Learn how to effectively utilize Forex Tester for better trading results

Tips and Tricks: How to Use Forex Tester If you are a trader looking to improve your forex trading skills, one tool that can help you achieve better …

Read Article

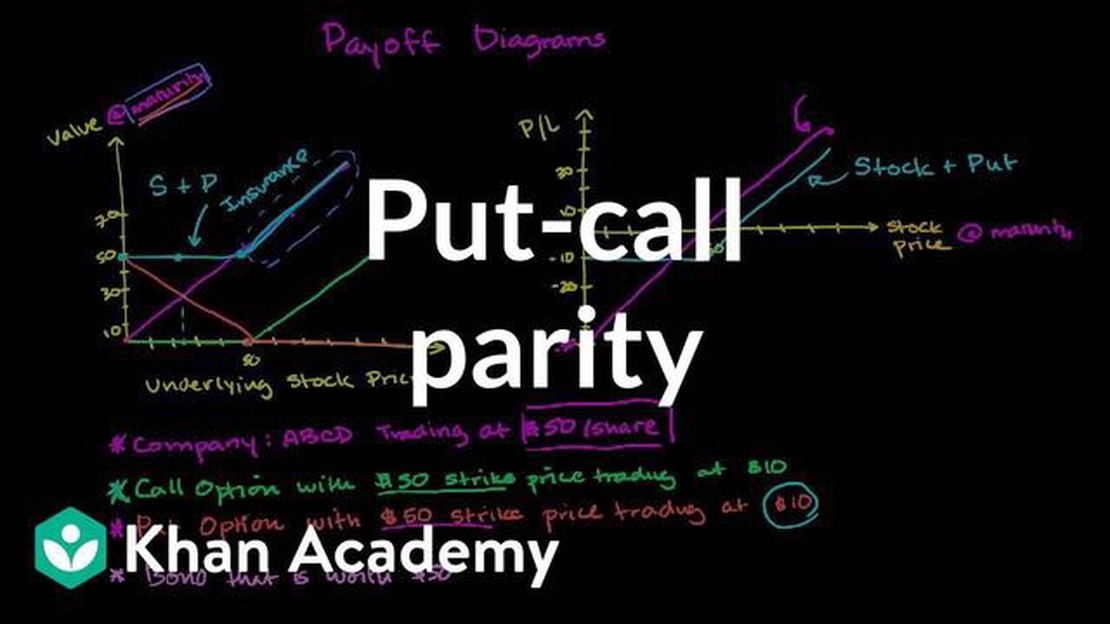

Options trading is a popular investment strategy that allows traders to profit from the price movements of various assets. Put and call options are two common types of options contracts that offer different opportunities for investors. Understanding the parity of put-call options is crucial for maximizing profits and managing risks in options trading.

Put options give the holder the right, but not the obligation, to sell an underlying asset at a specified price (the strike price) within a specific time period. On the other hand, call options give the holder the right, but not the obligation, to buy an underlying asset at a specified price within a specific time period. The parity relationship between put and call options is based on the principle of arbitrage, which ensures that there are no opportunities for risk-free profits in the market.

The concept of parity in options trading refers to the relationship between the prices of put and call options with the same strike price and expiration date. When put-call parity exists, the prices of put and call options are in equilibrium, and there is no room for arbitrage. Put-call parity is a fundamental concept in options pricing and helps traders to evaluate the fair value of options.

Understanding the parity of put-call options can help traders assess the relative value of these contracts and make informed trading decisions. By recognizing discrepancies in the prices of put and call options, traders can exploit arbitrage opportunities and potentially earn profits. Additionally, understanding put-call parity can provide insights into the behavior of options prices and market expectations.

Options trading is a complex financial instrument that allows investors to speculate on the price movement of underlying assets. One of the fundamental concepts in options trading is parity, which refers to the relationship between call and put options with the same strike price and expiration date.

In options trading, a call option gives the holder the right, but not the obligation, to buy the underlying asset at a specified price (strike price) within a specific time period (expiration date). On the other hand, a put option gives the holder the right, but not the obligation, to sell the underlying asset at a specified price (strike price) within a specific time period (expiration date).

Call and put options are said to be in parity when they are trading at fair value, meaning their prices are in equilibrium based on the underlying asset’s current price and other market factors. This fair value is determined through various pricing models and market forces.

There are two types of parity in options trading: put-call parity and synthetic parity. Put-call parity states that the price of a call option plus the present value of the strike price is equal to the price of a put option plus the current price of the underlying asset. This relationship allows for arbitrage opportunities if there are any deviations from parity.

Synthetic parity, on the other hand, refers to the concept of creating a synthetic position using combinations of different options and/or the underlying asset to replicate the risk and return characteristics of another options position. This allows traders to hedge or create trading strategies using various combinations of options.

| Parity Type | Definition |

|---|---|

| Put-Call Parity | The relationship between the price of a call option and a put option with the same strike price and expiration date. |

| Synthetic Parity | The concept of creating a synthetic position using combinations of different options and/or the underlying asset. |

Understanding the basics of parity in options trading is crucial for traders and investors to effectively analyze and strategize their options positions. By understanding how parity works, traders can identify potential arbitrage opportunities and construct synthetic positions that align with their investment objectives.

However, it’s important to note that options trading is inherently risky and complex. It’s recommended for traders to thoroughly educate themselves and seek professional advice before engaging in options trading activities.

Put and call options are financial instruments that play a crucial role in the functioning of the financial market. These options provide investors with the opportunity to profit from the price movements of various assets, such as stocks, commodities, or currencies.

Read Also: Discover the Current Lowest Rate of Yen to MYR | Expert Forex Analysis

A put option gives the holder the right, but not the obligation, to sell a specific asset at a predetermined price, known as the strike price, within a specified period. On the other hand, a call option gives the holder the right, but not the obligation, to buy a specific asset at the strike price within a specified period.

Put options are often used to protect against a decline in the price of an asset. Investors who are worried that the price of a stock or other asset may fall can purchase put options, which allow them to sell the asset at a predetermined price, protecting them from potential losses. This strategy is known as hedging.

Call options, on the other hand, are commonly used to speculate on the price increase of an asset. By purchasing call options, investors can potentially profit from the price appreciation of the underlying asset without actually owning it. They can later sell the call options for a profit if the price of the asset rises.

Put and call options also play a significant role in price discovery and market efficiency. The availability of these options allows market participants to express their views on the future direction of asset prices. The pricing of options is influenced by various factors, such as the current price of the underlying asset, the strike price, the time until expiration, and market volatility. Therefore, the trading and valuation of options provide valuable information to market participants.

Overall, put and call options are essential tools in the financial market that enable investors to protect against price declines and speculate on price increases. Their availability and trading activity contribute to market efficiency and provide valuable insights into market expectations.

When it comes to determining the parity in put-call options, there are several factors that need to be taken into consideration. These factors can help investors and traders understand the relationship between put and call options and determine if there is any price disparity.

Read Also: Is high average volume good? Exploring the importance of high average volume in online trading

3. Time to Expiration: The time to expiration is the amount of time remaining until the option expires. It is an important factor in determining the parity in put-call options. The parity exists when the time to expiration for both put and call options is the same. If the time to expiration is different, there may be a lack of parity.

4. Interest Rates: Interest rates can also play a role in determining the parity in put-call options. The parity exists when the interest rates for both put and call options are the same. If the interest rates are different, there may be a lack of parity.

5. Dividends: Dividends can also affect the parity in put-call options. The parity exists when there are no dividends during the life of the options. If there are dividends, they need to be taken into account when determining the parity.

3. Time to Expiration: The time to expiration is the amount of time remaining until the option expires. It is an important factor in determining the parity in put-call options. The parity exists when the time to expiration for both put and call options is the same. If the time to expiration is different, there may be a lack of parity.

4. Interest Rates: Interest rates can also play a role in determining the parity in put-call options. The parity exists when the interest rates for both put and call options are the same. If the interest rates are different, there may be a lack of parity.

5. Dividends: Dividends can also affect the parity in put-call options. The parity exists when there are no dividends during the life of the options. If there are dividends, they need to be taken into account when determining the parity.

Overall, determining the parity in put-call options requires considering several factors such as the strike price, expiration date, time to expiration, interest rates, and dividends. By understanding these factors and their impact on the parity, investors and traders can make more informed decisions when it comes to trading put and call options.

Put-call options are financial derivatives that give the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific asset at a predetermined price within a certain time frame.

The parity of put-call options is important for investors because it allows them to identify arbitrage opportunities in the market. If the put-call parity is violated, it implies that there is a mispricing in the options market, which can be exploited for potential profits.

Put-call parity is a relationship between the prices of European put and call options with the same strike price and expiration date. According to put-call parity, the sum of the price of a call option and the present value of the strike price equals the sum of the price of a put option and the spot price of the underlying asset.

Put-call parity can be used to calculate the price of an option by rearranging the formula and solving for the unknown variable. For example, if the price of a call option, the price of a put option, the strike price, and the spot price of the underlying asset are known, the formula can be rearranged to solve for the present value of the strike price.

The assumptions of put-call parity are that the options are European style, there are no transaction costs or taxes, the risk-free interest rate is constant throughout the life of the options, the markets are efficient, and there are no dividends or other cash flows from the underlying asset during the life of the options.

The Parity of Put-Call Options refers to the relationship between the prices of put options and call options with the same strike price and expiration date. According to the put-call parity theory, if the prices of these options do not follow a specific relationship, an arbitrage opportunity arises. This relationship is based on the fact that a protective put strategy (buying a put option and a corresponding amount of the underlying asset) is equivalent to a covered call strategy (buying the underlying asset and writing a call option).

Tips and Tricks: How to Use Forex Tester If you are a trader looking to improve your forex trading skills, one tool that can help you achieve better …

Read ArticleWhat is high latency trading? High latency trading has become a hot topic in the world of finance. With the increasing use of technology in the …

Read ArticleUnderstanding CTA in Financial Markets In the fast-paced world of financial markets, it is crucial to understand the various tools and strategies that …

Read ArticleGuide on Changing Gadgets in Windows 7 If you are using the Windows 7 operating system, you may be interested in changing the gadgets that appear on …

Read ArticleUsing Moving Average for Option Trading Option trading is a complex and risky endeavor that requires careful analysis and informed decision-making. …

Read ArticleComparing the Volatility of Forex and Futures Markets Volatility is a key factor that traders and investors need to take into consideration when …

Read Article