red line (slow line). The crossing of these two lines provides signals for entry and exit points in the market. When the blue line crosses above the red line, it generates a buy signal, indicating that it may be a good time to enter a long position. Conversely, when the blue line crosses below the red line, it generates a sell signal, indicating that it may be a good time to enter a short position.

In addition to the crossing of the two lines, the QQE indicator also provides a visual representation of the trend strength through the histogram. The histogram is displayed below the main chart and represents the difference between the blue and red lines. When the histogram is above the zero line, it indicates a bullish trend, and when it is below the zero line, it indicates a bearish trend. The taller the histogram bars, the stronger the trend.

The QQE indicator can be customized according to individual preferences. Users can adjust the period settings for the moving averages and RSI, as well as the threshold values for the blue and red lines. By tweaking these settings, traders can optimize the indicator to best suit their trading strategies and market conditions.

Read Also: Reasons to Choose Forex Trading: Discover the Benefits of Investing in the Forex Market

Overall, the QQE indicator is a useful tool for traders who want to identify trends and potential trade opportunities in the market. However, like any technical analysis tool, it is important to use it in conjunction with other indicators and analysis techniques to make well-informed trading decisions.

The QQE indicator in MT4 is a powerful tool that can help traders identify potential trend changes and trade setups. Here are the steps to effectively use the QQE indicator:

Step 1: Adding the QQE Indicator to a Chart

To add the QQE indicator to a chart, you need to follow these steps:

Step 2: Understanding the QQE Indicator

The QQE indicator consists of two lines:

Read Also: Exploring the Main Purpose of a Moving Average Filter in Accelerometer Data Analysis

When the blue line crosses above the red line, it is a bullish signal indicating a potential upward trend. Conversely, when the blue line crosses below the red line, it is a bearish signal indicating a potential downward trend.

Step 3: Trading with the QQE Indicator

The QQE indicator can be used to generate trading signals and identify potential trade setups:

Step 4: Setting Stop Loss and Take Profit Levels

To manage risk and protect profits, it is important to set appropriate stop loss and take profit levels when trading with the QQE indicator. Traders can use support and resistance levels, Fibonacci retracements, or other technical analysis tools to determine these levels.

Step 5: Monitoring and Adjusting the QQE Indicator Settings

Like any other technical indicator, the QQE indicator may not be perfect and can give false signals. It is important to monitor and adjust the indicator’s settings to better suit the specific market conditions and trading strategy.

Remember, the QQE indicator is just one tool among many in a trader’s toolbox. It should be used in conjunction with other indicators and analysis techniques to make well-informed trading decisions.

The QQE Indicator in MT4 is a technical analysis tool used to identify trend reversals and to generate trading signals.

The QQE Indicator calculates the rate of change of a smoothed moving average, and then applies that rate of change to a smoothed moving average of the rate of change. This helps to smooth out the price data and identify potential reversals in the trend.

The QQE Indicator generates buy signals when the line crosses above the 50 level and sell signals when the line crosses below the 50 level. Traders can also use the crosses above and below the 20 and 80 levels to generate additional signals.

Yes, the QQE Indicator can be used in conjunction with other technical indicators to confirm trading signals. Traders may use indicators such as moving averages or support and resistance levels to validate the signals generated by the QQE Indicator.

Discover the Advantages of Trading EUR USD Are you looking for a profitable trading opportunity? Look no further than the EUR USD pair! This currency …

Read ArticleWhere Can I Exchange USD to INR in India? When traveling to India, it is important to have local currency in hand for various expenses. If you are …

Read ArticleUnderstanding the Most Effective Stock Price Action Strategies Understanding and analyzing the price action of stocks is crucial for successful …

Read ArticleHow to Trade with ADX The Average Directional Movement Index (ADX) is a popular technical analysis indicator that is used to determine the strength of …

Read ArticleDemystifying the London Fix Strategy London Fix strategy is a popular method used by investors to determine the reference price for gold and silver. …

Read ArticleQuant Strategies for Forex: Maximizing Profits with Data-Driven Trading Forex trading has become increasingly popular, and traders are continuously …

Read Article